Introduction

Picture this: you open your laptop at 7 am, click one tab, and instantly see exactly how much cash is in the bank, what invoices are overdue, and whether last month’s marketing spend paid off. No digging through folders. No late-night spreadsheets. That’s what virtual bookkeeping and accounting delivers every single day.

We’re the Numberfied team, and we’ve sat across kitchen tables (virtually, of course) with tradies in Townsville, café owners in Hobart, and tech founders in Melbourne. The story is always the same: “I’m good at my job, but the numbers stress me out.” Virtual bookkeeping and accounting fixes that. You hand over the receipts, bank feeds, and payroll headaches. We give you back clarity, compliance, and confidence.

In the pages ahead, you’ll get straight-talk advice- no fluff, no jargon. We’ll show you how these services slot into your week, save you serious time, and keep the ATO happy. Ready to run your business instead of your books? Let’s go.

Key Takeaways

- Log in anywhere and see your numbers in real time.

- Never miss a BAS deadline or super payment again.

- Cut admin hours and put them back into revenue.

- Work with Aussies who know the local tax rules inside out.

- Turn reports into simple next-step actions

Understanding Virtual Bookkeeping and Accounting

Think of it as your finance department in the cloud. Everything that used to live on a dusty ledger or a cluttered desk now lives online, updated daily by people who do this for a living.

Daily Bookkeeping Tasks We Handle

Every sale, every purchase, every bank transaction gets recorded the right way:

- Sales invoices raised and chased

- Supplier bills entered and paid on time

- Bank feeds reconciled each morning

- Receipts snapped on your phone and categorised automatically

A sparky we work with photographs his material dockets at Bunnings. By the time he’s back on-site, the job cost is already in the system.

The Accounting Layer

Once the data is clean, we turn it into answers:

- Monthly profit check- did that new van pay for itself yet?

- Cash-flow forecast- can you hire that extra staff member next quarter?

- BAS ready to lodge with one click

- Tax pack prepped for your accountant in June

How It Beats the Old Way

No more employing someone to sit in your office five days a week. No more training them when rules change. You get a whole team- bookkeeper, payroll specialist, BAS agent– for less than one salary.

Top Benefits of Virtual Bookkeeping and Accounting

Here’s what you actually gain when the books are off your plate.

Time Back in Your Diary

Most owners tell us they reclaim at least one full day a week. That’s 50 extra days a year to quote jobs, see clients, or just switch off.

Zero ATO Surprises

We lodge on time, every time. GST coded correctly. Super paid by the 28th. Payroll reported through Single Touch Payroll the moment wages hit the bank.

Decisions Based on Fresh Numbers

Dashboards update live. Check profit on your phone while waiting for coffee. Spot a slow-paying client and follow up the same day.

Money Saved

Skip the:

- Extra desk and computer

- Super and workers comp

- Software seats for an in-house person

Pay only for the transactions you actually have. Scale up when you land that big contract; scale down in the quiet months.

How to Get Started with Virtual Bookkeeping and Accounting

Three weeks from “hello” to hassle-free. Here’s the roadmap we follow with every new client.

Week 1: Quick Chat & Quote

Jump on a 20-minute call. We ask about your software, transaction count, and pain points. You get a fixed monthly price on the spot.

Week 2: Handover & Clean-Up

Send us last month’s bank CSV (or give secure read-only access). We import, tidy any mess, and match every line. You watch it happen in your own Xero file.

Week 3: Live & Learning

Daily reconciliations start. You get a 15-minute screen-share walkthrough of your new dashboard. From here, it runs itself.

How Virtual Bookkeeping and Accounting Keeps You ATO-Ready

The tax office doesn’t send friendly nudges- they send penalties. We make sure that never happens.

BAS Lodgement on Autopilot

Every quarter we:

- Pull the numbers

- Double-check GST codes

- Lodge before the deadline

- Email you the confirmation

Payroll Without the Drama

Fortnightly pay runs, super cleared by the cut-off, leave balances tracked. Employees get payslips in their inbox; you get peace of mind.

End-of-Year Handover

30 June rolls around and your accountant receives a tidy folder: P&L, balance sheet, depreciation, payroll summary. Done.

Technology That Powers Virtual Bookkeeping and Accounting

You don’t need to love tech- just a smartphone and an internet connection.

Your Existing Software

We hop into whatever you already use- Xero, MYOB, QuickBooks. No forced switch.

Phone Apps for Everything

Snap receipts. Approve bills. Check cash balance. All from the same app you use for banking.

Rock-Solid Security

Bank-grade encryption. Australian data centres. Two-factor logins. Your numbers are safer online than in a filing cabinet.

Real Australian Businesses, Real Results

Three quick stories from clients you could ring tomorrow.

North Queensland Builder

“Used to wait until Sunday night to enter the week’s invoices. Now I photograph them on-site Friday arvo. Job costing is spot-on, and I quote tighter margins.”

Geelong Retail Shop

“Stocktake used to take two days. Virtual bookkeeping links POS sales to stock levels. We reorder before we run out and cut slow-moving lines.”

Perth Freelance Designer

“Travelled to Singapore for a pitch. Checked cash flow on the plane, saw the buffer, and confidently took the job. Landed it the next day.”

Common Questions About Virtual Bookkeeping and Accounting

Still got questions? Here are the ones we hear most.

Do I still own my data?

100%. It lives in your Xero or MYOB file. We’re guests with limited permissions. You can revoke access at any time.

What if I’m months behind?

No dramas. We quote a one-off clean-up fee, knock it out in a week, then switch to monthly maintenance.

Can I just outsource payroll?

Of course. Start with whatever hurts most payroll, BAS, full package. Add or subtract later.

Will my accountant be annoyed?

Most love it. Clean books mean they spend less time fixing and more time saving you tax.

The Future of Virtual Bookkeeping and Accounting in Australia

Cloud adoption is only going one way. By 2026, the ATO wants even more data reported in real time. Having a virtual team already plugged in keeps you ahead of the curve.

Conclusion

Virtual bookkeeping and accounting is the difference between guessing and knowing- between stressing over deadlines and steering your business with confidence.

The Numberfied crew has walked hundreds of Australian owners through this exact transition. We’d love to do the same for you.

Head to https://numberfied.com/au// and book a quick call. Tell us where your books are; we’ll show you where they could be. Your clearer, calmer financial life starts with one click.

FAQs

What does virtual bookkeeping and accounting actually look like day-to-day?

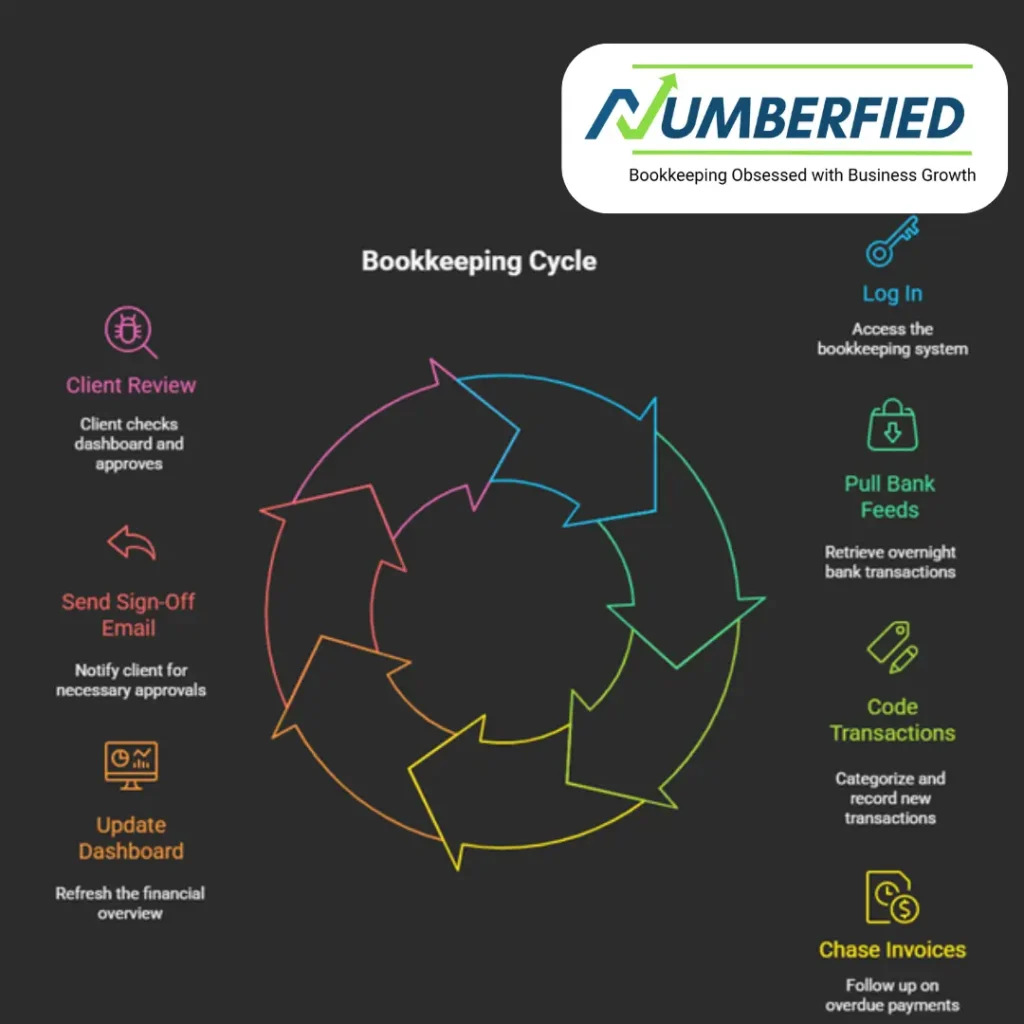

You run your business. We log in each morning, pull overnight bank feeds, code anything new, chase overdue invoices, and update your dashboard. You get a quick email if something needs your sign-off. That’s it. Most clients check in once a week for five minutes.

How much should I expect to pay for virtual bookkeeping and accounting?

Depends on volume. A sole trader with 50 transactions a month might pay a couple of hundred bucks. A medium-sized retailer with staff and stock could be double that. We quote fixed monthly fees after the discovery call- no surprises.

Is my data really secure with virtual bookkeeping and accounting?

Yes. We use the same encryption your bank does. Data stays in your software file; we never download it to laptops. Two-factor authentication is mandatory. We’ve never had a breach in eight years.

Can virtual bookkeeping and accounting save me tax?

It doesn’t create deductions, but it makes sure you claim every single one you’re entitled to. Missed fuel receipts, home-office running costs, tool depreciation- we catch them all. Clients often pick up thousands at tax time.

Do I have to change my current software for virtual bookkeeping and accounting?

Nope. We work inside Xero, MYOB, QuickBooks, Reckon- whatever you’ve got. If you’re still on desktop spreadsheets, we’ll migrate you to cloud for free as part of setup.

How fast can we be up and running with virtual bookkeeping and accounting?

If your books are current, we’re live within 48 hours. If there’s a backlog, give us a week to clear it. You’ll see your first clean dashboard inside 10 days, guaranteed.

What if I only need BAS help- can I use virtual bookkeeping and accounting for that?

Absolutely. Plenty of clients outsource just BAS or just payroll. Start small, add more when you’re ready. No lock-in contracts.

Will virtual bookkeeping and accounting work for my trade business?

Built for it. Job costing, progress invoicing, material tracking, subcontractor payments- we speak tradie. Snap photos of dockets; we’ll allocate costs to the right job code.

Can I phone someone if I have a question about virtual bookkeeping and accounting?

Always. You get a direct mobile for your bookkeeper and a backup for the manager. Call, text, or email- answered same day, Aussie hours.

Why choose Numberfied for virtual bookkeeping and accounting?

We’re not just number-crunchers. Every month you get a 15-minute call walking through your profit drivers and one action to improve them. Plus you join our private client Slack for quick advice and local referrals. It’s bookkeeping with a growth kick.