Introduction

Understanding underwriting real estate is essential for investors, homebuyers, mortgage brokers, lenders, and developers who want faster approvals, lower risk, and better returns. This complete guide explains what underwriting real estate is, why it matters, the step-by-step real estate underwriting process, differences between residential and commercial real estate underwriting, the key components, including the 3 C’s and underwriting risk assessment, in-house vs outsourced options, common mistakes, tools and software, and practical tips to streamline approvals. By the end, you’ll know how to confidently manage underwriting and protect your investments, plus how to request a free consultation to get personalized help.

What Is Underwriting Real Estate?

Underwriting real estate is the analytical process used to evaluate the risk and viability of a property transaction before funding or acquisition. Whether you’re underwriting a home loan, a multifamily investment, or a commercial development, the goal is the same: determine whether the borrower, project, and property meet established risk and return criteria. In mortgage contexts, mortgage underwriting focuses on borrower creditworthiness and collateral value. For investors and developers, underwriting real estate centers on cash flow projections, market dynamics, and structural risks.

Why Underwriting Real Estate Matters

Underwriting real estate matters because it protects capital, improves decision-making, and reduces surprises down the road. Proper underwriting helps lenders avoid defaults, helps investors forecast returns accurately, and helps developers secure financing with realistic budgets. Effective underwriting real estate practices also accelerate approvals, enhance negotiation leverage, and increase trust between parties. Poor underwriting, by contrast, can lead to overpaying, project delays, or loan losses.

Who Uses Underwriting Real Estate?

Key stakeholders involved in underwriting real estate include:

- Investors assessing acquisition opportunities and exit strategies.

- Homebuyers and mortgage brokers securing residential financing.

- Lenders and banks perform credit and collateral analysis.

- Developers underwriting feasibility and construction loans.

- Asset managers and underwriters are performing ongoing portfolio risk assessments.

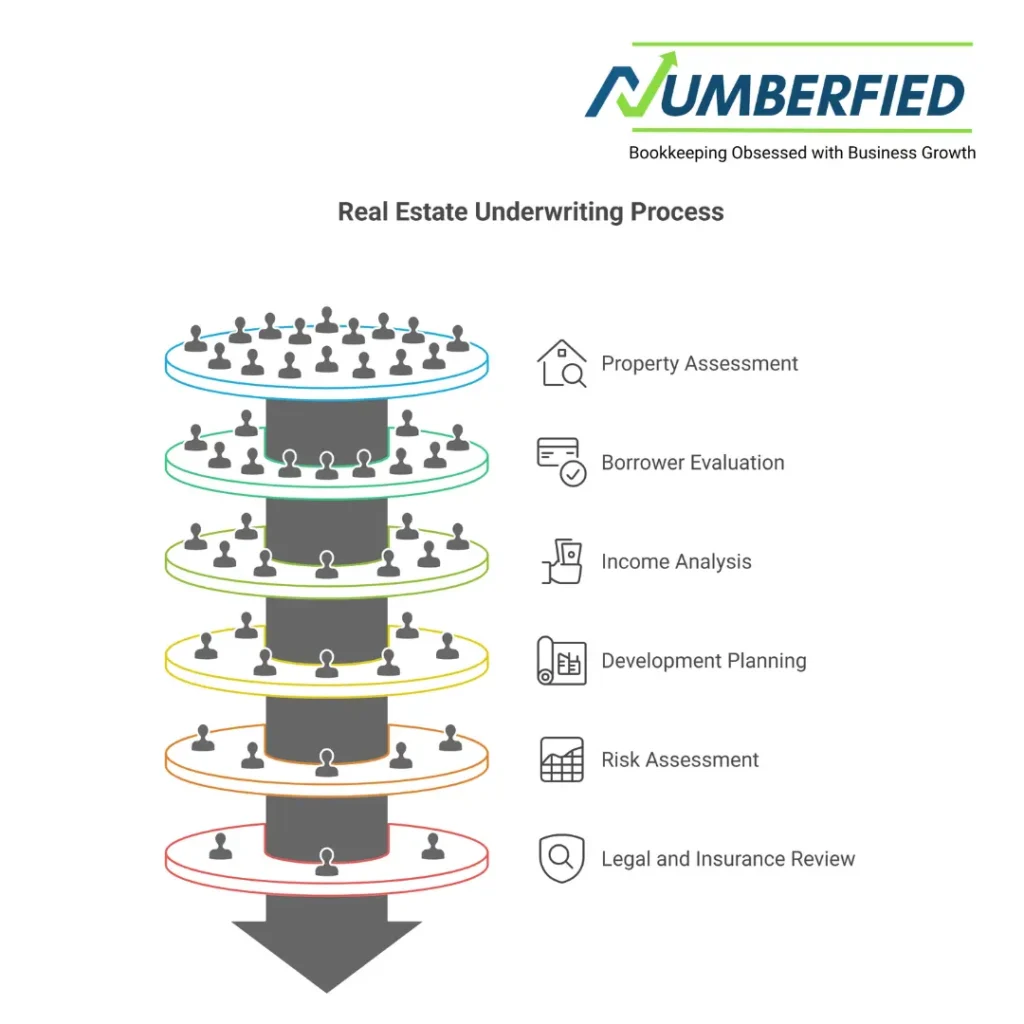

Step-by-Step Real Estate Underwriting Process

The real estate underwriting process follows structured phases to ensure all material risks and returns are analyzed. Below is a detailed step-by-step workflow you can apply across residential and commercial deals.

1. Initial Deal Screening

Begin with a high-level assessment to filter out unsuitable deals. Check basic criteria: property type, location, ask price, loan-to-value targets, and borrower credentials. This step saves time by focusing resources on viable opportunities.

2. Document Collection

Gather all necessary documentation: purchase agreements, title reports, appraisals, environmental reports, borrower financials, rent rolls, leases, construction budgets, and pro forma financials. Organized documentation makes underwriting faster and more accurate.

3. Financial Analysis and Cash Flow Modeling

Build or validate financial models showing income, operating expenses, debt service, and net operating income (NOI). For investments, calculate cap rates, internal rate of return (IRR), and debt service coverage ratio (DSCR). This stage is central to underwriting real estate because it quantifies expected returns and repayment capacity.

4. Property and Market Due Diligence

Analyze comparable sales, rental market trends, vacancy rates, and local economic indicators. Conduct site inspections and verify zoning, permits, and property condition. Commercial real estate underwriting often requires deeper market analysis and tenant risk evaluation.

5. Credit and Borrower Assessment

Evaluate the borrower or sponsor’s credit history, liquidity, experience, and track record. For mortgage underwriting, scrutinize credit scores, income documentation, and employment history. For developers, review past projects and development capabilities.

6. Risk Assessment and Mitigation

Identify potential risks: construction delays, tenant defaults, environmental issues, and propose mitigation: reserves, guarantees, higher interest rates, or lower loan-to-value ratios. Underwriting risk assessment must be explicit and tied to pricing and covenants.

7. Valuation and Appraisal

Confirm property value with an independent appraisal or valuation model. Ensure the appraisal methodology aligns with the property type and local market. Accurate valuation underpins appropriate loan sizing and investment decisions.

8. Legal and Title Review

Examine title reports, survey issues, easements, liens, and contract contingencies. Legal clarity reduces the chance of surprise claims that can derail a transaction.

9. Credit Decision and Document Preparation

After analysis, underwriters make a credit decision to approve, conditionally approve, or decline, and prepare loan documents and closing checklists. Conditional approvals outline requirements to be satisfied before funding.

10. Post-Closing Monitoring

For loans and investments, underwriting real estate continues after closing with covenants, reporting requirements, and periodic valuations. Ongoing monitoring catches deterioration early and preserves asset value.

Residential vs Commercial Underwriting Real Estate: Key Differences

While the core principles of underwriting real estate are consistent, residential and commercial underwriting differ in scope, metrics, and focus.

Residential Underwriting

Residential underwriting, often handled through mortgage underwriting, emphasizes borrower credit profiles, income documentation, employment stability, and property condition. Tools like automated underwriting systems (AUS) speed approvals for conforming loans. Lenders typically rely on standardized ratios such as debt-to-income (DTI) and loan-to-value (LTV). The process is more borrower-centric.

Commercial Underwriting

Commercial real estate underwriting centers on property cash flows, lease structures, tenant creditworthiness, and market dynamics. Metrics include NOI, DSCR, vacancy assumptions, and capitalization rates. Underwriters assess sponsor experience, capital stacks, and redevelopment risk. Commercial deals often require deeper due diligence, customized models, and longer timelines.

Key Components: The 3 C’s and Red Flags

Effective underwriting of real estate consistently evaluates the 3 C’s: Capacity, Collateral, and Character, plus other factors specific to property and market.

Capacity

Capacity measures the borrower’s ability to repay. For residential loans, verify income and employment. For commercial deals, assess project cash flow and DSCR. Capacity analysis should include stress tests for interest rate changes, higher vacancies, or cost overruns.

Collateral

Collateral is the property securing the loan. Appraisals, condition reports, and market comparisons determine the property’s value. Higher LTV ratios increase risk; conservative underwriting reduces LTV to safeguard lenders and investors.

Character

Character evaluates the borrower’s integrity, track record, and experience. For developers and sponsors, examine previous projects, defaults, or litigation. Reliable sponsors are often decisive in approval.

Other Key Factors

Include liquidity and reserves, loan structure and covenants, market trends, environmental and legal issues, and underwriting risk assessment covering tail risks. Red flags to watch for: unexplained income sources, poor maintenance, high vacancy history, aggressive pro formas, environmental concerns, title defects, and thin sponsor equity.

In-House vs Outsourced Underwriting: Pros and Cons

Organizations must decide whether to perform underwriting in-house or outsource it to specialized firms. Both approaches have trade-offs.

In-House Underwriting

Pros: Direct control over standards, faster feedback loops, institutional knowledge retention, and closer alignment with business strategy. Cons: Higher fixed costs, need for experienced staff, and potential capacity constraints during deal surges.

Outsourced Underwriting

Pros: Scalability, access to specialized expertise (especially for commercial real estate underwriting), lower overhead, and rapid ramp-up for peak volume. Cons: Less direct control, potential communication gaps, and the need for robust vendor management to ensure consistent quality.

Many firms adopt a hybrid approach: in-house underwriting for core deals and outsourced support for complex or overflow transactions.

Common Underwriting Real Estate Mistakes and How to Avoid Them

Avoiding common mistakes improves approval rates and reduces losses. Common pitfalls include:

- Relying on optimistic pro formas without sensitivity analysis. Fix: Run downside scenarios and stress tests.

- Skipping thorough title or environmental reviews. Fix: Require full due diligence before approval.

- Underestimating operating expenses or future capex. Fix: Use conservative expense assumptions and require reserves.

- Overvaluing rent growth or occupancy improvements. Fix: Benchmark against market comps and historical data.

- Poor documentation or missing borrower verifications. Fix: Implement strict document checklists and automated validation tools.

Tips for Smooth Approvals

Follow these practical steps to speed approvals and improve outcomes:

- Prepare complete documentation upfront: tax returns, bank statements, appraisals, and contracts.

- Use conservative assumptions in cash flow models and provide sensitivity analyses.

- Clarify borrower experience and provide references or case studies for sponsors.

- Address potential red flags, proactively resolve title issues, provide environmental assessments, and demonstrate contingency plans for construction projects.

- Communicate openly with underwriters and respond promptly to information requests.

- Consider pre-approval or bridge facilities for time-sensitive transactions.

Tools and Software for Underwriting Real Estate

Modern underwriting relies on software that accelerates analysis, standardizes workflows, and improves accuracy. Key tool categories include:

- Loan Origination Systems (LOS) and automated underwriting systems for mortgage underwriting.

- Financial modeling software and Excel templates tailored to commercial real estate underwriting.

- Portfolio management platforms for asset monitoring and ongoing underwriting risk assessment.

- Data and analytics services for comps, market trends, and property-level insights.

- Document management and e-closing platforms to streamline documentation and compliance.

Popular tools include ARGUS for commercial cash flow modeling, Moody’s RiskAnalyst and similar analytics tools for credit risk, various LOS vendors for mortgages, and specialized due diligence platforms for title and environmental data. Choose tools that integrate with your workflows and scale with deal volume.

Underwriting Real Estate Checklist

Use this concise checklist to ensure nothing is missed during underwriting:

- Complete purchase agreement and governing documents.

- Independent appraisal and property inspection.

- Title report and survey review.

- Environmental site assessment (as needed).

- Borrower credit report, tax returns, bank statements, and organizational documents.

- Detailed operating statements, rent rolls, and lease abstracts for income properties.

- Construction budgets, timelines, and contractor qualifications for development loans.

- Stress testing and sensitivity analysis for cash flows.

- Legal and insurance reviews.

- Final lending covenants and reserve requirements documented.

How to Improve Your Underwriting Outcomes

Continuous improvement in underwriting real estate comes from process discipline, better data, and clearer communication:

- Standardize underwriting criteria and templates to minimize subjective decisions.

- Invest in training for underwriters to interpret specialized financial models and legal documents.

- Use data analytics to spot market shifts early and update underwriting assumptions accordingly.

- Maintain an issues log and lessons-learned repository to avoid repeated mistakes.

- Engage external experts for niche asset classes or complex environmental issues.

The Role of Underwriting Risk Assessment

Underwriting risk assessment is the formal evaluation of potential losses and the probability they will occur. It integrates scenario analysis, sensitivity testing, and qualitative judgments about market and sponsor risk. A robust underwriting risk assessment links identified risks to pricing, covenants, and reserve requirements. For lenders, this assessment often translates to risk-based pricing; for investors, it informs acquisition discounts and exit strategies.

When to Consult an Underwriting Expert

Engage an underwriting expert if you encounter complex financing structures, unusual property types, cross-border transactions, or if your internal team lacks experience with a particular asset class. Experts can fast-track approvals, identify hidden risks, and provide independent validation of assumptions, particularly valuable for high-stakes investments and development projects.

Conclusion and Next Steps

Underwriting real estate is the backbone of prudent property investing and lending. Whether you’re a homebuyer seeking mortgage approval, an investor evaluating acquisitions, a mortgage broker navigating documentation, a lender protecting capital, or a developer proving feasibility, following a disciplined underwriting process reduces risk and improves outcomes. Prioritize accurate documentation, conservative assumptions, and thorough underwriting risk assessment. Use the right tools and consider in-house vs outsourced models based on volume and expertise.

Ready to make your next real estate decision with confidence? Request a free consultation with our underwriting experts to review your deal, refine your financial model, and get personalized guidance to speed approvals and reduce risk.

Request a Free Consultation: Contact us today to schedule a no-obligation review of your underwriting real estate needs.

FAQ

What are the 4 types of underwriting?

The four main types of underwriting in real estate are residential underwriting (for homes and small multifamily properties), commercial underwriting (for income-producing properties like offices or retail), construction underwriting (for new builds or renovations), and bridge/short-term underwriting (for transitional or fix-and-flip loans). Each type focuses on different risk factors, borrower profiles, and property characteristics.

What does it mean to underwrite real estate?

To underwrite real estate means to thoroughly evaluate the risk of a loan or investment by analyzing the borrower’s credit, income, assets, the property’s value, market conditions, and overall deal structure. The underwriter determines if the financing is safe and compliant, deciding whether to approve, condition, or deny the loan based on risk assessment.

Do underwriters get paid a lot?

Yes, underwriters in real estate and mortgage lending are well compensated. In the US in 2026, residential underwriters average $80,000–$110,000 per year, while commercial and senior underwriters often earn $110,000–$160,000+ annually, plus bonuses. Pay is higher in major markets or with specialized expertise.

Can you get denied during underwriting?

Yes, you can be denied during underwriting even after pre-approval. Common reasons include low appraisal, insufficient income, high debt-to-income ratio, credit issues, unverifiable documentation, property defects, or failure to meet lender guidelines. Underwriting is the final risk review before closing.

Has been rejected at the underwriting stage?

Yes, many loans are rejected at the underwriting stage after initial pre-approval. Typical causes are appraisal coming in low, borrower debt levels too high, employment or income changes, undisclosed liabilities, or property condition issues. Providing complete, accurate documentation upfront reduces this risk significantly.

What are the common red flags for underwriters?

Common red flags include inconsistent income or employment gaps, large unexplained deposits, high debt-to-income ratios, recent credit events (late payments, collections), low credit scores, appraisal significantly below purchase price, title issues or liens, environmental concerns, or declining property cash flow/occupancy.

What makes an underwriter say no?

An underwriter says no when the risk is too high, such as insufficient income to cover payments, poor credit history, low property appraisal, excessive debt, unverifiable employment, title problems, environmental hazards, or non-compliance with lender or regulatory guidelines. The decision protects the lender from potential default.

What should you not do during underwriting?

During underwriting, do not open new credit accounts, make large purchases, change jobs, deposit large unexplained funds, or miss payments. Avoid co-signing loans or taking on new debt, as these actions can raise red flags, increase your debt-to-income ratio, or lower your credit score, potentially leading to denial.

Can I get a $50,000 loan with a 700 credit score?

Yes, you can likely get a $50,000 loan with a 700 credit score, as it is considered good credit. Approval depends on income, debt-to-income ratio, down payment, employment stability, and property appraisal. A 700 score qualifies for most conventional, FHA, and VA loans, though rates may be slightly higher than with scores of 740+ or higher.

What do underwriters look for in final approval?

In final approval, underwriters verify all documentation, confirm stable income and employment, check credit for no new issues, ensure the appraisal meets or exceeds the loan amount, clear title and liens, and validate debt-to-income and loan-to-value ratios. They also confirm compliance with lender and regulatory guidelines before issuing a clear-to-close.

Read Also: 7 Insider Tips to Simplify Your Finances with QuickBooks Bookkeeping Services for Small Businesses