Introduction

Running a small business in Australia means juggling many responsibilities: sales, customer service, operations, and marketing, while also keeping your financial records accurate and up to date. Professional bookkeeping services in Australia can help business owners streamline their accounting system, automate routine tasks, and provide the accurate and timely financial data needed for better business decisions and sustainable business growth.

This guide explains bookkeeping services for small businesses, the benefits of outsourced bookkeeping in Australia, common bookkeeping costs, the best bookkeeping software in Australia, and how to choose an experienced bookkeeper or BAS agent to support your bookkeeping and accounting needs.

Why Choose Professional Bookkeeping

Many small business owners start by doing basic bookkeeping themselves, managing invoices, bank reconciliation, and data entry. But as your business grows, so do bookkeeping needs. Professional bookkeeping offers:

- Accurate and timely financial records to support business decisions and financial reporting.

- Streamlined business bookkeeping with cloud-based accounting software like Xero, MYOB, and QuickBooks Online.

- Peace of mind through compliance with BAS lodgment, payroll obligation, and tax deadlines.

- Reduced time spent on accounts payable, bank reconciliations, and invoicing so you can focus on running your business.

Qualified bookkeepers and bookkeeping firms across Australia work closely with accountants and registered BAS agents to ensure your bookkeeping and tax affairs are in order. Whether you need ongoing bookkeeping or project-based support, professional bookkeeping services can be tailored to your business needs.

Benefits of Outsourcing

Outsourcing bookkeeping is increasingly popular among Australian businesses. Outsourced bookkeeping Australia offers several advantages over in-house or DIY approaches:

- Cost savings: Outsourcing often reduces bookkeeping costs in Australia compared to hiring a full-time bookkeeper, as you only pay for the services you need.

- Access to expertise: Outsourcing gives you a bookkeeping team or expert bookkeeper experienced with Xero bookkeeping, MYOB bookkeeping, and QuickBooks Australia.

- Scalability: Virtual bookkeeping services can scale up during busy periods (e.g., EOFY or seasonal peaks) and scale down when you need less support.

- Improved cash flow management: Reliable bookkeeping services help you manage invoices, accounts payable, and payroll services so cash flow is optimised and predictable.

- Automation and efficiency: Outsourced providers use cloud bookkeeping and accounting software to automate reconciliation, recurring invoices, and payroll processing.

- Compliance and lodgment support: Many firms provide BAS agent services and work with registered BAS agents to ensure accurate BAS lodgment and GST compliance.

For many small business owners, outsourcing bookkeeping is the fastest way to gain accurate financial data and free up time to grow their business.

Top Software (Xero, MYOB, QuickBooks)

Choosing the best bookkeeping software in Australia depends on your business size, complexity, and integration needs. The three leading platforms are Xero, MYO, B, and QuickBooks Online. Each has strengths that suit different small businesses.

Xero Bookkeeping Services

Xero is widely used by bookkeepers and accountants across Australia. It is cloud-based, easy to use, and integrates with payroll, payment gateways, and many add-ons. Key benefits include automated bank reconciliation, real-time financial reporting, and strong support for Xero bookkeeping services provided by experienced bookkeepers and bookkeeping firms.

MYOB Bookkeeping

MYOB remains popular with Australian businesses who prefer a feature-rich accounting system with both cloud and desktop options. MYOB bookkeeping supports payroll services, BAS lodgment, and can be a good fit for businesses with industry-specific needs or those who have used MYOB historically.

QuickBooks Australia

QuickBooks Online offers a user-friendly interface and a broad app ecosystem. QuickBooks is suitable for businesses that want to automate invoices, manage accounts payable, and connect to many third-party apps. QuickBooks Australia continues to expand its local features for tax and payroll compliance.

Tips for choosing accounting software:

- Match software to your business bookkeeping needs and growth plans.

- Consider software that integrates with your point-of-sale, e-commerce, or timesheet systems.

- Look for cloud-based bookkeeping if you want remote access and virtual bookkeeping services.

- Ask prospective bookkeepers which accounting software they specialise in; many specialise in Xero, MYOB, or QuickBooks.

Costs and Rates

Understanding bookkeeper rates Australia and bookkeeping costs Australia helps you budget for business bookkeeping services. Rates depend on the scope of work, complexity, and whether you use an outsourced bookkeeping service or hire an in-house bookkeeper.

Typical Pricing Models

- Hourly rates: Many bookkeepers charge by the hour. Hourly rates vary depending on experience and location, expect mid-range rates for experienced bookkeepers and higher rates for qualified or specialised services.

- Fixed monthly packages: Common for small business bookkeeping services. Packages cover weekly or monthly tasks such as reconciliation, BAS preparation, payroll, and reporting.

- Project-based fees: Used for one-off cleans, migration to cloud bookkeeping, or reconciliation catch-ups.

Factors That Affect Cost

- Volume of transactions and data entry requirements.

- Complexity of payroll services and the number of employees.

- Integration and automation needs with other business systems.

- Frequency of reporting and management support required.

- Whether BAS agent services or tax-related work is included.

While specific bookkeeper rates in Australia fluctuate, outsourcing bookkeeping can reduce bookkeeping costs in Australia by removing overheads linked to full-time staff and by leveraging automation that reduces manual data entry.

Leading Providers

Across Australia, there are many reliable bookkeeping services and bookkeeping firms offering a range of solutions. Leading providers include boutique bookkeeping teams, virtual bookkeeping services, and larger bookkeeping firms that partner with accountants and registered BAS agents.

When evaluating providers, look for:

- Experience working with businesses of all sizes in your industry.

- Proven expertise with the accounting software you use (Xero, MYOB, QuickBooks).

- Clear service packages for small business bookkeeping services with defined deliverables (e.g., weekly reconciliations, BAS preparation, payroll management).

- Registered BAS agents or strong relationships with local accountants for lodgment and tax matters.

- Client testimonials and cases showing how bookkeeping solutions improved cash flow or streamlined business operations.

Examples of typical provider types:

- Local bookkeeping services in Melbourne, Sydney, and other major cities offer face-to-face support and bookkeeping services in Melbourne or other regions.

- Virtual bookkeeping services and online bookkeeping services that serve clients across Australia via cloud bookkeeping tools.

- Accounting firms that bundle bookkeeping and accounting services provide a single point of contact for bookkeeping and tax support.

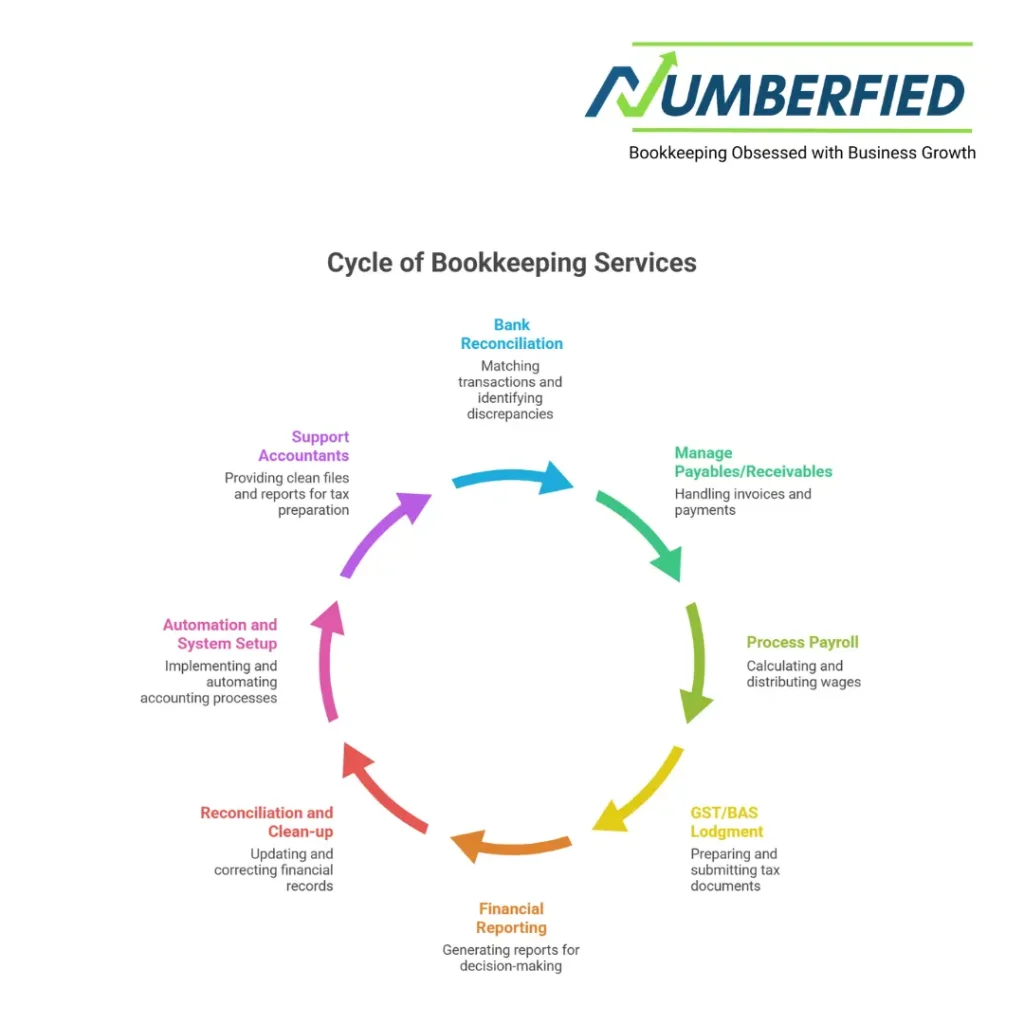

Key Services Offered

Comprehensive bookkeeping services for small businesses cover a range of tasks to ensure your financial records are accurate and up to date. Common services include:

- Bank reconciliation: Regular bank reconciliation to match transactions and catch discrepancies.

- Accounts payable and receivable: Managing invoices, vendor payments, and cash collections.

- Payroll services: Processing payroll, superannuation, and payroll tax obligations, and integrating with payroll software.

- GST and BAS lodgment: Preparing BAS and working with a registered BAS agent for lodgment and compliance.

- Financial reporting: Monthly management reports, profit and loss, balance sheet, and cash flow statements to support business decisions.

- Reconciliation and clean-up: One-off reconciliations or a bookkeeping catch-up to bring your financial records up to date.

- Automation and system setup: Implementing accounting software, automating invoice reminders, bank feed, and recurring transactions.

- Support for accountants: Preparing clean files and reports for tax time and liaising with your accountant.

These services help streamline business bookkeeping, reduce errors, and provide the financial data you need to grow your business and maintain compliance.

Choosing a Bookkeeper

Finding the right bookkeeper or bookkeeping service is critical. Here are steps and tips to choose someone who fits your business needs:

- Define your bookkeeping needs: List tasks you want help with, such as weekly reconciliations, payroll, BAS lodgment, or full bookkeeping and accounting support.

- Look for qualifications and registration: Check for qualified bookkeepers, experience with Xero, MYOB, or QuickBooks, and whether they work with a registered BAS agent for lodgment.

- Ask about software expertise: Ensure they can support your accounting system and help migrate data if needed.

- Request references and case studies: Speak with current clients to understand how the bookkeeper improved processes, reporting, and cash flow.

- Discuss turnaround times and reporting: Clarify how often you’ll receive financial reports and who will handle lodgments and reconciliations.

- Confirm pricing structure: Get clear details on bookkeeper rates in Australia, whether fees are hourly, monthly, or project-based, and what’s included.

- Assess communication and support: Make sure they provide proactive advice, help you understand financial reports, and align with your business goals.

Tips for business owners:

- Choose a bookkeeper who proactively helps you streamline processes and automate repetitive tasks.

- Prefer cloud-based providers so you can access financial data anywhere and support virtual bookkeeping.

- Make sure your bookkeeper collaborates with your accountant or is part of a bookkeeping and accounting team that can support tax and business development needs.

Conclusion

Bookkeeping services Australia offer invaluable support to small business owners who want accurate financial data, improved cash flow, and more time to focus on business development. Whether you choose outsourced bookkeeping Australia, a local bookkeeping service, or cloud-based virtual bookkeeping, the right bookkeeper will help streamline your accounting system, automate manual tasks, and provide the financial reporting needed to grow your business.

FAQs

How much do bookkeepers charge per hour in Australia?

Freelance or outsourced bookkeepers in Australia typically charge AU$45–$90 per hour, with averages around AU$50–$80 for experienced professionals and higher rates (up to AU$120+) for registered BAS agents or specialised services.

What is the hourly rate for a bookkeeper in Australia?

The average hourly rate for an employed bookkeeper in Australia is around AU$31–$35, ranging from AU$25 for entry-level to AU$42 for experienced roles (higher in cities like Sydney or Melbourne).

How much should you charge as a bookkeeper?

As a freelance bookkeeper in Australia, charge AU$50–$100 per hour based on your experience, location, and services offered (e.g., BAS lodgement). Beginners can start at AU$40–$60, while experienced BAS-registered bookkeepers often charge AU$70–$120.

What is the going rate for a full charge bookkeeper?

A full charge bookkeeper handles complete accounting responsibilities (e.g., all ledgers, payroll, reconciliations, and financial reports) for a business. In Australia, rates align with experienced bookkeepers: AU$50–$100 per hour freelance, or AU$70,000–$90,000 annual salary equivalent.

How much should I pay for bookkeeping services?

For small businesses in Australia, expect AU$300–$1,200 per month for outsourced services, depending on transaction volume and complexity. Basic packages start at AU$150–$400 for sole traders; more comprehensive ones (including payroll/BAS) reach AU$800+.

How much does a good bookkeeper charge?

A good, experienced bookkeeper (especially BAS-registered) charges AU$60–$100 per hour or AU$500–$1,500 monthly, delivering accurate compliance, reconciliations, and reporting to save time and avoid ATO penalties.

What is considered a full charge bookkeeper?

A full charge bookkeeper manages an entire company’s accounting process independently, including daily transactions, payroll, reconciliations, financial statements, and tax preparation support—common in small to medium businesses without a dedicated accountant.

How do I price myself as a bookkeeper?

Price based on experience, services, and market rates: start at AU$50–$70/hour as a beginner, rising to AU$80–$120 for BAS expertise. Offer fixed monthly packages (AU$400–$1,000) for predictability, factoring in overheads and value like compliance savings.

Is $40 an hour good in Australia?

AU$40 per hour is on the lower end for freelance bookkeeping in Australia (suitable for entry-level or basic tasks) but below average for experienced providers. Employed rates around this are common, but clients often pay more for quality outsourced services.

Can I do bookkeeping without being a BAS agent?

Yes, you can perform general bookkeeping tasks (e.g., data entry, reconciliations, invoicing, payroll processing) without being a registered BAS agent. However, you cannot legally lodge BAS/IAS, provide tax/GST advice, or handle certain compliance reporting for clients unless registered with the Tax Practitioners Board.

Also Read: Australia bookkeeping services: professional support for small business owners