Introduction

You close the sale, hand over the keys, and feel that rush. Then you open the glove box and see the stack of receipts staring back at you. Sound familiar? Agents everywhere fight this battle. A bookkeeper for real estate agents ends the fight. We’re the Numberfied team, and we’ve pulled hundreds of agents out of the paperwork swamp. Here’s the straight story, no fluff, just facts and steps you can use.

Key Takeaways

- Every receipt, every commission, and every fee is tracked and filed correctly.

- No more tax-season panic; everything is ready months ahead.

- Clear monthly snapshots show what’s working and what’s not.

- You sell houses; we count the money.

How the Right Bookkeeper Keeps Your Day on Track

You’re out with clients from dawn to dusk. The last thing you need is a second job balancing the books. A bookkeeper for real estate agents steps in and owns the numbers. The result is a schedule that stays wide open for showings, negotiations, and the relationships that drive your business forward.

Spotting Mistakes While They’re Still Tiny

One wrong category on a $47 lunch receipt won’t break you. A hundred of them will. Your bookkeeper scans the feed every Friday, flags the odd entry, and texts you: “Is this marketing or meals?” Fixed in thirty seconds. This weekly habit prevents small slips from turning into big headaches later. Over the course of a year, those quick catches add up to cleaner books, fewer corrections during tax season, and more money staying in your pocket where it belongs. Agents tell us the peace of mind from having a bookkeeper for real estate agents is worth the partnership.

Locking Down Every Commission

Broker split, referral fee, staging rebate, each line gets its own spot. When the check hits the bank, the bookkeeper for real estate agents already has the breakdown waiting in your inbox. You know the take-home before the deposit clears. This arrangement gets rid of the guessing that used to take up your nights. It is now possible to schedule personal expenses, marketing activities, or a few days of a vacation without having to ask yourself where the money will come from. The understanding that comes from it is also very useful when you go over brokerage agreements or talk about new splits; all the things are written down and can be referred to.

Showing Clients You Mean Business

Pull up a clean expense list on your tablet during a listing pitch. The seller sees organization, not chaos. That quiet confidence comes straight from the work your bookkeeper for real estate agents does every week. Clients pick up on the details: a polished presentation, quick answers about your marketing budget, or a clear breakdown of recent sales costs. These moments build trust fast. Over time, that trust translates into signed listings, smoother transactions, and referrals that keep your pipeline full.

Why Real Estate Needs Its Own Bookkeeper

A general bookkeeper can balance a retail shop. Real estate throws curveballs, escrow, prorated taxes, and 1099s for stagers. A bookkeeper for real estate agents knows the playbook. The specialized knowledge means fewer explanations, faster setup, and advice that actually applies to your daily work.

Mapping the Weird Stuff in Every Closing

Repair credit at closing? Title company overcharge? The bookkeeper parks each item in its own column. Nothing bleeds into the wrong deal. This precision matters when you review profit per transaction or prepare for an audit. You can pull the exact file for any property sold in the last three years without digging through folders. The system also flags patterns, like title fees creeping up, so you can negotiate better terms with your preferred providers. This is a level of detail a generic accountant might miss, but a bookkeeper for real estate agents will track.

Matching the Market’s Rhythm

March through June is nonstop; December is crickets. The bookkeeper for real estate agents ramps up reconciliations in spring and digs into year-over-year comparisons in winter. Your books never fall behind. During peak season, daily checks catch bank errors the same day. When things slow down in the off-season, we use that time to plan. We’ll look at which neighbourhoods actually made us money last year and see which lead sources are just costing us too much. That kind of planning keeps the business in good shape, even if the market gets weird.

Plotting the Next Move

Ready to add a buyer’s agent? The bookkeeper for real estate agents runs last year’s numbers, adds the new salary, and shows the break-even date. You hire with eyes open. The same process works for launching a luxury division, testing a new ad platform, or saving for a down payment on an office condo. Every big decision gets a custom forecast built on your actual data. Agents who use these projections report making bolder moves with far less risk.

The Jobs You Hand Over, and Never Miss

Stop doing these yourself. Your bookkeeper for real estate agents takes them and runs. The handoff is seamless, and the time you gain shows up immediately in your calendar.

Bucketing Every Expense

Gas, signs, MLS fees, coffee with a referral partner, each lands where it belongs. Tax time is just a download button. The bookkeeper sets up rules so recurring charges auto-categorize, but still reviews each one manually. This double-check catches subscription creep or vendor price hikes early. By year-end, you have a complete, IRS-friendly list of deductions that often surprises agents with how much they legitimately spent running their business. A good bookkeeper for real estate agents is trained to find these.

Lining Up Every Statement

Four accounts, three cards, one PayPal. The bookkeeper for real estate agents matches every line, circles anything off, and sends the all-clear. This daily reconciliation prevents overdraft fees, spots fraudulent charges within hours, and keeps your cash balance accurate to the penny. You can check your true available funds from your phone at any open house without second-guessing the number.

Handing You the Scorecard

End of the month: one page. Revenue in, expenses out, profit left. Another page lists the top five spending categories. You read it in the car between appointments. The report also includes a rolling 90-day trend line so you can see momentum building or slipping. Many agents print the single page and tape it inside their planner, a quick reference for every decision from ad budgets to personal withdrawals.

Tools That Actually Help

Old-school spreadsheets die in real estate. Cloud apps live for it. Your bookkeeper for real estate agents picks the winners and makes sure they play nice together.

Hooking Up Your CRM

Deal closes in BoomTown, commission hits QuickBooks, automatically. You sign the docs; the numbers update themselves. The integration also pulls pending contracts into a forecast tab, so you see expected income for the next 60 days. This pipeline view helps you decide whether to push for a faster closing or hold firm on price.

Killing Paper Receipts

Snap the gas receipt, toss the paper. The app reads it, the bookkeeper approves the category, and it’s done. Every image is stored with the transaction, searchable by date, vendor, or amount. When your CPA needs proof of a deduction, the bookkeeper emails the PDF in seconds. No more faded thermal paper or lost envelopes. This is the modern system a bookkeeper for real estate agents should provide.

Locking the Vault

Daily backups, two-factor everything, encrypted folders. Your client list and bank info stay safer than your lockbox codes. The bookkeeper for real estate agents runs quarterly permission audits to remove old team members and updates passwords on schedule. Compliance with SOC 2 standards means your data meets the same security level as big brokerages.

Fixing the Pain Points Every Agent Knows

Same headaches, different cities. Here’s the fix. These solutions come from real conversations with agents in every market from coast to coast.

Evening Out Lumpy Income

Fat check in May, skinny one in August. The bookkeeper for real estate agents skims 15% off the top into a holding account. Slow months feel normal. The reserve also covers quarterly estimated taxes, so you avoid underpayment penalties. Agents who follow this system report sleeping better and taking actual vacations without worrying about the mortgage.

Separating Ten Listings

Staging for Elm Street stays out of the ad budget for Pine Lane. Tags keep the dollars straight. The bookkeeper for real estate agents creates a profit-per-listing report that ranks each property by net return. You discover which price bands or property types are your sweet spot and double down on those leads.

Keeping the Team on One Page

The assistant sees the marketing budget, and the transaction coordinator sees the earnest-money log. Weekly five-minute sync, no confusion. Since the dashboard is live, everyone’s on the same page. We don’t have those fights over who spent what on signs or flyers anymore.

Getting Started and Staying Ahead

Day one to year five, here’s the roadmap. The process is straightforward, and the payoff compounds.

First Month Cleanup

Email the logins. The bookkeeper sorts the backlog, builds the chart of accounts, and hands you a fresh dashboard. Month two starts clean. Any old messes, like uncategorized transactions from two years ago, get resolved with your input in a single 30-minute call. You walk away with a system that matches how you actually work. This is the value a specialized bookkeeper for real estate agents delivers in the first 30 days.

Cadence That Fits

Text questions, get answers the same day. Monthly 15-minute call or quarterly deep dive, your choice. The bookkeeper sends a one-line agenda the day before so the conversation stays focused. Notes from each call live in a shared folder for easy reference.

Measuring the Win

Tax prep drops from 40 hours to 4. Refunds go up. Closings go up. That’s the proof. We track these metrics for every client and review them annually. If the numbers aren’t moving in the right direction, we adjust the plan together until they do.

Conclusion

A bookkeeper for real estate agents is the difference between scrambling and scaling. Hand over the receipts, keep the commissions, and watch the business run smoother than your best open house.

Numberfied is standing by. Head to https://numberfied.com/ and book a 20-minute call. We’ll map out exactly how to get your books off your mind and back in your pocket.

FAQs

1. What exactly lands on the bookkeeper’s desk every day?

Every bank feed, every credit-card charge, every commission deposit. The bookkeeper for real estate agents logs it, tags it, and files it before you finish your second coffee. By noon, the prior day is closed out. This rhythm means nothing sits for more than 24 hours, so errors surface while the transaction is still fresh in your memory. You get a quick text if anything looks off, and the fix happens before it becomes a problem.

2. My CPA says I don’t need a bookkeeper; just give him the shoebox in March. Thoughts?

Shoebox in March means April panic and missed deductions. A bookkeeper for real estate agents keeps the shoebox digital and organized 365 days a year. Your CPA gets a tidy export and sends you a bigger refund. Agents who switch to year-round bookkeeping typically find thousands in overlooked write-offs the first year alone, mileage, home office, and even the printer ink for listing flyers.

3. Will I really save enough on taxes to cover the fee?

Most agents pick up an extra $2,000–$5,000 in write-offs the first year, home office, mileage, and subscriptions they used to skip. The bookkeeper for real estate agents finds them; the fee pays itself. Beyond the refund boost, you avoid costly penalties from estimated-tax miscalculations or late filings. The math works even for part-time agents closing six deals a year.

4. What does the monthly report look like?

One sheet: money in, money out, money left. Second sheet: top five expense lines with last month’s numbers beside them. Takes 90 seconds to read, and tells you where to cut or spend. A third optional page graphs your rolling 12-month profit so you see seasonal trends at a glance. Many agents forward the report to their spouse or business coach, no extra explanation needed.

5. How do you handle a dry spell with no closings?

We look at the last three slow months, list the must-pay bills, and pull from the reserve we built in the busy months. You get a one-page survival budget that keeps the lights on until the next closing. The plan includes trigger points: at what cash balance you pause paid ads, when to tap the reserve, and how much to rebuild once deals pick up again. Agents following this system weather 60-day droughts without touching personal savings.

6. I’m a one-person shop. Can I justify the cost?

One extra closing covers the year. A bookkeeper for real estate agents frees 10–15 hours a month. That’s 10–15 more showings or follow-up calls. Math works. Solo agents also gain negotiating power with brokerages because they can show exact net-profit numbers. The confidence from clean books often leads to better splits or lower desk fees.

7. How fast can you link my CRM to the books?

Give us the API keys; we’re live in 48 hours. New pending contract hits the CRM, commission estimate hits the books. You see the projected cash flow before the inspection. The forecast updates automatically as contingencies lift or fall through. This real-time pipeline view helps you decide whether to double down on marketing or conserve cash for the next quarter.

8. IRS knocks, what do I do?

Tell your bookkeeper for real estate agents the years in question. We pull every receipt, every bank line, every 1099, organized by date and tagged. Most audits wrap in a single Zoom call because the files are ready. We also prepare a concise summary letter that your CPA can send, explaining any unusual entries like large staging reimbursements. Agents who’ve been through audits with us say the process felt routine instead of terrifying.

9. I’m eyeing a new zip code. How does bookkeeping change?

We add a “Market: NewTown” tag to every expense and revenue line. Three months in, you see the exact marketing cost per closing in the new area versus your old turf. Expand or pull back, data decides. The report also flags local differences like higher transfer taxes or mandatory seller concessions, so you price listings accurately from day one.

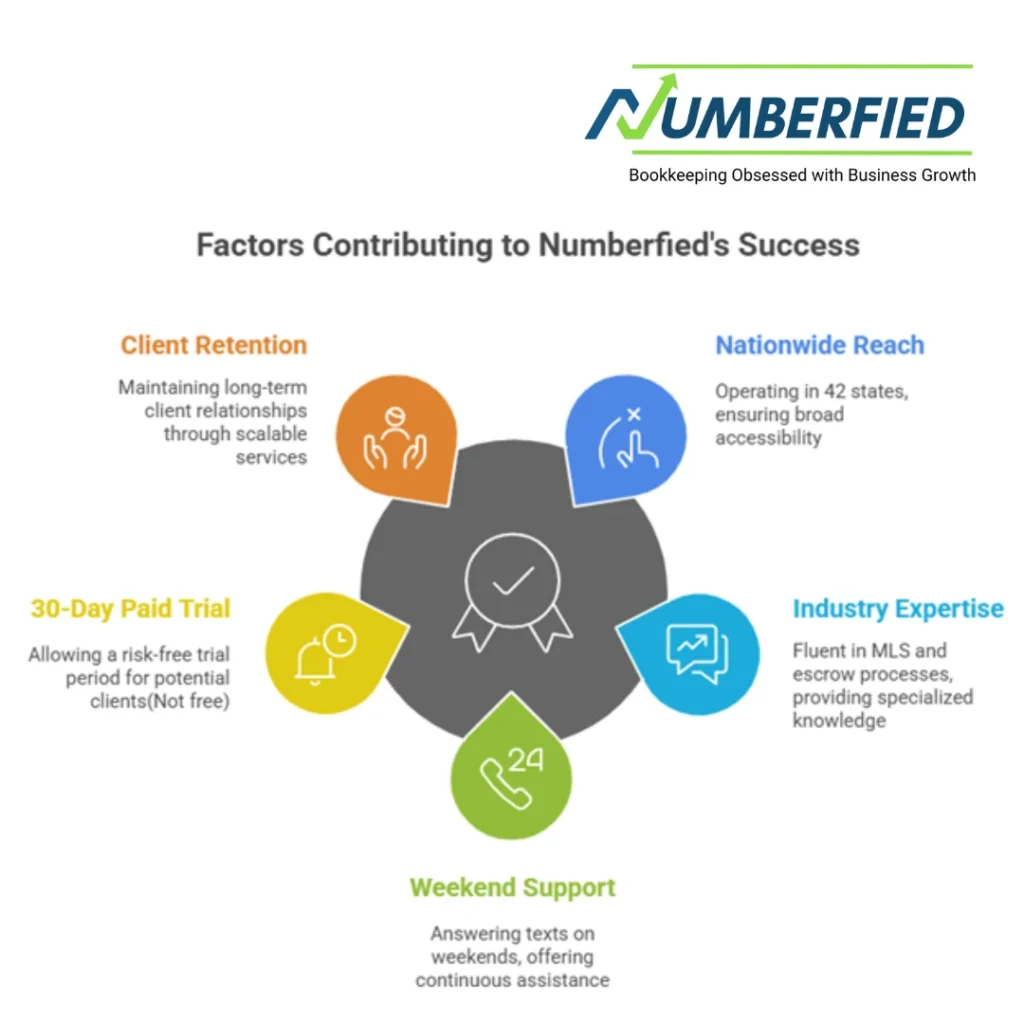

10. Why Numberfied over the dozens of other services?

We’ve booked agents in 42 states, speak MLS and escrow like natives, and answer texts on weekends. Try us for 30 days; if the books aren’t cleaner and your stress is lower, we part friends, no hard feelings. Our clients stay an average of four years because the system grows with them, from solo agent to 12-person team, without ever changing providers.