Why Real Estate Underwriting Services Matter

Real estate underwriting services provide the rigorous, data-driven analysis that lenders and investors need to underwrite transactions, assess risk, and evaluate the viability of real estate assets. Whether you’re a lender, broker, developer, or investor, accurate real estate underwriting services turn market trends, financial modeling, and due diligence into actionable insights. Underwriting serves as the foundation for profitable investment and helps ensure your acquisition, refinancing, or development meets investment strategy and risk tolerance.

Who Benefits from Professional Underwriting

Real estate underwriting services are essential for a wide range of stakeholders in the real estate industry: lenders and investors rely on thorough analysis to lend or leverage capital; developers and sponsors need underwriting to prove project viability and secure financing; mortgage brokers and CMBS originators use underwriting to verify borrower strength and property cash flow; and portfolio managers use consistent underwriting to compare asset classes like multifamily, office, retail, and industrial.

Top Benefits of Real Estate Underwriting Services

Improved Decision-Making and Risk Assessment

Underwriting provides a detailed evaluation of property cash flow, vacancy risk, tenant creditworthiness, lease terms, and market dynamics. A robust underwriting process uses analytics, appraisal data, and financial modeling to assess downside scenarios and probability-weighted outcomes so lenders and investors can make informed decisions and maximize returns.

Accurate Valuation and Profitability Forecasts

Accurate underwriting helps determine true asset value and future profitability through valuation models, cap rate analysis, and sensitivity testing. This leads to better pricing, negotiation leverage, and confidence when acquiring or refinancing assets.

Streamlined Workflow and Faster Closings

Outsourced underwriting services or a well-equipped in-house underwriting team streamline the due diligence timeline. Seamless integration with existing underwriting systems, appraisal providers, and legal teams reduces delays and keeps deadlines on track, enabling faster transaction execution.

Consistency Across Portfolios

For institutional investors and lenders managing diverse portfolios, standardized underwriting ensures consistent assumptions and comparable metrics across asset classes, improving portfolio-level decision-making and performance monitoring.

Key Components of the Underwriting Process

A comprehensive real estate underwriting services engagement should include:

Market and Competitive Analysis

Evaluate market trends, supply/demand dynamics, submarket performance, and comparable transactions. Understanding market fundamentals and dynamics is crucial for projecting vacancy, rent growth, and capitalization rates.

Financial Modeling and Cash Flow Analysis

Build pro forma models that forecast net operating income, debt service coverage, loan-to-value ratios, and return metrics. Financial modeling should incorporate sensitivity analysis and scenario planning to test downside and upside cases.

Valuation and Appraisal Coordination

Coordinate independent appraisals and reconcile valuation techniques, income, sales comparables, and cost approach to verify asset value. Accurate valuation supports lender loan sizing and investor pricing decisions.

Physical and Lease Due Diligence

Include property inspections, engineering reports, and environmental assessments. Analyze lease terms, tenant credit, lease expirations, and operating expenses to identify hidden liabilities and estimate future vacancy and tenant rollover risk.

Borrower and Sponsor Evaluation

Assess borrower financial strength, track record, and governance. Underwriters evaluate the sponsor experience in similar commercial real estate investments to understand execution risk.

Regulatory and Legal Review

Examine permits, zoning, title matters, and outstanding litigation. Legal diligence ensures that transfer, lease, and lending documents align with underwriting assumptions and protect lender and investor interests.

In-House vs. Outsourced Underwriting: Which Is Right?

Choosing between in-house underwriting and outsourced underwriting services depends on scale, complexity, and strategic priorities. Both approaches have pros and cons.

In-House Underwriting

Pros: Deep institutional knowledge, tighter control over underwriting assumptions, and alignment with internal investment strategies. In-house underwriters bring commercial real estate experience and direct access to proprietary data and internal stakeholders.

Cons: Higher fixed costs, recruiting and retention challenges, and potential capacity constraints during peak deal flow.

Outsourced Underwriting Services

Pros: Access to specialized commercial real estate underwriting expertise across asset classes, flexible scalability for transaction volume, and cost-effective access to analytics and valuation tools. Outsourcing can provide data-driven insights and streamline workflows for lenders and investors who want to scale quickly or augment internal teams.

Cons: Requires strong vendor management to ensure consistent assumptions and integration. Select a provider with a deep understanding of your market and transaction types to avoid misaligned results.

When to Outsource

Outsource when you need to underwrite multiple simultaneous transactions, require specialized CRE underwriting experience (e.g., multifamily or CMBS), or want to maintain lean operations while preserving access to accurate underwriting and detailed evaluation.

Top Features to Look For in Real Estate Underwriting Providers

Not all underwriting services are created equal. When evaluating providers, prioritize the following features:

- Commercial real estate experience across asset classes and transaction types.

- Data-driven analytics and market intelligence to reflect current market trends.

- Integrated financial modeling with sensitivity and scenario analysis.

- Thorough due diligence capabilities, including appraisal coordination, inspections, and legal review.

- Experienced underwriters and analysts with proven track records in CRE underwriting and investment decisions.

- Seamless integration with your workflow, loan origination systems, and investor reporting.

- Clear deliverables, turnaround times, and transparent pricing to meet deal deadlines.

Common Underwriting Mistakes and How to Avoid Them

Overly Optimistic Revenue Projections

Inflated rent growth or unrealistic lease assumptions can skew loan sizing and investment returns. Insist on conservative assumptions and market-validated rent escalations.

Ignoring Vacancy and Turnover Risk

Underestimating vacancy or tenant turnover leads to cash flow shocks. Include vacancy reserves, realistic lease rollover schedules, and sensitivity testing for vacancy spikes.

Skipping Physical and Environmental Due Diligence

Deferred maintenance, environmental issues, or structural problems can erase projected profitability. Require inspection reports and appropriate reserves or escrows in underwriting assumptions.

Failing to Evaluate Sponsor Experience

A strong borrower or sponsor with commercial real estate experience significantly reduces execution risk. Factor sponsor track record into risk assessment and pricing.

Relying on Outdated Market Data

Real estate markets shift quickly. Underwriting must reflect current market dynamics and comparable sales to produce accurate valuations.

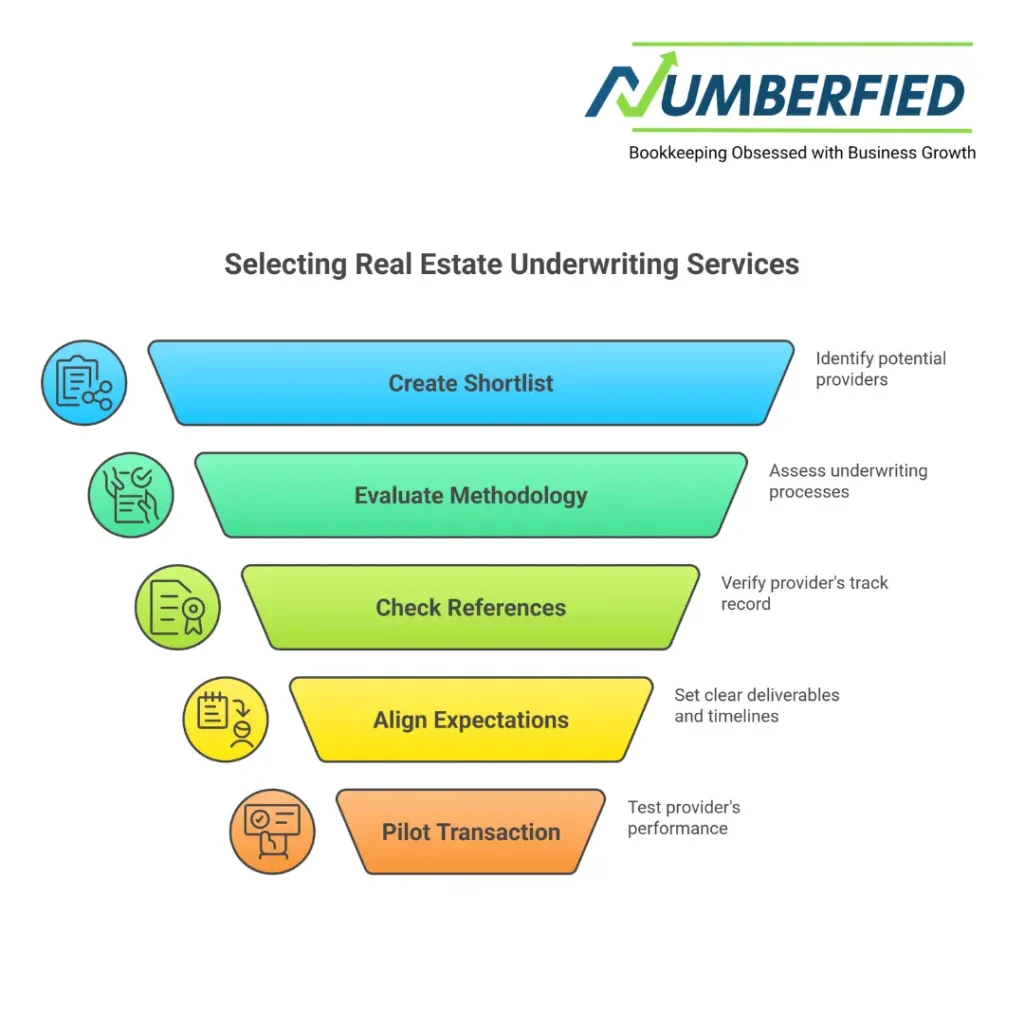

Step-by-Step Guide to Choosing Real Estate Underwriting Services

Step 1: Define Your Needs and Objectives

Clarify whether you need underwriting for acquisition, refinancing, construction lending, or portfolio reviews. Define asset classes (multifamily, office, industrial, retail), transaction size, and target timelines.

Step 2: Create a Shortlist of Providers

Search for providers with commercial real estate experience and relevant case studies. Look for firms offering property underwriting, real estate loan underwriting, and outsourced underwriting services.

Step 3: Evaluate Methodology and Tools

Ask for sample deliverables and the provider’s underwriting process. Confirm they use rigorous financial modeling, third-party appraisals, inspection coordination, and data-driven insights to evaluate value and risk.

Step 4: Check References and Track Record

Speak with lenders, investors, and brokers who have used the provider. Verify experience with CMBS, multifamily underwriting, and other relevant commercial real estate underwriting matters.

Step 5: Align on Assumptions and Deliverables

Set clear expectations for assumptions, scenario analysis, and turnaround time. Ensure deliverables integrate with your workflow and loan origination systems for seamless decision-making.

Step 6: Pilot a Transaction

Start with a pilot underwriting to test the provider’s accuracy and responsiveness. Evaluate how well underwriters assess risk, valuation, and viability under real market conditions.

Step 7: Scale and Integrate

Once validated, integrate the provider into your underwriting workflow. Use standardized templates to compare assets within a portfolio and leverage data-driven analytics for strategic decisions and investments.

How Accurate Underwriting Improves Investment Outcomes

Accurate underwriting reduces surprise costs, supports better valuation and negotiation, and aligns investment decisions with risk tolerance. By combining market analysis, financial modeling, and thorough diligence, underwriting services help lenders and investors identify profitable investment opportunities, avoid bad transactions, and optimize capital deployment across asset classes.

Case Example: Underwriting a Multifamily Acquisition

When a lender evaluates a multifamily acquisition, underwriters will assess tenant mix, lease expirations, rent roll, local market rent growth, vacancy trends, and comparable sales. They’ll run sensitivity analyses on rent growth and vacancy, determine appropriate capitalization rates, coordinate an independent appraisal and inspection, and evaluate sponsor experience. This thorough analysis determines loan sizing, loan-to-value ratio, and debt service coverage used by lenders to issue credit. With accurate underwriting, the lender and investor better understand how the asset will perform under changing market dynamics.

Integrating Underwriting into Your Investment Workflow

For maximum impact, integrate real estate underwriting services into each stage of the transaction lifecycle: sourcing and screening deals, deep underwriting during diligence, closing and loan servicing, and periodic portfolio reviews. Use consistent key metrics, such as cash flow, NOI, cap rate, vacancy, DSCR, and LTV, to compare potential acquisitions and existing assets. This allows you to make informed decisions and maximize returns across your portfolio.

Tips for Working Effectively with Underwriters

- Provide complete and accurate documentation of front rent rolls, leases, financials, and prior appraisals to accelerate the underwriting process.

- Agree on assumptions early rental growth, expense inflation, and vacancy rates, so deliverables match your investment strategy.

- Request sensitivity analyses to understand downside scenarios and how much leverage you can responsibly take.

- Communicate timelines and deadlines clearly to coordinate inspections, appraisals, and legal reviews without delaying closings.

- Ensure underwriters include contingency reserves for capex, lease-up, and tenant improvements when appropriate.

Conclusion

Real estate underwriting services convert market data, underwriting expertise, and thorough due diligence into the certainty lenders and investors need to underwrite deals, evaluate risk, and pursue profitable investments. Whether you choose in-house underwriters or outsource to specialist firms, prioritize accurate underwriting, data-driven insights, and a partner with commercial real estate experience. With the right underwriting process integrated into your workflow, you can make informed investment decisions, protect capital, and maximize returns across your asset portfolio.

Request a free consultation today to underwrite your next real estate investment with accuracy and speed.

FAQ

What does a real estate underwriter do?

A real estate underwriter assesses the risk associated with a property loan or investment by carefully examining the borrower’s financial background, credit history, income stability, property appraisal, local market conditions, and the overall structure of the deal. They verify compliance with lender policies, regulatory standards, and investor guidelines while calculating key ratios such as the debt service coverage ratio and loan-to-value.

What are the four types of underwriting?

The four primary types of underwriting in real estate include residential underwriting, which focuses on single-family homes and small multifamily properties with emphasis on personal credit and income; commercial underwriting, which evaluates larger properties like offices or retail spaces based on property cash flow and debt service coverage; construction or development underwriting, which reviews project budgets, timelines, and sponsor experience for new builds.

What are red flags for underwriters?

Red flags that concern underwriters typically involve inconsistent or unverifiable income sources, declining property occupancy or cash flow, unresolved title issues or liens, environmental hazards identified in assessments, significant deferred maintenance, recent borrower credit events such as bankruptcy or foreclosure, excessive sponsor leverage, appraisals well below purchase price, or oversupply in the local market.

What are the 3 C’s of underwriting?

The three C’s of underwriting serve as foundational principles for risk evaluation. Credit examines the borrower’s credit score, payment history, and overall creditworthiness. Capacity evaluates the ability to repay through stable income, debt-to-income ratios for residential loans, or property debt service coverage for commercial deals.

Why is real estate underwriting important?

Real estate underwriting is crucial because it protects lenders and investors from financial losses by identifying potential risks early in the lending process. It ensures deals meet regulatory requirements, supports accurate pricing of loans, and provides confidence in property valuations and borrower qualifications. Without thorough underwriting, lenders face higher default rates, while borrowers benefit from fair assessments that match financing to their actual capacity.

How long does the real estate underwriting process take?

The real estate underwriting process usually takes 3 to 10 business days for residential loans, but commercial or complex deals can extend to 2-4 weeks or longer, depending on documentation completeness, property type, and market conditions. Delays often stem from missing financials, appraisal issues, or additional verification needs, so preparing complete paperwork upfront speeds it up significantly.

What qualifications are needed to become a real estate underwriter?

To become a real estate underwriter, individuals typically need a bachelor’s degree in finance, business, or accounting, along with 2-5 years of lending or real estate experience. Certifications like Certified Mortgage Underwriter (CMU) or state licensing for loan originators enhance credentials, and strong analytical skills, attention to detail, and knowledge of regulations such as Fannie Mae guidelines or Dodd-Frank are essential for success in the field.

What software is used in real estate underwriting?

Real estate underwriters commonly use software like Encompass by Ellie Mae for loan origination and automation, Argus for commercial cash flow modelling, or Black Knight’s MSP for servicing data. Excel remains a staple for custom analysis, while AI tools like those from Moody’s Analytics or CoreLogic assist with risk scoring, appraisals, and compliance checks to streamline workflows and improve accuracy.

What is the average salary of an underwriter in the US?

The average salary for an underwriter in the US varies by specialization within real estate and mortgage lending. For commercial real estate underwriters, salaries typically range from $100,000 to $130,000 annually, with higher figures in major markets. Residential mortgage underwriters earn around $80,000 to $95,000 on average, while general real estate underwriters earn between $100,000 and $110,000 based on recent data.

Is it hard to become an underwriter?

Becoming a real estate or mortgage underwriter requires dedication, but it is achievable with the right preparation. Most positions prefer a bachelor’s degree in finance, business, or a related field, along with analytical skills and attention to detail. Entry often starts in roles like loan processing or assistant positions, followed by on-the-job training and optional certifications.

Read Also: Why Numberfied’s Accounting Bookkeeping Service Saves Small Businesses Time and Money