Introduction

US businesses facing rising processing costs, staff turnover, and growing transaction volumes are increasingly turning to outsourced accounts payable services to cut costs, reduce errors, and strengthen fraud prevention. Whether you’re a mid-market firm or a large enterprise, accounts payable outsourcing and automation solutions can transform the accounts payable function into a strategic, efficient operation that supports growth. In this guide, we’ll explain why companies outsource AP, outline key services such as outsourced invoice processing and vendor payments, profile leading AP outsourcing companies, compare in-house vs outsourced models, provide implementation tips, estimate typical costs, and offer criteria to choose the right provider.

Why Outsource Accounts Payable?

Outsourcing your accounts payable delivers multiple measurable benefits. For many US businesses, the decision to outsource AP is driven by the need to reduce processing costs, improve the accuracy of invoice data, prevent fraud, and scale without adding headcount.

benefits of outsourcing accounts payable

- Reduce costs: Outsourcing and AP automation eliminate manual data entry, lower staffing overhead, and reduce process inefficiencies, helping companies reduce accounts payable processing costs by 30-70% in many cases.

- Improve accuracy: Automated invoice data capture and structured AP workflows minimize human error in invoice and payment processing, improving vendor relations and financial reporting.

- Strengthen fraud prevention: Segregation of duties, secure payment process controls, and automated matching reduce opportunities for fraud in the AP process.

- Scale with demand: Outsourced AP services and virtual accounts payable services allow businesses to handle peak invoice volumes without hiring and training new personnel.

- Access expertise and technology: Working with an accounts payable outsourcing provider gives you access to specialized accounts payable automation software, best practices, and continuous process improvements.

Key Services Offered by Outsourced Accounts Payable Providers

Most accounts payable outsourcing companies provide a range of services designed to cover the entire accounts payable process from invoice receipt to payment reconciliation. Below are the core services to expect when you outsource accounts payable services.

Outsourced invoice processing

Outsourced invoice processing includes invoice capture, data extraction, validation, routing, and exception handling. Providers use data capture and optical character recognition (OCR) or intelligent document processing to create automated invoice records for your AP system.

- Invoice receipt: email, EDI, supplier portals, or paper scanning.

- Data capture: OCR, machine learning, and manual review for accuracy.

- Invoice data validation: vendor matching, PO matching, and tax/terms verification.

- Exception handling: research and resolution for price discrepancies and missing approvals.

Vendor payments and payment process

Outsourced payments include check printing and mailing, ACH, virtual card payments, and international wire disbursements. AP outsourcing companies often integrate payment processes with banks and treasury systems to optimize cash flow and take advantage of early payment discounts.

- Secure payment orchestration and authorizations.

- Payment reconciliation and posting to the general ledger.

- Fraud controls, such as two-factor approval and payee validation.

Expense management

Many outsourcing providers offer expense report processing and employee reimbursement workflows, often integrated with the invoice process and corporate card platforms. This ensures consistent policy enforcement across accounts payable and expenses.

Purchase order (PO) matching and accounts payable workflow

PO matching automates three-way or two-way matches between PO, receipt of goods and services, and invoices. Automated AP services reduce mismatches, speed approvals, and minimize manual intervention.

- 3-way matching: invoice, PO, and goods receipt.

- Invoice routing and approval workflows are managed through the AP system.

1099 reporting and compliance

Seasonal reporting, such as 1099 generation and filing, is often handled by accounts payable outsourcing providers, ensuring compliance with IRS requirements and state filings.

Reconciliation and reporting

Outsourced AP services typically include reconciliation of payments to bank statements, supplier statements, and monthly reporting to support accounting close and audits.

In-house versus Outsourced AP: A Practical Comparison

Choosing between keeping AP in-house and partnering with an outsourcing company depends on your strategic priorities, volume, available technology, and risk tolerance. Consider these factors when comparing options.

Cost and scalability

- In-house: Requires hiring, training, and maintaining staff; costs scale with volume and may require investment in accounts payable software or hardware.

- Outsourced: Pay-for-service model typically lowers processing costs and scales quickly to handle seasonal peaks without hiring.

Control and visibility

- In-house: Greater direct control over AP workflow, data, and compliance. Useful if AP is tightly integrated with procurement or treasury operations.

- Outsourced: Visibility depends on provider dashboards and integrations; strong providers offer real-time reporting and full audit trails.

Technology and automation

- In-house: You must select and implement accounts payable automation software and maintain integrations with ERP, which can be resource-intensive.

- Outsourced: Many providers deliver both a service and an AP automation solution, reducing the burden on internal IT and offering best-in-class automation solutions.

Risk and compliance

- In-house: Easier to internalize compliance controls, but susceptible to staff turnover and fraud risk if segregation of duties is limited.

- Outsourced: Reputable outsourcing providers implement formal controls, encrypted data transfer, and compliance processes across the AP lifecycle.

When to keep AP in-house

- Very small volume where outsourcing costs won’t provide ROI.

- Highly sensitive supplier relationships or bespoke payment agreements requiring direct negotiation.

- When the organization wants to retain full control over payment timing for working capital reasons.

When to outsource accounts payable

- Rapidly growing invoice volumes or multinational operations.

- Need to reduce processing costs and move to automated AP services quickly.

- Desire to reduce manual data entry and improve AP workflow efficiency.

Implementation Tips for Successful AP Outsourcing

Transitioning to accounts payable outsourcing or accounts payable automation outsourcing is a change management project. Follow these implementation best practices to ensure a smooth rollout and fast realization of benefits.

- Map your current accounts payable process: Document invoice types, supplier channels, approval workflows, PO matching rules, and exceptions before engaging an outsourcing provider.

- Define clear KPIs: Typical metrics include cost per invoice, invoice cycle time, percent electronic payments, and exception rates.

- Prioritize integration: Ensure the provider integrates with your ERP, accounting software, and bank platforms for automated posting and payment reconciliation.

- Plan a phased rollout: Start with a pilot (a subset of suppliers or invoice types) to resolve process and technical issues before full migration.

- Standardize supplier onboarding: Encourage suppliers to send electronic invoices or use a supplier portal to reduce manual invoice capture and paper processing.

- Retain internal ownership: Keep strategic control of vendor relationships and treasury policies even when you outsource the operational AP tasks.

- Train staff and suppliers: Provide clear guidance to AP team members and suppliers on new processes, portals, and expectations.

- Confirm security and compliance: Verify data encryption, access controls, audit trails, and regulatory reporting capabilities.

Typical Costs of Outsourced Accounts Payable

Costs vary by provider model (transactional pricing, subscription, or hybrid), invoice complexity, and required services. Typical pricing elements include per-invoice fees, monthly platform subscriptions, and payment transaction fees.

Common pricing models

- Per-invoice pricing: Common for full-service outsourcing ranges widely depending on volume and level of automation, often $2–$15 per invoice.

- Subscription + per-transaction: Monthly software fee plus low per-invoice processing charges for virtual accounts payable services.

- Flat monthly fee: For predictable volumes and managed services, some providers offer fixed monthly pricing.

- Payment fees: Additional fees for ACH, virtual card, or international wire disbursements.

When estimating costs, include potential savings from reduced headcount, automation of manual data entry, fewer payment errors, early payment discounts captured, and decreased processing time per invoice. Effective accounts payable automation solutions often produce rapid ROI by cutting processing costs and improving supplier terms.

How to Choose the Right Accounts Payable Outsourcing Provider

Selecting the right accounts payable outsourcing provider requires evaluating technology, services, compliance, and cultural fit. Use the checklist below to compare finalists.

Provider selection checklist

- Service scope: Does the provider offer the complete accounts payable outsourcing service you need, including outsourced invoice processing, payment services, PO matching, expense management, and 1099 reporting?

- Technology capabilities: Look for accounts payable automation software, OCR/data capture quality, AI-based invoice recognition, and solid integrations with your ERP and banking systems.

- Security and compliance: Confirm encryption, SOC reports, data residency options, and controls for payment fraud prevention.

- Scalability and SLAs: Can the outsourcing provider scale with your volume and meet uptime, turnaround time, and accuracy SLAs?

- Supplier onboarding and adoption: Does the provider help onboard suppliers and provide supplier portals to reduce manual invoice receipt?

- Reporting and analytics: Ensure rich dashboards for invoice lifecycle metrics, cash forecasting, and exception trends.

- Customer support and implementation: Check references and confirm the level of implementation assistance and ongoing support.

- Pricing model: Choose transparent pricing aligned to your volume and services, seek models that incentivize automation and process improvement.

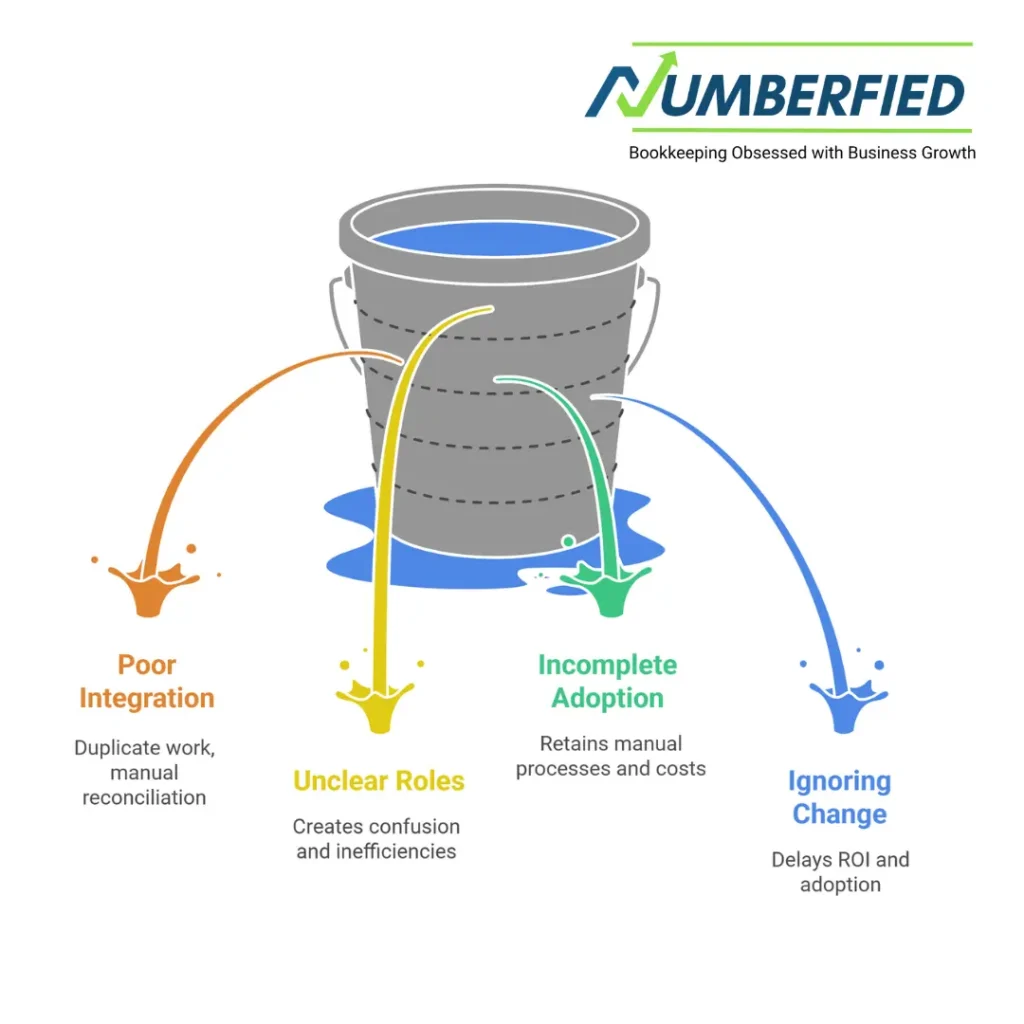

Common Pitfalls and How to Avoid Them

Even with the right provider, some common pitfalls can undermine the benefits of accounts payable outsourcing and automation.

- Poor integration: Failing to integrate the AP system with your ERP leads to duplicate work and manual reconciliations. Make integrations a priority.

- Unclear roles: Not clearly defining which tasks remain in-house vs outsourced can create confusion. Document roles and responsibilities upfront.

- Incomplete supplier adoption: If suppliers continue to send paper invoices, you’ll retain manual processes. Drive supplier adoption through incentives and support.

- Ignoring change management: Underestimating the internal change required for new AP workflows can delay ROI. Communicate benefits and provide training.

How Accounts Payable Automation Enhances Outsourcing

Accounts payable automation and AP automation solutions are central to maximizing your outsourcing benefits. Automation technologies reduce manual data entry, streamline the AP workflow, and provide visibility into the invoice and payment process.

Key automation capabilities

- Automated invoice capture and data extraction for faster invoice processing.

- AI-driven OCR and machine learning to improve invoice data accuracy over time.

- Automated PO matching to eliminate routine exceptions.

- Workflow automation to route invoices for approvals based on rules and thresholds.

- Automated payments to reduce check usage and speed reconciliations.

Combining outsourcing with accounts payable automation solutions lets organizations outsource transactional tasks while retaining strategic control and benefit from processing efficiencies, reduced costs, and improved supplier relationships.

Real-World Use Cases

Here are common scenarios where businesses choose accounts payable outsourcing and automation:

- Fast-growing startups that need to scale the AP department without hiring full-time staff.

- Mid-size companies are undergoing digital transformation to eliminate manual data entry and streamline the invoice process.

- Enterprises with international suppliers require global payment capabilities and tax compliance.

- Organizations with seasonal spikes in invoice volume that want virtual accounts payable services to handle peaks.

Final Considerations: Making the Move to Outsourced AP

Outsourcing accounts payable is a strategic decision that can deliver substantial benefits when executed correctly. The right combination of outsourcing service and accounts payable automation software reduces manual data entry, improves financial data accuracy, reduces processing costs, and strengthens fraud prevention.

Keep these final points in mind:

- Start with clear objectives and KPIs (cost per invoice, invoice cycle time, electronic payment rate).

- Select a provider that combines a service-oriented approach with modern automation solutions.

- Ensure smooth ERP and bank integrations to minimize manual reconciliation work.

- Focus on supplier adoption and user training to unlock the full benefits of outsourced AP services.

FAQ

What are the different types of outsourcing?

Common types include location-based (offshore, nearshore, onshore), function-based (IT outsourcing, business process outsourcing/BPO, knowledge process outsourcing/KPO, manufacturing), and relationship-based (project-based, staff augmentation, dedicated team, managed services).

What is the most common type of outsourcing?

Business process outsourcing (BPO) is the most common, especially for functions like customer service, HR, finance, and IT support. IT outsourcing is also very prevalent.

What are common outsourcing examples?

Popular examples include IT support and software development, customer service call centers, payroll and HR administration, accounting and bookkeeping, manufacturing, marketing, and data entry.

What are the three levels of outsourcing?

The three main levels are tactical/project-level (specific tasks or projects), strategic/process-level (entire business processes), and transformational (long-term partnerships that improve or transform operations).

Can accounts payable be outsourced?

Yes, accounts payable is commonly outsourced. Many businesses use third-party providers for invoice processing, payments, and vendor management to reduce costs and improve efficiency.

Can accounts payable be remote?

Yes, accounts payable can easily be handled remotely using cloud-based software, electronic approvals, and digital payments, allowing teams to work from anywhere.

Can accounts payable be automated?

Yes, accounts payable can be fully automated using software for invoice capture, approval workflows, PO matching, payments, and reporting, reducing manual work and errors.

How much do outsourced accounting services cost?

In the US, outsourced accounting typically costs $1,000–$5,000 per month for small to medium businesses, depending on scope, complexity, and provider.

How much does it cost to outsource an accountant?

Outsourcing an accountant or full accounting services ranges from $500–$5,000+ per month, or $75–$250 per hour for project work, varying by business needs and expertise.

How much should you pay a bookkeeper per month?

For small businesses in the US, expect $300–$2,500 per month for bookkeeping services, based on transaction volume and required tasks.

Read Also: 7 Insider Tips to Simplify Your Finances with QuickBooks Bookkeeping Services for Small Businesses