Most business owners are lying to themselves. You tell yourself that handling the books is “saving money.” You believe that keeping finance in-house, or worse, doing it yourself on weekends, is a sign of grit. It is not. It is a sign of stagnation.

If you view your financial data merely as a compliance hurdle or a history report of what you spent last month, you are already losing. Real growth requires looking forward. It requires strategy. We are talking about outsourcing accounting services for small business not to save an hour on Friday, but to find the cash bleeding out of your operations right now. This is about transforming cold data into usable capital. It is about precision. It is about stopping the bleed and funding your own expansion with money you didn’t even know you had.

Key Takeaways

- Why the “DIY” accounting mindset is the primary bottleneck for scaling companies.

- How professional forecasting identifies tax credits and cash flow gaps before they become crises.

- The difference between reactive bookkeeping and proactive financial strategy.

- How the Numberfied Ecosystem integrates technology and strategy to produce revenue.

- Why generic accounting firms fail to provide the growth intelligence entrepreneurs need.

The Shift: Moving From Operator to Owner

You started your business because you were good at something. Maybe you are a brilliant marketer. An incredible chef. A visionary architect. You probably did not start a business to categorize receipts at 11 PM on a Sunday. Yet here you are.

The trap is subtle. In the early days, you wear every hat. That makes sense. Revenue is low. Margins are tight. But as you hit the $500k, $1M, or $5M mark, that same “hustle” becomes toxic. It turns into a bottleneck.

When you function as the Operator, you are in the weeds. You look at the bank balance to make decisions. If there is cash, you spend. If there isn’t, you panic. This is reactive. It is emotional.

The Owner operates differently.

The Owner does not look at the bank balance. The Owner looks at the cash flow forecast for the next six months. The Owner understands the difference between profit and cash. They know their customer acquisition cost (CAC) down to the penny. They do not guess.

Outsourcing your financial function is the catalyst for this identity shift. It forces a separation between the person delivering the service and the entity managing the resources. It provides a mirror. When you have a dedicated team managing the numbers, you are no longer allowed to bury your head in the sand about a bad quarter. The numbers are right there. Staring at you.

This clarity is painful at first. Then it becomes profitable.

You cannot scale what you do not measure. And you cannot measure what you are too busy to track. Moving from Operator to Owner means firing yourself from the finance department so you can actually run the company.

The “Found Money” Methodology

Let’s destroy the biggest myth in our industry. The idea that accounting is an expense.

If you hire a mediocre bookkeeper, yes, it is an expense. It is a drain. But if you partner with a strategic financial team, it is an investment with a measurable return. We call this the “Found Money” effect.

Professional eyes spot things you miss. They see patterns. They see leaks.

Tax Credits and Incentives

Most small businesses overpay taxes. It is a fact. You are likely missing out on R&D credits, employment incentives, or industry-specific deductions because you are using out-of-the-box software or a generalist CPA who only looks at your file once a year. A strategic accounting partner looks at your activity in real-time. They say: “You hired three people in this zone, that qualifies for a credit.” That is immediate cash back in your pocket.

Eliminating Zombie Costs

Review your recurring expenses. I bet you will find subscriptions for software nobody uses. Retainers for agencies that aren’t performing. Insurance policies that are redundant. When we take over a set of books, we perform a forensic audit of expenses. We find the waste. Usually, we find enough wasted spend in the first 90 days to cover our fees for the entire year. That is not an exaggeration. That is the Found Money effect in action.

Pricing Strategy Optimization

Are you charging enough? Probably not. But you are scared to raise prices because you “feel” like you will lose customers. Data kills feelings. A financial strategist analyzes your margins per product or service line. We often find that 80% of your headaches come from the 20% of clients who pay you the least. We show you the math. We give you the confidence to fire bad clients and raise rates on the good ones. The result is immediate margin expansion.

Cash Flow Velocity: The Lifeblood of Scale

Profit is a theory. Cash is a fact.

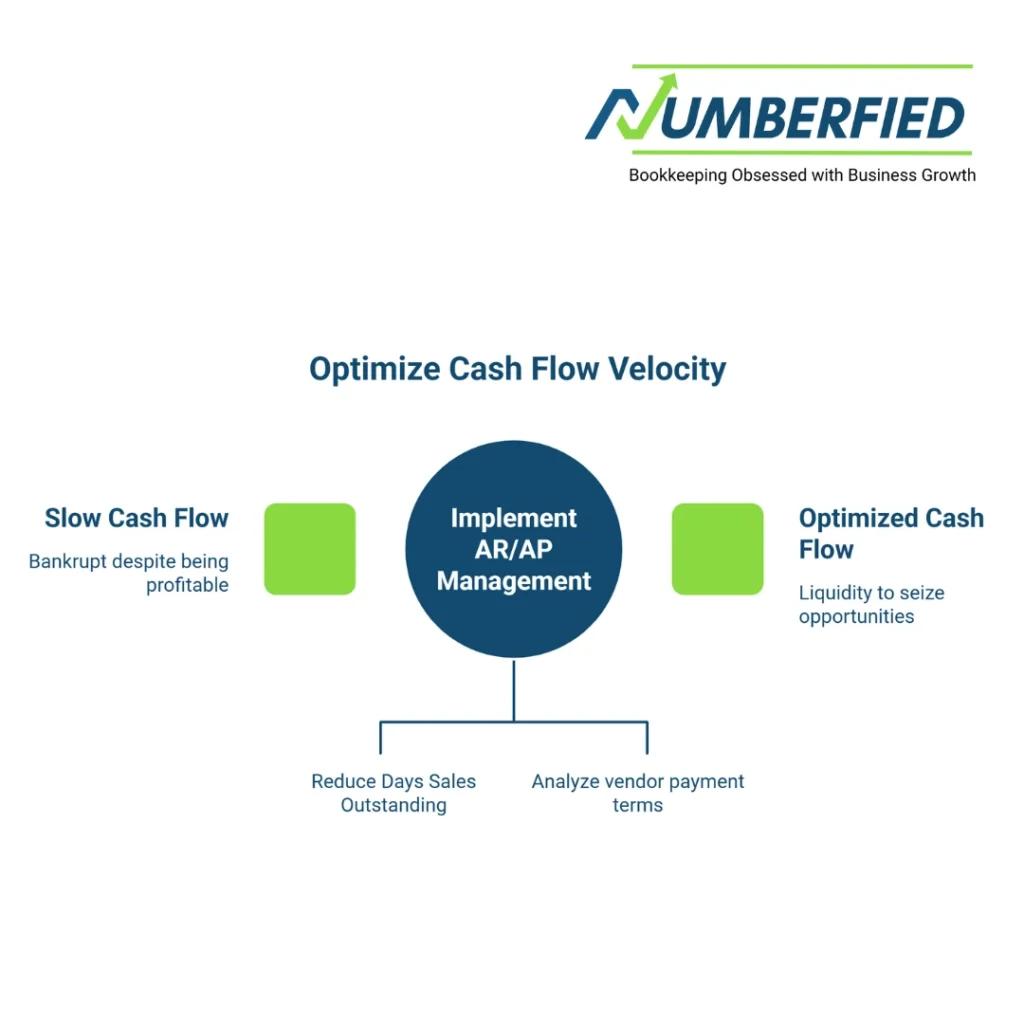

You can be profitable on paper and still go bankrupt. This happens when your “Cash Flow Velocity” is too slow. This is the speed at which money moves through your business.

If you pay your vendors in 10 days but your clients pay you in 60 days, you are acting as a bank for your customers. You are financing their growth with your stress. This is unsustainable.

A high-level outsourced accounting team implements rigorous Accounts Receivable (AR) and Accounts Payable (AP) management. This isn’t just sending invoices. It is a system.

- Tightening AR: We implement automated reminders. We restructure payment terms. We move clients to auto-pay. Reducing your Days Sales Outstanding (DSO) from 45 days to 25 days can double your available working capital without selling a single extra unit.

- Strategic AP: We don’t just pay bills when they come in. We analyze vendor terms. If a vendor offers 30 days, we take 29. We keep that cash in your interest-bearing account or working for your inventory for as long as possible.

This push-and-pull management requires daily attention. It requires software stacks that talk to each other. It requires a human who understands that cash flow is not just math. It is leverage.

When you optimize velocity, you don’t need to borrow as much. You don’t pay as much interest. You have the liquidity to seize opportunities like buying bulk inventory at a discount that your competitors miss because they are cash-poor.

Outsourcing Accounting Services for Small Business: The Strategic ROI

Let’s talk about the cost of not doing this.

Hiring a full-time CFO costs anywhere from $175,000 to $250,000 a year plus benefits. A full-time Controller is $120,000. A decent in-house bookkeeper is $60,000.

For a business doing $1M to $10M in revenue, a full-time in-house finance team is often bloated and inefficient. You pay for downtime. You pay for their vacation days. You pay for their training.

When you utilize outsourcing accounting services for small business, you are engaging in labor arbitrage and expertise aggregation. You get access to a CFO-level strategist, a Controller-level reviewer, and a detail-oriented bookkeeper for a fraction of the cost of one full-time hire.

But the ROI goes deeper than payroll savings.

The Cost of Errors

What does an IRS audit cost you? Not just in fines, but in time? In reputation? Amateur books are a liability. They are a ticking time bomb. Professional outsourcing transfers that risk. We know the code. We know the compliance. We provide a shield.

The Opportunity Cost

Every hour you spend fighting with QuickBooks is an hour you are not selling. Not leading. Not creating. If your hourly value as a CEO is $500, and you spend 10 hours a month on finance, you are “spending” $5,000 a month on bad bookkeeping. Outsourcing restores that time. It returns your mental bandwidth.

The ROI is simple: Lower overhead + Higher tax savings + Improved cash flow + Reclaimed CEO time.

The “Numberfied Ecosystem”

At Numberfied, we do not just balance the books. We build a financial infrastructure around your vision. We recognized early on that the traditional accounting model is broken. It is reactive. It looks backward.

We built an ecosystem designed for speed and scale.

The Tech Stack

We refuse to work with archaic systems. We deploy a cloud-based stack that gives you real-time visibility. Xero. QuickBooks Online. Dext. Gusto. Fathom. We integrate these tools so data flows automatically. No manual entry. No human error. You get a dashboard on your phone that tells you exactly where you stand, 24/7.

The Human Element

Technology is useless without interpretation. Our ecosystem assigns you a dedicated financial squad. You get a daily tactical contact for the weeds and a strategic partner for the vision. We speak your language. We don’t speak “GAAP” to you; we speak “Profit,” “Burn Rate,” and “Runway.”

The Growth Loop

Our process is circular.

- Clean Up: We fix the mess. We organize the chart of accounts.

- Maintain: We execute flawless weekly bookkeeping.

- Forecast: We build predictive models based on the clean data.

- Strategize: We meet with you to interpret the models and make big decisions.

This is not a vendor relationship. It is a partnership. When you plug into the Numberfied Ecosystem, you are upgrading your business’s operating system.

Differentiation: Why Most Agencies Fail You

The market is flooded with “virtual bookkeepers.” They are everywhere. They charge $300 a month. And they are dangerous.

Most agencies operate on a volume model. They hire low-skill data entry clerks and assign them 50 clients each. They don’t care about your business. They care about categorizing transactions fast enough to move to the next file. They do not ask questions. If you buy a boat and call it “Office Expense,” they will categorize it as Office Expense. Until the IRS knocks on your door.

Most agencies are reactive. You have to email them to ask for reports. You have to catch their mistakes.

Numberfied is different because we are entrepreneurs first.

I am a Serial Entrepreneur. I have built businesses. I have sold businesses. I know the terror of a low bank account and the thrill of a record month. I built Numberfied because I couldn’t find an accounting firm that understood the pace of modern business.

We don’t just record history. We help you write the future.

We challenge you. If we see your marketing spend rising but your revenue staying flat, we call you. We ask why. If we see you hoarding cash when you should be investing, we push you.

We are not here to be your friends. We are here to be your financial conscience. We are here to ensure you win.

Conclusion

The era of the “do-it-all” entrepreneur is over. The market is too competitive. The margins are too thin. To win today, you must specialize. You must focus entirely on your Zone of Genius and ruthlessly outsource everything else to experts.

Outsourcing accounting services for small business is the leverage point. It is the switch that turns the lights on in a dark room. It reveals the money you are losing, the opportunities you are missing, and the path you need to walk.

Stop treating your finances like a chore. Treat them like the fuel they are. Let Numberfied build the engine so you can drive the car.

FAQs

1. Will I lose control of my money if I outsource?

No. You actually gain control. Right now, you have the illusion of control because you hold the checkbook, but you lack data. We give you approval rights on all payments, but we handle the execution. You see everything. You touch nothing.

2. My business is unique. Can you handle my specific industry?

Business physics are universal. Revenue, expenses, margins, cash flow. While your product is unique, the math of scaling it is not. We work across industries because we focus on the fundamentals of growth finance.

3. How fast can you clean up my messy books?

It depends on the damage. Usually, we can overhaul a year’s worth of messy data in 30 days or less. We have forensic teams dedicated specifically to clean-up jobs.

4. Do I still need a CPA if I hire Numberfied?

We handle the day-to-day, the strategy, and the forecasting. For the final annual tax filing, we prepare a “tax-ready” file that makes your CPA’s life easy. We can work with your existing CPA or introduce you to our tax partners.

5. Is this expensive?

Ignorance is expensive. Bad data is expensive. Our fees are a fraction of the cost of a full-time hire and usually pay for themselves through the tax savings and waste reduction we identify in the first quarter.

Are you ready to stop guessing and start scaling? Book Your Free Growth Strategy Meeting With Numberfied Today

Also Read: Outsourcing Accounting Services for Small Business A Path to Growth