Introduction

When you search for what is underwriting in real estate, you’re asking how lenders, underwriters, and investors evaluate risk and decide whether to approve a mortgage loan, commercial loan, or other property financing. Real estate underwriting is the process lenders use to evaluate a borrower’s creditworthiness, the property’s value, and the potential risk for the lender. Whether you are a homebuyer, developer, investor, or mortgage lender, understanding how underwriting works in real estate helps you make informed decisions, speed the mortgage approval process, and improve your chances of underwriting successfully.

Why Underwriting in Real Estate Matters

Underwriting plays a central role in real estate investing and mortgage lending. Underwriting is used to assess the risk that a borrower won’t repay the loan and to set loan terms such as loan amount, interest rate, and required documentation. For lenders, the real estate underwriting process protects capital and determines whether to approve the loan. For borrowers and investors, a clear grasp of underwriting means fewer surprises, faster mortgage approval, and better negotiation of loan terms.

Key benefits of effective underwriting

- Protects lenders by evaluating potential risk and estimating loss exposure.

- Helps borrowers understand required documentation and how creditworthiness affects loan terms.

- Enables investors to evaluate real estate investment viability by analyzing cash flow, cap rate, and market conditions.

- Improves the accuracy of loan approvals and reduces defaults by matching mortgage loan size to the ability to repay.

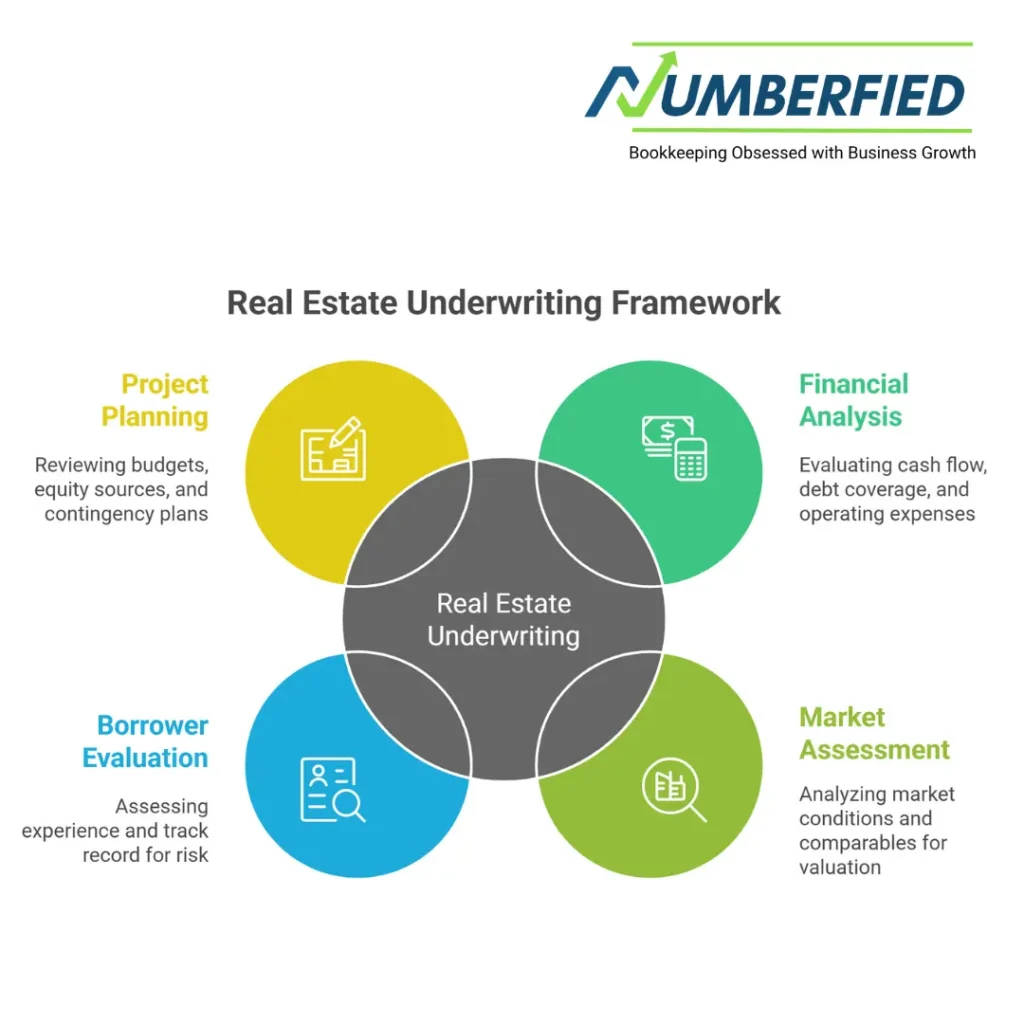

Core Components of the Real Estate Underwriting Process

The mortgage underwriting process combines borrower analysis, property appraisal, and market assessment. Underwriting is the process of gathering and verifying financial documents, assessing the property’s value, and deciding whether to approve or deny the loan. Underwriters use the three C’s: credit, capacity, and collateral, plus other factors, to evaluate creditworthiness and risk for the lender.

1. Loan application and initial review

The loan underwriting process typically begins with a mortgage application. The mortgage lender collects the loan application, credit report, tax returns, pay stubs, bank statements, employment verification, and other required documents. Automated underwriting systems may provide a preliminary decision, but a real estate underwriter conducts a full review before final loan approval.

2. Credit evaluation

Underwriters analyze the borrower’s credit score and credit history, looking for timely payments, outstanding debts, and recent delinquencies. The borrower’s debt-to-income ratio (DTI) helps determine capacity to repay and influences loan terms like the mortgage amount and interest rate. Lenders use credit reports and creditworthiness assessments to underwrite responsibly.

3. Capacity to repay

Capacity refers to the borrower’s ability to repay the loan based on income, employment stability, and existing obligations. Underwriters review tax returns, pay stubs, and business financials for investors and developers. For commercial real estate underwriting, underwriters also evaluate cash flow, rents, occupancy, and operating expenses to determine whether the property generates sufficient income to cover debt service.

4. Collateral and property appraisal

Underwriters verify the property’s value through a property appraisal and review title insurance and the property’s condition. The property appraisal, market value, and comparable sales data inform the loan-to-value (LTV) ratio. For residential mortgages, appraisals confirm the property’s market value. For commercial real estate underwriting, appraisals and income analyses (e.g., cap rate, net operating income) determine the property’s value and suitability as collateral.

5. Risk assessment and decision

After evaluating credit, capacity, and collateral, underwriters assess potential risk for the lender and decide whether to approve the loan, approve with conditions, or deny the loan. Underwriting may include requirements such as a higher down payment, mortgage insurance, or updated documentation. Underwriters recommend loan terms and interest rate adjustments to reflect assessed risk.

Residential vs. Commercial Real Estate Underwriting

While many principles overlap, residential and commercial real estate underwriting have distinct focuses and documentation requirements.

Residential underwriting

Residential mortgage underwriting typically centers on the borrower as the primary source of repayment. Lenders assess the borrower’s credit score, credit report, employment, debt-to-income ratio, and the property’s appraisal for market value. The mortgage underwriter may require title insurance, home inspection results, and clear documentation of assets for the down payment. Automated underwriting systems often handle conventional mortgage applications, but human underwriters review circumstances that require judgment.

Commercial real estate underwriting

Commercial real estate underwriting places more emphasis on the property’s cash flow and income-generation potential. Underwriters analyze rent rolls, leases, tenant quality, operating expenses, vacancy rates, cap rates, and market conditions. For commercial real estate investment, lenders often expect lower loan-to-value ratios, stricter covenants, and more detailed financial projections. The underwriter may evaluate a sponsor’s track record and the borrower’s business finances in addition to the property’s appraisal.

Step-by-Step: How the Underwriting Process Works in Real Estate

- Prequalification: The borrower provides basic income and credit information to get prequalified and estimate the potential mortgage amount and interest rate.

- Loan application: The borrower submits a formal mortgage application with full documentation, initiating the mortgage underwriting process.

- Document verification: Underwriters verify tax returns, pay stubs, bank statements, and the borrower’s credit report to confirm income and creditworthiness.

- Appraisal and title search: A property appraisal determines market value; a title search and title insurance ensure clear ownership and identify liens or encumbrances.

- Underwriting analysis: The underwriter evaluates credit score, DTI, property appraisal, loan-to-value ratio, and any unique factors like repairs or conditional approvals.

- Conditional approval: The underwriter may issue a conditional approval requiring additional items (updated bank statements, clarity on credit history, or repairs).

- Final approval and closing: Once conditions are met and the underwriter signs off, the mortgage lender issues final loan approval and schedules closing.

Common Red Flags Underwriters Watch For

Underwriters look for signs that increase potential risk for the lender. Knowing these red flags helps borrowers and investors prepare stronger applications.

Typical red flags

- Low credit score or recent credit derogatory items on the credit report.

- A high debt-to-income ratio indicates limited ability to repay the loan.

- Insufficient documentation of income, employment gaps, or unverifiable assets.

- Appraisal value below the agreed purchase price or market value concerns.

- Title issues, liens, or unresolved judgments on the property.

- Unstable cash flow for commercial properties, high vacancy or unreliable tenants.

- Recent large deposits or unverifiable funds in bank statements without explanation.

- Environmental concerns or natural disasters are affecting property value in certain markets.

The Three C’s: Credit, Capacity, Collateral

Underwriters concentrate on the three C’s when they underwrite: credit (credit score and credit history), capacity (ability to repay measured by income and DTI), and collateral (property’s value and condition). These elements help underwriters evaluate creditworthiness and estimate potential risk for the lender.

Credit

Credit score and credit report records influence interest rate, loan approval, and mortgage insurance requirements. A higher credit score often produces better loan terms and a lower mortgage interest rate.

Capacity

Capacity is measured through tax returns, pay stubs, and business financials for investors. Lenders use the debt-to-income ratio to see whether the borrower can repay the loan and cover the loan terms.

Collateral

Collateral is the property’s value verified by a property appraisal. The loan-to-value ratio and market conditions determine how much a lender will underwrite relative to the property’s value.

In-House Underwriting vs Outsourced Underwriting

Lenders can perform underwriting in-house with their teams of real estate underwriters or outsource to third-party underwriting services and automated underwriting systems. Each option has pros and cons depending on volume, complexity, and cost.

In-house underwriting

In-house underwriters give lenders more control and faster feedback for complex loans. For large commercial real estate underwriting or specialized mortgage products, an in-house underwriter’s expertise helps evaluate nuanced risks such as tenant creditworthiness, operating expenses, and market conditions.

Outsourced underwriting

Outsourced underwriting or automated underwriting systems can speed up approvals and reduce overhead for standard residential mortgages. Lenders may outsource to save costs or handle overflow, but they should monitor quality to ensure consistent risk assessment and conforming underwriting standards.

Common Questions: How Long Does Underwriting Take?

The amount of time underwriting takes varies. Much of the underwriting process can be quick with complete documentation and automated systems, sometimes in a few days. For complex commercial loans, unique property issues, or conditional requests, underwriting may take several weeks. Timely responses to additional requests, accurate documentation, and proactive appraisal scheduling shorten the mortgage underwriting process.

Tips to Smooth the Underwriting Process

Borrowers and investors can take proactive steps to improve the chances of loan approval and speed up mortgage approval:

- Provide complete documentation up front: tax returns, bank statements, pay stubs, and explanations for large deposits.

- Check your credit report and address errors to improve your credit score before applying.

- Limit new credit inquiries and avoid large purchases that affect your debt-to-income ratio.

- Secure a reliable, experienced lender or mortgage broker who communicates quickly with the underwriter.

- Obtain a thorough property appraisal and address any identified condition issues prior to closing.

- For investors, prepare detailed rent rolls, lease agreements, and financial projections to demonstrate stable cash flow.

- Be ready to provide additional documentation promptly when an underwriter requests it to avoid delays.

How Underwriting Affects Loan Terms and Interest Rate

The outcome of underwriting influences loan terms, mortgage amount, and mortgage interest rate. A stronger credit profile and lower LTV can secure a lower interest rate and more favourable loan terms. Conversely, higher perceived risk can increase the interest rate, require mortgage insurance, or lead a lender to underwrite a smaller loan amount. Underwriting weighs the borrower’s creditworthiness and the property’s value to set terms that reflect the level of risk for the lender.

Special Underwriting Considerations for Real Estate Investors and Developers

Real estate investing and commercial real estate underwriting demand deeper analyses than typical residential loans. Underwriters evaluate potential risk for lenders by examining:

- Projected cash flow and debt service coverage ratio for income-producing properties.

- Operating expenses, capital expenditures, and tenant stability.

- Market conditions and comparables to determine likely market value and cap rate.

- Borrower’s experience and track record, especially for new developments or value-add projects.

- Sources of equity, construction budgets, and contingency plans for cost overruns or natural disasters.

Underwriters may require higher reserves, lower LTV, or sponsor guarantees for commercial real estate investment loans.

What Happens If the Underwriter Denies the Loan?

If an underwriter denies the loan, the lender will explain the reasons, whether credit issues, appraisal shortfall, title problems, or insufficient documentation. Borrowers can address many denial reasons by improving credit, correcting errors on the credit report, providing additional documentation, renegotiating the purchase price after a low appraisal, or increasing the down payment. For commercial loans, investors may need to provide better pro forma projections, secure stronger tenants, or reduce exposure through lower leverage.

How to Work with Underwriters Effectively

Good communication with the underwriter and your lender helps the underwriting process move smoothly. Provide clear, organized documentation, respond quickly to requests, and be transparent about any credit history issues or past bankruptcies. For developers and commercial borrowers, prepare a comprehensive underwriting packet with rent rolls, leases, operating expense statements, and contingency plans to demonstrate the property’s ability to repay the mortgage loan.

Insurance and Title Considerations in Underwriting

Underwriting often involves coordination with title insurance and, in some cases, property insurance or insurance underwriting related to natural disasters and property risks. Title insurance protects lenders and borrowers against defects in title, while property and casualty insurance protects against damage risks that could affect the property’s value and the borrower’s ability to repay the loan.

Automated Underwriting Systems vs. Manual Review

Automated underwriting systems speed up routine mortgage approval decisions by running rules against credit reports, income, and basic documentation. However, much of the underwriting process still requires human judgment, particularly for nonstandard income, unusual property issues, or commercial real estate underwriting where cash flow and market dynamics are critical.

Conclusion

Understanding what is underwriting in real estate is empowers borrowers, investors, and lenders to make informed decisions about mortgage loans and real estate investments. Underwriting evaluates the borrower’s creditworthiness, the property’s value, and the potential risk for the lender. Whether you’re seeking a mortgage loan for a home or underwriting a commercial real estate investment, a clear underwriting process reduces surprises and aligns loan terms with risk.

Read Also: Virtual Bookkeeping Services for Small Businesses That’ll Change Your Life!

FAQs

Need Help Navigating Real Estate Underwriting?

If you’re preparing a mortgage application, pursuing a commercial real estate investment, or advising clients, expert guidance can speed underwriting and improve outcomes. Contact us for personalized guidance on the underwriting process, mortgage underwriting strategies, and how to present the strongest loan package to a lender. Our team helps borrowers and investors understand underwriting, evaluate potential risk, and secure the loan approval you need.

What does it mean to underwrite a property?

To underwrite a property means to conduct a thorough risk assessment of the real estate transaction by analyzing the borrower’s financial profile, credit history, income stability, the property’s value through appraisal, market conditions, and overall loan structure. The underwriter evaluates whether the deal meets lender guidelines and calculates key metrics like loan-to-value and debt service coverage to determine if the financing is low-risk and viable.

What are the four types of underwriting?

The four main types of underwriting in real estate include residential underwriting for single-family or small multifamily homes focused on personal borrower qualifications, commercial underwriting for larger income-producing properties emphasizing cash flow and property performance, construction underwriting for development projects assessing budgets and timelines, and bridge underwriting for short-term transitional financing with higher risk and faster processing.

Can you get denied during underwriting?

Yes, a loan can be denied during underwriting if the underwriter identifies significant risks such as low credit scores, insufficient income, appraisal issues, property defects, unverifiable documentation, or failure to meet lender guidelines. Denials often occur after initial pre-approval, which is why providing accurate and complete information upfront is critical.

Is underwriting the last step before closing?

Underwriting is typically one of the final major steps before closing, but it is not the absolute last. After underwriting approval (often with conditions), the lender issues a clear-to-close, followed by final document preparation, funding review, and the actual closing appointment where documents are signed.

What is the main purpose of underwriting?

The main purpose of underwriting is to protect the lender by carefully evaluating the risk of the loan and ensuring the borrower and property qualify under established guidelines. It confirms the transaction is financially sound, compliant with regulations, and likely to perform without default.

What is underwriting in real estate?

Underwriting in real estate is the detailed risk evaluation process where a professional reviews all aspects of a loan application, including borrower finances, credit, property value, and market factors, to decide whether to approve financing. It serves as the lender’s due diligence to minimize potential losses.

Does underwriting mean you are approved?

Underwriting does not automatically mean full approval. It means the file is under review, and approval may be granted, denied, or issued with conditions that must be satisfied before final clearance. Conditional approval is common, requiring additional documentation before moving to closing.

What is the meaning of underwrite in real estate?

To underwrite in real estate means to assume the financial risk of a loan by thoroughly analyzing and verifying the borrower’s ability to repay, the property’s value as collateral, and the overall viability of the transaction before committing funds.

How long does it take for the underwriter to make a decision?

The underwriter typically takes 3 to 10 business days to make a decision on residential loans, though commercial or complex deals can take 2 to 6 weeks. Timelines depend on workload, documentation completeness, appraisal delivery, and any additional verification needed.

What is underwriting in simple words?

Underwriting, in simple words, is the lender’s careful check to make sure both the borrower and the property are strong enough for the loan. The underwriter reviews finances, credit, and property details to decide if it’s safe to lend the money.