You bid the job with a healthy 20% margin. You high-fived your foreman. You felt confident. Six months later, the project is wrapped up. You run the final numbers. You made 4%. Maybe you even lost money.

Where did the cash go?

It wasn’t theft. It wasn’t a natural disaster. It was profit fade. This is the single most dangerous threat to contractors today. It is the slow, silent erosion of your gross margin over the life of a project. It happens when you manage your business by bank balance rather than by job progress. Most contractors treat accounting as a necessary evil for tax season. That is a mistake. Professional construction bookkeeping services are not about satisfying the IRS. They are about survival. They are the only warning system you have to catch bleeding margins while there is still time to apply a tourniquet.

Key Takeaways

- Define Profit Fade: Understand exactly why your estimated profit rarely matches your actual profit.

- The Power of WIP: Learn why the Work-in-Progress (WIP) schedule is the most critical document in your business.

- Warning Signs: Identify the red flags in your financial data that indicate a job is going off the rails.

- Strategic Shifts: How to move from reactive “shoebox” accounting to proactive job costing.

- The Change Order Trap: How proper bookkeeping prevents unbilled scope creep.

The Anatomy of Profit Fade: Why Estimates Fail

Profit fade is not usually caused by one catastrophic event. It is death by a thousand cuts. It happens when your estimated costs remain static, but your actual costs creep up. Slowly.

Most contractors do not see this happening until the job is 90% complete. By then, it is too late. The money is spent. The concrete is poured. You cannot go back to the client and ask for more money because you were inefficient.

The root cause is a disconnect between the field and the office. The field crew runs into an issue. They fix it. It takes four extra hours and $500 in materials. They don’t report it. They just get it done. This happens ten times a month. Suddenly, your labor budget is blown.

General accounting does not catch this. A standard Profit and Loss (P&L) statement tells you what happened last month. It is a rearview mirror. It cannot tell you that you are 40% through the budget but only 25% through the work. To stop profit fade, you need to look forward. You need to compare “percent complete” against “percent of budget spent.” If those two numbers do not align, you are fading.

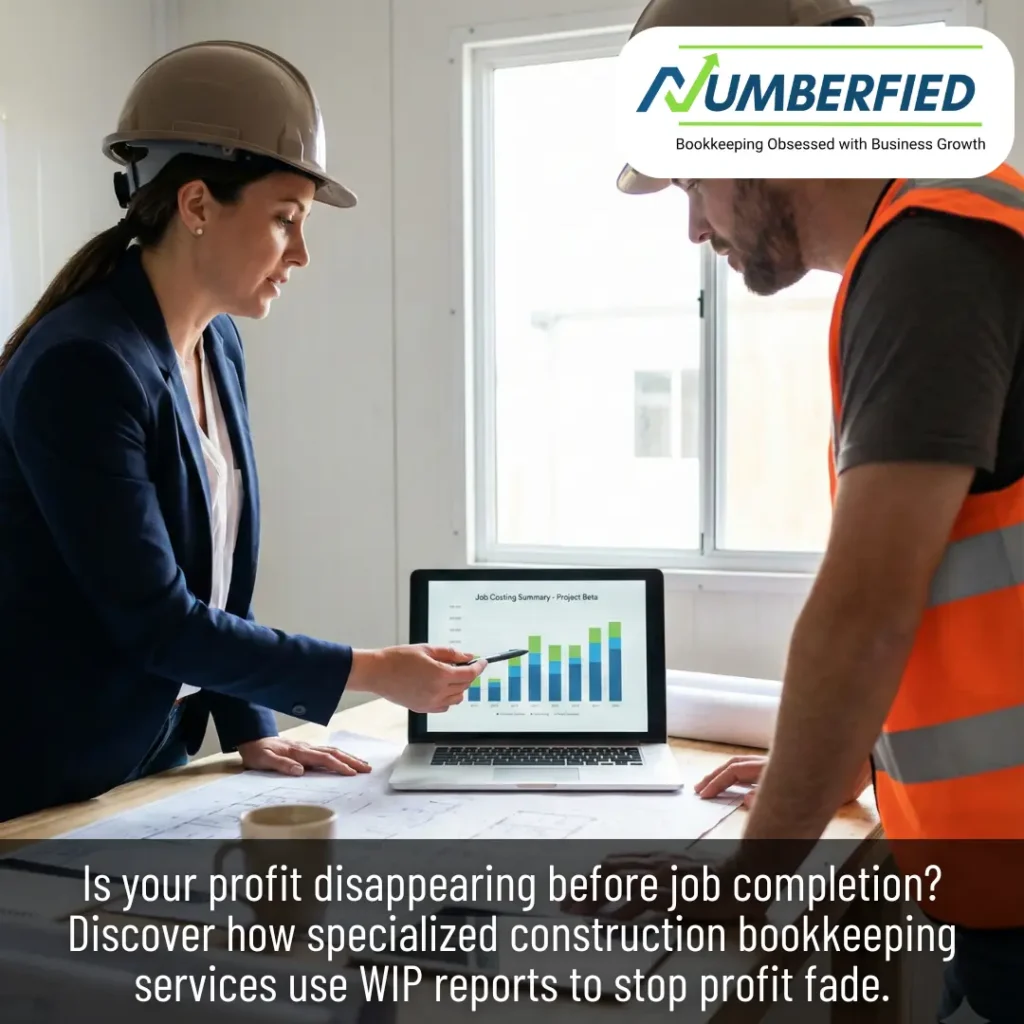

The WIP Report: Your Financial GPS

If you are running a construction company without a Work-in-Progress (WIP) report, you are flying blind. You are guessing.

A WIP report is the heartbeat of construction accounting. It tracks the financial health of every active job in real-time. It tells you if you are overbilled or underbilled.

Here is the logic. If you have billed the client for 50% of the contract value, but you have only completed 30% of the work, you are overbilled. This looks great in your bank account. You have cash. But that cash is a liability. You owe work for that money. If you spend that cash on a new truck or bonuses, you will run out of money before the job ends. This is the cash flow trap that kills contractors.

Conversely, if you have completed 60% of the work but only billed for 40%, you are underbilled. You are financing the job for the client. You are essentially a bank. This drains your liquidity and puts your company at risk.

A properly managed WIP report flags these discrepancies immediately. It forces you to ask hard questions. Why are we underbilled? Did we miss a draw request? Why are we overbilled? Are we going to have enough cash to finish? This report turns accounting data into actionable intelligence.

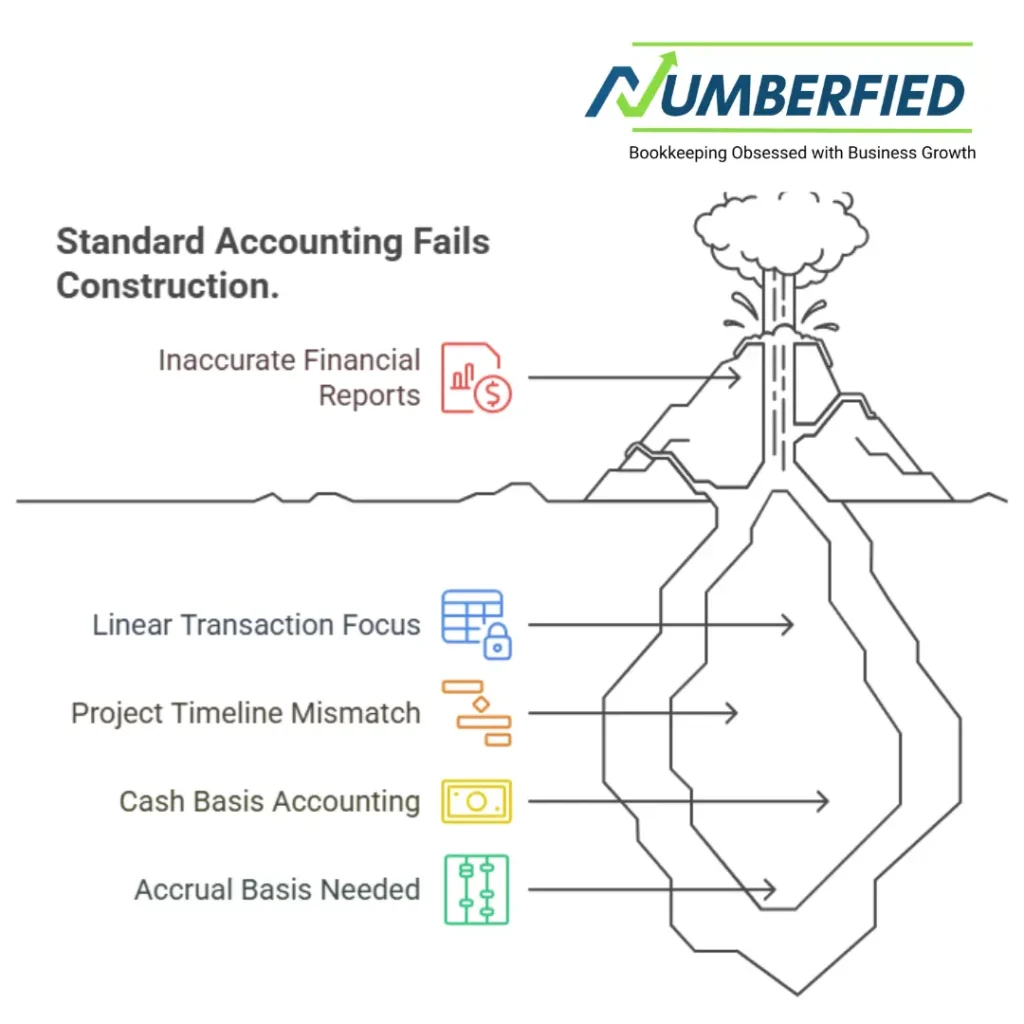

Why Standard Accounting Fails Construction

Construction is not retail. It is not consulting. It is a unique beast with specific financial requirements.

Standard accounting software is built for linear transactions. You sell a widget. You record the sale. You record the cost of the widget. The math is simple.

Construction projects span months or years. Expenses happen today. Revenue happens next month. Retainage is held back for a year. If you use a generic bookkeeper or a standard CPA who treats you like a coffee shop, your numbers will be wrong.

They will likely use “Cash Basis” accounting. This records revenue when cash hits the bank and expenses when checks are written. In construction, this is useless for management. You might buy $50,000 of lumber in December for a job starting in January. On a cash basis, December looks like a massive loss. January looks like a massive profit. Neither is true.

You must use “Accrual Basis” accounting modified for construction. This matches revenue to the expenses incurred to earn that revenue. It aligns the financial reality with the physical reality of the job site. Without this alignment, you cannot calculate true gross margin. You cannot spot profit fade because your numbers are fluctuating wildly based on when a check clears, not based on how the job is performing.

The Strategic Role of Construction Bookkeeping Services

This is where the distinction between a data entry clerk and a strategic partner becomes obvious. Data entry is typing receipts into QuickBooks. Strategy is interpreting what those receipts mean for the future of the company.

Specialized construction bookkeeping services function as a warning system. They do not just categorize expenses. They allocate costs to specific cost codes. They track “committed costs”, money you have promised to pay subcontractors via purchase orders, even if the bill hasn’t arrived yet.

If you don’t track committed costs, you think you have more budget remaining than you actually do. You might look at a line item for “Framing” and see $10,000 remaining. You think you are safe. But if you have a signed purchase order out for $9,000 that hasn’t been invoiced, you actually only have $1,000 remaining. A generalist bookkeeper won’t track that. They wait for the bill. A construction specialist tracks the commitment.

This level of detail allows you to project the “Estimated Cost to Complete.” This is the most important number in your business. It answers the question: “Based on what we know today, how much more money will it cost to finish this job?” If that number plus your “Cost to Date” is higher than your original estimate, you have profit fade. You need to know that now. Not in three months.

The Change Order Black Hole

Uncaptured change orders are the fastest way to destroy a healthy margin.

It happens every day. The client asks for a different tile. The architect moves a wall. The site conditions are different than the plan. Your crew adapts. They do the work. They want to keep the job moving. They don’t want to stop and do paperwork.

But if that extra work is not documented, priced, and signed by the client, you are doing it for free.

Effective bookkeeping creates a rigid structure for change management. It links the field to the finance. When a cost comes in that does not match a budget line item, it raises a flag. It forces the question: “Is this in the scope?”

If the answer is no, a change order must be created immediately. The budget must be adjusted. The contract value must be increased.

Many contractors are afraid to send change orders. They fear conflict. But clients usually understand that scope changes cost money. What they hate is a surprise bill at the end of the job. Real-time cost tracking allows you to present change orders while the work is happening. “Mr. Client, we can move that wall, but it will add $2,000 and two days. Please sign here.”

That is professional. Doing the work and hoping to get paid later is amateur. It leads to disputes. It leads to profit fade.

Implementation: Moving From Reactive to Proactive

You are tired of the surprises. You want to stop the bleeding. How do you shift your culture?

First, you must stop treating the office and the field as enemies. They are partners. The field provides the data (hours, receipts, progress). The office provides the intelligence (budget status, WIP reports).

You need a chart of accounts that mirrors your estimating structure. If you bid by CSI code, you must bookkeep by CSI code. If your estimate has a line for “Drywall Labor,” your accounting software must have a bucket for “Drywall Labor.” If you lump everything into “Cost of Goods Sold,” you have zero visibility.

Next, you need to digitize time tracking and receipt capture. Paper is slow. Paper gets lost in the dash of a truck. Use mobile apps that allow foremen to code time to specific jobs and cost codes instantly.

Finally, implement a monthly WIP meeting. Sit down with your project managers and your bookkeeper. Review every active job. Look at the percent complete. Look at the billed amount. Look at the costs. Challenge the numbers. If a PM says a job is 80% done but they have only spent 40% of the labor budget, they are probably wrong. Or they are a genius. Either way, you need to verify it.

This rhythm creates accountability. It makes everyone in the company aware that margins matter. It shifts the focus from “getting it done” to “getting it done profitably.”

Conclusion

Profit is not what you estimate. Profit is what you keep. The gap between those two numbers is where businesses fail. You can be the best builder in your state, but if you cannot manage the flow of money through your projects, you will eventually hit a wall.

Stop viewing your back office as overhead. It is your control center. It is the only way to see the reality of your projects through the fog of daily chaos. By utilizing expert construction bookkeeping services, you gain the ability to spot profit fade before it becomes fatal. You move from guessing to knowing. That is how you grow. That is how you build a legacy rather than just a job.

Read Also: 7 Insider Tips to Simplify Your Finances with QuickBooks Bookkeeping Services for Small Businesses

FAQs

1. Why does my bank balance look high if my job is losing money?

You are likely overbilled. You have collected cash for work you haven’t done yet. That money belongs to the job, not you. If you spend it, you will face a cash crunch later when the costs hit.

2. What is the difference between job costing and general bookkeeping?

General bookkeeping tracks expenses by category (e.g., fuel, materials). Job costing tracks expenses by specific project and phase (e.g., Job #101 – Foundation). Job costing is required to know which projects are profitable.

3. How often should I look at a WIP report?

At least monthly. For larger, fast-moving companies, bi-weekly is better. Waiting until the end of the quarter is too long; the damage will already be done.

4. Can I use QuickBooks Online for construction bookkeeping?

Yes, but it requires setup by someone who understands construction. You need to utilize the “Projects” feature and set up a proper item list that maps to your cost codes. Out of the box, it is insufficient.

5. What are “committed costs”?

These are costs you have agreed to pay (via purchase orders or subcontracts) but haven’t been billed for yet. If you ignore them, you will think you have more budget left than you actually do.

Ready to stop the bleeding and secure your margins?

Don’t let another project finish in the red. At Numberfied, we turn your numbers into your biggest competitive advantage. Get Your Financial Health Assessment Today