Introduction

Have you ever stared at an accounting invoice and felt a bit stunned? We get it- at Numberfied, we hear that reaction all the time. The real question on your mind is “Why do accountants charge so much?” Let’s unpack the reasons together and show how accounting firm CFO services turn those dollars into real momentum for your business. You’ll get useful insights and a straightforward way to connect with us. Good financial management keeps your business compliant, profitable, and prepared for new opportunities. Our pricing is based on proven experience and real results. At Numberfied, we’re committed to delivering lasting value and clear guidance at every stage.

Key Takeaways

- Accountants bring years of training and certifications to every engagement.

- Ever-changing rules demand constant attention to detail.

- Accounting firm CFO services give you strategic direction that fuels growth.

- Tailored plans fit your exact operations and goals.

- Partner with Numberfied to free up your team and cut risks.

The Expertise Behind Accounting Fees

Accountants don’t just crunch numbers- they solve problems. This section digs into the skills that justify the price tag.

Years of Education and Certification

Most accountants hold finance degrees and pass the CPA exam, a multi-part test that demands months of study. They renew licenses every year with required courses. That foundation lets accounting firm CFO services deliver advice you can trust.

Staying sharp on new standards means clients avoid costly missteps. The time invested up front protects your bottom line later.

Specialized Knowledge in Multiple Areas

From payroll taxes to merger analysis, accountants cover a wide range. They translate raw data into decisions that matter. Growing companies lean on accounting firm CFO services for cash-flow forecasts and capital planning.

Broad capabilities require ongoing learning. Firms pay to keep top talent, and that shows in the results.

Risk Management and Liability

When an accountant signs off on a return or forecast, they stand behind it. Mistakes can trigger audits or lost funding. Professional liability insurance covers those risks- and adds to overhead.

Accounting firm CFO services include double-checks and contingency plans so you sleep easier.

Time-Intensive Processes in Accounting

Accurate work takes hours, plain and simple. Here’s where the clock runs.

Detailed Record-Keeping and Reconciliation

Every receipt, invoice, and bank entry is carefully reviewed and matched. Finding a $500 error today can prevent a $50,000 problem later. Our CFO accounting services streamline routine tasks while ensuring every detail is double-checked.

Compliance with Evolving Regulations

IRS rules, state filings, and GAAP updates land on desks weekly. Accountants track each change and apply it to your books. Skip a step, and penalties follow.

Our accounting firm CFO services keep you current without pulling your focus from daily operations.

Reporting and Analysis Preparation

Quarterly reviews, board packages, and lender reports don’t write themselves. Accountants build the story behind the numbers. Accounting firm CFO services add forward-looking models so you see the road ahead.

The Value of Strategic Financial Guidance

Basic compliance is table stakes. Real impact comes from direction.

Forecasting and Budgeting Support

Accountants map revenue cycles and expense trends to build realistic budgets. Adjust on the fly when sales shift. Accounting firm CFO services run “what-if” scenarios so you’re never caught off guard.

Investment and Growth Recommendations

Considering a new location or product line? Accountants stress-test the idea with ROI projections. Accounting firm CFO services align the numbers with your vision.

Cost-Saving Opportunities Identification

A fresh set of eyes spots duplicate subscriptions or tax credits you missed. Those recoveries often cover the service fee. Numberfied’s accounting firm CFO services hunt for every dollar.

Technology and Tools in Modern Accounting

Software isn’t cheap, but it’s essential.

Advanced Software Subscriptions

Cloud platforms, AI reconciliation, and secure portals require monthly licenses. The speed and accuracy justify the spend. Accounting firm CFO services tap these tools to give you live dashboards.

Data Security Measures

Encryption, two-factor login, and regular audits protect your files. Compliance with SOC 2 standards isn’t optional. Accounting firm CFO services handle the heavy lifting on security.

Training on New Technologies

Teams attend webinars and certifications to master the latest features. That knowledge translates into cleaner books for you.

Customization for Unique Business Needs

One-size-fits-all doesn’t exist in accounting.

Tailored Service Packages

We start with a discovery call to map your pain points- then build the exact scope. Accounting firm CFO services scale from monthly close support to full capital-raise prep.

Industry-Specific Expertise

Restaurants track tip credits; manufacturers manage inventory turns. Specialists speak your language. Our CFO services match your sector.

Scalability as Your Business Grows

Add locations or product lines- we adjust the plan. No need to hire a new controller every time revenue doubles.

Comparing In-House and Outsourced Options

Do the math before you post a job listing.

Costs of Hiring Full-Time Staff

Salary, 401(k) match, payroll taxes, and office space add up fast. One person rarely covers strategy, compliance, and daily entries.

Accounting firm CFO services give you an entire bench without the fixed overhead.

Flexibility and Expertise on Demand

Need a valuation expert for one week? We bring them in. Seasonal spikes get handled without permanent headcount.

Focus on Core Business Activities

Let your sales team sell and your ops team deliver. Accounting firm services keep the books humming in the background.

How Numberfied Delivers Affordable Excellence

We built Numberfied to remove the sticker shock while keeping the quality.

Transparent Pricing Models

You see the scope and cost before we start- no surprise invoices. Our services quote includes every deliverable.

Dedicated Support Teams

Your lead accountant and CFO advisor stay consistent quarter after quarter. They learn your quirks and goals.

Proven Results for Diverse Clients

From e-commerce startups to regional contractors, our clients report clearer forecasts and smoother audits. CFO services move the needle.

Conclusion

Accountants charge for expertise, compliance rigor, and strategic horsepower- three pillars that protect and grow your business. Accounting firm CFO services package that value into a flexible, scalable solution.

The big picture: education, regulatory demands, and custom planning all drive fees, but they also drive results. Numberfied makes the partnership simple and joyful.

Reach out today at https://numberfied.com/ to schedule a no-pressure intro call. Let our services show you what’s possible.

FAQs

1. What drives the biggest chunk of an accountant’s fee?

The largest slice usually comes from the hours spent ensuring every transaction ties out and every regulation is met. Think of it as paying for peace of mind- your books are audit-ready and your taxes are optimized. With accounting firm CFO services, those hours also include high-level strategy that directly impacts profit.

2. How are accounting firm CFO services different from hiring a regular bookkeeper?

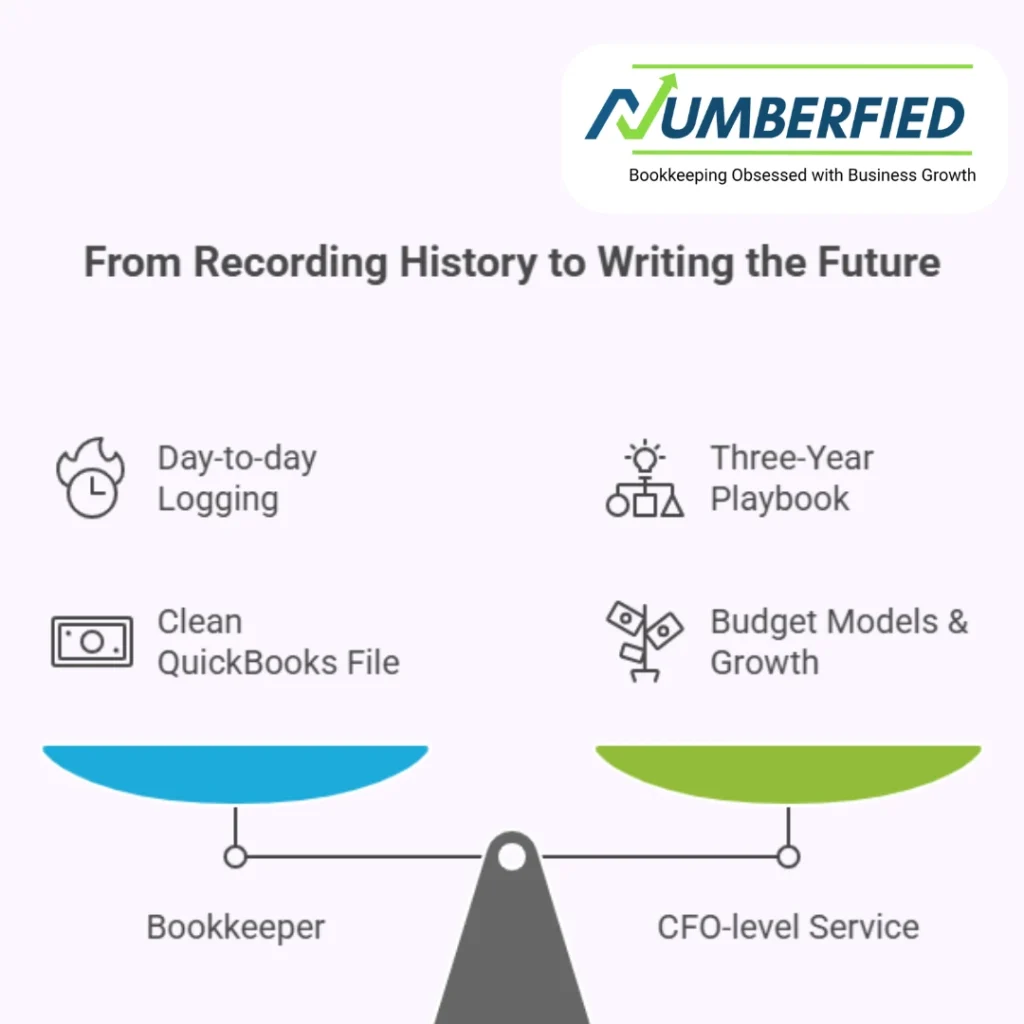

A bookkeeper logs the day-to-day; a CFO-level service builds the playbook for the next three years. You get budget models, lender packages, and growth scenarios- not just a clean QuickBooks file. It’s the difference between recording history and writing the future.

3. Can a startup really justify the cost of professional accounting?

Absolutely- especially when cash is tight. An early misfiled tax form or missed deduction can cost more than a year of service. Accounting firm CFO services often pay for themselves by catching R&D credits or structuring payroll correctly from day one.

4. Why do accountants keep taking classes long after college?

Because the tax code alone changes thousands of times a year. One overlooked rule can trigger an audit. Ongoing education means your advisor spots opportunities- like a new state incentive- before your competitor does.

5. What happens if I try to save money with a cheap provider?

You might get clean books today and a nasty IRS letter tomorrow. Or you miss a growth signal buried in the data. Solid accounting firm CFO services prevent both headaches and open doors you didn’t know existed.

6. Does all the fancy software really add value for a small business?

Yes- when it’s used right. Automated bank feeds cut manual entry errors by 90%. Real-time dashboards let you see cash runway at a glance. Accounting firm CFO services put those tools in your hands without you managing the licenses.

7. Are accounting firm CFO services only useful for big corporations?

Not at all. A $2 million retailer uses them to negotiate better vendor terms; a $20 million manufacturer uses them for acquisition due diligence. The scope scales- your business doesn’t have to.

8. What should I ask when vetting an accounting partner?

Start with: “Walk me through your last three client audits- any findings?” Then ask how often you’ll speak directly with the CFO advisor. At Numberfied, we schedule monthly review calls and send plain-English summaries so you’re never in the dark.

9. How soon do most companies notice a difference after bringing in outside help?

Many see cleaner month-end closes within 30 days. Strategic wins- like a refinanced line of credit or a new tax election- often land in the first quarter. The longer you partner, the deeper the impact.

10. Why pick Numberfied over the dozens of other firms out there?

We treat every client like our only client. You get a dedicated team that learns your story, not a revolving door of junior staff. Visit https://numberfied.com/ and book a 15-minute call- we’ll show you the difference in one conversation.

Read Also: Small Bookkeeping Services: The Key to Unlocking Your Business’s Potential!