Your Profit and Loss statement is likely lying to you. It might show a positive net income. It might even show a decent cash-on-cash return. However, if your expense categories are broad buckets like “Repairs” or “General Admin,” you are ignoring the single greatest lever for increasing asset value.

Most property managers view accounting as a compliance hurdle. They rush to clean up the books in February just to keep the IRS at bay. This mindset is a financial error.

By shifting your perspective, you transform data entry into asset management. When you utilize strategic real estate bookkeeping services, you stop looking at what you spent. You start analyzing where you are bleeding value. Precision is not about being neat. It is about maximizing the exit multiple on your portfolio.

Key Takeaways

- Granularity Equals Leverage: Why lumping expenses into broad categories hides theft, inefficiency, and waste.

- The CapEx vs. OpEx Impact: How proper classification affects your Net Operating Income (NOI) and tax basis immediately.

- Unit-Level Economics: Moving beyond portfolio averages to identify which specific doors are dragging down your yield.

- Vendor Accountability: Using historical data to negotiate better rates and spot billing creep.

- The Valuation Multiplier: How saving $1 in expenses can create $20 in property value.

The General Ledger Trap: Why “Miscellaneous” Is a Dirty Word

The standard chart of accounts for most real estate businesses is woefully inadequate. It is usually a default list from QuickBooks or Xero that was never customized for property management. You likely have a massive bucket labeled “Repairs & Maintenance.” This tells you nothing.

When you see $50,000 in maintenance for the year, you have a number. You do not have insight. Insight requires breaking that number down until it confesses.

Designing a Strategic Chart of Accounts

You must architect your chart of accounts to reflect the physical reality of your buildings. You need specific line items for Plumbing, HVAC, Electrical, Roofing, Landscaping, and Turnover Costs.

When you separate “Plumbing” from “General Maintenance,” you might spot a trend. perhaps 40% of your maintenance budget is going to plumbing issues in a specific building. That is not a maintenance problem. That is a capital expenditure signal. It suggests you should replace the galvanized pipes rather than patching leaks every month. You cannot make that strategic decision if the data is hidden in a general bucket.

Tracking the “Ghost” Expenses

Granular tracking also catches the small leaks that drain cash flow. Subscriptions for property management software, unused marketing channels, or bank fees often get buried. When you force every transaction into a specific home, these “ghost” expenses become visible. You can cut them immediately. That is instant ROI.

The CapEx vs. OpEx Pivot: Maximizing NOI and Tax Strategy

One of the most frequent errors I see in self-managed portfolios is the mishandling of Capital Expenditures (CapEx) versus Operating Expenses (OpEx). This is not just semantic. It fundamentally alters your profitability profile.

OpEx includes day-to-day costs to keep the property running. Think minor repairs, insurance, and utilities. These are fully deductible in the year they occur. They lower your taxable income now.

CapEx involves improvements that add value or extend the life of the property. Think a new roof or a full HVAC system replacement. These must be capitalized and depreciated over years (27.5 for residential, 39 for commercial).

The NOI Distortion

If you accidentally classify a $15,000 roof repair as an expense, you artificially lower your Net Operating Income (NOI). Since commercial and multifamily properties are valued based on NOI, you have just theoretically lowered the value of your asset.

Conversely, if you capitalize a repair that should have been an expense, you are inflating your tax bill unnecessarily. You are paying taxes on cash you no longer have.

Utilizing the Safe Harbor Election

A sophisticated approach involves the De Minimis Safe Harbor election. This allows you to deduct invoices under $2,500 as expenses, even if they could technically be CapEx. To use this legal tax strategy, your books must be impeccable. You need a consistent policy in place at the start of the year. If your receipts are a shoebox mess, your CPA cannot confidently apply these strategies without charging you a fortune to reconstruct the year.

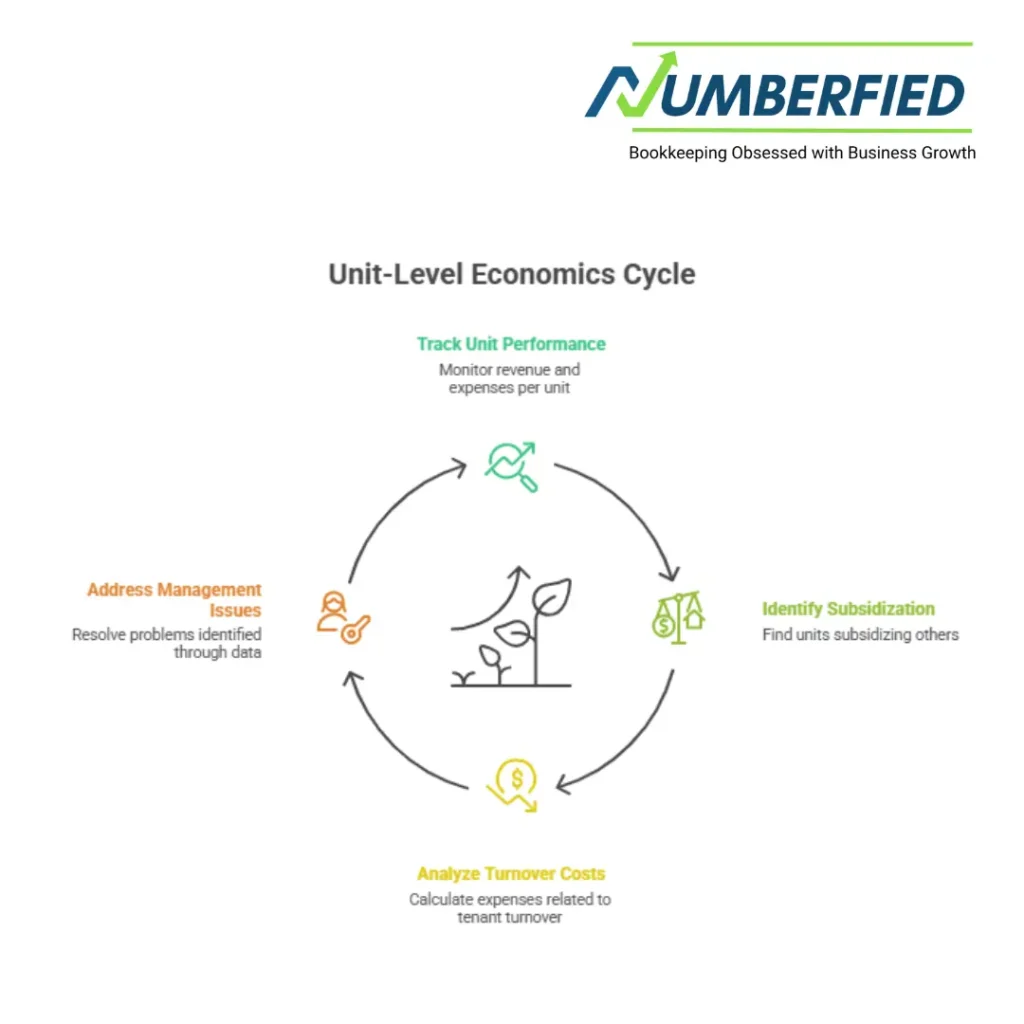

Unit-Level Economics: Identifying the Anchors in Your Portfolio

Averages are dangerous. You might look at a 10-unit apartment building and see it is performing at a 12% margin. You feel good.

However, granular tracking allows you to drill down to the class and location. More importantly, it allows you to track profitability on a per-unit basis.

The Subsidization Problem

When you track revenue and expenses by “Class” (QuickBooks terminology) or “Tracking Category” (Xero terminology), you often find that Unit 101 is subsidizing Unit 204.

Maybe Unit 204 has a legacy tenant paying 20% under market rent, but that tenant also calls for maintenance three times as often as anyone else. On a portfolio level, this noise is lost. On a unit level, the data screams at you.

Turnover Cost Analysis

Turnover is the biggest killer of yields. By tagging expenses to specific turnover events, you can calculate the true cost of a tenant leaving. It is not just the lost rent. It is the painting, the cleaning, the marketing, and the leasing fee.

If you find that your turnover costs average $2,000 per unit, but one property manager averages $3,500, you have a management problem. You can only fix this if the data is isolated and comparable.

Vendor Accountability: Using Data as Leverage

Your vendors are partners. They are also businesses trying to maximize their own margins. Without granular data, you are a passive payer. With data, you are an active negotiator.

Detecting Price Creep

Service providers often increase prices slowly. A lawn care company might charge $50 per visit in January and $55 in June. By December, it is $65. If this is buried in “Landscaping,” you won’t notice the 30% hike until the end-of-year review.

If you track expenses by vendor, you can run a “Vendor Expenses by Month” report. You spot the trend line instantly. You call the vendor. You ask why. You freeze the rate or you switch providers.

Bulk Negotiation Power

Let’s say you own 50 single-family homes. You use four different pest control companies because you acquired the properties at different times.

Granular bookkeeping reveals that you spent a total of $18,000 on pest control last year across all entities. You take that number to a single national provider. You offer them an exclusive contract for the entire portfolio in exchange for a 20% discount.

You just added $3,600 to your bottom line simply by organizing your data. That is pure profit. That is the ROI of detail.

The Valuation Multiplier: How Bookkeeping Prints Money

This is the most critical concept for any investor to grasp. Commercial real estate value is a function of NOI and Cap Rate.

$$Value = \frac{NOI}{Cap Rate}$$

If you sell a property at a 5% Cap Rate, every single dollar of annual NOI is worth $20 in sale price.

The $20,000 Cup of Coffee

Let’s assume your messy books result in $1,000 of leaked expenses per year. Maybe it is late fees, duplicate payments, or uncancelled subscriptions.

If you fix your books and stop that $1,000 leak, you haven’t just saved $1,000. You have increased the asset value by $20,000 (at a 5% cap rate).

If you scale this across a large portfolio, the numbers become staggering. Improving operational efficiency by $50,000 a year adds $1 million to your exit price.

Due Diligence Confidence

When you go to sell or refinance, the buyer or bank will scrutinize your P&L. If your books are messy, they assume the worst. They assume you are hiding costs. They will increase the cap rate (lower the price) to account for the risk.

Clean, granular books signal professional management. They reduce the perceived risk. They defend your asking price. You can point to the “CapEx” line and prove that the roof is new, justifying a lower cap rate and a higher price.

Why Professional Real Estate Bookkeeping Services Beat DIY

You might be thinking you can do this yourself on weekends. You cannot. Not if you want to scale. The opportunity cost of your time is too high.

Entrepreneurs often try to save money by doing their own data entry. They end up losing money because they are not analyzing deals or managing tenants. They are classifying receipts at 11 PM.

The Specialist Difference

Outsourcing to professional real estate bookkeeping services ensures that the person handling your data understands the difference between a security deposit and prepaid rent. These are liabilities, not income. If you book them as income, you pay taxes on money that isn’t yours.

A specialist bookkeeper builds the chart of accounts correctly from day one. They set up the classes. They track the mortgages and escrow accounts. They reconcile the bank accounts monthly so you can make decisions based on real-time cash positions.

Scalability and Systems

When you hire a service, you are hiring a system. You do not need to worry about software updates, backup protocols, or staffing turnover. You get a clean set of financials delivered to your inbox every month.

This creates a feedback loop. You get the report. You see the HVAC spike in Building C. You fix Building C. Your NOI goes up. Your equity grows.

Conclusion

Bookkeeping is not about pleasing the IRS. It is about understanding the mechanical health of your investment vehicle. Granular expense tracking is the diagnostic tool that tells you exactly which parts are working and which are about to fail.

When you invest in detailed financial clarity through strategic real estate bookkeeping services, you are buying higher yields. You are buying leverage against vendors. You are buying a higher valuation at the closing table. Do not settle for a generic P&L that hides the truth. Demand data that empowers you to execute your strategy. The ROI is not hidden. It is right there in the details.

Read Also: Virtual Bookkeeping Services for Small Businesses That’ll Change Your Life!

FAQs

1. Can I just use Excel for my rental properties?

No. Excel is prone to user error and lacks the double-entry accounting safeguards required for accuracy and legal defense during an audit.

2. How often should my books be reconciled?

Monthly. Waiting until the end of the year denies you the ability to spot cash leaks or overspending in time to correct them.

3. What is the difference between a bookkeeper and a CPA?

A bookkeeper records daily transactions and maintains the ledger. A CPA analyzes that data for tax planning and filing. You need both.

4. Does granular tracking cost more?

The upfront setup might cost slightly more, but the money saved through discovered inefficiencies and tax strategies yields a massive return on investment.

5. How do I track expenses for a mixed-use property?

You must use class tracking or location tracking within your software to separate residential units from commercial spaces, as they have different depreciation and tax rules.