Introduction

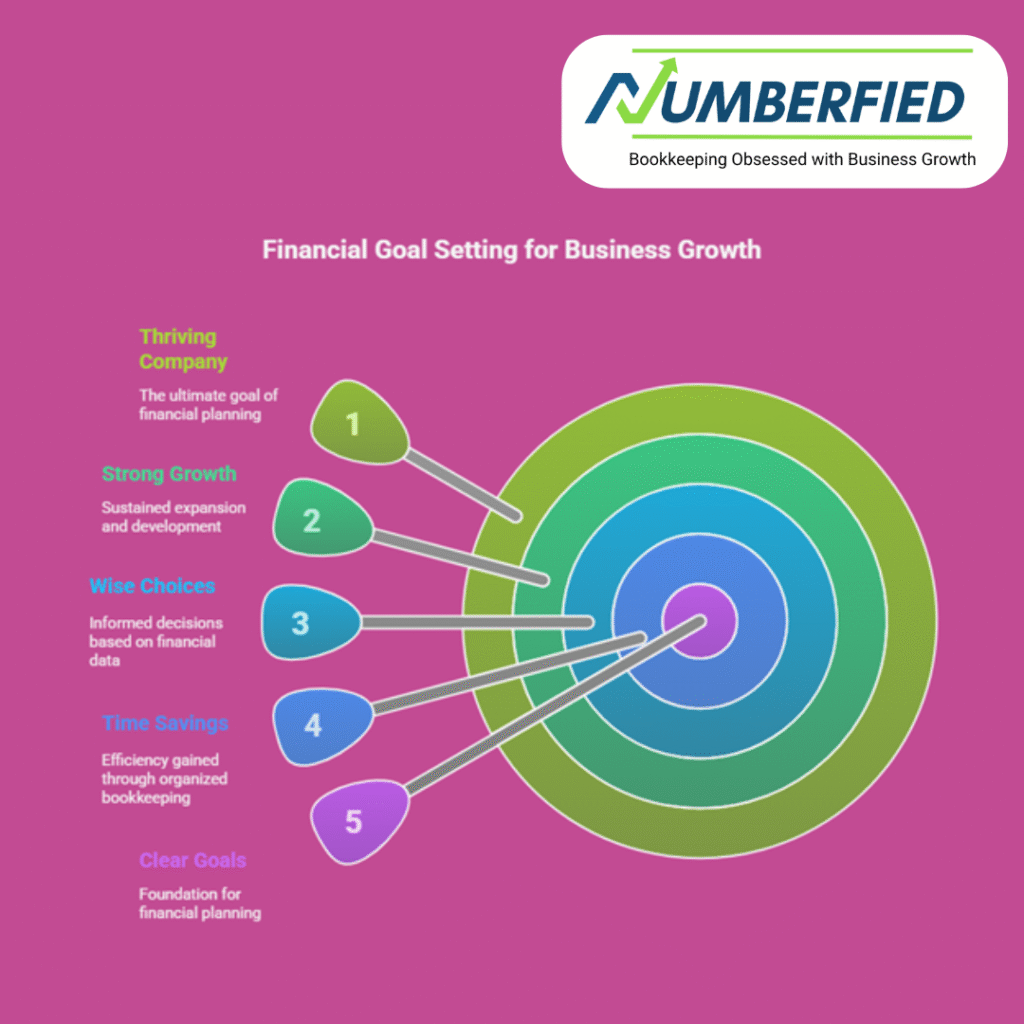

Running a small business in the USA requires constant attention to customers, operations, and growth. Without a structured plan, it’s easy to lose direction and miss key opportunities. Financial goal setting for businesses is like your trusty market map, showing you the way to success.

At Numberfied, we’ve sat down with business owners swamped by piles of receipts and confusing numbers, helping them get organized with our bookkeeping expertise. We think financial goal setting for businesses is more than just math, it’s about turning your big ideas into reality. We’re excited to show you how Numberfied’s bookkeeping can take the stress out of setting financial goals, free up your time, and support your business growth, with a touch of fun and a whole lot of care.

Key Takeaways

- Financial goal setting for businesses keeps your company focused.

- Clear goals help your team work together and use resources wisely.

- Checking progress regularly enables you to stay on track.

- Numberfied’s bookkeeping makes goal setting simple.

- A solid financial plan builds a strong future for your business.

Why You Need Financial Goal Setting for Businesses

Find Your Focus

Financial goal setting for businesses is like picking a spot to set up your market stall. Without it, you’re just wandering. A small shop owner we talked to wanted to sell 10% more this year. By setting that goal, she rearranged her displays and hit her target in five months. A clear goal points you in the right direction.

Get Everyone on Board

When your team knows the goal, they pull together like a great market crew. Financial goal setting for businesses makes sure everyone’s working toward the same thing. We worked with a coffee shop owner who set a goal to save more money. Her staff suggested cutting down on wasted ingredients, and they saved 5% on costs. Goals bring people together.

Make Every Penny Count

Money and time are tight for small businesses. Financial goal setting for businesses helps you use both well. A builder we helped decided to spend 8% less on materials. By keeping an eye on his costs, he saved $3,800 in a year. Goals help you make wise choices with what you have.

Keep the Energy Up

Goals are like little wins that keep you going. Financial goal setting for businesses gives you something to cheer about. A freelance writer we know wanted to earn twice as much. She set monthly targets, stayed excited, and reached her goal in a year. Goals keep you motivated.

Roll with Changes

Markets can be unpredictable, like a sudden rain at the farmer’s market. Financial goal setting for businesses lets you adjust quickly. We helped a new business owner change her spending plan when sales slowed, saving her from running out of cash. Goals help you stay ready for surprises.

Know You’re Winning

Without goals, it’s hard to tell if you’re doing well. Financial goal setting for businesses gives you a way to measure success. A pet shop owner, we helped set a goal to sell more treats. She checked her sales every month and ended up 9% ahead. Goals show you’re making progress.

How to Set Good Financial Goals

Try the SMART Way

SMART goals, Specific, Measurable, Achievable, Relevant, and Time-bound are an excellent tool for financial goal setting for businesses. A bakery owner we know used this to plan a 15% increase in party orders over three months. She advertised at community events and made it happen. SMART goals keep you focused.

Start with Your Big Dream

Your business has a purpose, and financial goal-setting for businesses should match it. Want to open another shop? Plan how much money you’ll need. We helped a hairdresser save for a second salon, and she had enough saved in 18 months. Your dream shapes your goals.

Break It Down

Big goals can feel scary, but small steps make them easier. Financial goal setting for businesses works best with bite-sized pieces. A graphic designer we worked with wanted to buy new software for $10,000. She saved a little each month and got there in a year. Small wins add up.

Talk to Your Team

Your staff has excellent ideas, so include them in financial goal-setting for businesses. A diner owner we helped asked her team how to save money. They suggested using less food waste, and they cut costs by 7%. Team ideas make goals stronger.

Look at Your Industry

Your goals should fit what’s happening in your market. Financial goal setting for businesses means knowing trends, like more online shopping. We helped a store owner plan to sell more online, and her sales grew by 12%. Goals that match your industry hit the mark.

Write It Out

Putting goals on paper makes them real. Financial goal setting for businesses needs clear notes. A builder we know wrote down his profit plans and stuck to 80% of them. Writing goals down keeps you on track.

Tools That Help with Financial Goal Setting

Use Bookkeeping Apps

Apps like QuickBooks or Wave make financial goal-setting for businesses easier by showing your numbers clearly. We helped a freelancer connect her app to Numberfied’s bookkeeping so she could see her savings grow. Apps make planning less of a chore.

Grab a Budget Template

A budget is like a shopping list for your business. Financial goal setting for businesses works better with a template to organize your money. A new company we helped used our budget sheet to save $5,000 in six months. Templates keep you organized.

Check Out Dashboards

Dashboards are like a market stall sign, they show you what’s happening fast. Financial goal setting for businesses gets fun with visuals. We made a dashboard for a pet store owner to track her sales daily, and she grew her business by 8%. Dashboards keep goals in sight.

Ask a Bookkeeper

Bookkeepers know numbers inside out, and they help with financial goal-setting for businesses. Numberfied’s team worked with a coffee shop owner to set profit goals, and she saved 6% more. A bookkeeper’s advice makes goals sharper.

Watch Important Numbers

Numbers like sales or spending are key for financial goal setting for businesses. A gardener we helped kept an eye on his costs to save $3,500 a year. Watching the correct numbers keeps your goals clear.

Check In Often

Looking at your goals regularly keeps financial goal-setting for businesses on track. We helped a shop owner check her sales goals every three months, and she grew her business by 10%. Regular checks stop you from drifting.

Dealing with Goal-Setting Problems

Don’t Aim Too High

Big goals are exciting, but impossible ones can make you give up. Financial goal setting for businesses needs realistic targets. A new business we helped lowered a 50% sales goal to 20%, and they made it in nine months. Realistic goals keep you going.

Find Time

Running a business is busy, and financial goal-setting for businesses can get pushed aside. Let someone else handle tasks like bookkeeping. We took over a shop owner’s books so she could plan sales goals and grow by 7%. Handing off work keeps goals alive.

Handle Surprises

Unexpected problems, like price hikes, can mess up plans. Financial goal setting for businesses means being ready to change. We helped a builder adjust his profit goals when supplies got pricey, saving $2,000. Flexible goals keep you steady.

Stick with It

Forgetting to check your goals can stop financial goal-setting for businesses. Make it a habit. A baker we worked with looked at her savings goals every week with Numberfied’s reports and saved $4,000 in a year. Doing it regularly works.

Be Clear

Goals that are too fuzzy don’t help. Financial goal setting for businesses needs details. We helped a yoga teacher change make more money to get 10% more class sign-ups, and she did it in six months. Clear goals show the way.

Work with What You Have

If money or staff are tight, financial goal setting for businesses can feel hard. Start small. A pet groomer, we helped put a small ad budget goal and grew her clients by 5% with cheap flyers. Small goals make the most of what’s there.

How Bookkeeping Helps with Goal Setting

Keep Your Numbers Straight

Good bookkeeping is like a tidy market stall-it makes everything easier. Financial goal setting for businesses needs accurate numbers. Numberfied cleaned up a startup’s books, helping them set sales goals that grew their business by 12%. Clear books make great goals.

Watch Your Cash

Knowing how much money comes and goes helps financial goal-setting for businesses. We worked with a deli owner to track her cash, setting a savings goal that stopped a $3,000 shortage. Cash tracking keeps goals doable.

Get Reports on Time

Reports show how you’re doing, and they’re key for financial goal-setting for businesses. Numberfied’s monthly reports helped a hairdresser hit her profit goal, saving 6% more. Up-to-date reports keep goals in reach.

Plan for What’s Next

Bookkeeping can help predict what’s coming, helping with financial goal setting for businesses. We helped a builder predict his costs, setting a budget goal that saved $4,500 a year. Looking ahead makes goals solid.

Find Ways to Save

Bookkeeping spots where you’re spending too much, aiding financial goal setting for businesses. A shop owner we helped used our reports to cut costs by $2,800 a year. Saving money enables you to reach goals.

Make Big Choices

Bookkeeping shows you the numbers behind big decisions, supporting financial goal-setting for businesses. We helped a store owner use sales numbers to plan a new shop, getting a $100,000 loan. Good data leads to big wins.

Keeping Your Financial Goals Going Strong

Update Your Goals

The market changes, and your goals should, too. Financial goal setting for businesses needs regular tweaks. We helped a coffee shop owner update her sales goals every year, hitting 90% of them. Changing goals keeps them useful.

Cheer for Wins

Celebrating small successes helps with financial goal-setting for businesses. A pet shop owner we worked with threw a little party when she hit her sales goal, and her team worked harder next time. Celebrating keeps everyone excited.

Save for a Rainy Day

Having extra cash helps with financial goal-setting for businesses when things get tough. We helped a freelancer save $5,000 in a year for emergencies. A savings cushion protects your goals.

Put Money Back In

Using profits to grow your business supports financial goal-setting for businesses. A gardener we helped used his savings for ads, growing his customers by 10%. Putting money back in builds bigger goals.

Keep Learning

Knowing what’s new in your industry helps with financial goal-setting for businesses. We told a baker about new tax rules, and she set a goal that saved $1,500. Staying in the know keeps goals bright.

Work with a Bookkeeper

Bookkeeper services providers like Numberfied make financial goal setting for businesses easier with precise numbers. We helped a startup plan growth goals, and they grew sales by 15%. A bookkeeper’s help makes goals last.

Conclusion

Financial goal setting for businesses is your map to a thriving company, and Numberfied’s bookkeeping services make it easier to follow. Clear goals save time, guide wise choices, and help your business grow strong. By letting us handle your books, you can focus on planning while we keep your numbers in order. At Numberfied, we’re not just bookkeepers, we’re your teammates, rooting for your success. Ready to start financial goal setting for businesses and build your future? Head to https://numberfied.com/ for a free chat, and let’s make your market stall shine.

FAQs

What’s involved in financial goal setting for businesses?

It’s about setting clear financial goals, such as growing sales or saving money, to guide your business. Numberfied’s bookkeeping gives you the numbers you need to make these goals real and keep them tied to your company’s dreams.

How does financial goal setting for businesses save me time?

Clear goals mean you spend less time guessing what to do. Numberfied’s bookkeeping keeps your finances tidy so you can plan faster. As shop owners, we helped save 5 hours a week by setting clear goals.

Can new businesses use financial goal-setting?

New businesses need focus, and goals help even with small budgets. Numberfied’s bookkeeping helped a startup grow sales by 10% in a year with simple, clear goals.

How does bookkeeping help with financial goal-setting for businesses?

Bookkeeping gives you clean numbers to plan and check your goals. Numberfied’s reports helped a coffee shop owner set profit goals, saving 6% more. Good books make goals easier to reach.

How often should I look at my financial goals?

Check them every month or every three months to stay on track. Numberfied’s reports helped a store owner update her sales goals, hitting 90% of them. Checking often keeps goals working.

What tools make financial goal-setting for businesses easier?

Apps like QuickBooks, budget sheets, and dashboards help you see your progress. Numberfied works with your tools to keep financial goal setting for businesses smooth, as we did for a freelancer, saving money.

How do I start financial goal-setting for businesses?

Think about your big dream, then set clear, SMART goals. Numberfied’s free chats help you figure out where to start, as we did for a baker who grew sales by 15%. Start small for significant results.

What if something goes wrong with my goals?

Change your goals if things like market shifts happen. We helped a builder adjust his profit goals when supplies cost more, saving $2,000. Flexible financial goal setting for businesses keeps you going.

Do I need to know finance to set goals?

Not at all. Numberfied’s bookkeeping does the number work and explains things. As shop owners, we helped set goals with no financial know-how, thanks to our clear help.

How is Numberfied right for my goals?

Let’s have a chat. Book a free call at https://numberfied.com/, and we’ll talk about your dreams. We’ll show you how we helped a craft shop grow and how our bookkeeping can help you with financial goal-setting for businesses.

Read Also: 9 Surprising Ways a Bookkeeping Service for Small Business Can Boost Your Success