Most founders look at their accountant and see a cost. They see a necessary evil required to keep the tax authorities at bay. This mindset is the single biggest ceiling on your growth potential.

If you treat your financial data as a compliance box to check, you are driving your business with a blindfold on. You are looking at where you have been. You are ignoring where you are going.

Real growth requires a strategic pivot. It requires moving from reactive bookkeeping to proactive financial strategy. Professional account services are not just about filing taxes on time. They are the main source of decisions that follow. They give you the precision necessary to carry out the activities of hiring, investing, and scaling without a lack of sleep.

Key Takeaways

- Shift Your Perspective: Learn why accounting is a profit center, not an administrative expense.

- Master Cash Flow: Understand how to forecast runway and liquidity to survive lean months.

- Reduce Liability: Discover how expert oversight prevents costly compliance errors.

- Data-Driven Decisions: distinct methods to use financial reports for strategic hiring and expansion.

- Reclaim Time: Calculate the true ROI of outsourcing your financial heavy lifting.

The Strategic Shift: From Scorekeeper to Navigator

In the early days, you do it all. You send the invoices. You reconcile the bank feed. You stress over the receipts. It works when you are small. It becomes a liability when you start to grow.

Standard bookkeeping is historical. It is a scorekeeper. It tells you what happened last month or last quarter. While accurate records are foundational, they do not help you navigate the future. A historical report cannot tell you if you can afford to hire that new VP of Sales next month. It cannot tell you if your current pricing model will sustain your overhead in Q4.

The Difference Between Compliance and Advisory

Compliance looks backward. Advisory looks forward.

Compliance ensures you do not go to jail. It is keeping the books clean and the tax filings accurate. This is the baseline. It is non-negotiable. But it is not a competitive advantage.

Advisory is where the magic happens. A strategic partner analyzes the data to identify trends. They look at your margins. They analyze your customer acquisition costs. They tell you which service lines are actually profitable and which ones are bleeding you dry. This transition from “counting beans” to “planting seeds” is essential for any business aiming for seven or eight figures.

Building a Financial Infrastructure

You wouldn’t build a skyscraper on a swamp. You shouldn’t build a business on shaky spreadsheets.

Professional oversight establishes a robust financial infrastructure. This includes chart of accounts optimization, software integration, and automated reporting systems. When your infrastructure is solid, your data is real-time. Real-time data means agility. In a market that is changing at a fast pace, being agile is what separates the businesses that can grab the opportunity from those that lose it.

Cash Flow Forecasting: Your Business Survival Kit

Profit is vanity. Cash is sanity. You have heard it a thousand times. Yet, businesses with strong profit margins on paper go bust every single day. Why? Because they ran out of cash.

A profitable month means nothing if the money is stuck in accounts receivable while payroll is due on Friday. This is where the strategic value of professional financial management becomes undeniable. It is about visibility.

Predicting the Pinch Points

A professional creates a cash flow forecast that acts as a radar system. It spots the storms before they hit.

We map out your inflows and outflows over 12, 24, and 36 weeks. We identify the exact week you will hit a cash crunch based on your current burn rate and payment cycles. Knowing you will be short on cash in three months allows you to act now. You can adjust terms with suppliers. You can chase overdue invoices aggressively. You can secure a line of credit while your financials look strong.

Waiting until the bank account is empty is not a strategy. It is negligence.

Managing Working Capital

Growth eats cash. It is a counterintuitive reality. As you scale, your expenses often increase before your revenue catches up. You need to buy more inventory. You need to hire staff to service the new contracts.

Without professional oversight, this “growth gap” can kill you. We help you manage working capital efficiency. We look at your Days Sales Outstanding (DSO) and Days Payable Outstanding (DPO). We tweak the levers of your business model to shorten the cash conversion cycle. The goal is to get money in your pocket faster than it leaves. That is how you fund growth internally without giving away equity.

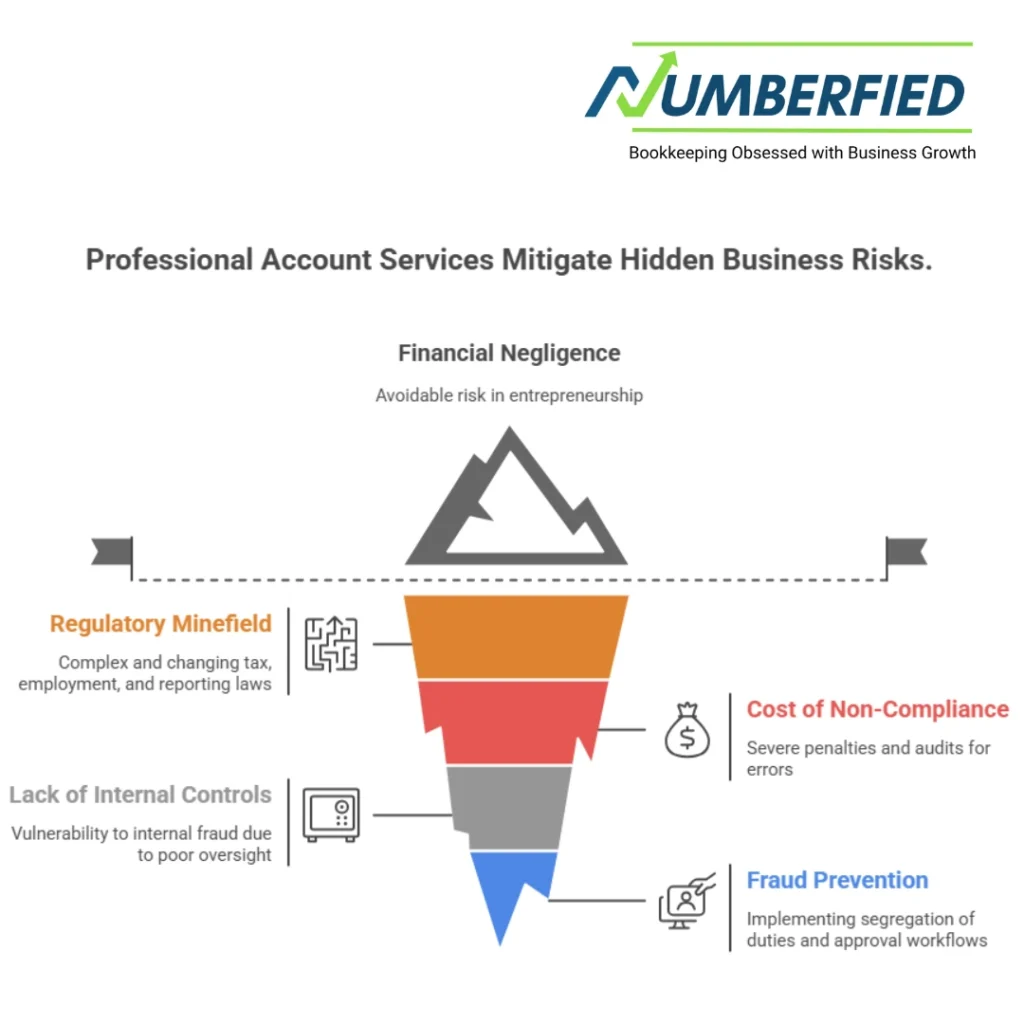

How Professional Account Services Mitigate Hidden Risks

Entrepreneurship involves risk. Financial negligence shouldn’t be one of them. The regulatory environment is a minefield. Tax laws change. Employment laws evolve. Reporting standards shift.

Attempting to navigate this alone is like performing surgery on yourself. You might survive, but it is going to be messy. Utilizing professional account services provides a layer of armor around your business operations.

The Cost of Non-Compliance

The penalties for getting it wrong are severe. We are talking about fines that can wipe out a year’s worth of profit. We are talking about audits that paralyze your operations for months.

A professional team ensures your tax strategy is watertight. We ensure you are claiming every deduction you are legally entitled to, but we also ensure you aren’t crossing the line. We handle the payroll tax, the sales tax, and the superannuation or pension requirements. We insulate you from the bureaucracy so you can focus on the product.

Internal Controls and Fraud Prevention

No one likes to think their employees would steal from them. It happens.

Small businesses are the most common victims of internal fraud because they lack controls. The person writing the checks is often the same person reconciling the bank account. That is a recipe for disaster.

We implement segregation of duties. We set up approval workflows. We conduct periodic reviews of the ledger to spot anomalies. If a vendor name looks similar to an employee’s relative, we catch it. If expenses are creeping up in a category that doesn’t make sense, we flag it. Risk mitigation is about closing the loopholes before someone exploits them.

Data-Driven Decision Making for Expansion

Gut feeling is great for product design. It is terrible for financial management.

When you are looking to scale, you need hard data. You need to know your unit economics inside and out. You need to know your Customer Lifetime Value (LTV) relative to your Customer Acquisition Cost (CAC).

Pricing for Profitability

Most business owners guess at pricing. They look at competitors and undercut them by 10%. This is a race to the bottom.

We analyze your cost structure to determine your true break-even point. We factor in the overhead, the labor burden, and the marketing spend. We help you price for margin, not just for volume. Sometimes, the best way to grow is to fire your bottom 20% of clients who are low-margin and high-maintenance. A professional advisor gives you the confidence to make those tough calls because the numbers back you up.

Scenario Planning

“What if?” is the most powerful question in business.

What if we lose our biggest client? What if we open a second location? What if we increase our ad spend by 50%?

We run these scenarios through your financial model. We stress-test your business. We show you the financial impact of different strategic paths before you commit a single dollar. This transforms decision-making from a gamble into a calculated risk. You stop hoping for the best and start planning for the likely outcome.

The Opportunity Cost of DIY Finance

Your time is the most expensive asset in the company.

Every hour you spend categorizing expenses in Xero or QuickBooks is an hour you are not selling. It is an hour you are not leading your team. It is an hour you are not innovating.

Calculating Your Hourly Rate

Let’s do the math. If your specialized skill, the thing that brings value to the market, generates $500 an hour for the business, why are you doing $50 an hour work?

When you handle your own accounts, you are not saving money. You are losing money. You are paying the opportunity cost of your lost revenue generation. Outsourcing this function is an arbitrage play. You pay a professional a fraction of your hourly value to handle the finance, freeing you up to generate 10x the return on your time.

Avoiding the “Fix-It” Bill

There is another cost to DIY: the cost of fixing your mistakes.

We often onboard clients who have tried to do it themselves for two years. The books are a disaster. Nothing reconciles. The tax categories are wrong. It takes us three times as long to untangle the mess as it would have taken to do it right the first time. You end up paying for the cleanup on top of the missed tax savings. It is expensive to be cheap.

Building a Valuation-Ready Business

You might not be thinking about selling today. But you should run your business as if you are selling it tomorrow.

Buyers do not buy chaos. They buy systems. They buy predictable cash flow. They buy clean, audited financial history.

The Due Diligence Test

If a private equity firm knocked on your door tomorrow with a check, could you pass due diligence?

If your financials are a mix of spreadsheets and shoe boxes, the deal dies. Or, the valuation gets cut in half. Professional accounting ensures your books are always “deal-ready.” We maintain an asset register. We keep the balance sheet clean. We ensure that intellectual property is properly valued and capitalized.

Maximizing the Multiple

Valuation is usually a multiple of EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization).

A professional advisor helps you maximize EBITDA. We identify “add-backs” personal expenses or one-off costs that shouldn’t negatively impact your valuation. We help you structure the business to show consistent growth and healthy margins. We turn your financial history into a compelling story of success that commands a premium price in the market.

Conclusion

Accounting is not about the past. It is about the future.

If you continue to view your finance function as a mandatory expense, you will remain stuck in the cycle of survival. You will lack the visibility to scale and the data to pivot. By engaging professional account services, you invest in the brain of your business. You gain the clarity to make bold moves and the safety net to take calculated risks.

Stop counting the cost. Start counting the value. Your growth depends on it.

Frequently Asked Questions

1. Is a bookkeeper the same as an accountant?

No. A bookkeeper records the daily transactions and keeps the ledger clean. An accountant analyzes that data for tax planning, strategy, and high-level reporting. You usually need both.

2. Can’t I just use AI or software to do this?

Software is a means, not a plan. AI may sort out a receipt, but it won’t be able to inform you whether you have sufficient cash to employ three new staff members next quarter. Software is devoid of context.

3. When is the right time to hire professional help?

Yesterday. If you are generating revenue and have expenses, you need oversight. Waiting until you are “big enough” usually means waiting until you have a massive mess to clean up.

4. How does an accountant actually help cash flow?

We don’t just track it; we forecast it. We help you negotiate better payment terms, chase receivables faster, and structure your debt to keep cash in the bank for operations.

5. What is the biggest mistake founders make with finance?

Mixing personal and business finances. It pierces the corporate veil, complicates tax time, and makes it impossible to see if the business is actually profitable.

Ready to Scale?

Stop guessing with your numbers. Join the entrepreneurs who use financial clarity as a competitive advantage. Contact Numberfied Today and let’s turn your accounting into your biggest growth asset.

Also Read: Why Accounting Companies in US Are Your Business’s Best Friend