Introduction: Free Isn’t Always Free-But It Can Be a Starting Point

Let’s be honest most people don’t exactly wake up excited about balancing books. Unless, of course, you’re one of us at Numberfied. We genuinely enjoy diving into spreadsheets, tidying up ledgers, and making sense of the financial chaos that gives most folks a headache.

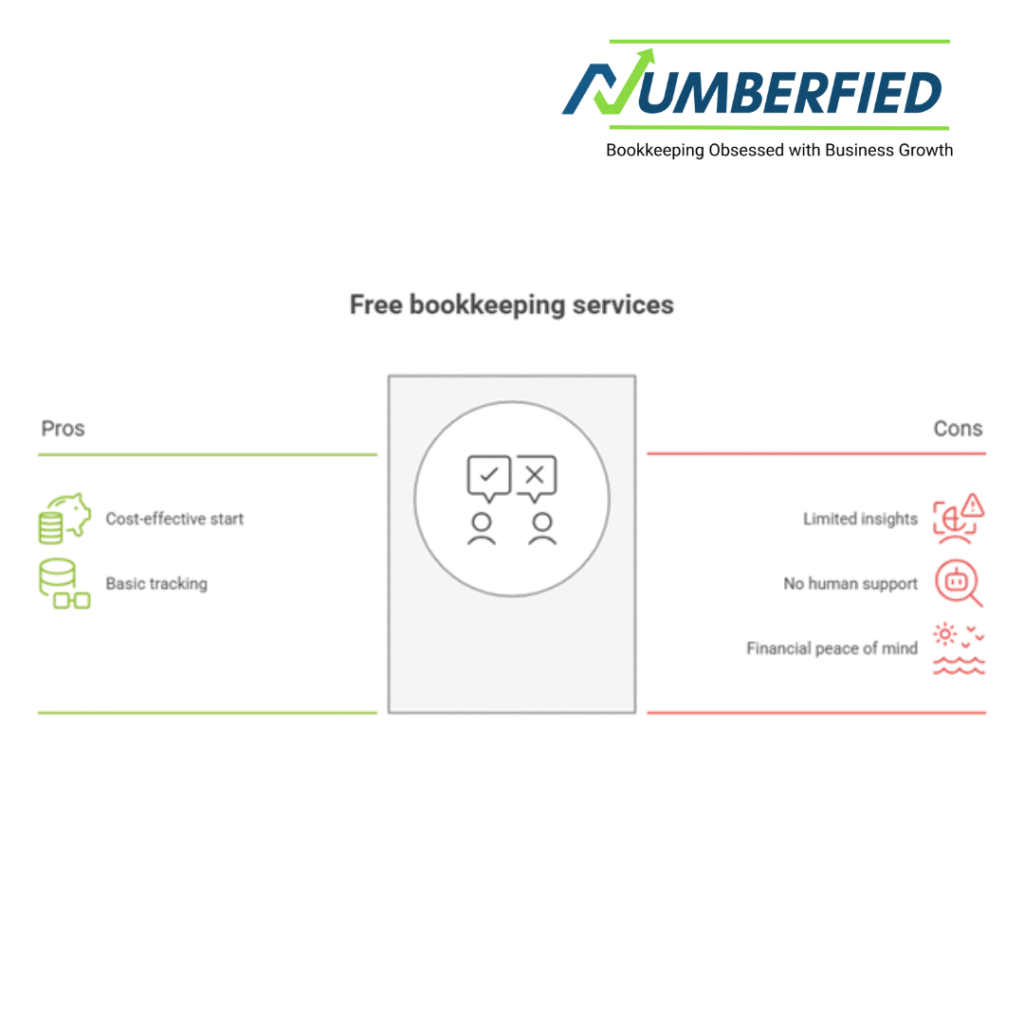

Now, if you’ve landed here, chances are you’re asking yourself a few questions: Are free bookkeeping services useful? Can I manage my books without shelling out cash right away? We completely understand. Free is tempting especially when you’re building a business from scratch or trying to keep expenses low. It makes perfect sense to explore your options before committing to a paid service. That’s exactly why we’re unpacking the real deal behind free bookkeeping services: what you can expect, where they fall short, and how to tell when it’s time to switch to something more robust.

These free tools aren’t meant to carry you all the way, but they can help you get moving in the right direction. For expert advice regarding clean books, you should contact the Numberfied team.

Key Takeaways

- Free bookkeeping services are helpful for new businesses that are just starting, but they’re often limited.

- You still need to watch for hidden costs, time traps, and a lack of support.

- DIY might work at first, but growth means complexity. And complexity? That’s our jam.

- When free tools aren’t cutting it, Numberfied steps in with clarity, confidence, and custom solutions.

What Are Free Bookkeeping Services?

The Tools People Do Discuss

What comes into your mind when you hear free bookkeeping services? You are mostly referring to cloud apps or entry-level software like Wave, ZipBooks, or the free version of commercial software like QuickBooks or Xero.

What You Typically Get

Most free options include:

- Invoicing and basic income tracking

- Limited expense logging

- A few reporting features

- Some bank syncing not always real-time

But many don’t offer full-scale support, tax prep, payroll integration, or reconciliation help.

What You Don’t Get

Here’s what’s not usually included:

- Dedicated help from a bookkeeper

- Custom reports tailored to your business

- Deep financial insights

- Scalability as your business grows

So yes they’re helpful. But they’re not complete.

When Free Bookkeeping Makes Sense

Starting From Scratch

If you’re launching a side hustle or your business is still in the napkin sketch stage, a free tool can give you structure without cost.

Testing the Waters

Trying to figure out if you want to handle your books? Free tools are great sandboxes to play in before you commit to a bigger solution.

Learning the Basics

Some entrepreneurs just want to understand how bookkeeping works before they hire anyone. That’s fair, and free software lets you explore without risk.

The Hidden Costs of Free

Time Is Money

Even if the software is free, your time isn’t. If you’re spending hours trying to make sense of your books instead of growing your business, that’s a loss.

Mistakes Happen

Free tools don’t catch everything. Misclassify one expense, forget a tax deduction, or miss a payment? That can cost you more than a monthly fee would.

Upgrade Walls

Most free bookkeeping services work like this: lure you in, then limit functionality until you upgrade. And when you do? Surprise the free plan suddenly got pricey.

Signs You’ve Outgrown Free Bookkeeping Services

You’re Spending More Time on Your Books Than Your Business

If logging receipts, reconciling accounts, and generating reports takes over your week, it’s time to bring in backup.

Tax Season Sends You Into a Panic

When your books are a mess and your CPA is charging extra just to sort them, that free system just got expensive.

You Need Financial Strategy, Not Just Tracking

Growth brings questions: Can I afford to hire? Where’s my cash going? Free tools don’t offer insight just data. That’s where a professional bookkeeping team (like us!) makes a difference.

Why Businesses Trust Numberfied Over Free

You Get Real People, Not Robots

Our team doesn’t just plug numbers into a system, we understand the why behind every transaction. And we’re always a click or call away.

Custom Plans, Clear Pricing

We don’t play games with upgrades or hidden fees. You get a clear plan that fits your business, whether you’re running an e-commerce store or a multi-location service business.

Growth-Friendly Support

Your business won’t stay small forever. And when it scales? Numberfied scales with you, adding payroll, tax planning, forecasting, and more when you’re ready.

Real-Life Example: Meet Kevin from Denver

Kevin started a small landscaping business and used a free tool to track invoices. It worked… at first. Then came the busy season 20+ clients a week, late payments, tax deadlines.

He missed a sales tax filing, had confused cash flow, and had no time left for customers. That’s when he called us.

We cleaned up his records, automated his invoicing, and gave him monthly insights to plan for slower seasons. Today? He’s expanding to a second location and hasn’t touched a spreadsheet in months.

So… What Does Free Actually Cost You?

Here’s the thing: free bookkeeping services aren’t bad. But they’re not built for growing businesses. Eventually, you hit a ceiling, and the cost of staying free becomes lost time, missed opportunities, and avoidable stress.

With Numberfied, you’re investing in clarity, control, and confidence. And those things? They’re worth every penny.

Conclusion: When You’re Ready to Move Past Free-We’re Here

We won’t knock the freebies. If you’re just dipping your toes into the business world, free bookkeeping services are a smart way to start. But when you want more than just basic tracking-when you’re ready for tailored insight, real human help, and financial peace of mind Numberfied is your next step.

Let us help you move from just getting by to totally dialed in.

Visit Numberfied.com and let’s talk about where your business is headed. We’re ready when you are.

FAQs

1. Are there any platforms that actually provide free bookkeeping services?

Yes, some platforms like Wave offer basic tools for free, but they often come with limitations or ads.

2. Can I run a business long-term on free software?

It is recommended to use, if you are a startup. But with a growing business, things become tricky. As your business needs grow, you’ll have to face issues with features, accuracy, or compliance.

3. What’s the catch with free forever offers?

Many free services charge for add-ons, integrations, or support. Always check the fine print.

4. Is Excel considered a free bookkeeping service?

Technically, yes if you already have it. But it requires manual entry and has no automation or syncing.

5. Why don’t you offer free bookkeeping at Numberfied?

Because we believe in doing the job right. Our time, attention, and expertise go into every account and that’s worth paying for.

6. Do free tools offer tax support?

Rarely. Most don’t handle tax filing or planning you’ll need a pro (like us!) for that.

7. Can I try Numberfied before I commit?

Yes! We offer a free consultation so you can see if we’re a good fit no pressure, no obligation.

8. What industries do free tools work best for?

Usually, solo entrepreneurs or freelancers with simple income/expense tracking.

9. What’s better: free software or hiring a cheap freelancer?

Depends. A freelancer may offer help, but you risk inconsistency or a lack of compliance. We bring structure, strategy, and accountability.

10. What’s one thing free tools can’t replace?

Perspective. A machine can track numbers. But understanding what they mean? That takes experience and that’s what we bring to Numberfied.

Read Also: 7 Insider Tips to Simplify Your Finances with QuickBooks Bookkeeping Services for Small Businesses