Why bookkeeping for real estate investors is crucial

Good bookkeeping is the foundation of successful real estate investing. Whether you’re a landlord managing rental properties, a flipper completing short-term renovations, or a real estate investor building a diversified real estate portfolio, accurate accounting and timely financial records are crucial for tracking income and expenses, preserving cash flow, meeting tax regulations, and improving property performance. Proper bookkeeping for real estate investors helps you see cash flow and profitability, supports tax compliance, and positions your real estate business for growth.

What real estate bookkeeping covers

Real estate bookkeeping and property accounting go beyond basic bookkeeping. Effective real estate bookkeeping includes:

- Recording rental income, security deposits, and ancillary fees.

- Tracking operating expenses, repairs, maintenance, utilities, and property management fees.

- Maintaining accounts payable and receivable, vendor invoices, and contractor payments.

- Reconciliations of bank accounts and credit cards tied to the real estate business.

- Generating monthly bookkeeping reports: profit and loss (income and expenses), cash flow statements, and balance sheet snapshots.

- Tracking capital expenditures and improvements versus repairs to support tax treatment and depreciation schedules.

- Preparing financial records and reports needed by your CPA for tax planning, tax preparation, and tax filing.

Core benefits of reliable bookkeeping for real estate investors

Implementing proper bookkeeping delivers tangible benefits for investors, landlords, and property managers:

- Clear cash flow visibility: Regular financial reporting and cash flow statements show whether properties generate positive cash flow and identify seasonal or vacancy impacts.

- Better decision-making: Accurate accounting lets you compare property performance, prioritize investments, and forecast returns on investment.

- Tax optimization: Robust records enable tax strategies, maximize deductions, and simplify tax time for your CPA or tax preparer.

- Loan and investor readiness: Lenders and partners want clean financial balance sheets and income statements to prove creditworthiness and portfolio health.

- Compliance and audit trail: Proper documentation reduces the risk of disputes with tenants, vendors, or tax authorities and ensures tax compliance.

- Scalability: Clean bookkeeping systems and bookkeeping services for real estate make it easier to scale from a single rental to a large real estate portfolio or commercial real estate operations.

Key reports every investor should produce

Real estate-specific financial reporting is essential. At a minimum, produce these reports monthly and review them with your accountant or bookkeeper:

- Profit and Loss (Income and Expenses): Shows rental income, operating expenses, net operating income, and profit for each property.

- Cash Flow Statement: Tracks cash inflows and outflows to ensure liquidity for mortgage payments, taxes, and repairs.

- Balance Sheet: Summarizes assets, liabilities, and equity, which are important for loan applications and portfolio valuation.

- Property Performance Report: Compares properties across metrics like cap rate, cash-on-cash return, and occupancy.

Common accounting methods and best practices

Most real estate investors choose between cash-basis and accrual accounting. Cash-basis accounting recognizes transactions when cash changes hands and is simple for small rental portfolios. Accrual accounting records income and expenses when earned or incurred and provides a fuller view of performance, which is beneficial as your real estate business grows.

Best practices:

- Use separate bank accounts for each entity or property when possible to simplify property accounting and protect personal assets.

- Adopt reliable accounting software designed for rental property accounting or customizable bookkeeping software like QuickBooks, Xero, or real estate-specific platforms integrated with property management software.

- Categorize transactions consistently: repairs, maintenance, capital improvements, mortgage interest, property tax, insurance, utilities, and management fees.

- Keep digital records of leases, vendor contracts, invoices, and receipts to support tax deductions for investors.

- Reconcile bank statements monthly and review cash flow statements to spot variances early.

DIY bookkeeping for real estate investors: what to expect

Doing your own bookkeeping can save money and keep you close to your numbers, but it requires discipline and the right systems. DIY bookkeeping for real estate investors is feasible for small portfolios with straightforward rental income. Here’s what to consider:

Advantages

- Lower ongoing costs compared with hiring a bookkeeping service or full-time bookkeeper.

- Direct control and immediate access to financial records and insights.

- Learning accounting basics that help with strategic decisions and tax planning.

Challenges

- Time-consuming monthly bookkeeping, reconciliations, and financial reporting can take hours.

- Risk of errors that affect tax filing and cash flow management.

- Limited access to specialized real estate accounting expertise for complex transactions like cost segregation or 1031 exchanges.

Tools to support DIY investors: accounting software with rental property templates, property management software that syncs bank feeds, and checklists for monthly bookkeeping and tax time preparation.

Outsourcing bookkeeping: when it makes sense

As your real estate investment activity grows, outsourcing your bookkeeping becomes attractive. Many investors benefit from bookkeeping services for real estate that specialize in investor needs and integrate with CPAs and property managers. Consider outsourcing when:

- You own multiple rental properties or commercial real estate and need accurate accounting across a portfolio.

- Time constraints prevent timely monthly bookkeeping and reconciliations.

- You want expert bookkeeping that understands real estate-specific tax regulations and reporting needs.

- You need clean financials for lenders, investors, or to scale the business.

Benefits of outsourcing

- Access to expert bookkeeping specialized in real estate improves accuracy and property accounting.

- Scalable monthly bookkeeping services that produce timely financial reporting and cash flow statements.

- Better coordination with your CPA for tax planning and tax preparation, saving money during tax time.

- Ability to focus on core activities: finding deals, increasing rents, and improving property performance.

How to choose a bookkeeper or bookkeeping service

Pick a partner who specializes in real estate bookkeeping or has significant experience with rental properties and investment property finances. Ask prospective bookkeepers these questions:

- Do you specialize in real estate accounting or work with real estate investors frequently?

- What accounting software do you use, and can it integrate with my property management software?

- How do you handle bank reconciliations, month-end close, and financial reporting?

- Can you prepare records to simplify tax filing and work with my CPA on tax strategies?

- Do you offer scalable services for growing portfolios and commercial real estate?

Look for credentials like experience with CPAs, knowledge of tax regulations affecting rental property accounting, and references from other investors. A good bookkeeper can also advise on financial management, cash flow optimization, and the bookkeeping systems that support business growth.

Technology that improves real estate bookkeeping

Modern bookkeeping software and property management tools make bookkeeping for real estate investors more efficient and accurate. Consider platforms that offer:

- Bank and credit card feeds that automate transaction imports.

- Integration with property management software to sync rental income and tenant payments.

- Templates for rental property accounting, depreciation schedules, and capital improvements tracking.

- Dashboards for portfolio-level financial reporting and property performance comparisons.

Using specialized accounting software or real estate-specific bookkeeping service reduces manual data entry, improves financial reporting, and supports tax compliance. Whether you use bookkeeping software yourself or via a bookkeeping service, automation saves time and reduces errors.

Tax time and bookkeeping: maximize deductions and simplify filing

Accurate bookkeeping makes tax planning and tax filing far easier. Your CPA will rely on detailed financial records to claim deductions and meet tax regulations. Key bookkeeping tasks that help at tax time:

- Document and categorize deductible expenses: mortgage interest, property tax, insurance, repairs, utilities, management fees, and advertising.

- Separate capital expenditures from repairs to ensure correct depreciation and tax treatment.

- Maintain records of passive activity rules, rental income, and losses for real estate professionals and investors.

- Collaborate with your CPA early for tax strategies like cost segregation, 1031 exchanges, and entity structure adjustments to reduce tax liability.

Timely monthly bookkeeping means less scrambling at year-end and more effective tax planning that preserves returns on investment.

Common pitfalls and how to avoid them

Real estate bookkeeping has pitfalls that can undermine profitability and tax compliance. Avoid these common mistakes:

- Mixing personal and business accounts, use separate bank and credit card accounts for your real estate business or for each entity.

- Missing or misclassifying expenses, consistent categorization prevents lost deductions and inaccurate cash flow reports.

- Neglecting reconciliations, unreconciled accounts hide transaction errors and potential fraud.

- Delaying bookkeeping monthly keeps figures accurate and avoids year-end surprises.

Regular reviews with a CPA or experienced bookkeeper can correct course, enforce best practices, and improve financial management across your real estate ventures.

Scaling bookkeeping as your portfolio grows

As you expand from a few rental properties to a sizable real estate portfolio or commercial real estate holdings, your accounting needs become more complex. Plan a pathway to scale:

- Standardize the chart of accounts across properties to enable portfolio-level reporting and comparisons.

- Move from basic accounting software to platforms that support multi-entity structures, consolidated financial reporting, and advanced depreciation methods.

- Consider outsourcing monthly bookkeeping and payroll to specialized bookkeeping services for real estate that can coordinate with your CPA.

- Implement performance dashboards to monitor cash flow, occupancy, and returns on investment across each property.

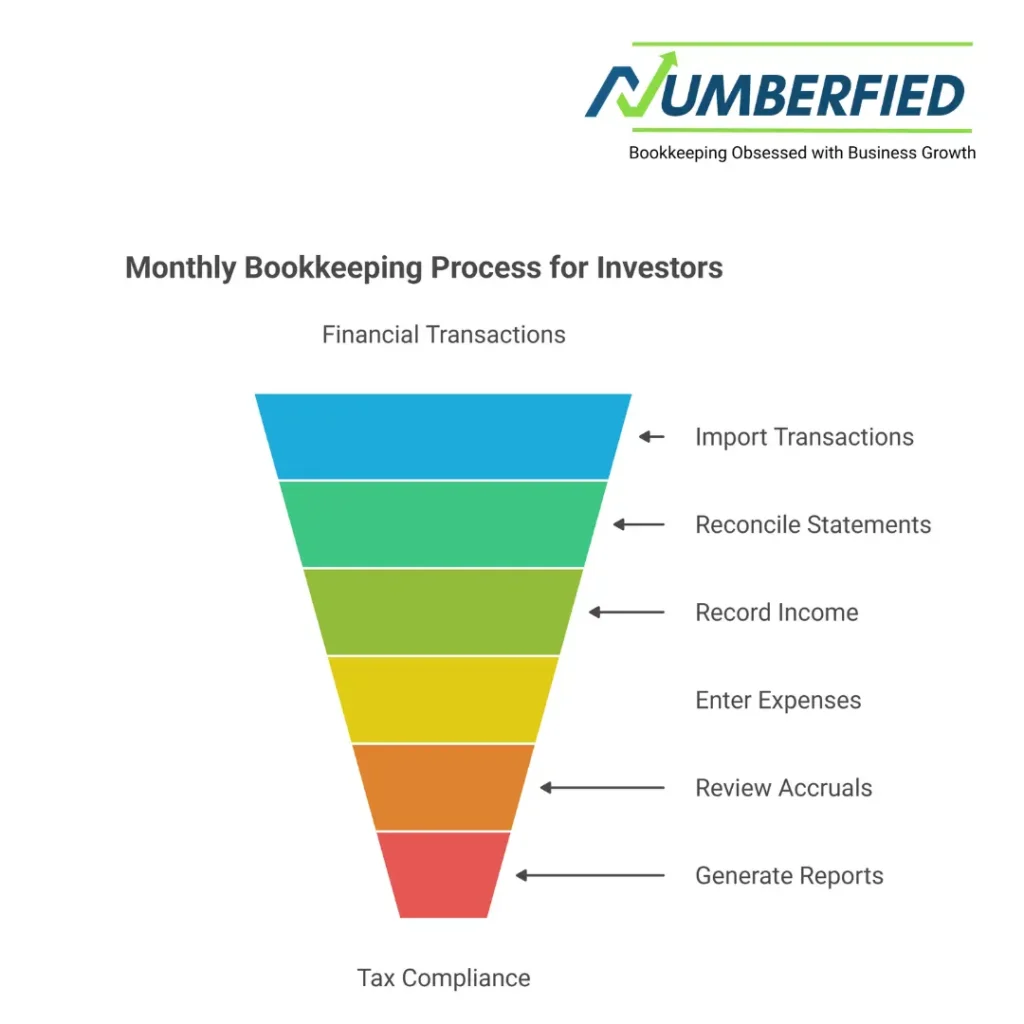

Checklist: Monthly bookkeeping tasks for investors

Adopt this monthly routine to keep accounting accurate and actionable:

- Import and categorize bank and credit card transactions.

- Reconcile bank and credit card statements.

- Record rental income, late fees, and tenant payments.

- Enter invoices and payables for repairs, maintenance, and contractors.

- Review accruals and prepaids; update depreciation schedules as needed.

- Run profit and loss, cash flow statements, and balance sheet; review property performance.

- Share reports with your CPA for tax planning and compliance.

Real-world example: How bookkeeping improved a small portfolio

Consider a landlord who managed five rental properties with inconsistent bookkeeping and mixed personal accounts. After separating accounts, implementing a property-level chart of accounts, and outsourcing monthly bookkeeping to a firm that specializes in real estate bookkeeping, the investor gained clear cash flow statements and property performance reports. The investor identified underperforming units, adjusted rents, optimized repairs, and saved thousands at tax time through correctly documented deductions, demonstrating how accurate accounting directly improves returns and supports business growth.

Final recommendations for real estate investors

Bookkeeping for real estate investors is not optional; it’s a strategic function that protects cash flow, ensures tax compliance, and powers business growth. To strengthen your real estate investing success:

- Start with proper bookkeeping systems and choose accounting methods that fit your portfolio size and goals.

- Invest in bookkeeping software and property management software that integrate to reduce manual work.

- Decide early whether to DIY or outsource: outsource when complexity, scale, or time constraints demand professional support.

- Work closely with a CPA and a bookkeeper who specialize in real estate to implement tax strategies and accurate financial reporting.

- Make monthly bookkeeping a priority to maintain accurate financial records and to make informed decisions that improve property performance and grow your real estate business.

Whether you manage single-family rentals, commercial real estate, or a growing real estate portfolio, effective real estate bookkeeping is crucial for real estate investors who want reliable cash flow, stronger returns on investment, and long-term success.

FAQ

What is the 7% rule in real estate?

The 7% rule is a quick guideline used by real estate investors to evaluate whether a rental property is likely to be profitable. It states that the monthly rent should be at least 7% of the property’s purchase price (or total acquisition cost). For example, a $300,000 property should generate at least $2,100 in monthly rent. While not as conservative as the 1% rule, it helps filter potential deals quickly.

How to do bookkeeping for real estate?

Real estate bookkeeping involves tracking all income (rent, commissions, fees) and expenses (mortgage interest, repairs, property taxes, insurance, management fees) separately for each property. Use dedicated software to categorize transactions, reconcile bank accounts monthly, track depreciation, maintain security deposits in separate accounts, and generate reports like profit-and-loss per property for tax and investment analysis.

What does a real estate bookkeeper do?

A real estate bookkeeper records daily financial transactions, reconciles bank and credit card statements, tracks rental income and expenses by property, manages escrow and security deposits, processes payroll if applicable, handles vendor payments, prepares financial reports, and organizes records for tax preparation. They ensure compliance with real estate-specific rules and help investors maximize deductions.

Is real estate bookkeeping hard?

Real estate bookkeeping can be challenging due to multiple properties, varying income streams (rent, flips, commissions), complex expenses (depreciation, capital improvements), and strict rules around security deposits and escrow. However, with proper software and systems, it becomes manageable, and many investors find it straightforward once organized.

Is bookkeeping hard for beginners?

Bookkeeping is approachable for beginners with the right tools and basic understanding of categories like income, expenses, assets, and liabilities. Modern cloud software automates much of the work (bank feeds, categorization), making it far easier than manual methods. The learning curve is gentle, especially for real estate with dedicated investor-focused apps.

What is the highest-paid position in real estate?

The highest-paid positions in real estate are typically real estate developers (often earning millions through project profits), commercial real estate brokers in major markets (commissions can exceed $500,000+ annually), luxury residential brokers, and real estate private equity professionals. Top-performing agents in high-value markets can also earn seven figures through commissions.

What is the 3 3 3 rule in real estate?

The 3-3-3 rule is a guideline for homebuyers: housing costs should not exceed 30% of gross monthly income, the home price should be no more than 3 times annual household income, and buyers should have 3 months of living expenses saved as reserves. It promotes financial stability and reduces the risk of overextending.

Is QuickBooks good for real estate investors?

Yes, QuickBooks is widely used and effective for real estate investors, especially with proper setup using classes or locations to track each property separately. It handles rental income, expenses, depreciation, and reporting well. Many pair it with third-party apps for advanced investor features like tenant tracking or performance analytics.

What is the best accounting software for real estate investing?

The best accounting software depends on needs: Stessa (free, investor-focused with automated tracking), REI Hub (strong for tax and portfolio reporting), Baselane (great for landlords with banking integration), AppFolio (property management focus), or QuickBooks Online (versatile and widely supported). Stessa and REI Hub are top choices specifically for investors.

Also Read: Why Bookkeeping for Real Estate Investors Should Be Your Top Priority Right Now