Introduction

For small businesses, startups, and growing companies, bookkeeping outsourcing services offer a practical way to manage the accounting function without expanding an in-house accounting department. Outsourcing your bookkeeping delivers timely financial information, reduces costs, and lets the business owner and finance team focus on core business activities like sales, product development, and scaling. Whether you need monthly bookkeeping, payroll coordination, or real-time financial reporting, reliable outsourced bookkeeping services provide professionals who specialize in bookkeeping and accounting services tailored to your business needs.

Key benefits of bookkeeping outsourcing services

Cost-effectiveness and predictable pricing

One of the most tangible benefits of outsourced bookkeeping is lower overhead. Hiring a full-time in-house bookkeeper or building an accounting team involves salaries, benefits, software licenses, training, and management time. Bookkeeping outsourcing services typically offer predictable monthly fees for bookkeeping and accounting services, payroll coordination, and tax preparation support, making cash flow planning simpler for small businesses and startups.

Access to highly skilled accounting professionals

Professional bookkeeping firms and outsourced accounting services employ experienced bookkeepers, CPAs, controllers, and CFO that many small businesses cannot afford to hire directly. These professionals provide high-quality financial records, GAAP-trimmed reporting, and advisory services that improve decision-making for business owners and CFOs.

Scalability and flexibility

As your business grows, bookkeeping outsourcing services scale with you. Outsourced bookkeeping services can expand from basic bookkeeping to outsourced accounting services, controller services, and advisory services. This flexibility lets startups and small businesses add the level of financial management they need without hiring an entire accounting department.

Improved accuracy and compliance

Experienced bookkeeping service providers follow best practices and use reliable bookkeeping software, reducing errors in payroll, tax preparation, and financial reporting. Outsourced bookkeeping reduces the risk of missed filings, payroll mistakes, and inaccurate financial statements, which are critical for businesses planning to raise capital or undergo audits.

Real-time financial information and streamlined workflows

Many outsourced bookkeeping providers use modern accounting software like QuickBooks and cloud bookkeeping software to deliver real-time financial dashboards. This enables business owners and finance teams to make quicker decisions and monitor cash flow, accounts receivable, and expenses more effectively.

In-house vs. outsourced bookkeeping: a practical comparison

Choosing between an in-house bookkeeper and bookkeeping outsourcing services depends on cost, control, expertise, and long-term business strategy. Below is a pragmatic comparison to help you evaluate which approach fits your business needs.

Cost and overhead

In-house bookkeeper: Salaries, benefits, training, software licenses, workstation costs.

Outsourced bookkeeping services: Monthly service fees, often lower overall cost, and predictable budgeting.

Expertise and coverage

In-house bookkeeper: May be limited to the skills of a single individual.

Outsourced bookkeeping services: Access to a bookkeeping firm’s team, including CPAs, controllers, and bookkeeping specialists across different industries and accounting software platforms.

Scalability

In-house bookkeeper: Hiring additional staff is time-consuming and costly.

Outsourced bookkeeping services: Easily scale services up or down as the business grows or experiences seasonal fluctuations.

Control and proximity

In-house bookkeeper: Greater day-to-day control and onsite presence.

Outsourced bookkeeping services: Remote bookkeeper or virtual bookkeeping models require clear processes and technology, but often provide remote access to real-time financial information and collaboration tools.

Security and continuity

In-house bookkeeper: Risk of disruption if the person leaves; dependency on one employee.

Outsourced bookkeeping services: Firms typically have succession plans and backups to ensure continuity of service and secure online practices for financial records.

Key features to look for in bookkeeping outsourcing services

When evaluating outsourced bookkeeping providers, prioritize the following features to ensure a successful partnership:

1. Experience with small businesses and startups

Choose a provider that understands services for startups and small businesses, including compliance needs, cash flow patterns, and common challenges faced by growing companies.

2. Technology and accounting software expertise

Ensure the provider is skilled in popular bookkeeping software like QuickBooks, bookkeeping software integrations, and cloud accounting platforms to streamline workflows and offer real-time financial reporting.

3. Clear scope: bookkeeping and accounting services

Look for firms that clearly define services, such as monthly bookkeeping, payroll support, tax preparation services, financial reporting, and advisory services. This clarity prevents scope creep and ensures expectations align with pricing.

4. Security and data controls

Verify secure data practices, including access controls, encryption, secure file sharing, and backups. Reliable outsourced bookkeeping services should protect sensitive financial information for your company and customers.

5. Communication and collaboration

Good providers assign a dedicated bookkeeper or bookkeeping team and provide regular review meetings, dashboards, and consistent communication with your CFO, controller, or business owner.

6. Integration with your accounting function

Top bookkeeping firms integrate with your existing accounting team, CPA, or tax preparer to streamline bookkeeping and tax preparation, reduce duplication, and improve financial reporting accuracy.

Common challenges and mistakes when outsourcing bookkeeping

Outsourcing your accounting brings many advantages, but there are pitfalls if the process is rushed or poorly managed. Avoid these common mistakes:

Poor onboarding and unclear expectations

Failing to provide access to financial records, accounting software, and clear process documentation will delay progress. A structured onboarding process with a checklist for financial information, vendor lists, and bank access is essential.

Choosing the lowest-cost provider without vetting

Cost-effective doesn’t mean compromising quality. Vet providers for experience, references, and technology capabilities rather than selecting solely on price.

Insufficient communication

Not scheduling regular review calls or failing to establish who handles which accounting needs leads to missed deadlines and confusion. Define communication cadence and responsibilities up front.

Not integrating with tax and advisory services

Bookkeeping that’s disconnected from your CPA or tax preparer can create extra work and reconciliation issues. Choose providers that coordinate with CPAs and offer bookkeeping and tax preparation alignment.

Lack of data security

Giving broad access without secure controls or relying on spreadsheets instead of bookkeeping software increases risk. Ensure secure practices and modern accounting software usage.

Step-by-step guide

Step 1: Define your business needs and objectives

Start by documenting what you want from outsourced bookkeeping: monthly bookkeeping, payroll coordination, tax-ready books, financial reporting, or CFO-level advisory. Identify pain points, such as late invoices, poor cash flow visibility, or time spent on bookkeeping tasks, and set measurable goals.

Step 2: Prepare financial information and processes

Gather current financial records, access to accounting software (QuickBooks or other bookkeeping software), bank statements, vendor lists, payroll info, and any existing spreadsheets. Map out your invoicing, expense approval, and payroll workflows so the provider can understand your business needs.

Step 3: Shortlist and vet providers

Look for bookkeeping service providers with experience in small businesses, positive client references, certifications (QuickBooks ProAdvisor, CPA partnerships), and demonstrated security practices. Ask about team structure, turnaround times, and whether they provide outsourced accounting services beyond basic bookkeeping.

Step 4: Evaluate technology and integrations

Confirm the provider supports your accounting software and can integrate with banking feeds, payroll platforms, and other tools. A provider that uses cloud-based systems can provide real-time financial information and streamline collaboration.

Step 5: Define scope, pricing, and SLAs

Negotiate a clear scope of work, pricing model (fixed monthly, hourly, or tiered), and service-level agreements for deliverables like monthly close, reconciliations, and reporting cadence. Include provisions for additional services like controller services or CFO services if needed later.

Step 6: Onboard and transfer responsibilities

Use a structured onboarding plan with timelines, access permissions, and a checklist of required documents. Assign a primary contact on both sides: your in-house point person (business owner, CFO, or controller) and the assigned bookkeeper or team from the provider.

Step 7: Establish reporting and review cadence

Set expectations for monthly financial reporting, dashboards, and quarterly review meetings. Ensure reports include KPIs relevant to your business cash flow, gross margin, accounts receivable aging, and budget-to-actual comparisons.

Step 8: Continuous improvement and advisory

After the initial stabilization, use your bookkeeping partner for process improvements, automation, and advisory services. Outsourced accounting services can help with budgeting, forecasting, and strategic planning as your business grows.

How outsourcing bookkeeping helps with tax preparation, payroll, and financial reporting

Reliable bookkeeping and tax preparation go hand-in-hand. Outsourced bookkeeping services that maintain clean, reconciled books simplify tax preparation and reduce surprises at year-end. Many bookkeeping firms coordinate with CPAs to provide bookkeeping and tax preparation packages, ensuring your financial records meet tax compliance requirements.

For payroll, outsourced bookkeeping services either coordinate with payroll providers or manage payroll themselves, ensuring payroll entries are recorded correctly and taxes are accounted for. Accurate payroll and tax records improve financial reporting and support audit preparedness.

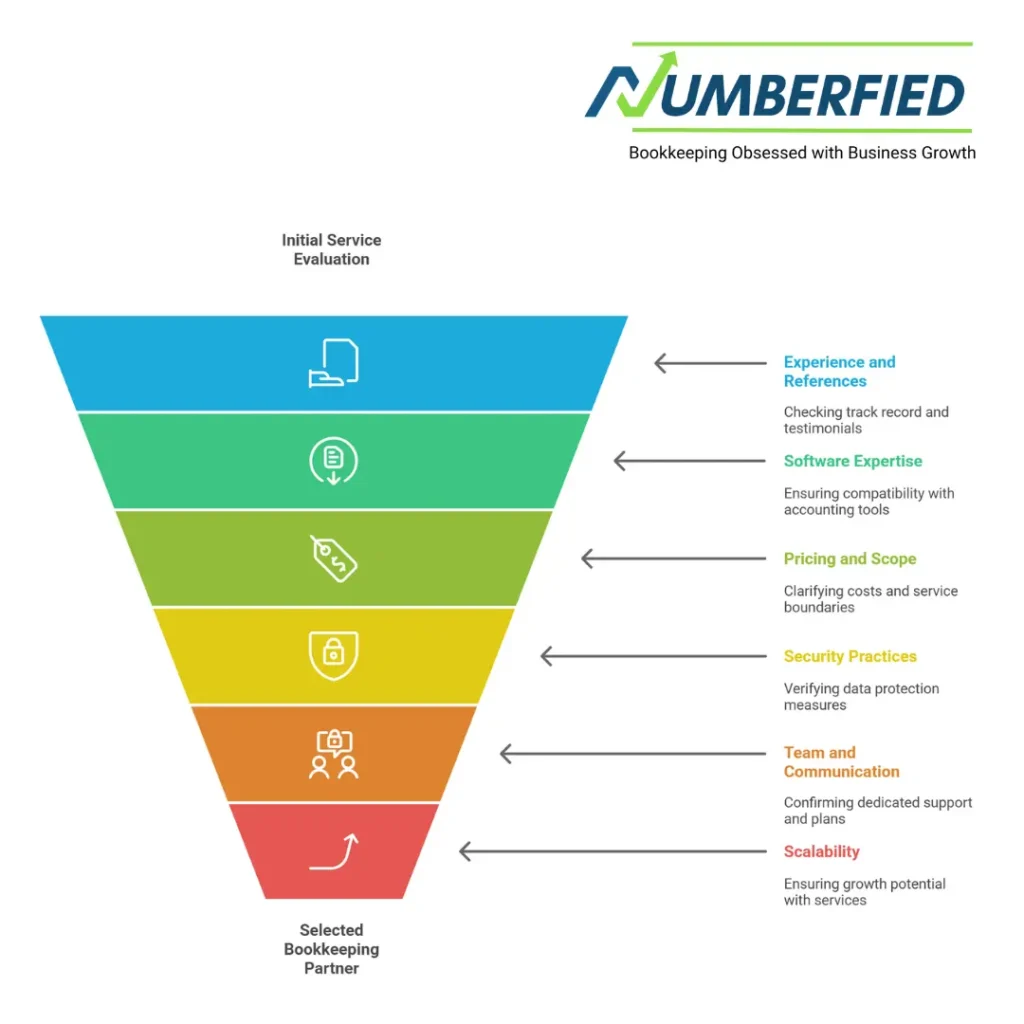

Selecting a partner: checklist for evaluating bookkeeping outsourcing services

- Experience with small businesses and startups, and references.

- Expertise in your accounting software (QuickBooks or alternative bookkeeping software).

- Transparent pricing and clear scope of bookkeeping and accounting services.

- Security practices and data access controls.

- Dedicated bookkeeper or bookkeeping team and communication plan.

- Ability to scale to controller services or CFO services as you grow.

- Integration with your CPA and tax preparation workflows.

- Use of automation and real-time financial reporting capabilities.

Costs and ROI

Pricing varies by provider, scope, and business complexity. Many small businesses find that a predictable monthly fee for outsourced bookkeeping replaces the higher total cost of an in-house bookkeeper while delivering broader expertise. The ROI includes time savings for the owner, improved decision-making from real-time financial reporting, reduced errors in tax filings, and better financial management that supports scaling and fundraising.

Conclusion

When outsourcing your bookkeeping, prioritize clarity: define the scope, agree on deliverables, protect data security, and foster open communication. Use bookkeeping outsourcing services not only to relieve transactional workloads but also to gain financial clarity that powers growth. Integrate your outsourced bookkeeping partner with your CPA and consider staged growth, start with monthly bookkeeping, and expand to controller or CFO services as your business grows.

Take the next step: get a free consultation

If you’re a business owner or financial manager ready to streamline your accounting needs and focus on growing your business, request a free consultation to evaluate bookkeeping outsourcing services tailored to your business. A short conversation can clarify whether outsourced bookkeeping, virtual bookkeeping, or a full outsourced accounting services package best fits your needs and budget. Reach out today to get a custom plan for accurate financial records, timely tax preparation, and better cash flow management.

Request your free consultation now, get faster, more reliable bookkeeping and accounting so your business can grow with confidence.

FAQ

What is outsourcing bookkeeping services?

Outsourcing bookkeeping services involves hiring an external provider to handle a business’s financial record-keeping, transaction categorization, reconciliation, and reporting tasks. These providers use secure cloud software to manage books remotely, allowing companies to access expert bookkeepers without maintaining an in-house team.

How does outsourcing bookkeeping work?

Outsourcing bookkeeping works by securely sharing financial data (bank feeds, receipts, invoices) with the provider through integrated software like QuickBooks or Xero. The outsourced team categorizes transactions, reconciles accounts, generates reports, and communicates regularly via email or portals, while the business retains oversight and approval authority.

What are the three types of bookkeeping?

The three main types of bookkeeping are single-entry bookkeeping, which records transactions once and suits very simple operations; double-entry bookkeeping, which records each transaction as debit and credit for accuracy and is the standard method; and virtual or cloud bookkeeping, which uses online software for real-time access and collaboration.

What are the 4 types of outsourcing?

The four primary types of outsourcing are offshore outsourcing to distant countries for cost savings, nearshore outsourcing to nearby countries for similar time zones, onshore outsourcing within the same country for compliance ease, and business process outsourcing for specific functions like bookkeeping or payroll.

Is it a good idea to outsource bookkeeping?

Outsourcing bookkeeping is generally a good idea for most small to medium businesses because it reduces costs, provides access to specialized expertise, improves accuracy, ensures compliance, and frees internal resources for core activities rather than administrative tasks.

How much does outsourced bookkeeping cost?

Outsourced bookkeeping typically costs between $300 and $2,000 per month for small to medium businesses, depending on transaction volume, complexity, and additional services like payroll or tax preparation. Many providers offer tiered packages or per-hour rates around $40–$80.

How much does outsourced bookkeeping cost?

Outsourced bookkeeping costs vary widely but average $500–$1,500 monthly for typical small businesses, with basic plans starting lower and comprehensive services reaching higher amounts based on needs such as transaction count and reporting frequency.

What is outsourcing bookkeeping services?

Outsourcing bookkeeping services means delegating daily financial tasks like recording transactions, managing payables/receivables, reconciling statements, and preparing reports to a third-party specialist firm, often operating remotely with cloud-based tools for efficiency and scalability.

How much should you pay a bookkeeper per month?

Businesses should expect to pay $400–$2,000 per month for a professional bookkeeper, whether outsourced or in-house equivalent, depending on the scope of work, business size, and whether the service includes advisory or just transactional recording.

Is it a good idea to outsource bookkeeping?

Yes, outsourcing bookkeeping is a smart choice for many businesses as it lowers overhead, minimizes errors through expert handling, ensures timely compliance, scales with growth, and allows owners and staff to focus on revenue-generating activities instead of routine financial administration.

Read Also: 7 Insider Tips to Simplify Your Finances with QuickBooks Bookkeeping Services for Small Businesses