Introduction

Ever stared at a stack of receipts from your latest flip, wondering where half your profit vanished? That’s the trap so many real estate investors fall into without solid bookkeeping for real estate investors in place. From coast to coast, the story’s the same: Money comes in waves, expenses hit hard. If you don’t have a grip on your numbers, you’re just making it up as you go.

Hey, it’s the Numberfied crew here, folks who’ve helped hundreds of property owners like you wrangle the mess and turn it into momentum. Think of bookkeeping for real estate investors as your secret weapon. It spots the leaks, highlights the winners, and sets you up to grab more deals without the dread. We’ll walk you through the nuts and bolts in this piece: real talk on setups, fixes for common snags, and paths to hand it off when you’re ready. By the end, you’ll have a plan to keep your books tight and your head clear. Sound good? Let’s roll up our sleeves.

Key Takeaways

- Grab It Early: Jump on bookkeeping for real estate investors the minute you sign that first lease; delays cost more later.

- Go Digital Fast: Ditch paper trails for apps that sync everything in one spot.

- Flag the Red Flags: Watch for mismatched deposits or surprise fees weekly, not yearly.

- Build in Buffers: Set aside 25% of rents for taxes from day one to avoid the scramble.

- Team Up Sooner: Don’t wait for overwhelm, pros like us at Numberfied step in to free your time.

The Real Scoop on Bookkeeping for Real Estate Investors: Basics

Forget what you learned in that one accounting class ages ago. When you’re knee-deep in keys and leases, bookkeeping for real estate investors means capturing the chaos of multiple roofs under one clear roof. It’s not fancy, it’s just honest tracking that shows if your hard work is paying off or padding someone else’s pocket.

Nail Down Your Income Sources First

Start with rents: base pay, late add-ons, one-time cleanouts. Pin each to the unit’s door number. Then layer in the extras, parking spots, laundry coins, even those Airbnb bursts if you’re dipping into short stays. Miss this, and your “steady” income looks like a rollercoaster.

I remember one client who ignored the side gigs from storage sheds; come tax time, we unearthed an extra $4k in overlooked cash. Lesson learned: log it all, label it tight.

Categorize Expenses Like a Pro

Utilities, fixes, supplies, bucket them by type and by building. A leaky faucet in Unit 2A doesn’t belong mixed with the whole complex’s snow removal. This split lets you zero in on money pits quickly.

Pro tip: color-code in your spreadsheet or app. Green for ops, yellow for big buys. It jumps out when you’re scanning late at night.

Tackle the Big Capital Stuff Up Front

Roofs, remodels, that fancy security system, they’re not monthly nibbles. Treat them as investments that drip value over the years. Note the date, the cost, and the expected life, and watch your software chew through the math.

One investor buddy skipped this on a kitchen gut; IRS flagged it as a repair, not an upgrade. Headache avoided with upfront notes.

Tools That Make Bookkeeping for Real Estate Investors Less of a Grind

Nobody’s asking you to code your own system. Smart picks do the heavy lifting in bookkeeping for real estate investors, so you spend less time typing and more time touring empty units.

Entry-Level Software Picks

QuickBooks Online gets my vote for starters; it’s got real estate templates that tag everything by address right out of the gate. Hook it to your bank, and boom: transactions flow in, ready for a quick yes or tweak.

We’ve onboarded dozens with it; the learning curve is gentle, and it scales when you snag that next multi-family.

Add-Ons for Rent and Tenant Wrangling

Pair it with something like AppFolio for the people side. Tenants pay online, you get the ping, and the books update automatically. No more chasing checks or wondering if that Zelle was for May or June.

A client switched mid-year and cut collection calls by 80%. That’s time back for coffee, not calls.

Phone-Friendly Features You Can’t Skip

Look for scan-to-file: point, shoot, done. Expenses hit the books, tagged, and dated before lunch. And dashboards? Make yours show cash on hand, upcoming bills, vacancy hits at a glance.

I use mine driving between showings, pull over, check, and adjust. Keeps the day flowing.

Pitfalls in Bookkeeping for Real Estate Investors (And the Easy Fixes)

You’re not the first to stub your toe here. These trips happen; spotting them early keeps you upright.

Blurring Lines Between Personal and Biz

That vacation week at your rental? Slice the costs fairly, days rented versus days you lounged. Jot the math in notes; repeat monthly.

One guy got nailed for full-year deductions on a part-time pad. Simple log fixed it retro.

Chasing Ghosts with Incomplete Logs

Forgot the plumber’s text invoice? Snap it then, file by prop. Email rules auto-sort the rest. Build the habit: end-of-day dump.

We’ve rescued stacks of “where’s that bill?” moments with this routine.

Overlooking Seasonal Swings

Winter heat bills spike, summer AC too. Average last year’s, pad 10%, review quarterly. Your books whisper warnings if you listen.

A flipper ignored this; a cash crunch hit mid-renovation. Buffer saved the next one.

How Bookkeeping for Real Estate Investors Powers Your Tax Game

Taxes aren’t the enemy; they’re the reward if your records sing. Clean books mean bolder claims, smoother filings.

Everyday Write-Offs Waiting for You

Drive to check a roof? Mileage. Hire a landscaper? Full shot. Management app sub? Deduct. Stack them with dates and whys.

We pull these for clients routinely; one year, it shaved 15% off a bill.

Master Depreciation Without the Math Headache

Residential? 27.5 years straight-line. Commercial? 39. Input once, auto-spread. Track improvements separately to accelerate where you can.

A partner property we handled? Proper splits unlocked faster drops, pure win.

Nail Those Quarterly Hits

Quarter-end report: income minus expenses, times your bracket guess. Pay up, sleep easy. Tweak as deals close.

No more year-end gut punch; it’s paced like your rent cycle.

Growing Your Holdings? Keep Bookkeeping for Real Estate Investors in Sync

From one door to a dozen, the system has to flex. Here’s how to stretch without strain.

Property-Specific Tracking Hacks

Sub-folders or accounts per address. Reports compare apples to oranges, or duplexes to quads.

The client went from three to 12; this setup let her spot the star performer overnight.

Monthly Rituals for Big-Picture Views

First of the month: auto-report emails in. Scan trends, flag outliers. Takes 20 minutes, informs your next offer.

We’ve templated this for teams; it’s their North Star.

Projecting Buys with Past Data

Pull 18 months’ averages: rents up 3%, repairs steady. Model the new spot against it. Green light or pause.

One forecast kept a client from a dud, saved six figures easily.

Signs It’s Time to Outsource Bookkeeping for Real Estate Investors

Solo’s fine for starters, but growth demands backup. Know when to pass the baton.

When Hours Start Slipping Away

If entries eat evenings, that’s deal-hunting time lost. We step in at that pivot.

When Rules Get Tricky

Swaps, syndicates, multi-state filings, nuance city. Experts navigate without the school.

The Calm That Comes With It

Double eyes catch what yours miss; strategies emerge you didn’t see. Worth every minute freed.

Linking Your Books to Real Wins in Real Estate

Data’s useless, siloed. Tie it to moves that matter.

Crunching New Deals on the Fly

Input projected numbers into your tool; IRR pops up. Go/no-go in minutes.

We ran this for a mid-market buy, tweaked terms, and closed stronger.

Quarterly Portfolio Autopsies

Rank by ROI, flag fixes. Raise rents here, shop insurance there. Action list follows.

One review sparked a full refresh; returns jumped 12%.

Planning the Big Exit

Buyers love plug-and-play books. Due diligence flies; price holds firm.

We’ve prepped three sales this year, smooth as the closings.

Conclusion

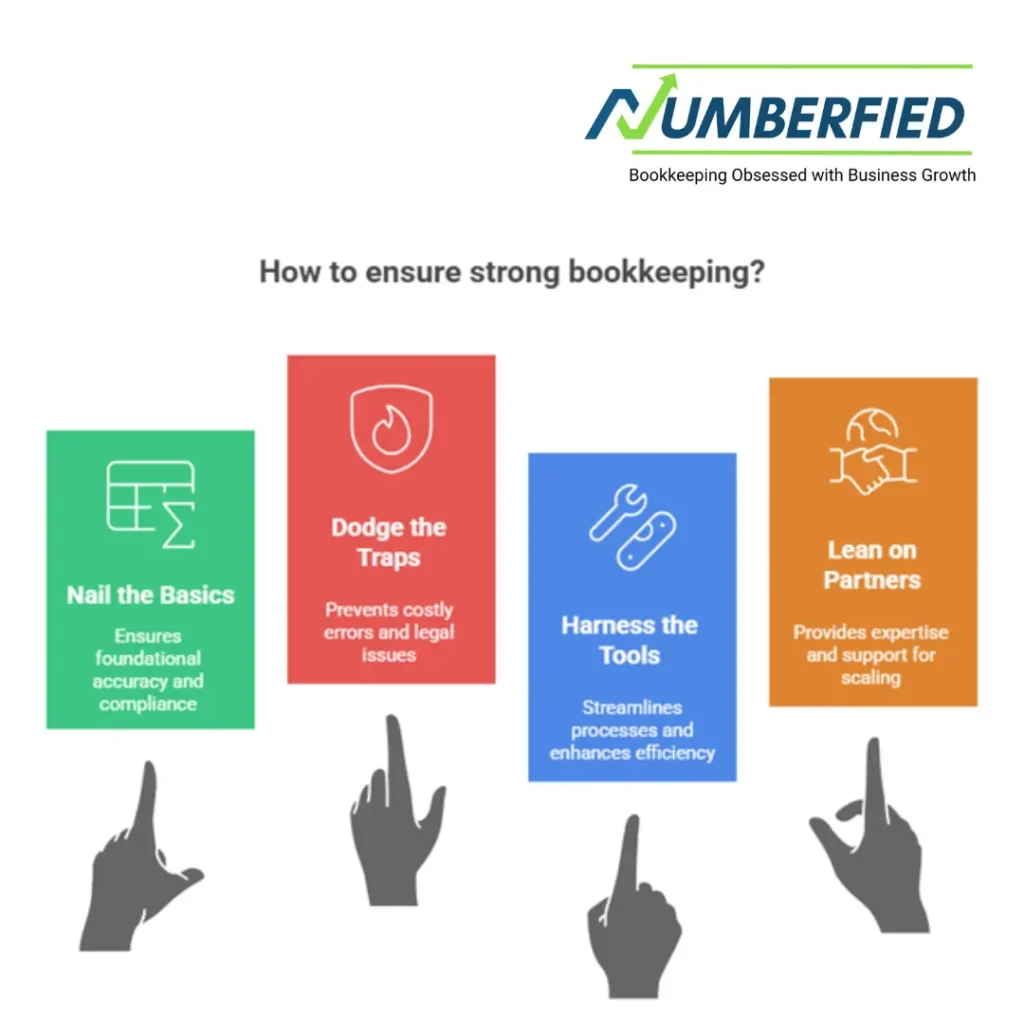

Strong bookkeeping for real estate investors isn’t optional; it’s your edge in a competitive field. Nail the basics, dodge the traps, harness the tools, and lean on partners when scale hits. You’ll end up with sharper taxes, surer buys, and a portfolio that hums.

That’s our take from the Numberfied front lines. We’re geared to dive into your setup and streamline it all. Head to https://numberfied.com/contact-us/ for that no-strings strategy chat. Your next level starts with a conversation. Let’s make it happen.

Also Read: 7 Astonishing Ways Virtual Accounting and Bookkeeping Services Can Boost Your Business

FAQs

What’s the core of bookkeeping for real estate investors anyway?

At heart, it’s logging every in and out tied to your holdings: rents deposited, repairs invoiced, loans serviced. We craft a setup that fits your flow, maybe separate tabs for flips versus keepers, so you always know the pulse without digging. It builds that trust in your gut for big calls, like holding or selling.

Over coffee with a new client last week, we mapped his three units this way; he spotted a rent hike opportunity he’d missed for months.

Short-term versus long-haul rentals, do the books change?

Big time. Short-term mean nightly tallies, supply restocks, and fee scraps from platforms. We carve out daily views for those, then aggregate for the tax man. Long-hauls? Monthly rhythms, big annual hits like certs.

A VRBO owner we work with swears by the split; it caught a cleaning creep that was eating margins alive.

Best starter software for bookkeeping for real estate investors?

Hands down, QuickBooks with the landlord pack. Banks feed directly, addresses auto-tag, and year-end forms are half-done. We’ve migrated folks from Excel to this; the “aha” moment hits when reports just appear.

If you’re tech-shy, we walk the setup, first month’s a breeze.

Realistic check-in schedule for your books?

Weekly peeks for new stuff, full monthly match-up. Our checklist? Bank sync, weirdos flagged, rents verified under 45 minutes after a bit.

One busy doc client does Sundays over brunch; keeps him sane through rounds.

How does solid bookkeeping for real estate investors trim tax bites?

It arms you with proof for every pull: trips logged, fees stacked, assets spread right. We hunt the oversights, like double-dipped supplies, and reroute them.

Last season, this netted one couple an extra $2,800 back. Small habits, big rebounds.

Top blunder in bookkeeping for real estate investors for rookies?

Dipping into one pot for everything. That “quick” personal pull for groceries muddies the whole stream come audit. Day-one move: biz account only, period.

Heard it from a first-timer who called panicked in March; we sorted, but oof, the stress.

Crossover point from solo to pro bookkeeping for real estate investors?

When it affects your joy or deals. Around four to six doors for most. We handle the grind, deliver insights, and leave you the wins.

A contractor client hit that wall at five; now he bids bolder, books hum in the background.

Cash flow in your books, how’s it shift your plays?

Spotlights the squeezes: vacancy voids, bill bunches. One duplex case? Books revealed power hogs; tenant tweaks turned red to black fast.

It’s like a mirror, no fluff, just facts to steer by.

IRS audit prep via bookkeeping for real estate investors?

Organized stack: chronos, backups, notes galore. We drill a mock run yearly, gaps filled, stories straight. Turns “oh no” to “here you go.”

A commercial guy faced one last spring; he walked out with a nod, thanks to the prep.

Worth pros for a tiny lineup, say two doors?

If life’s full elsewhere, yes, it frees headspace for growth. Our entry tier? Covers basics plus tips, cheaper than one bad miss.

A teacher with duplexes started small; now eyeing a triplex, books locked tight.