Investors do not care about your vision as much as you think they do. They care about the math. If the math does not work, the vision is hallucination. This is the brutal reality of the venture capital world. I have sat on both sides of the table. I have seen brilliant products fail to raise a single dollar because the founders could not answer a simple question about their gross margins.

They had a pitch deck full of hockey-stick graphs. They had charisma. They had a “disruptive” idea. But their backend data was a disaster.

Operational discipline signals risk management. When a VC looks at your data room, they are running a litmus test on your ability to manage capital. If your books are messy, they assume your engineering, hiring, and sales processes are also chaotic. You need a professional accounting and bookkeeping service for startups to transform raw data into the metrics that actually close deals.

Key Takeaways

- Metric Validity: Why CAC and LTV are fictional numbers without granular expense categorization.

- The Trust Factor: How clean financial data proves operational maturity to skeptical investors.

- Runway Reality: Understanding the massive difference between bank balance and true burn rate.

- Strategic Setup: How to design a Chart of Accounts that separates COGS from OpEx for accurate gross margin calculation.

- Due Diligence: Preparing your General Ledger to survive the intense scrutiny of a Series A audit.

The General Ledger Is Your Only Source of Truth

Most founders treat their accounting software as a tax compliance tool. This is a fatal mistake. Your General Ledger (GL) is not there to satisfy the IRS. It is there to model the future of your company.

When you are in the early stages, “growth at all costs” is a popular mantra. But that mantra hides inefficient spending. You might be growing revenue by 20% month-over-month, but if your cost of revenue is growing by 25%, you are scaling a loss. You are digging a hole.

The Granularity Gap

Generalist bookkeepers love generic categories. They see a credit card charge for Amazon Web Services (AWS) and throw it into “Software & Subscriptions.” They see a payment to a freelancer and book it to “Contractors.”

This destroys your unit economics.

To an investor, that AWS bill is not just “software.” It needs to be split. The portion hosting your production environment is a Cost of Goods Sold (COGS). The portion used by your developers for testing is Research and Development (R&D). The portion hosting your marketing website is Sales and Marketing (S&M).

If you lump them all together, your Gross Margin is wrong. If your Gross Margin is wrong, your entire valuation model collapses.

Investors Buy Predictability

Seed and Series A investors are looking for a machine. They want to put $1 in and get $5 out. They need proof that the machine works. Your financial statements are the blueprint of that machine.

If I ask you for your Customer Acquisition Cost (CAC) and you give me a rough estimate based on your total marketing budget divided by new users, I will pass. I need to know the CAC by channel. I need to know the payback period. I need to see that you are tracking these metrics month over month in your accounting software, not just in a spreadsheet that doesn’t reconcile with the bank.

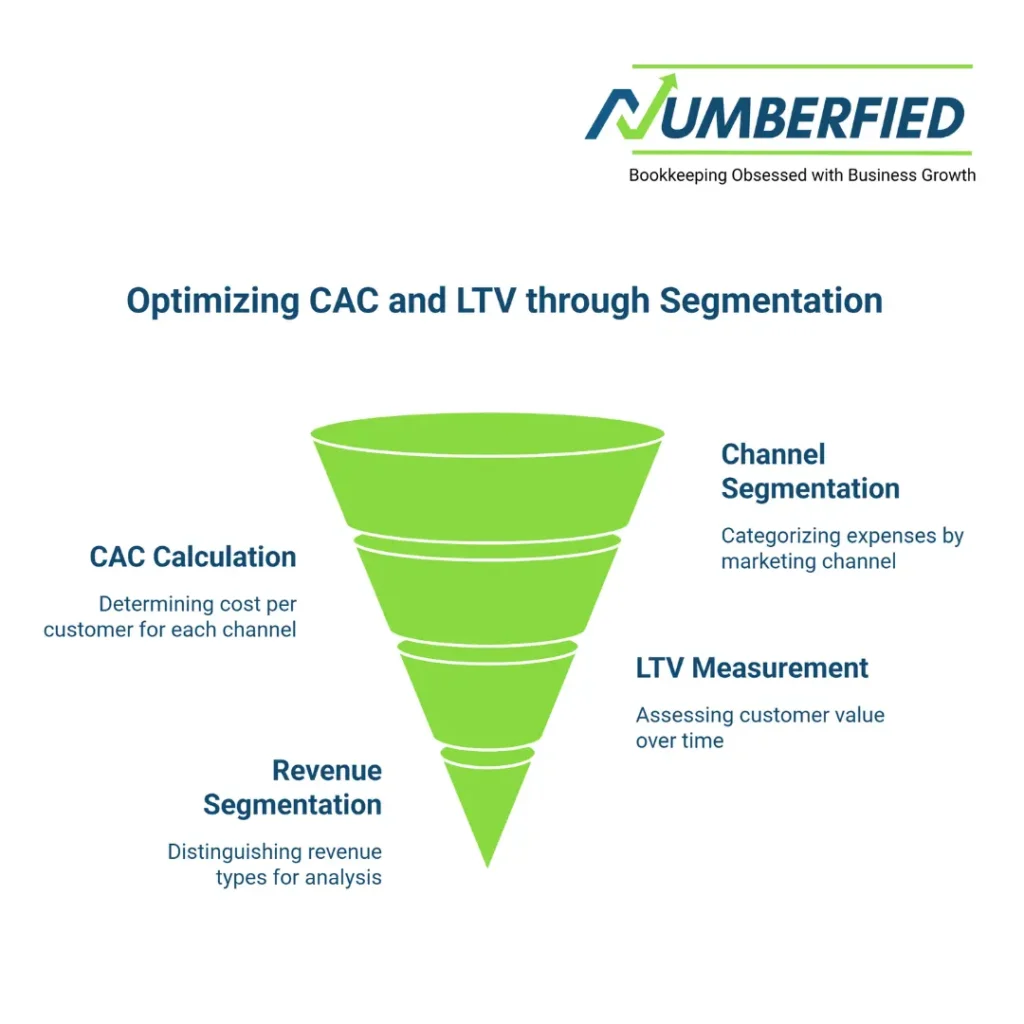

CAC and LTV Are Impossible Without Segmentation

The two most important metrics for any startup are Customer Acquisition Cost (CAC) and Lifetime Value (LTV). The ratio between these two determines if you have a viable business or just a hobby.

You cannot calculate these accurately if your bookkeeping is sloppy.

The Marketing Spend Trap

Let’s look at a common scenario. A founder runs ads on Facebook, Google, and LinkedIn. They also attend three industry conferences and sponsor a podcast.

In a messy set of books, all these expenses sit in a bucket called “Advertising.”

This provides zero insight. You might be spending $10,000 on LinkedIn and getting zero qualified leads, while your $2,000 podcast sponsorship is bringing in your best clients. If the books don’t separate these vendors and tag them correctly, you cannot calculate channel-specific CAC.

You end up scaling the wrong channel. You burn cash on LinkedIn because “everyone is doing it,” while ignoring the channel that actually yields high LTV customers.

Measuring Lifetime Value (LTV)

LTV is even harder to pin down without clean data. It requires understanding churn and expansion revenue.

If your bookkeeping doesn’t separate “New Revenue” from “Renewal Revenue” and “Upsell Revenue,” you are flying blind. You might see top-line growth and celebrate. But if that growth is entirely from new sales while 15% of your existing customer base is churning every month, you have a leaky bucket.

Investors spot this immediately. They look at the revenue lines in the P&L. If they see a single line item called “Sales,” they know you aren’t tracking retention properly.

A strategic finance approach breaks revenue down:

- Recurring Revenue (MRR/ARR): The lifeblood.

- Non-Recurring Revenue: Setup fees, one-time implementations.

- Expansion Revenue: Upgrades from existing cohorts.

This segmentation allows you to present a “Net Dollar Retention” number that is backed by hard data. That is what gets a term sheet signed.

The “Burn Rate” Illusion and Runway Reality

“We have $500,000 in the bank. Our burn is $50,000 a month. We have 10 months of runway.”

I hear this logic every week. It is almost always wrong.

Cash accounting is deceptive for startups. It only shows you what has left the building. It does not show you what you have committed to pay.

The Danger of Accruals

Your burn rate must be calculated on an accrual basis for internal planning.

Imagine you just signed a contract for a $60,000 recruiting retainer to hire engineers. You haven’t paid it yet. The invoice comes next month. If you are looking at your cash balance today, you feel rich. You might decide to buy new laptops for the team.

Next month, the invoice hits. Suddenly your burn spikes to $110,000. Your runway just got cut in half.

Prepaid Expenses and “Lumpy” Cash Flow

The reverse is also true. You might pay $120,000 upfront for an annual Salesforce contract in January. On a cash basis, your January burn looks catastrophic. It looks like you are hemorrhaging money.

Proper bookkeeping amortizes that expense over 12 months. It shows the investor that your operating burn is stable, even if your cash flow is lumpy.

Investors need to know your “Net Burn.” This is your true cash consumption adjusted for these anomalies. If you cannot produce a Burn Rate analysis that accounts for accounts payable and accrued expenses, you look amateurish. It signals that you are managing the company by looking at the bank app on your phone.

Due Diligence is Where Deals Die

You nailed the pitch. The partner likes you. They issue a term sheet. Now comes the Due Diligence phase.

This is where they send in their analysts or hire an external firm to tear your business apart. They will ask for access to your Xero or QuickBooks Online file. They will ask for your bank statements. They will ask for a transaction-level export of your expenses.

The “Red Flag” Hunt

They are not just checking for fraud. They are checking for competence.

Here is what they look for:

- Commingling: Are you paying for your personal groceries on the corporate card? Even small amounts signal a lack of judgment.

- Uncategorized Transactions: Is there a “Ask My Accountant” bucket with $50,000 in it? That basically tells the auditor, “We don’t know where this money went.”

- Inconsistent Vendor Naming: Do you have “Uber,” “Uber Trip,” and “Uber * Washington” as separate vendors? It shows a lack of attention to detail.

The narrative of the Financials

Financial statements tell a story.

A clean set of books tells this story: “We experimented in Q1. We saw the data in Q2. We cut the losers and doubled down on the winners in Q3. The efficiency metrics improved.”

Messy books tell this story: “We spent money everywhere. We hope it worked. We need more money to keep trying things.”

The second story does not get funded in this economic environment.

Implementing a Strategic Accounting and Bookkeeping Service for Startups

There comes a tipping point in every founder’s journey. It usually happens around the Seed stage or just before Series A. The DIY approach stops working. The “friend who knows numbers” is no longer enough. You need to institutionalize your financial stack.

This is where you bring in a specialized accounting and bookkeeping service for startups to overhaul your infrastructure.

Moving Beyond Data Entry

You are not hiring someone to just type data. Automation does that now. Bank feeds pull the transactions in. You are hiring someone to design the architecture of your financial data.

The service must understand the difference between SaaS accounting and e-commerce accounting. They need to know how to recognize revenue over time (ASC 606 compliance) rather than all at once. If you collect cash upfront for an annual subscription, you cannot recognize that as revenue in month one. It must be a liability (Deferred Revenue) on the balance sheet.

If your accountant books it all as revenue immediately, your P&L will show a massive spike followed by 11 months of zero revenue. This makes your growth charts look like a heart attack. A specialized startup accountant smooths this out so investors see the true growth trajectory.

The Tech Stack Integration

Modern finance is about API connections. Your bookkeeping service needs to integrate your billing platform (Stripe/Chargebee), your payroll (Gusto/Rippling), and your expense management (Brex/Ramp) into the GL.

If these systems are not talking to each other, you have data silos. The strategic partner sets up these syncs so that your financial close happens in days, not weeks. Speed is an asset. If investors ask for last month’s numbers on the 5th, and you have to wait until the 25th to give them, confidence erodes.

Designing a Chart of Accounts That Tells a Story

The Chart of Accounts (COA) is the skeleton of your business. Most founders accept the default COA provided by QuickBooks. This is a generic list designed for a coffee shop or a plumber. It is useless for a high-growth tech company.

Splitting COGS and OpEx

I cannot stress this enough: You must separate Cost of Goods Sold from Operating Expenses.

COGS includes:

- Hosting costs (AWS, Azure, Google Cloud) for the product.

- Customer support salaries.

- Third-party API fees required to deliver the service.

- Merchant processing fees.

OpEx includes:

- Sales commissions.

- Marketing spend.

- Engineering salaries (R&D).

- Rent and legal fees (G&A).

Why This Matters for Valuation

SaaS companies are valued based on a multiple of revenue, but that multiple is heavily influenced by Gross Margin.

If you bury your hosting costs in “Office Expense,” your Gross Margin looks artificially high (e.g., 95%). Investors will eventually find the error during diligence. When they move that cost to COGS, your margin might drop to 70%.

Suddenly, your valuation drops. You might lose 20% of your company’s value simply because you categorized an expense in the wrong bucket.

A customized COA prevents this. It aligns your internal reporting with the “Standard SaaS P&L” that investors expect to see. It speaks their language before they even ask the question.

Conclusion

Founders love to talk about product-market fit. But there is another fit that matters just as much: product-finance fit.

You can have the best software in the world. But if you cannot prove the unit economics work, you do not have a business. You have a project. Investors are in the business of scaling businesses.

Clean bookkeeping is not about satisfying the tax man. It is about satisfying the skepticism of the market. It is about proving that you have the discipline to measure, manage, and multiply the capital you are asking for.

Do not let bad data be the reason you get a “no.” Build a financial foundation that is as robust as your code. Partner with a dedicated accounting and bookkeeping service for startups. Make your metrics your strongest pitch.

FAQs

1. Can I just use Excel for my startup bookkeeping?

No. Excel is prone to broken formulas and lacks an audit trail. Investors will not trust a spreadsheet. You need cloud-based software like Xero or QuickBooks Online.

2. When should I switch from cash to accrual accounting?

Immediately for internal reporting. You can still file taxes on a cash basis, but you need accrual accounting to understand your true burn rate and monthly recurring revenue.

3. Do investors actually look at the General Ledger?

Yes. In later-stage funding (Series A and beyond), they will perform a forensic deep dive. They will export your GL and analyze every transaction to verify your metrics.

4. What is the biggest red flag in startup books?

Commingling funds. Mixing personal and business expenses is the fastest way to kill investor trust. It suggests you don’t take your fiduciary duty seriously.

5. How often should I be closing my books?

Monthly. You need to close the books by the 10th of the following month. If you are making decisions based on data that is three months old, you are already crashing.

Is your pitch deck writing checks your books can’t cash?

Don’t wait for due diligence to find out your metrics are wrong. At Numberfied, we build financial infrastructure for high-growth startups. We turn messy data into a Series A asset.

Book Your Free Growth Strategy Call

Also Read: What’s the Bookkeeping Services for Small Business Cost? Save Big with Numberfied!