Introduction

Real estate underwriting is the process lenders and investors use to evaluate the risk of financing or acquiring property. Whether the subject is a single-family mortgage or a large commercial real estate investment, underwriting is the engine that determines whether to approve or deny the loan, what loan terms to offer, and how to manage potential risk. This article explains underwriting in real estate, the real estate underwriting process step by step, the differences between residential mortgage underwriting and commercial real estate underwriting, and the key CRE underwriting factors underwriters consider, including DSCR, NOI, cap rate, property appraisal, and borrower credit assessment.

What Is Real Estate Underwriting and Why It Matters

Underwriting is the process of evaluating the financial, legal, and physical characteristics of a loan request or investment to determine whether the lender or investor should proceed. Real estate underwriting helps lenders assess the risk for the lender and the potential return for the investor. Underwriting involves analyzing both the borrower and the property: the borrower’s ability to repay, the property’s appraised value, current market conditions, operating expenses, vacancy rate, and projected cash flow. In short, underwriting is used to determine whether the loan amount, collateral, and borrower’s creditworthiness align with the lender’s risk tolerance.

Roles: Underwriter, Lender, Investor, and Borrower

A real estate underwriter or underwriting team evaluates loan applications and investment opportunities. The underwriter in real estate reviews the borrower’s credit history, credit report, income, and credit score to assess the borrower’s ability to repay the loan. The underwriter also evaluates the property’s value through property appraisal and comparable market analysis, and they examine net operating income (NOI), lease structures, and market trends to assess the viability of a commercial real estate investment or residential mortgage. Investors use underwriting to make informed decisions about acquisitions and portfolio risk.

Overview of the Real Estate Underwriting Process

The real estate underwriting process involves multiple steps designed to quantify potential risk and to recommend loan terms. Underwriting is the process lenders use to determine loan eligibility and structure. Below are the main steps in the real estate loan underwriting process for both commercial and residential loans.

Step 1: Receive and Review the Loan Application

The underwriting process begins when a lender receives a loan application. The application contains details about the borrower, loan amount requested, property address, and supporting documentation. The underwriter verifies that the loan application is complete and that required documents like tax returns, bank statements, leases, and rent rolls are included.

Step 2: Borrower Credit Assessment

Underwriters evaluate the borrower’s creditworthiness by examining the borrower’s credit report, credit score, credit history, and overall financial profile. This assessment checks the borrower’s ability to repay the loan, or in the case of commercial loans, the sponsor’s track record. Real estate underwriters also review debt-to-income ratios, liquidity, and any off-balance-sheet liabilities that could affect repayment.

Step 3: Property Appraisal and Valuation

Property appraisal underwriting analyzes the property’s appraised value and its condition. An appraised value is used to calculate loan-to-value ratios and to verify that the property’s market value supports the loan amount. Underwriting involves comparing the property’s appraised value to recent sales, replacement cost, and income-generation potential, especially important for investment properties where NOI and cap rate drive valuation.

Step 4: Cash Flow and Financial Analysis

Underwriting in commercial real estate focuses heavily on cash flow. Real estate underwriters calculate net operating income (NOI), consider operating expenses, and determine the property’s ability to generate sufficient cash flow to repay the loan. For commercial loans, underwriters use metrics like DSCR (debt service coverage ratio) to ensure the property produces enough net operating income to cover debt payments. A lender will typically set minimum DSCR thresholds as part of the underwriting guidelines for real estate.

Step 5: Market Analysis and Risk Factors

Underwriting involves assessing market conditions and market trends that could affect property value and cash flow. Underwriters analyze local vacancy rates, demand drivers, comparable lease rates, and economic indicators. For commercial underwriting, the presence of long-term leases and creditworthy tenants reduces potential risk. Residential mortgage underwriting will consider neighborhood trends and comparable sales to determine whether market conditions support the property’s value.

Step 6: Collateral and Legal Review

Underwriters verify collateral and perform title and legal reviews. Collateral is the property securing the loan; ensuring a clear title and marketable liens protects the lender’s interest. The underwriting process involves reviewing leases, environmental reports, insurance coverage, and any legal encumbrances that could jeopardize the property’s value. Insurance underwriting for property risk is often coordinated in this stage to mitigate hazards like fire or flood.

Step 7: Structuring the Loan and Setting Loan Terms

After evaluating borrower creditworthiness and property value, the underwriter recommends loan terms. These include loan amount, interest rate, amortization period, covenants, and any required reserves. Underwriting guidelines for real estate will dictate maximum loan-to-value ratios, minimum credit score requirements, and acceptable DSCR levels. The underwriter’s job is to balance the lender’s desire to make loans with the need to control potential risk exposure.

Step 8: Final Approval or Denial

Underwriters compile their findings and either approve the loan, approve with conditions, or deny the loan. Automated underwriting systems may be used for many residential mortgage underwriting decisions, but complex commercial real estate underwriting typically requires manual review by experienced underwriters. If approved, the loan is documented and closed. If denied, the lender explains reasons such as insufficient ability to repay, low appraisal, poor credit history, or unacceptable market conditions.

Residential Mortgage Underwriting vs Commercial Real Estate Underwriting

While both types of underwriting share the same objective, to assess the risk and determine whether the borrower can repay the loan, the processes and emphasis differ significantly.

Residential Mortgage Underwriting

Residential mortgage underwriting is typically more standardized and often uses automated underwriting systems to evaluate borrower creditworthiness and income documentation. The underwriters focus on the borrower’s personal ability to repay the loan: employment history, credit score, debt-to-income ratio, and assets. The property appraisal confirms property value relative to loan-to-value thresholds. Mortgage underwriting policies are influenced by secondary market standards when loans will be sold to agencies like Fannie Mae or Freddie Mac. In many cases, underwriting is the process that determines whether a mortgage is eligible for sale to those agencies.

Commercial Real Estate Underwriting

Commercial real estate underwriting is more complex and property-centric. Underwriting in commercial real estate evaluates the property’s net operating income, vacancy risk, lease terms, tenant creditworthiness, and cap rate assumptions. Commercial underwriting factors include DSCR, NOI, and an in-depth market analysis. A real estate underwriter in commercial real estate must determine whether the property’s income can support the loan, often using pro forma statements and stress tests. Commercial underwriting also assesses the sponsor’s track record, capital structure, and the property’s potential to maintain or increase its value over time.

Key Commercial Real Estate Underwriting Factors (CRE Underwriting Factors)

Commercial lenders rely on a set of core metrics when underwriting commercial loans. These CRE underwriting factors are essential to determine whether the real estate investment is viable and to assess the risk for the lender.

Net Operating Income (NOI)

NOI equals gross rental income minus operating expenses (excluding debt service and capital expenditures). Underwriters analyze historical NOI and project future NOI to see if the property can service the debt and produce expected returns. NOI is central to calculating the cap rate and DSCR.

Debt Service Coverage Ratio (DSCR)

DSCR is a ratio of NOI to total debt service (annual mortgage payments). Lenders use DSCR to assess whether the property’s cash flow will cover debt obligations. Many lenders require a minimum DSCR commonly between 1.20 and 1.40, depending on property type and market conditions. A higher DSCR indicates lower risk for the lender.

Cap Rate

Cap rate helps underwriters estimate the property’s market value based on NOI. Cap rate equals NOI divided by property value. Cap rates reflect market trends and investor required returns; they are used to determine the property’s valuation and investment attractiveness. When underwriting, underwriters compare the implied cap rate from the appraised value against market cap rates.

Vacancy Rate and Lease Analysis

Vacancy rate and lease terms affect the property’s income predictability. Underwriting involves analyzing existing leases, tenant quality, lease expirations, and market vacancy data. High vacancy or short lease terms increase potential risk, while long-term leases to creditworthy tenants stabilize cash flow.

Operating Expenses and Cash Flow Stability

Underwriters examine operating expenses, property management, taxes, insurance, utilities, and repairs to ensure NOI projections are realistic. Overstated income or understated operating expenses can misrepresent the property’s ability to repay. The underwriting process involves stress testing cash flow under higher operating expenses or higher vacancy rates to assess resilience.

Collateral and Appraised Value

Property appraisal underwriting ensures the collateral supports the loan amount. The appraised value informs loan-to-value ratios and loss severity in case of default. Underwriters review the appraisal for assumptions about comparable sales, income capitalization, and replacement cost to confirm the property’s appraised value accurately reflects market conditions.

Borrower/Sponsor Assessment

Underwriting involves evaluating the borrower’s financial strength, experience, and creditworthiness. For commercial real estate investment, the sponsor’s track record in managing similar properties or executing redevelopment plans is critical. Underwriters assess the borrower’s credit history, liquidity, and ability to cover operating shortfalls or capital needs.

Underwriting Guidelines Real Estate: Policies and Automated Tools

Underwriting guidelines for real estate are the institutional rules that determine acceptable risk levels. These guidelines include maximum loan-to-value ratios, minimum credit scores, acceptable DSCR thresholds, and required reserves. Lenders document underwriting policies to standardize decisions and comply with regulatory and investor requirements.

Automated Underwriting Systems and Manual Underwriting

Residential mortgage underwriting often uses automated underwriting systems to speed decisions and enforce guidelines consistent with secondary market buyers. Commercial underwriting tends to be manual due to complexity. Automated underwriting systems can flag issues, but underwriters still apply judgment to factors like market trends, tenant lease strength, and property condition. Underwriting is the process where both automated insights and human expertise combine to make informed decisions.

Property Appraisal Underwriting: Valuation Essentials

Property appraisal underwriting is a crucial part of the underwriting process. The appraisal approach depends on the property type. For residential properties, comparables and sales approach predominate. For commercial properties, income capitalization and discounted cash flow methods are common. Underwriters scrutinize appraisals to ensure assumptions about rental rates, vacancy, and operating expenses align with market reality. An appraisal that undervalues the property can lead to loan denial or lower loan amounts; an appraisal that overestimates value increases risk for the lender.

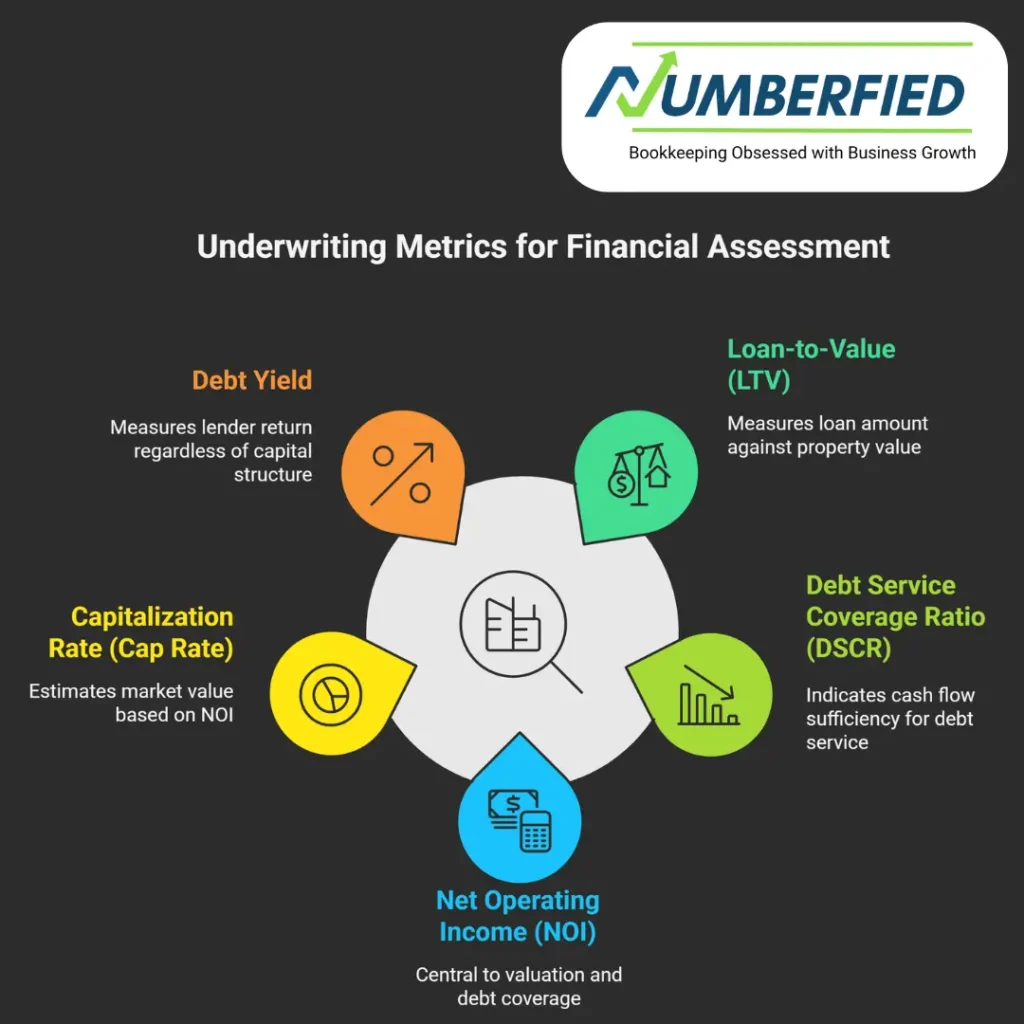

Common Underwriting Metrics and How They’re Used

Understanding common underwriting metrics helps both borrowers and investors prepare for the underwriting process.

- Loan-to-Value (LTV): Loan amount divided by appraised value. Higher LTV increases risk for the lender.

- Debt Service Coverage Ratio (DSCR): NOI divided by annual debt service. DSCR shows cash flow sufficiency.

- Net Operating Income (NOI): Income minus operating expenses. Central to valuation and debt coverage.

- Capitalization Rate (Cap Rate): NOI divided by property value. Used to estimate market value.

- Debt Yield: NOI divided by loan amount. Measures lender return regardless of capital structure.

How Underwriters Assess Borrower Credit: Credit Score, Credit Report, and Capacity

Borrower credit assessment examines the borrower’s credit report, credit score, credit history, and overall financial strength. Underwriting evaluates not just the credit score but the underlying credit events, such as late payments, collections, and bankruptcies, that could indicate repayment risk. Lenders also look at liquidity reserves, evidence of the borrower’s ability to cover unexpected expenses, and the borrower’s past performance in real estate investing. For commercial loans, sponsor experience and track record may be weighed more heavily than personal credit scores alone.

Stress Testing and Scenario Analysis

Underwriting involves scenario analysis and stress testing to assess potential risk under changing market conditions. Underwriters test higher vacancy rates, increased operating expenses, or lower rental rates to see if the property still meets underwriting thresholds. Stress testing helps lenders prepare loan terms that account for potential downturns and ensures that borrowers have a plan for weathering temporary shortfalls.

Underwriting Outcomes: Approve, Approve With Conditions, or Deny

After the underwriting process, underwriters reach one of several outcomes: approve the loan, approve with conditions (such as requiring reserves, reduced loan amount, or additional guarantors), or deny the loan. Denying the loan often stems from insufficient borrower creditworthiness, a low appraised value, weak cash flow, or adverse market trends. Approve with conditions is common when risks can be mitigated through documentation, insurance, or structural changes to the loan.

Tips for Borrowers to Improve Underwriting Outcomes

Borrowers can take several steps to improve their chances of loan approval and better loan terms:

- Maintain strong credit: keep your credit score healthy and manage debt.

- Document income and liquidity: provide clear bank statements, tax returns, and evidence of reserves.

- Prepare property documentation: clean leases, current rent rolls, and maintenance records help streamline property underwriting.

- Understand market conditions: present realistic pro formas and market comps to support rent assumptions and cap rate expectations.

- Work with experienced brokers and appraisers: credible valuation and underwriting partners increase lender confidence.

How Investors Use Underwriting for Real Estate Investing

Real estate investors use underwriting to evaluate acquisitions and to determine project viability. Underwriting in commercial real estate investment helps investors determine whether projected cash flows and appreciation justify the investment and financing structure. A robust underwriting process enables the investor to underwrite potential risk, set realistic returns, and make informed decisions about capital allocation. The type of underwriting will vary by strategy: value-add, core, opportunistic, but the essential goals remain: assess the property’s ability to generate cash flow, estimate market-driven cap rates, and determine whether the borrower or sponsor can execute the business plan.

Specialized Types of Underwriting in Real Estate

Underwriting in real estate can be tailored to specific situations: construction loans require builder experience and cost estimates; bridge loans focus on short-term exit strategies; and multifamily underwriting emphasizes unit-level rents and turnover. Insurance underwriting and securities underwriting are related but distinct disciplines: insurance underwriting assesses insurable risks, while securities underwriting (for REITs or mortgage-backed securities) involves pricing and distributing financial instruments. However, the core principle of assessing the potential risk and determining whether it is acceptable remains the same across types of underwriting.

Common Challenges in Real Estate Underwriting

Underwriters often face challenges such as volatile market conditions, inaccurate or incomplete documentation, and unpredictable tenant behavior. Environmental risks, unexpected capital expenditures, and regulatory changes can also affect underwriting assumptions. Effective underwriting requires continuously updated market data, rigorous documentation, and conservative assumptions to account for potential uncertainty.

Conclusion

Real estate underwriting is central to making informed decisions in lending and investing. The real estate underwriting process involves evaluating the borrower, assessing the property’s appraised value, analyzing NOI and cash flow, reviewing market conditions, and ultimately deciding whether to approve a loan and under what terms. For lenders and real estate investors, strong underwriting minimizes potential risk, clarifies loan terms, and improves portfolio performance. By understanding the components of underwriting borrower credit assessment, property appraisal underwriting, DSCR, cap rate, operating expenses, and vacancy risk, borrowers and investors can better prepare for the underwriting process and increase their chances of favorable outcomes.

Book a FREE strategy call with Numberfied

FAQ

What are the three C’s of underwriting?

In mortgage and general credit underwriting, the three C’s are Credit (your credit history and score), Capacity (your ability to repay based on income, debt-to-income ratio, and employment), and Collateral (the property’s value as security for the loan).

What are the three main elements of underwriting?

The three main elements are typically Credit, Capacity, and Collateral, evaluating the borrower’s repayment history, financial ability, and the asset securing the loan.

What are the three C’s of surety underwriting?

In surety bond underwriting (e.g., for construction bonds), the three C’s are Character (reputation and integrity), Capacity (ability to complete the project), and Capital (financial strength and resources).

What is the 3 7 3 rule for a mortgage?

The 3-7-3 rule refers to timing requirements under the Truth in Lending Act: Lenders must provide initial disclosures within three business days of application, allow at least seven business days before closing after disclosures, and provide revised disclosures three business days in advance if the APR changes significantly.

What is underwriting in real estate?

Underwriting in real estate is the lender’s process of assessing risk by verifying the borrower’s credit, income, assets, and the property’s value/appraisal to decide if the loan should be approved and on what terms.

Does underwriting mean you are approved?

No, underwriting does not guarantee approval; it means your application is being reviewed. You could be approved, conditionally approved, suspended (needing more info), or denied.

What is the meaning of underwrite in real estate?

To underwrite means to evaluate the risk of a real estate loan by analyzing the borrower’s finances, credit, and the property’s value to determine loan eligibility and conditions.

How long does it take for the underwriter to make a decision?

Mortgage underwriting typically takes a few days to several weeks, with the overall process averaging 30–45 days from application to closing, depending on complexity and document submission speed.

What is underwriting in simple words?

Underwriting is the lender’s review of your finances, credit, and property to assess the risk of lending you money for a home purchase.

Can you get denied during underwriting?

Yes, you can be denied during underwriting if issues arise, such as a low credit score, insufficient income, high debt, appraisal problems, or unverifiable information.

Read Also: 9 Surprising Ways a Bookkeeping Service for Small Business Can Boost Your Success