You started a business to solve a specific problem. You didn’t start it to categorize receipts at 2 AM on a Saturday. That is the quickest path to burnout. Most founders believe they save money by managing finances themselves. They are wrong. Every hour you spend fighting Excel is an hour you aren’t selling. It is an hour you aren’t leading. Eventually, the cracks show. A missed tax deadline costs significantly more than a monthly retainer. You cannot build a seven-figure business with a five-figure mindset. This guide breaks down exactly when to switch to professional business startup accounting and bookkeeping services before your growth stalls.

Key Takeaways

- The Opportunity Cost: Why your “free” labor is actually the most expensive line item on your P&L.

- The $250k Barrier: Recognizing the specific revenue milestone where DIY finance becomes a liability.

- Operational Triggers: How hiring employees and crossing state lines creates immediate compliance needs.

- Strategic vs. Transactional: Understanding the difference between data entry and financial intelligence.

The High Cost of “Free” DIY Bookkeeping

Founders are scrappy. We have to be. In the early days, you are the CEO, the janitor, and the CFO. This works when you have five transactions a month. It becomes toxic when you have five hundred. The biggest lie in startup culture is that doing your own books saves capital. It wastes your most finite resource: focus.

Calculating the Founder’s Hourly Rate

Let’s do the math. If your specialized skill, whether it is coding, consulting, or product design, generates $200 per hour in value, spending ten hours a month on bookkeeping costs the company $2,000. You might think you are saving a $500 monthly bookkeeping fee. In reality, you are losing $1,500 in potential revenue generation.

This is the opportunity cost. When you outsource, you are buying your time back at a discount. You leverage a professional’s efficiency against your own high-value hourly rate. Successful founders do not do $20/hour work. They hire experts to handle it so they can focus on $1,000/hour strategic decisions.

The Accuracy Gap and Cleanup Costs

There is another cost to DIY. It is the cost of incompetence. You are not an accountant. You shouldn’t be. However, amateur mistakes compound over time. Misclassifying assets as expenses, failing to reconcile bank feeds properly, or mixing personal and business expenses creates a tangled mess.

We see this constantly at Numberfied. A founder comes to us after two years of DIY. We have to spend weeks untangling the data before we can even run a report. This “cleanup” phase is expensive. It often costs three times as much as it would have to pay for proper service from day one. Bad data is worse than no data. It gives you a false sense of security while you bleed cash.

The Revenue Tipping Point: Hitting the $250k Mark

Revenue is a loud signal. It screams complexity. It is totally fine to use a spreadsheet when your startup is not generating revenue or is only making a few thousand dollars. However, the rules of the game change as soon as you get traction.

Volume Overwhelms Manual Processes

Somewhere between $150,000 and $250,000 in annual recurring revenue (ARR), manual entry breaks. The transaction volume becomes too high for a Sunday afternoon catch-up session. You have multiple payment processors. You have credit card statements. You have vendor invoices.

At this stage, you need automation. You need bank feeds syncing to a general ledger. If you are still manually entering invoice data into a spreadsheet at $250k revenue, you are actively suppressing your growth. You lose visibility. You cannot see your burn rate in real-time. You are making decisions based on the bank balance you see on your phone, not your actual cash flow. That is how businesses die.

The Shift from Cash to Accrual

Most startups begin on a cash basis. You record income when it hits the bank. Simple. As you scale towards that quarter-million mark, you may need to look at accrual accounting. This records revenue when it is earned and expenses when they are billed.

This gives a more accurate picture of financial health. It matches revenue to the costs incurred to generate it. Doing this on a spreadsheet is nearly impossible. It requires sophisticated journal entries and reconciliation. If you have investors, or plan to get them, they will demand accrual-based financials. You cannot DIY this transition without creating chaos.

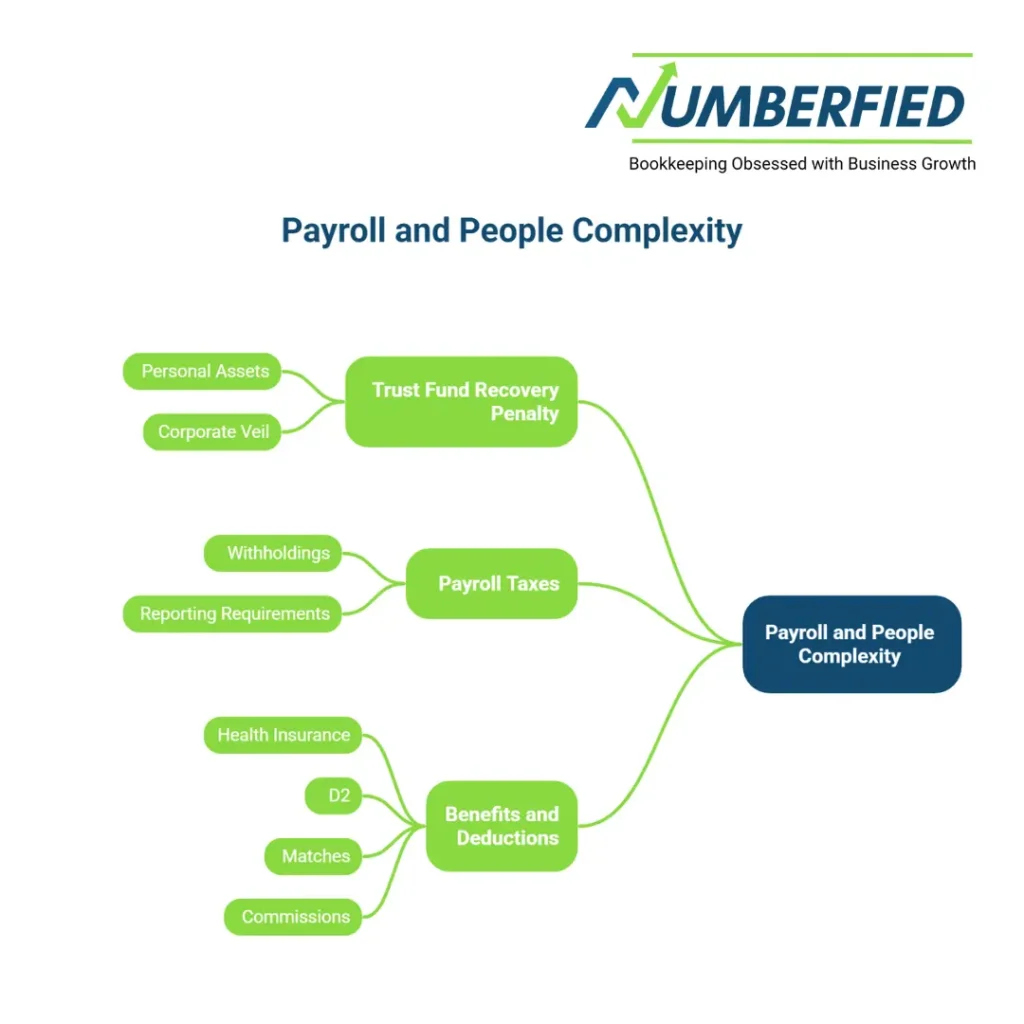

The Payroll and People Complexity

The moment you hire your first W-2 employee, your liability skyrockets. Contractors are simple. Employees are complex. The government does not play games with payroll taxes.

The Trust Fund Recovery Penalty

This is terrifying. If you fail to withhold or pay payroll taxes correctly, the IRS can pierce the corporate veil. This means they can come after your personal assets. It is called the Trust Fund Recovery Penalty. They view that money as belonging to the employee and the government, not you.

Managing payroll withholdings, state unemployment insurance, and federal reporting requirements is not a DIY task. It requires precision. One missed filing deadline results in automatic penalties. These penalties often exceed the cost of a professional service.

Benefits and Deductions

It gets deeper. As you grow, you want to retain talent. You offer health insurance, 401(k) matches, or commissions. Tracking these liabilities manually is a recipe for a lawsuit. Your books must match your payroll reports exactly. If there is a discrepancy, you are painting a target on your back for an audit.

Outsourcing this function ensures a barrier between your operational cash and your tax obligations. It ensures compliance. It protects your team and it protects you.

Sales Tax Nexus and Multi-State Chaos

If you sell physical products or digital goods, you are likely operating in a minefield. The digital economy has erased borders, but tax laws are still painfully local.

The Wayfair Ruling Impact

Years ago, you only paid sales tax where you had a physical office. That is gone. The South Dakota v. Wayfair ruling changed the landscape. Now, “economic nexus” applies. If you sell enough volume or have enough transactions in a specific state, you owe sales tax there. Even if you never set foot in the state.

Each state has different thresholds. Some are $100,000 in sales. Others are 200 transactions. If you sell SaaS or e-commerce products across the US, you could technically owe tax in 40 jurisdictions.

The Liability of Non-Compliance

Ignoring this does not make it go away. The states are aggressive. They have software to track sellers. If you are not collecting tax, you are still liable for it out of your own pocket. Plus interest. Plus penalties.

Tracking nexus thresholds on a spreadsheet is futile. You need automated tools integrated with professional oversight. A bookkeeper monitors these thresholds. They alert you when you cross a line. They register you. They file the returns. Attempting to navigate fifty different tax codes alone is not entrepreneurship. It is masochism.

Why Professional Business Startup Accounting and Bookkeeping Services Pay for Themselves

This is the mental shift successful founders make. They stop viewing accounting as a cost center. They view it as a profit generator. Good financial data tells you where to double down.

Tax Planning vs. Tax Preparation

A tax preparer takes your numbers in April and puts them on a form. That is history. A strategic accounting partner works with you year-round. This is tax planning.

We look at your profit in November. We advise you to buy equipment or prepay expenses to lower your taxable income. We structure your salary to optimize S-Corp distributions. We find R&D credits you didn’t know existed. These moves save thousands. Often, the tax savings alone cover the annual cost of the bookkeeping service. You cannot plan for tax efficiency if you don’t have accurate, up-to-date books throughout the year.

Investor-Ready Financials

If you want VC money or a bank loan, your books are your resume. Investors do not trust founders with messy finances. They want to see a clean P&L. They want to see a balance sheet that balances. They want to see customer acquisition costs (CAC) and lifetime value (LTV) supported by hard data.

When you hand over professionally prepared financial statements, you signal maturity. You signal that you are a risky investment, but a calculated one. Messy books signal risk. They signal a lack of control. Investors run from lack of control.

How to Transition Without Breaking Operations

You have realized you need help. Good. Now you need to execute the handoff without stalling your business.

The Clean-Up Phase

Be prepared for the audit of your past work. A professional firm will not just build on top of your old spreadsheets. They will scrub them. They will reconcile your accounts back to the beginning of the fiscal year.

Do not be embarrassed. We have seen it all. We have seen personal dinners expensed as marketing. We have seen negative cash balances. The goal is to reach a “clean slate.” This provides a solid foundation for future reporting. Cooperate with this phase. Dig up the old bank statements. Find the missing receipts. The faster you get through clean-up, the faster you get strategic insights.

Integrating Tech Stacks

Modern accounting relies heavily on technology. We have tools such as Xero, QuickBooks Online, Gusto, and Bill.com in our arsenal. We combine them into one efficient system.

Your role changes here. You stop doing data entry. You start approving workflows. You snap a photo of a receipt, and the software does the rest. You approve a bill payment, and the system cuts the check. You gain control without the grunt work. This transition requires you to learn new dashboards, but it frees up massive amounts of mental bandwidth.

Conclusion

You cannot scale what you do not measure. You definitely cannot scale if you are the one doing the measuring. There comes a time when letting go is the only way to grow. Recognize the signs. If you are hitting $250k in revenue, hiring employees, or selling across state lines, the spreadsheet era is over. It is time to invest in professional business startup accounting and bookkeeping services. Your future self will thank you. The market rewards founders who focus on growth, not founders who focus on administrative maintenance. Make the switch.

FAQs

1. How much should a startup budget for bookkeeping?

Expect to pay between $500 and $2,500 monthly depending on transaction volume and complexity. If it is cheaper than that, you are likely getting bad data.

2. Can I just use software like QuickBooks without a bookkeeper?

Software is a tool, not a solution. QuickBooks does not know if you categorized a laptop as office supplies or an asset. You need a human pilot.

3. What is the difference between a bookkeeper and an accountant?

Bookkeepers record the daily transactions and maintain the ledger. Accountants analyze that data for tax planning, strategy, and compliance. You generally need both.

4. When is the absolute latest I should hire a professional?

Before you file your first corporate tax return. Fixing mistakes after filing requires amendments, which triggers audits and costs double.

5. Does outsourcing give me less control over my money?

No. It gives you more control. You get clear reports and insights instead of guessing. You still approve payments; you just don’t type them in.

Ready to Stop Guessing?

Your numbers tell a story. Make sure it’s the right one. Book a FREE Growth Strategy Session with Numberfied today and let’s turn your accounting into your competitive advantage.

Read Also: 7 Insider Tips to Simplify Your Finances with QuickBooks Bookkeeping Services for Small Businesses