You are probably lying to yourself. Not on purpose. You aren’t malicious. You just want your business to succeed. So you look at your bank balance and your revenue chart. You see the line going up and assumes everything is fine.

It isn’t.

Most startups do not die because they lack a product market fit. They die because they sell dollar bills for ninety cents. You think you have a margin. You check your accounts and find them empty. Why? Because you calculated your price based on obvious costs like AWS bills and raw materials. You forgot the rest. The transaction fees. The support tickets. The churn. Real profitability is not about revenue lines. It is about granular cost allocation. If you do not have professional bookkeeping services for startups handling this data, you are flying blind. You are scaling losses. Not profits.

Key Takeaways

- True Unit Economics: Why your Gross Margin is likely inflated and how to calculate the “Fully Loaded” cost of a single customer.

- The Invisible Killers: How to identify and allocate “zombie” costs like unused software seats and payment gateway percentages.

- Time is Money: Methods to quantify support hours and founder time into the Cost of Goods Sold (COGS).

- The Scale Trap: Understanding why increasing sales volume will accelerate bankruptcy if your unit economics are negative.

- Strategic Pricing: How to set prices that account for friction and overhead, ensuring sustainable growth.

The Illusion of Gross Margin: Why Standard Accounting Fail You

Traditional accounting is dangerous for early-stage companies. It groups expenses into broad buckets. Rent. Payroll. Software. Marketing. This is fine for tax compliance. It is useless for strategy.

When you look at a standard Profit and Loss statement, you see a blended average. It tells you what happened to the company as a whole. It does not tell you what happens when you sign one new client.

This is the “Unit Economics” gap.

To price effectively, you must understand the cost of a single unit. If you sell SaaS, a unit is a subscription. If you sell e-commerce, it is a box. Standard accounting puts your payment processing fees in “General & Administrative” expenses. It puts your customer success manager’s salary in “Payroll.”

This is a mistake.

Those costs are direct. They happen because you sold the product. If you do not allocate them to the specific unit, your pricing model is built on sand. You might think your product costs $10 to make and you sell it for $20. A 50% margin. Great. But once you add the “invisible” costs, that product might actually cost $22 to deliver. You are losing $2 every time you make a sale. Growth in this scenario does not fix the problem. It accelerates your demise.

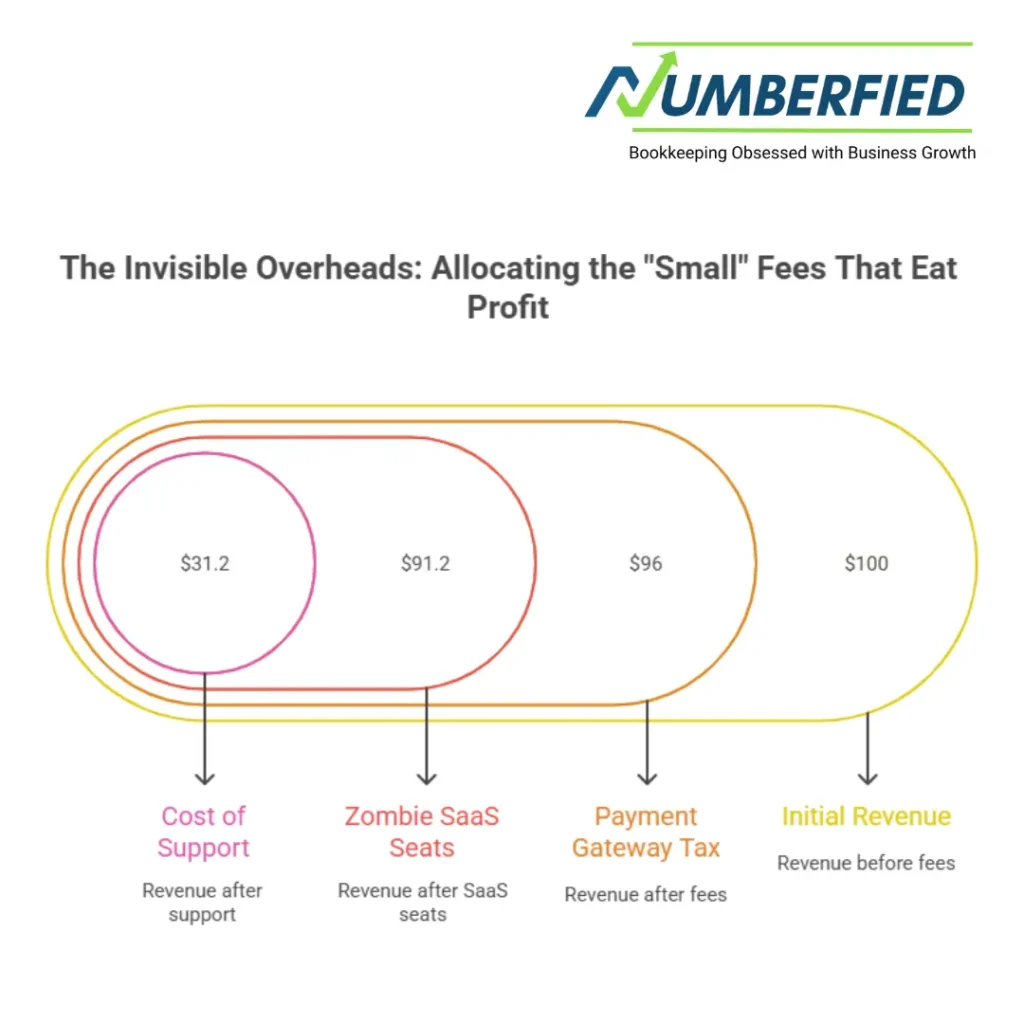

The Invisible Overheads: Allocating the “Small” Fees That Eat Profit

Let’s talk about the silent killers. These are the costs that seem negligible in isolation. They are rounding errors. Until they aren’t.

The Payment Gateway Tax

You sell a subscription for $100. You don’t receive $100. Stripe or PayPal takes 2.9% plus 30 cents. Maybe there is a currency conversion fee of another 1%. Suddenly, your revenue is $96.

This seems small. But if your margin is tight, that 4% reduction in top-line revenue could be a 20% reduction in your bottom-line profit. Startups rarely factor this into their pricing models. They price for the $100. They budget for the $100. The reality is $96.

The Zombie SaaS Seats

Software bloat is real. You buy a project management tool. You pay for 10 seats. You have 4 employees. You are paying for 6 ghosts.

This is overhead. But how do you allocate it? If that software is essential for delivering your product, those unused seats are a drag on your unit economics. They increase the cost of delivery for every active customer.

Granular bookkeeping forces you to audit these lines. It forces you to ask difficult questions. Is this tool generating revenue? If not, why are we paying for it? By allocating these costs back to the unit level, you see the inefficiency. You realize that to maintain your current tech stack, you need to charge 5% more. Or you need to cut the stack.

Determining the Cost of Support

This is the place where service-based startups and SaaS companies bleed out.

You have a customer paying $50 a month. They submit two support tickets. Your developer spends an hour fixing a bug or explaining a feature.

What is the cost of that hour?

If you don’t track it, the cost is zero. In reality, that developer’s time costs the company $60 an hour (loaded with taxes and benefits). You just spent $60 to service a $50 client. You lost money.

Bookkeeping for growth requires tagging support time. You need to know that Client A costs $10 to support, while Client B costs $100. Without this data, you cannot price correctly. You cannot fire bad clients. You simply work harder and make less.

Why Bookkeeping Services for Startups Must Go Beyond Taxes

Most founders treat bookkeeping as a chore. It is something you do so the tax authority doesn’t fine you. This is a waste of data.

Competent bookkeeping services for startups act as a diagnostic tool. We don’t just categorize transactions. We tag them.

We need to separate “Fixed Costs” from “Variable Costs” with surgical precision.

- Fixed Costs: Rent, insurance, core salaries. These don’t change much whether you have 1 customer or 100.

- Variable Costs: Server usage, payment fees, onboarding time, specific software users. These go up with every sale.

The goal of your bookkeeper is to move as many expenses as possible into the “Variable” bucket (Cost of Goods Sold). Why? Because it lowers your Gross Margin.

Wait. Why would you want to lower your margin?

Because it reveals the truth. A lower, accurate Gross Margin prevents you from overspending on marketing. If you think your LTV (Lifetime Value) is $1000, you might spend $300 to acquire a customer. But if your true LTV after invisible costs is only $400, that $300 acquisition cost is suicide.

Your bookkeeper helps you see the floor. Once you know the floor, you can build the ceiling.

The Scaling Trap: Volume Does Not Fix Negative Unit Economics

“We will make it up in volume.”

I hear this in pitch decks every week. It is the most dangerous sentence in business. Volume only magnifies your core economics. It functions as a multiplier.

If your unit economics are positive, volume creates wealth. If your unit economics are negative, volume creates debt.

Let’s look at a common scenario. A startup launches a meal delivery kit.

- Price: $10.

- Ingredients: $4.

- Packaging: $1.

- Shipping: $2.

The founder sees a profit of $3 per box. They raise money to scale. They start shipping 10,000 boxes a month.

But they forgot the invisible costs.

- Marketing cost per customer: $1.50 (amortized).

- Refund rate (spoilage/theft): 5% (averages to $0.50 per box).

- Customer support: $0.50 per box.

- Payment fees: $0.50 per box.

The real cost is $4 + $1 + $2 + $1.50 + $0.50 + $0.50 + $0.50 = $10.

They are breaking even. Exactly even. But they have overhead. Rent. Founder salaries. Legal fees.

At 10,000 boxes, they are burning cash. They think the solution is 20,000 boxes. At 20,000 boxes, the operational complexity increases. Shipping errors go up. Support costs go up. The unit economics actually get worse.

You cannot scale your way out of a broken pricing model. You must fix the inputs first. You need to know that the box actually costs $10 to deliver. Then, you can raise the price to $14.

The Human Element: Founder Time is Not Free

Early-stage founders have a bad habit. They value their time at $0.

You do the bookkeeping yourself. You answer the support tickets. You do the sales calls. Since you aren’t drawing a full salary, you leave these costs out of the pricing model.

This works for month one. It breaks at month twelve.

Eventually, you will need to hire people to do these things. If your pricing is based on “founder labor” (which is free), your margins will collapse the moment you hire a replacement.

Your pricing reality check must include a “Shadow Payroll.” Calculate what it would cost to pay a stranger to do your job.

- Bookkeeping: $500/month.

- Sales: $2000/month + commission.

- Support: $15/hour.

Add these shadow costs to your P&L. Now look at your net income. Are you still profitable? If the answer is no, your product is underpriced. You are subsidizing your customers with your own sweat equity. That is charity. It is not business.

Actionable Steps: Fixing the Price With Data

You have the data. You see the invisible costs. You realize you are underpriced. Now what?

You have three levers.

1. Raise the Price This is the most obvious and the most terrifying. You fear customers will leave. Here is the reality check: If a customer leaves because you increased the price to a level where you are actually profitable, let them go. They were not a customer. They were a liability. Value-based pricing is the goal. But cost-plus pricing is the safety net. You must charge enough to cover the fully loaded cost plus a margin that covers your fixed overhead.

2. Lower the Variable Costs Look at the granular report.

- Can you switch payment processors to save 0.5%?

- Can you automate the support tickets to reduce labor hours?

- Can you cut the zombie software seats? Every dollar you save here goes directly to the bottom line. It improves the unit economics instantly.

3. Change the Business Model Sometimes the math just doesn’t work. The cost of delivery is too high for the market to bear. This is a pivot point. Maybe you stop offering “unlimited support.” Maybe you shift from a monthly subscription to an annual one to secure cash flow and reduce churn. Maybe you stop selling the physical product and license the IP.

You cannot make these decisions based on gut feeling. You make them based on the ledger.

Conclusion

Pricing is not a marketing exercise. It is a math problem. If you get the variables wrong, the answer will always be failure.

Startups ignore the details because they are messy. It is easier to look at the top line and dream of unicorn status. But the graveyard of failed ventures is full of companies with high revenue and negative unit economics. Do not join them. Dig into the invisible costs. Allocate every cent. Use the data and rely on bookkeeping services for startups to demand the price your survival requires.

Scaling a business is hard enough. Don’t make it impossible by running a race where every step forward costs you money.

Read Also: Why Accounting and Bookkeeping Services Will Change Your Business for the Better!

FAQs

1. Why is my bank account empty if my P&L shows a profit?

Profit is an accounting theory; cash is reality. Your P&L likely spreads out costs (amortization) or records revenue before you actually collect the cash (accrual accounting). Also, loan payments and inventory purchases drain cash but don’t always hit the P&L immediately as expenses.

2. What is the difference between Gross Margin and Contribution Margin?

Gross Margin usually just subtracts direct material and labor. Contribution Margin subtracts all variable costs associated with a sale, including shipping, transaction fees, and sales commissions. Contribution margin is the true measure of scalability.

3. How often should I review my unit economics?

Monthly. Costs drift. New software is added. Vendor prices increase. If you only check once a year, you could be bleeding margin for 11 months without knowing it.

4. Should I allocate rent to my unit costs?

Generally, no. Rent is a fixed cost. It doesn’t change if you sell one more unit. Keep it in operating expenses. Focus on allocating costs that fluctuate with volume.

5. How do I calculate “Shadow Payroll” for pricing?

Estimate the market rate for the hours you work. If you spend 10 hours a week on support, and a support rep costs $20/hr, add $200/week to your theoretical costs. Build your price to cover that $200.

Get clarity on your numbers today

Your pricing model is leaking cash. You just can’t see where. Let Numberfied run the numbers. We will uncover your true costs and help you build a pricing strategy that actually scales.