Introduction: Why complete bookkeeping services matter

For small business owners, entrepreneurs, and startups, reliable financial records are the foundation of growth. Complete bookkeeping services take you beyond ad hoc transaction entry to a complete, end-to-end solution that keeps your books up-to-date, supports tax filing and tax preparation, and provides the financial reports you need to make better business decisions. Whether you plan to handle bookkeeping tasks in-house or use an outsourced complete bookkeeping offering, understanding the benefits, components, and implementation steps will help you choose a solution that saves you time and improves accuracy.

What are complete bookkeeping services?

Complete bookkeeping services, also marketed as full-service bookkeeping or comprehensive bookkeeping, cover the entire lifecycle of routine financial recordkeeping. From transaction recording and categorization to payroll, sales tax tracking, reconciliation, and the generation of profit and loss statements and balance sheet reports, these services deliver a single source of truth for your business’s financials. Many providers bundle bookkeeping and tax services or offer bookkeeping and payroll services, plus advisory and access to tax planning and tax filing support.

Core components: What complete bookkeeping services include

- Transaction recording and categorization: timely input of invoices, receipts, expenses, bank, and credit card transactions with consistent categorization for accurate financials.

- Bank and credit card reconciliation: regular reconciliation to ensure your books match your accounts, reducing errors and fraud risk.

- Accounts payable and receivable management: invoice creation, collections, vendor bill recording, and aging reports to protect cash flow.

- Payroll processing and payroll tax filing: paychecks, tax withholdings, payroll tax reporting, and integration with payroll providers.

- Sales tax tracking and filing support: accurate sales tax collection and timely filings to keep you compliant.

- Financial statements and reporting: month-end profit and loss, balance sheet, cash flow statements, and customized financial reports for business decisions.

- Month-end close and live expert cleanup: monthly close processes and one-time or ongoing cleanup to get your books in order.

- Integration and software support: setup and management of QuickBooks, QuickBooks Live, or other accounting platforms and ongoing bookkeeping plans tailored to your business needs.

- Tax support and coordination with accountants: preparation-ready records for tax returns, coordination with your accountant, and access to tax planning and strategy.

- Advisory services and forecasting: forecasting, CFO-level advisory, and business consulting to guide growth and scaling.

Key benefits of complete bookkeeping services

Accuracy and compliance

Complete bookkeeping services reduce errors through standardized processes, regular reconciliation, and professional oversight. Accurate books ensure compliance with payroll tax, sales tax, and business tax requirements and make tax filing straightforward.

Time savings and operational efficiency

Outsourcing or using a full-service bookkeeping plan frees owners and teams to focus on products and services, sales, and scaling. A dedicated bookkeeper or bookkeeping firm can handle day-to-day tasks so you can grow your business.

Financial clarity and better decisions

Timely financial reports, profit and loss, balance sheet, and cash flow forecasts provide insights that improve pricing, hiring, and investment decisions. Complete bookkeeping gives business owners the visibility needed to run toward profit and sustainability.

Support during tax season and beyond

With bookkeeping and tax services aligned, your accountant can prepare tax returns efficiently. Access to tax planning and tax strategy from your bookkeeping team or a dedicated accountant can lower tax liabilities and avoid surprises at year-end.

Key features to look for in complete bookkeeping services

- A dedicated bookkeeper or dedicated accountant is assigned to your account for personalized service.

- Live expert services such as live expert-assisted cleanup, QuickBooks Live, or live expert full-service bookkeeping to ensure human oversight.

- Integrated payroll and tax filing support bookkeeping and payroll services that handle payroll tax and filings.

- Software expertise across QuickBooks, cloud platforms, and online bookkeeping service tools.

- Clear bookkeeping plans and pricing: full-service plan options, 12-month commitments, or one-time cleanup offers.

- Regular financial reports and advisory services: monthly financials, forecasts, and CFO-level guidance.

- Free consultation and schedule a free consultation to assess fit without risk.

- Secure data handling and up-to-date processes that keep books compliant and audit-ready.

Common bookkeeping mistakes

Common errors include inconsistent categorization, missed reconciliations, late payroll tax payments, incorrect sales tax handling, and delayed financial reporting. Complete bookkeeping services implement standardized categorization, monthly reconciliations, timely payroll and sales tax processing, and automated reminders for filings. Professional bookkeepers and bookkeeping firms also coordinate with accountants to reduce errors that affect tax returns and business tax liabilities.

Step-by-step guide to choosing complete bookkeeping services

1. Assess your business needs

Identify your current pain points: Are invoices unpaid? Is cash flow unclear? Do you need payroll and tax help? Determine whether you need a one-time cleanup or full-service bookkeeping ongoing support. Consider a small business bookkeeping or a full-service bookkeeping services provider if you want comprehensive coverage.

2. Define scope and budget

Decide which services you require: transaction recording, payroll, tax filing coordination, advisory, or CFO services. Set a realistic budget and compare bookkeeping plans from providers, including whether they offer free consultation or upfront live expert cleanup.

3. Evaluate providers

Look for providers with strong QuickBooks expertise, positive reviews, and clear packages that include bookkeeping and tax coordination. Ask about dedicated bookkeeper availability, access to tax professionals, and whether they offer live expert-assisted setups like QuickBooks Live.

4. Check security and integrations

Ensure the provider supports your software ecosystem, including invoice systems, bank feeds, payment processors, and payroll platforms. Verify data security practices and access controls.

5. Onboard and clean up

Start with a one-time cleanup if needed to get your books in order for the first month. Provide documents, grant secure access, and let the provider perform reconciliations and adjustments to create accurate starting financials.

6. Establish cadence and reporting

Agree on monthly close procedures, report delivery (profit and loss, balance sheet, cash flow statements), and advisory calls. Set goals for cash flow forecasting and tax planning to align bookkeeping with business objectives.

7. Review and iterate

Regularly review reports and advisory recommendations. Adjust bookkeeping plans as you scale, add payroll, sales tax filing, or CFO advisory services when needed.

Top providers and trends in 2026

In 2026, the bookkeeping landscape will emphasize hybrid models combining automation and live expert support. Leading trends include live expert full-service bookkeeping, deeper integration with tax services, and advisory-led bookkeeping where providers offer forecasting and CFO-level insight. Prominent providers and categories to consider:

- Platform-integrated bookkeeping services: Companies offering QuickBooks Live and online bookkeeping service bundles that pair cloud accounting software with human bookkeepers.

- Full-service bookkeeping firms: Firms that combine bookkeeping and tax preparation, offering bookkeeping and tax as a consolidated service for smoother tax returns and tax strategy.

- Specialized small business bookkeeping providers: Firms focused on startups and small businesses that offer scaling packages, payroll, and sales tax filing support.

- Hybrid advisory and bookkeeping firms: Providers that include advisory services, monthly forecasts, and access to a dedicated accountant or CFO on demand.

When evaluating vendors in 2026, prioritize those offering live expert cleanup, dedicated bookkeeper assignments, and seamless tax filing coordination. Look for providers advertising a free consultation, transparent bookkeeping plans, and options for one-time or ongoing services.

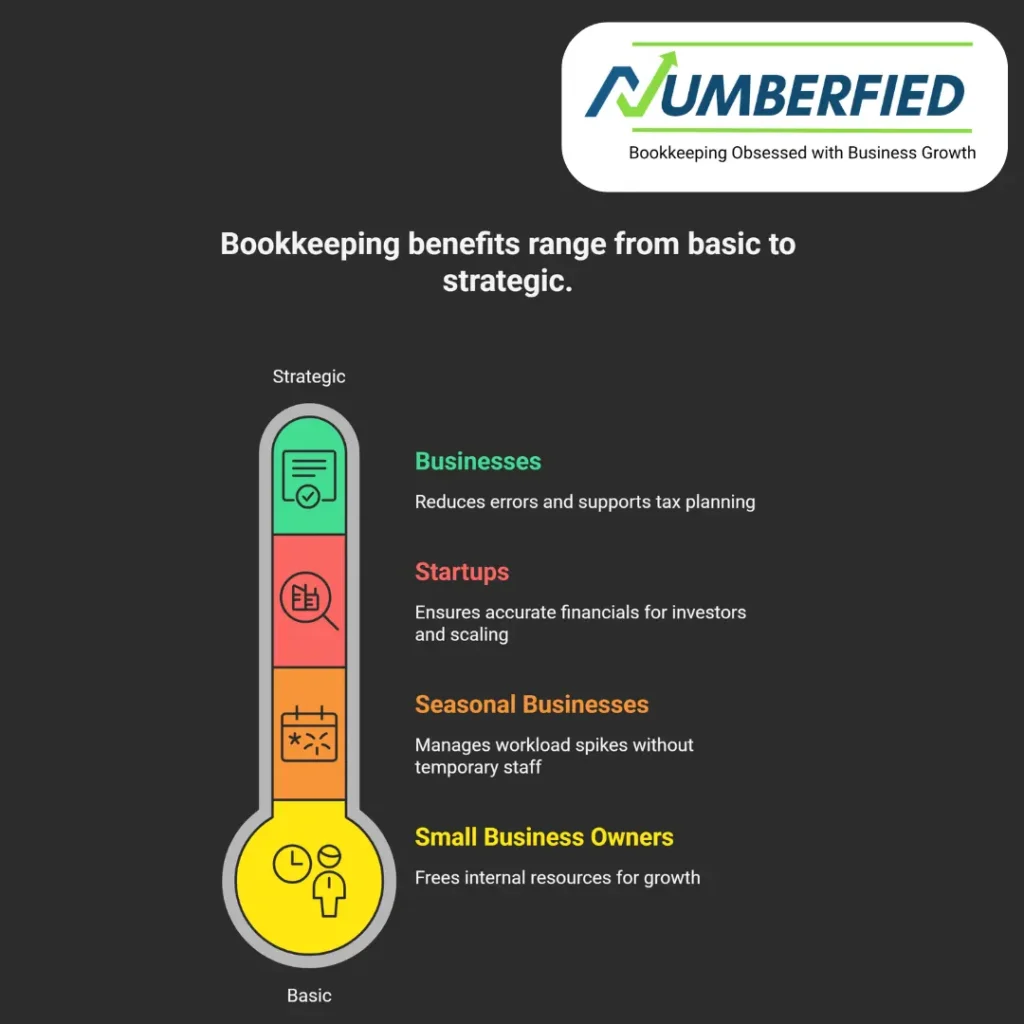

Typical scenarios: Who benefits most?

- Startups needing clean books for investors and scaling: complete bookkeeping ensures accurate financials for due diligence and forecasting.

- Small business owners who want to save time and focus on growth: outsourcing bookkeeping frees internal resources.

- Companies with seasonal peaks: flexible plans and outsourced support help manage workload spikes without hiring temporary staff.

- Businesses seeking tax efficiency: coordinated bookkeeping and tax services reduce errors and support tax planning.

Checklist: How to get started

- Schedule a free consultation with two or three providers.

- Gather your financial documents: bank and credit card statements, invoices, receipts, payroll records, and past tax returns.

- Decide on a preferred software (QuickBooks recommended) and confirm provider compatibility.

- Request a one-time live expert cleanup if your books need immediate attention.

- Choose a bookkeeping plan with dedicated bookkeeper availability and a monthly reporting cadence.

- Set measurable goals: timely payroll, accurate monthly financials, improved cash flow, or tax savings.

How complete bookkeeping services support growth

Complete bookkeeping doesn’t just keep the books tidy; it enables better business advice and strategic decisions. With accurate profit and loss statements, balance sheets, and forecasts, your advisory team or CFO can recommend pricing adjustments, cost controls, and scaling strategies that help you grow profitably. Bookkeeping gives business owners the clarity to act confidently and the data to back decisions.

Strong call to action

Ready to get your books in order and free up time to grow your business? Schedule a free consultation today to explore complete bookkeeping services tailored to your business needs. Whether you need a one-time cleanup, full-service bookkeeping, payroll and tax coordination, or CFO-level advisory, a dedicated bookkeeper can help you save time, stay compliant, and make smarter business decisions. Contact us now to schedule a free consultation and take the first step toward accurate, up-to-date financials.

FAQs

What is full-service bookkeeping?

Full-service bookkeeping is a comprehensive package where a professional handles all aspects of your financial records. It includes daily transaction entry, bank reconciliations, accounts payable/receivable, payroll processing, financial statement preparation, and often basic tax reporting support. The goal is to deliver clean, accurate, tax-ready books without you managing any routine tasks.

What do full-charge bookkeepers do?

Full charge bookkeepers manage the entire accounting cycle independently, from recording transactions to preparing financial statements. They handle reconciliations, vendor payments, invoicing, payroll, month-end closing, and often prepare reports for tax professionals. They require advanced skills and often work with minimal supervision in small to medium businesses.

What is included in full-service bookkeeping services?

Full-service bookkeeping typically includes transaction categorization, bank and credit card reconciliations, accounts payable/receivable management, payroll processing, monthly financial statements, and year-end tax prep support. Many packages also cover sales tax tracking, expense classification, and basic financial analysis or reporting.

What is the going rate for a full-charge bookkeeper?

In the US in 2026, full-charge bookkeepers typically charge $50–$100 per hour or $1,200–$4,000 per month for small to medium clients. Monthly retainers often fall between $1,800–$3,000 for comprehensive service, depending on transaction volume and complexity.

How much should you pay a bookkeeper per month?

For small businesses, expect to pay $500–$2,500 per month for professional bookkeeping services. Basic packages start around $600–$1,200, while full-service (including payroll, reporting, and tax prep support) usually costs $1,500–$2,500+.

What are the three golden rules of bookkeeping?

The three golden rules are: debit the receiver and credit the giver (personal accounts), debit what comes in and credit what goes out (real accounts), and debit all expenses and losses while crediting all incomes and gains (nominal accounts). These rules ensure every transaction balances and maintains accurate double-entry records.

What does full-service bookkeeping include?

Full-service bookkeeping includes daily transaction recording, bank/credit card reconciliations, accounts payable and receivable management, payroll processing, monthly financial statements, sales tax tracking, and year-end preparation support.

How much should I pay for bookkeeping services?

Most small businesses pay $500–$2,500 per month for outsourced bookkeeping services. Simple operations start at $600–$1,200, while full-service packages with payroll and reporting often range from $1,500–$2,500,+ depending on volume and needs.

How much should you pay a bookkeeper?

You should expect to pay $50–$100 per hour or $800–$3,000 per month for a professional bookkeeper. Monthly retainers are common for ongoing work, with most small businesses falling in the $1,200–$2,500 range for reliable, full-service support.

What is a bookkeeper’s hourly rate?

In the US in 2026, bookkeepers typically charge $40–$90 per hour. Freelance or junior bookkeepers often charge $40–$65, while experienced or full-charge bookkeepers (especially those working with CPAs) usually charge $70–$90+ per hour.

Read Also: Why Accounting and Bookkeeping Services Will Change Your Business for the Better!