Introduction

You cannot scale a million-dollar business on a hundred-dollar spreadsheet. That is a hard reality. Yet, the alternative often feels like financial suicide. You look at the price tag for an enterprise-grade ERP implementation or a custom AI automation stack, and you freeze. The licenses alone are six figures. The consultants cost double that. It takes twelve months to build. By the time it is live, it is obsolete.

Most small to mid-sized enterprises (SMEs) stay stuck in “tech purgatory” because they believe ownership is the only path to access. It is not. The smartest CFOs today do not buy infrastructure. They rent the outcome.

Modern Finance and Accounting Outsourcing Services have evolved. They are no longer just about cheaper labor. They are about instant technological maturity. By partnering with the right provider, you bypass the capital expenditure entirely and plug directly into a pre-built, fortress-level financial stack.

Key Takeaways

- The CapEx Trap: Why buying software licenses kills cash flow for growing SMEs.

- The Tech Arbitrage Model: How to access Fortune 500 tools without the Fortune 500 price tag.

- AI Reality: Utilizing robotic process automation (RPA) for AP/AR without writing a single line of code.

- Security protocols: Gaining bank-level data protection that internal teams rarely achieve.

- Speed to Insight: Moving from monthly close delays to real-time dashboarding.

The New Model: Tech Arbitrage Over Labor Arbitrage

Ten years ago, you outsourced to save money on salaries. Today, you outsource to gain instant access to a technology stack that would cost you millions to replicate. This is the concept of tech arbitrage.

When you hire a modern financial partner, you are not just getting a Controller or a team of accountants. You are inheriting their infrastructure. These firms spend heavily on the best general ledgers, optical character recognition (OCR) tools, and cloud environments. They amortize these costs across hundreds of clients.

The Subscription Economy for Operations

Think of it like AWS (Amazon Web Services). You do not build a server farm to host your website. You leverage Amazon’s billions of dollars in infrastructure.

The same logic applies here. A sophisticated outsourcing partner brings a “finance-as-a-service” platform. This includes:

- Tier-1 ERP access: Systems like NetSuite or Sage Intacct tailored for your vertical.

- Integrated middleware: Connectors that link your CRM, bank feeds, and payroll automatically.

- Maintenance teams: IT specialists who handle the updates, patches, and downtime.

You get the power. You avoid the headache.

Automating the Grunt Work: AI and RPA Without the Dev Team

Everyone talks about Artificial Intelligence. Very few SMEs actually use it effectively in finance. Why? Because implementing AI requires data scientists, clean data sets, and testing. It is messy.

When you utilize specialized firms, the AI is already trained. It is plugged in. It works on Day One.

Robotic Process Automation (RPA) in Action

We are not talking about “magic.” We are talking about Robotic Process Automation. This is the engine that drives efficiency.

Consider Accounts Payable (AP). In a traditional setup, an invoice arrives via email. A human opens it. They type the data into QuickBooks. They categorize it. They route it for approval.

In an outsourced model, the tech stack handles this:

- OCR Scanning: The machine reads the invoice PDF with 99.9% accuracy.

- 3-Way Matching: The system automatically checks the invoice against the PO and the receiving report.

- Fraud Detection: Algorithms flag duplicate invoices or suspicious vendor details instantly.

- Posting: The entry is made in the ledger without human hands.

This is not a future goal. This is the baseline standard for high-level providers. You get cleaner books. You get them faster.

The End of Manual Reconciliation

Bank reconciliations are the bottleneck of the monthly close. Tech-enabled providers use continuous accounting tools. These tools ping bank servers every few hours. They match transactions as they happen.

By the time month-end arrives, the work is already 95% done. Your internal team stops being data entry clerks. They become analysts.

Why Finance and Accounting Outsourcing Services Beat Internal Builds

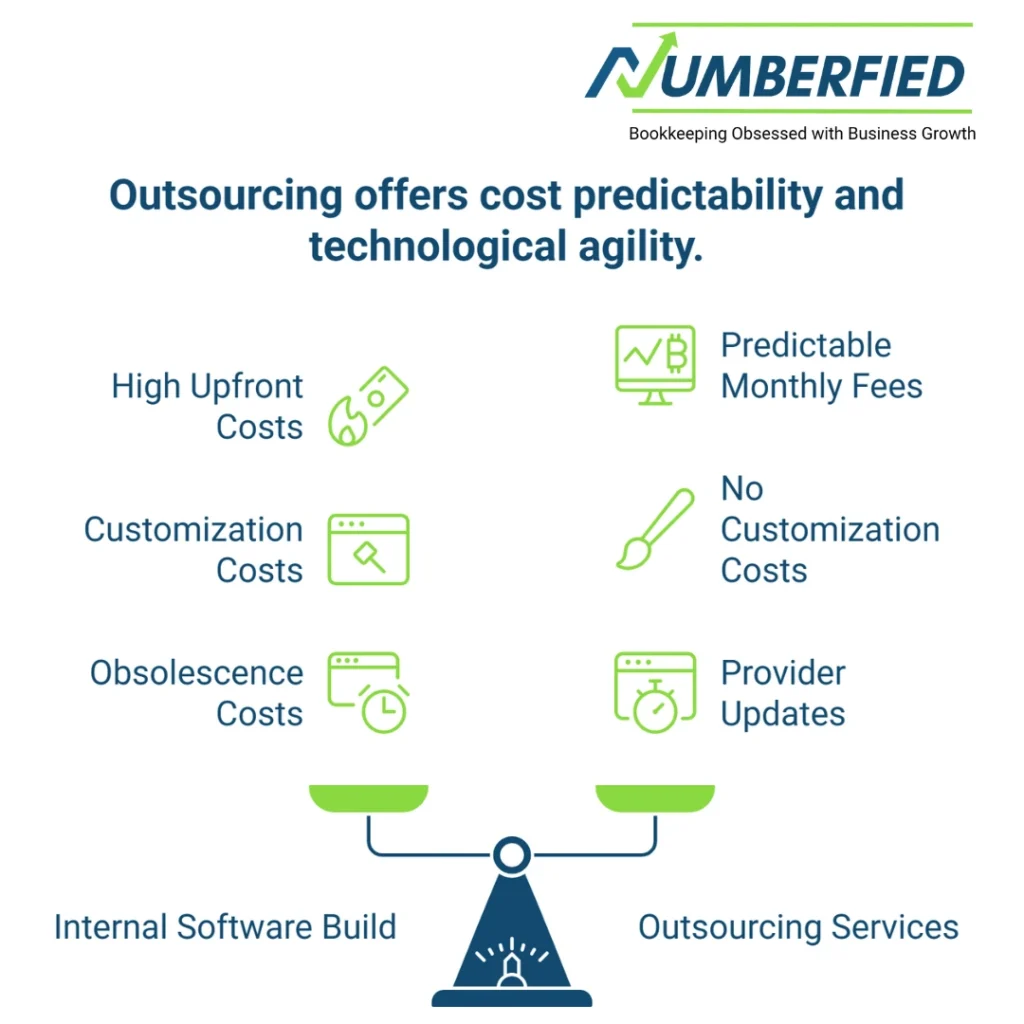

The decision between building internally versus outsourcing often comes down to control versus speed. However, the financial argument is even stronger. It is a battle between Capital Expenditure (CapEx) and Operating Expenditure (OpEx).

The Hidden Costs of Internal Software

When you decide to implement a new financial system internally, the license fee is just the tip of the iceberg. You must account for:

- Implementation fees: Often 1-3x the cost of the annual software license.

- Customization costs: Paying developers to make the software fit your business model.

- Training: Downtime while your staff learns the new system.

- Obsolescence: The moment you finish building it, new updates require more money.

This burns cash. It ties up capital that should be used for product development or marketing.

The OpEx Advantage

With Finance and Accounting Outsourcing Services, these costs vanish. You pay a monthly fee. That fee covers the talent. It covers the tech. It covers the security.

If the technology changes, the provider upgrades it. If a security patch is needed, they handle it. Your costs remain predictable. Your cash flow stays healthy. You essentially “leapfrog” the technological barrier. You go from a legacy system to a futuristic stack in the time it takes to sign a contract and onboard.

Fortress-Level Security and Compliance

A terrifying statistic exists regarding SMEs and cyberattacks. Most small businesses do not recover from a significant financial data breach. Yet, most small businesses keep their financial data on local servers or poorly secured cloud instances with weak password protocols.

Inheriting Enterprise Security Protocols

Top-tier outsourcing firms are targets. They know this. Therefore, they invest in security at a level no individual SME can match.

When you partner with them, you operate under their umbrella.

- SOC 2 Type II Compliance: This is the gold standard. It proves the provider has rigorous controls over data privacy and security. Obtaining this certification costs tens of thousands of dollars annually. You get it for free as a client.

- Encrypted Data Transfer: There will be no more sending of spreadsheets containing social security numbers through emails. Data is securely encrypted both during the transfer and when it is stored through secure portals.

- Segregation of Duties: Software permissions are hard-coded. The person who approves the payment cannot be the person who creates the vendor. This prevents internal fraud.

From Hindsight to Foresight: Real-Time Dashboarding

The old way of accounting is historical. You get a P&L statement 15 days after the month ends. You are driving the business by looking in the rearview mirror.

Enterprise-grade tech stacks flip this dynamic. They focus on real-time visibility.

The Executive Dashboard

Because the data entry is automated (see the RPA section), the data is live. Providers give you access to visualization tools like Power BI or Tableau. These are not static PDFs. They are interactive dashboards.

You can log in at 9:00 AM on a Tuesday and see:

- Current Cash Position: Across all accounts.

- Daily Sales Outstanding (DSO): Are clients paying slower this week?

- Burn Rate: Precise calculation of runway based on yesterday’s spend.

Scenario Planning and Forecasting

This is where the “Strategic” part of “Business Growth Strategist” comes in. With clean, real-time data, you can run scenarios.

- What if we hire five sales reps?

- What if inventory costs rise by 8%?

Advanced financial stacks include forecasting modules. We can model these changes instantly. We stop guessing. We start engineering outcomes.

Implementation Velocity: Weeks, Not Years

Time is the most undervalued asset in business. If you decide to upgrade your internal finance function today, you are looking at a six-month timeline minimum. You have to hire the right Controller. You have to select the software. You have to migrate the data. You have to train the team.

During those six months, you are flying blind.

The Plug-and-Play Approach

Outsourcing providers operate on standardized, optimized stacks. We have done the integration a thousand times. We know exactly how to map your chart of accounts to the new system.

- Week 1: Assessment and data mapping.

- Week 2: System configuration and connection.

- Week 3: Parallel run (running old and new systems together).

- Week 4: Go live.

This speed is critical. In a volatile market, you cannot afford to wait a year for better data. You need it now. This agility allows you to pivot, raise capital faster, or cut losses on bad product lines before they drain the bank.

Conclusion

The barrier to entry for enterprise-grade financial technology has crumbled. It is no longer a question of who has the biggest budget. It is a question of who chooses the smartest partnership.

You do not need to be a Fortune 500 company to operate like one. You do not need to dilute your equity to pay for an ERP implementation. By leveraging Finance and Accounting Outsourcing Services, you bypass the heavy lifting. You gain immediate access to AI, automation, bank-level security, and real-time insights.

This is the cheat code for modern growth. Stop building infrastructure. Start building your business. The technology is ready. The question is: are you?

FAQs

1. Is my data actually safer with a third party?

Yes. Reputable providers bring SOC 2 Type II compliance, encryption, and redundancies that almost 90% of small and medium-sized enterprises (SMEs) cannot afford to implement inside by themselves.

2. Will I lose control of my finances?

No. You gain visibility. You give up the data entry work but keep the decision-making power through real-time dashboards and approval workflows.

3. How much money does this really save?

Typically 30% to 50% compared to an in-house team plus software costs. The savings come from salary reduction and eliminating software licensing fees.

4. Can these systems handle complex inventory?

Absolutely. Modern tech stacks integrate directly with inventory management systems to track unit costs, landing costs, and turnover rates in real time.

5. How fast can we switch?

Most providers can fully onboard a mid-sized company in 30 to 45 days.

Your Financial Data is Telling a Story. Are You Listening?

Stop relying on outdated spreadsheets and delayed reports. At Numberfied, we bring the enterprise tech stack to you. No CapEx. No implementation nightmares. Just clarity.

Book Your Free Strategy Session with Numberfied Today

Also Read: Finance and Accounting Outsourcing Services Your Growth Partner with Numberfied