Introduction

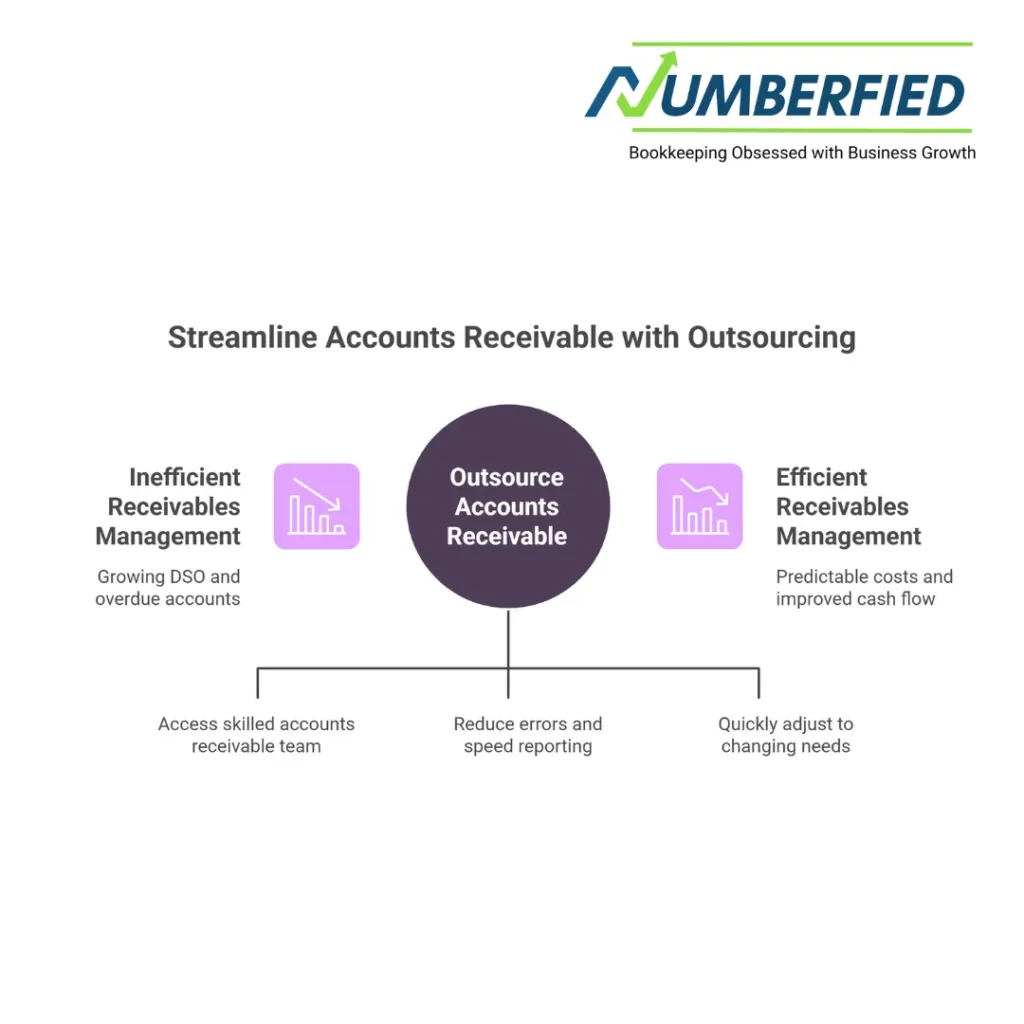

For small and medium businesses, CFOs, and financial managers, managing accounts receivable day-to-day can drain time, obscure cash flow, and increase overhead costs. Outsourced accounts receivable services provide a practical, scalable alternative. An accounts receivable outsourcing partner can streamline invoice processing, speed collections, and let your team focus on strategic financial process improvements. This guide explains the benefits of outsourced accounts receivable services, compares DIY vs. outsourced approaches, highlights top features to look for in an outsourcing company, outlines common mistakes to avoid, and gives a step-by-step plan to select and implement the right accounts receivable outsourcing services for your business needs.

What Are Outsourced Accounts Receivable Services?

Outsourced accounts receivable services (also called AR outsourcing or accounts receivable outsourcing) encompass a range of accounts receivable management activities handled by a third-party service provider. Typical accounts receivable functions include invoice processing, payment processing, collections and debt recovery, reconciliation, reporting, and accounts receivable automation. An outsourcing provider delivers accounts receivable solutions that integrate with your accounting and bookkeeping services or ERP, offering scalable accounts receivable management services that support business growth and reduce the burden on in-house teams.

Practical Benefits of Outsourced Accounts Receivable Services

Hiring an outsourcing firm for your receivable function can transform your financial process. The core benefits include:

- Improve cash flow: Faster invoice processing and a disciplined collection process reduce days sales outstanding (DSO), accelerating cash inflows.

- Cost savings: Outsourcing accounts receivable often lowers overhead costs by minimizing headcount, reducing training expenses, and leveraging automation solutions provided by a service provider.

- Scalability: An accounts receivable outsourcing partner scales processes and teams with your business, so seasonal peaks or rapid growth don’t overload internal staff.

- Access to expertise: Outsourcing companies bring best practices in accounts receivable management, collections strategies, and compliance, improving recovery on overdue accounts.

- Technology and automation: Accounts receivable automation, electronic invoicing, and integrated payment process tools increase efficiency and reduce manual errors.

- Focus on core business: By outsourcing the receivable processes, your finance team can concentrate on strategic priorities like forecasting, budgeting, and financial planning.

DIY vs. Outsourced Accounts Receivable: Which Is Right?

Do-It-Yourself (In-House) Accounts Receivable

Keeping the accounts receivable process in-house gives you direct control over the payment process, customer communications, and data. For very small businesses with limited invoices and straightforward receivable cycles, this can be practical. However, DIY approaches often run into problems as the business grows: rising overhead costs, inconsistent collections, stretched accounting and bookkeeping services, and delayed cash flow due to manual invoice processing.

Outsource Accounts Receivable Services

Outsourcing accounts receivable transfers operational responsibility to an outsourcing partner or accounts receivable outsourcing company. The benefits include professional collections, advanced automation solutions, reduced DSO, and predictable costs. Outsource AR services are particularly valuable when your team spends too much time managing overdue accounts or when financial leaders want reliable receivables reporting to support business growth.

Checklist

- Control vs. Efficiency: In-house gives control; outsourcing gives efficiency and expertise.

- Cost Structure: DIY raises overhead costs as you hire; outsourcing converts fixed costs to variable service costs and typically offers cost savings.

- Scalability: Outsourcing providers scale faster than adding internal headcount.

- Risk & Compliance: Outsourcing firms are experienced in managing disputes, collections compliance, and data security.

Top Providers and Key Features

When evaluating accounts receivable outsourcing companies or a service provider, focus on capabilities that directly impact cash flow, customer experience, and operational efficiency. The best accounts receivable outsourcing companies and top accounts receivable outsourcing companies generally offer:

- Integrated invoice processing: Electronic invoicing, automated invoice delivery, and workflow for invoice approvals reduce errors and speed billing.

- Payments and receivable automation: Multiple payment channels, lockbox and payment reconciliation, and automated posting to your general ledger.

- Collections management: A disciplined collection process with segmented strategies for early-stage reminders, late-stage collections, and debt recovery outsourcing when necessary.

- Reporting and analytics: Real-time dashboards, aging reports, cash forecasting, and customizable KPIs for CFOs and financial managers.

- Seamless integration: Compatibility with your accounting and bookkeeping services, ERP, and CRM to keep customer and invoice data synchronized.

- Security and compliance: Data protection, PCI compliance for payment processing, and adherence to collection regulations.

- Customer experience focus: Professional communications and dispute resolution processes that preserve customer relationships while resolving overdue accounts.

Common Mistakes When Outsourcing Accounts Receivable

Many companies expect immediate transformation and overlook critical factors during selection and implementation. Avoid these mistakes:

- Poor scoping: Not defining the accounts receivable process scope, KPIs, or success metrics before engaging an outsourcing firm leads to misaligned expectations.

- Choosing price over fit: Selecting an outsourcing provider solely on cost risks poor integration, lower recovery rates, and hidden fees.

- Ignoring integration: Failure to integrate the outsourcing partner with your accounting systems and receivable processes results in duplicated work and reporting gaps.

- Lack of governance: No clear SLAs, escalation paths, or dispute resolution procedures create friction and slow collections.

- Underestimating change management: Not preparing internal teams for process changes or role shifts can undermine the benefits of outsourcing.

Step-by-Step Guide to Selecting an Outsourcing Partner

Follow these practical steps to choose and implement accounts receivable outsourcing services that match your business needs and deliver measurable improvements:

Step 1: Define Your Objectives and KPIs

Start with what you want to achieve: reduce DSO, improve cash flow, lower overhead costs, scale receivable functions, or improve customer payment experience. Set KPIs such as DSO reduction target, collection rate, cost per invoice, dispute resolution time, and error rates.

Step 2: Map Your Current Receivable Processes

Document your current accounts receivable process end-to-end: invoice generation, delivery, follow-up cadence, dispute handling, payment processing, reconciliation, and reporting. Identify bottlenecks in the payment process and manual tasks ripe for automation.

Step 3: Shortlist Providers by Capabilities

Look for accounts receivable outsourcing solutions that offer automation, integration with your accounting and bookkeeping services, and a strong collections methodology. Evaluate the outsourcing provider’s experience in your industry, references, and case studies, particularly with accounts receivable management services and receivable recovery results.

Step 4: Evaluate Technology and Integration

Ask about APIs, connector capabilities for your ERP and payment gateways, and support for electronic invoicing and accounts receivable automation. The right outsourcing firm will minimize manual data entry and provide clear handoffs between your internal team and the outsourcing firm.

Step 5: Negotiate Service Level Agreements and Pricing

Define SLAs for invoice turn-around, collection timeliness, reporting frequency, and dispute resolution. Consider pricing models: per-invoice fees, percentage of collections, or subscription-based rates. Ensure pricing aligns incentives between your company and the outsourcing partner.

Step 6: Plan Implementation and Change Management

Create a phased implementation plan: pilot with a customer segment or invoice type, validate integrations and KPIs, then scale. Train internal staff on the new AR process, update roles, and maintain communication with customers about any changes to invoicing or payment channels.

Step 7: Monitor, Optimize, and Evolve

Regularly review performance against KPIs, adjust collection strategies based on aging reports, and explore further automation opportunities. A true accounts receivable outsourcing partner will act as a management service to continually improve your receivable processes.

Implementation Best Practices

Maximize the value of outsourced accounts receivable services with these best practices:

- Standardize invoice formats and payment terms to reduce disputes and accelerate payments.

- Automate reminders and late notices while preserving personalized customer communication for high-value accounts.

- Segment receivables for targeted collection strategies: high-value clients, high-risk accounts, and recurring billing customers.

- Retain clear internal ownership for exceptions and disputes; the outsourcing firm should handle routine collections and escalation per SLAs.

- Use analytics for proactive cash flow forecasting and to prioritize collection efforts.

How Outsourced Accounts Receivable Services Support Business Growth

When accounts receivable processes run efficiently, your business frees up working capital to invest in growth initiatives. Outsource accounts receivable services to reduce days sales outstanding, allowing you to reinvest in sales, product development, or to hire for strategic roles rather than back-office functions. Scalable accounts receivable teams from an outsourcing provider let you enter new markets or manage seasonal volume without the overhead of a larger internal team.

Real-World Use Cases

Examples of where accounts receivable outsourcing delivers measurable impact:

- Manufacturing firms are outsourcing invoice processing and collections to reduce DSO by 20–40% and improve receivable turnover.

- Software-as-a-Service companies are integrating accounts receivable automation for subscription billing and payment reconciliations to accelerate cash flow and reduce manual errors.

- Professional services firms use an outsourcing provider’s collections team to manage overdue accounts while protecting client relationships through professional communications.

When to Consider Outsourcing Accounts Receivable

Consider accounts receivable outsourcing when:

- Your DSO or overdue accounts are growing despite internal efforts.

- Headcount constraints prevent hiring specialized accounts receivable staff.

- Manual invoice processing and reconciliation cause frequent errors or delayed financial reporting.

- You need predictable costs and the ability to scale receivable processes quickly.

Measuring Success: KPIs and Metrics

Track these KPIs to evaluate the performance of your accounts receivable outsourcing partner:

- Days Sales Outstanding (DSO)

- Average collection period

- Collection rate and recovery on overdue accounts

- Cost per invoice and total accounts receivable overhead

- Percentage of electronic invoices and automated payments

- Dispute resolution time and aging report improvements

Conclusion

Outsourced accounts receivable services can deliver faster cash flow, lower overhead costs, and a more efficient accounts receivable process for small and medium businesses. Whether you need complete accounts receivable outsourcing or targeted support for invoice processing, collections, or accounts receivable automation, a thoughtful selection and implementation process ensures measurable returns. Avoid common mistakes by defining objectives, prioritizing integration, and establishing clear SLAs.

If improving cash flow and reducing receivable headaches is a priority, take the next step: request a free consultation to review your current accounts receivable process, benchmark your KPIs, and explore a tailored accounts receivable outsourcing solution. Let an experienced accounts receivable outsourcing partner help you streamline the accounts receivable function, recover overdue accounts, and free your team to focus on core business growth.

Frequently Asked Questions

What are outsourced accounts receivable services?

Outsourced accounts receivable services are third-party solutions that manage invoicing, payment processing, collections, and customer account reconciliation on behalf of a business to improve cash flow and reduce administrative burden.

How can outsourced accounts receivable services improve cash flow?

Outsourced accounts receivable services improve cash flow by accelerating invoice delivery, enforcing consistent collection processes, reducing days sales outstanding (DSO), and using proven follow-up strategies to secure timely payments.

Are outsourced accounts receivable services secure for handling sensitive customer data?

Yes, reputable outsourced accounts receivable services implement data security measures such as encryption, access controls, compliance with industry standards (e.g., PCI DSS where applicable), and regular audits to protect sensitive customer and payment information.

What types of businesses benefit most from outsourced accounts receivable services?

Small and mid-sized businesses, firms experiencing rapid growth, companies with limited finance staff, and organizations seeking to reduce DSO often benefit most from outsourced accounts receivable services.

How do outsourced accounts receivable services integrate with existing accounting systems?

Most outsourced accounts receivable services offer integrations or APIs that connect to common accounting and ERP systems, enabling seamless data synchronization for invoices, payments, customer records, and reconciliation.

What costs are associated with outsourced accounts receivable services?

Costs vary by provider and may include setup fees, monthly or per-invoice fees, percentage-based collection fees, and additional charges for advanced reporting or specialized collections; a clear service agreement from the provider outlines all fees for outsourced accounts receivable services.

Can outsourced accounts receivable services be customized to our billing policies?

Yes, reputable outsourced accounts receivable services can be tailored to match your billing cycles, credit policies, invoicing formats, and customer communication preferences while maintaining brand consistency.

How quickly can we expect results after switching to outsourced accounts receivable services?

Many companies see improvements in cash flow and reduced DSO within the first few months of implementing outsourced accounts receivable services, though exact timelines depend on invoice volume, customer base, and the provider’s onboarding process.

What reporting and analytics do outsourced accounts receivable services typically provide?

Outsourced accounts receivable services typically provide dashboards and reports on aging receivables, payment trends, collection effectiveness, DSO, dispute statuses, and cash forecasting to help finance teams make informed decisions.

How do we choose the right provider for outsourced accounts receivable services?

Choose a provider for outsourced accounts receivable services by evaluating their industry experience, integration capabilities, security practices, pricing transparency, client references, service-level agreements, and the ability to scale with your business needs.

Read Also: Virtual Bookkeeping Services for Small Businesses That’ll Change Your Life!