Why accounting and bookkeeping services matter for small business owners

As a business owner or entrepreneur, managing finances is one of the most critical yet time-consuming parts of running a small business. Accurate bookkeeping and robust accounting services provide the foundation for cash flow management, tax preparation, profitability analysis, and strategic decision-making. When you use professional accounting and bookkeeping services, you get real-time financials, cleaner financial statements, and the confidence to focus on scaling and operations while experts manage your financial processes.

What “accounting and bookkeeping services” include

Accounting and bookkeeping services cover a range of tasks from daily transaction recording to higher-level financial advisory. Common elements include:

- Bookkeeping: managing your books, recording transactions, reconciling accounts, and maintaining accurate ledgers.

- Payroll: payroll processing, payroll tax filings, and compliance.

- Accounts receivable and accounts payable management: invoice creation, chasing payments, and vendor payments.

- Financial statements: preparing profit & loss, balance sheet, and cash flow statements.

- Tax prep and year-round tax strategy: preparing tax returns, maximizing tax deductions, and coordinating with CPAs.

- Advisory services: budgeting, forecasting, profitability analysis, and CFO-level insights.

- Cloud-based accounting and software setup: QuickBooks, bookkeeping software configuration, and training.

Primary benefits of hiring accounting and bookkeeping services

Professional accounting and bookkeeping services deliver tangible benefits to small business owners and startups:

Save time and reduce administrative burden

Outsourcing bookkeeping lets you focus on growing your business rather than managing receipts, invoices, or payroll. A dedicated accounting team or online bookkeeping services handles daily tasks so you can spend time on customers and strategy.

Improve cash flow and profitability

Accurate bookkeeping and timely accounts receivable management ensure you understand cash flow and can act quickly to improve collections and reduce late payments.

Better tax outcomes and fewer surprises

Year-round tax prep and tax strategy from accountants and CPAs identify deductions and prepare accurate tax returns, reducing the risk of penalties and missed opportunities.

Reliable financial statements and compliance

Professional bookkeeping experts produce reliable financial statements that lenders, investors, and stakeholders can trust, which are essential when you seek funding or plan to scale.

Scalable accounting solution

As your business grows, outsourced accounting services or a dedicated accounting team can scale with you, adding CFO advisory services, accrual accounting, and more advanced financial management as needs evolve.

DIY bookkeeping vs. hiring outsourced accounting services

Deciding between handling bookkeeping yourself and outsourcing depends on your time, expertise, and growth plans. Below is a practical comparison.

DIY bookkeeping

Pros: lower direct monthly cost if you handle it yourself, full control, and a learning opportunity. Cons: time-consuming, prone to errors, and may lack strategic insight. If you use bookkeeping software like QuickBooks, it helps, but software alone doesn’t replace expertise.

Outsourced accounting services

Pros: expert bookkeeping, payroll, tax preparation, financial statements, and advisory services delivered by a team. Real-time financials and fewer compliance risks. Cons: monthly cost and potential additional fees for one-time projects.

Current cost range

Outsourced accounting for small businesses typically ranges from $300–$1,200/month, depending on transaction volume, payroll complexity, and level of advisory support. Lower-tier packages often include basic bookkeeping and monthly reconciliations; mid and higher tiers add payroll, tax prep, and a dedicated accounting team or partial CFO services.

Consider the time value of your labor: if outsourcing saves you hours that you can spend growing the business, the net ROI is often positive, ve especially when expert accounting reduces tax liabilities and improves profitability.

Common mistakes small business owners make with bookkeeping and accounting

Avoid these pitfalls to keep your financials clean and useful:

- Failing to separate business and personal accounts, which complicates bookkeeping and tax prep.

- Delaying monthly bank and credit card reconciliations prevents errors from compounding.

- Using inconsistent bookkeeping practices or failing to use bookkeeping software effectively.

- Neglecting to set up payroll correctly results in missed filings and penalties.

- Overlooking tax deductions because records aren’t organized throughout the year.

- Not using accrual accounting when required for accurate financial reporting.

- Choosing the cheapest service without verifying expertise leads to rework, additional fees, or incorrect financials.

Step-by-step guide to choosing the right accounting and bookkeeping services

Follow this practical process to select services that match your small business bookkeeping needs and long-term goals.

Step 1: Assess your business needs

List current financial tasks (invoicing, payroll, taxes, reconciliations) and future needs (scaling, cash flow forecasting, CFO advisory). Identify your bookkeeping needs and how much time you currently spend on finance tasks.

Step 2: Decide between full-service and modular solutions

Full-service options include bookkeeping, payroll, tax preparation, and advisory services. Modular services let you outsource specific functions. Online bookkeeping services for small businesses often offer a mix. Match service scope to your business needs and budget.

Step 3: Evaluate providers by expertise and tools

Look for providers experienced with small business bookkeeping services, QuickBooks, or other accounting software, and those that offer real-time financials. Ask whether they use cloud-based accounting, offer dedicated accounting team members, and provide access to CPAs or CFOs when needed.

Step 4: Check pricing and what’s included

Compare packages within the $300–$1,200/month range and clarify additional fees for payroll, tax prep, catch-up bookkeeping, or one-time projects. Ask about bookkeeper-to-client ratios and whether you’ll have a dedicated bookkeeper or a team of experts handling your account.

Step 5: Verify compliance and references

Request references from similar small business clients, verify credentials like CPA or enrolled agent status, and confirm data security practices for cloud-based accounting solutions.

Step 6: Pilot with a month-to-quarter trial

Start with a short trial period to ensure responsiveness, quality of financial statements, and seamless integration with your bookkeeping software. Confirm the provider can handle tax prep and year-round tax strategy as your business grows.

How outsourced accounting integrates with your operations

Good outsourced accounting services integrate with your existing tools and workflows. Typical integration points include:

- QuickBooks and bookkeeping software sync for automated transaction capture.

- Payroll systems integration for timely payroll and tax filings.

- Invoice automation and accounts receivable workflows to speed collections.

- Secure client portals for document exchange and real-time access to financials.

Integration reduces manual data entry, minimizes errors, and provides seamless access to financial management and reporting.

When to upgrade to advanced accounting or CFO services

Consider adding advisory services or a part-time CFO when your business reaches points where strategic financial planning matters: you’re seeking investment, planning a major expansion, or needing a complex tax strategy. CFOs and advanced accounting teams help with cash flow modeling, profit optimization, and fundraising preparations.

Practical checklist:

- Provide clear documentation: bank statements, prior tax returns, payroll records, and organizational details.

- Grant secure access to bookkeeping software and banking portals (read-only where appropriate).

- Agree on the frequency of reporting and KPI dashboards you want, including monthly P&L, cash flow forecasts, and accounts receivable aging.

- Establish a communication cadence: provide weekly or monthly updates and outline an escalation path for urgent issues.

- Plan for year-round tax preparation to maximize deductions and reduce surprises at tax time.

Pricing examples and value considerations

Here’s how typical pricing tiers map to services and value:

- $300–$500/month: Basic bookkeeping, monthly reconciliations, and accountant-ready financials suitable for low transaction volume businesses.

- $500–$900/month: Mid-tier includes payroll, more frequent reporting, accounts receivable management, and some advisory time.

- $900–$1,200+/month: Full-service packages with a dedicated accounting team, CFO advisory services, advanced tax strategies, and real-time dashboards are ideal for scaling small businesses or startups with complex needs.

When comparing costs, factor in savings from improved tax deductions, reduced penalties, better cash flow, and the time you reclaim to focus on growing your business.

How expert bookkeeping and accounting helped a startup

A growing startup outsourced bookkeeping and payroll to a dedicated accounting team. After switching to an online bookkeeping services provider integrated with QuickBooks, they received monthly financial statements and quarterly tax strategy sessions. The result: a 25% reduction in missed deductions, improved cash flow forecasting that avoided a funding shortfall, and management time freed to pursue product development and sales. This concrete outcome reflects how expert accounting and bookkeeping services can directly impact profitability and growth.

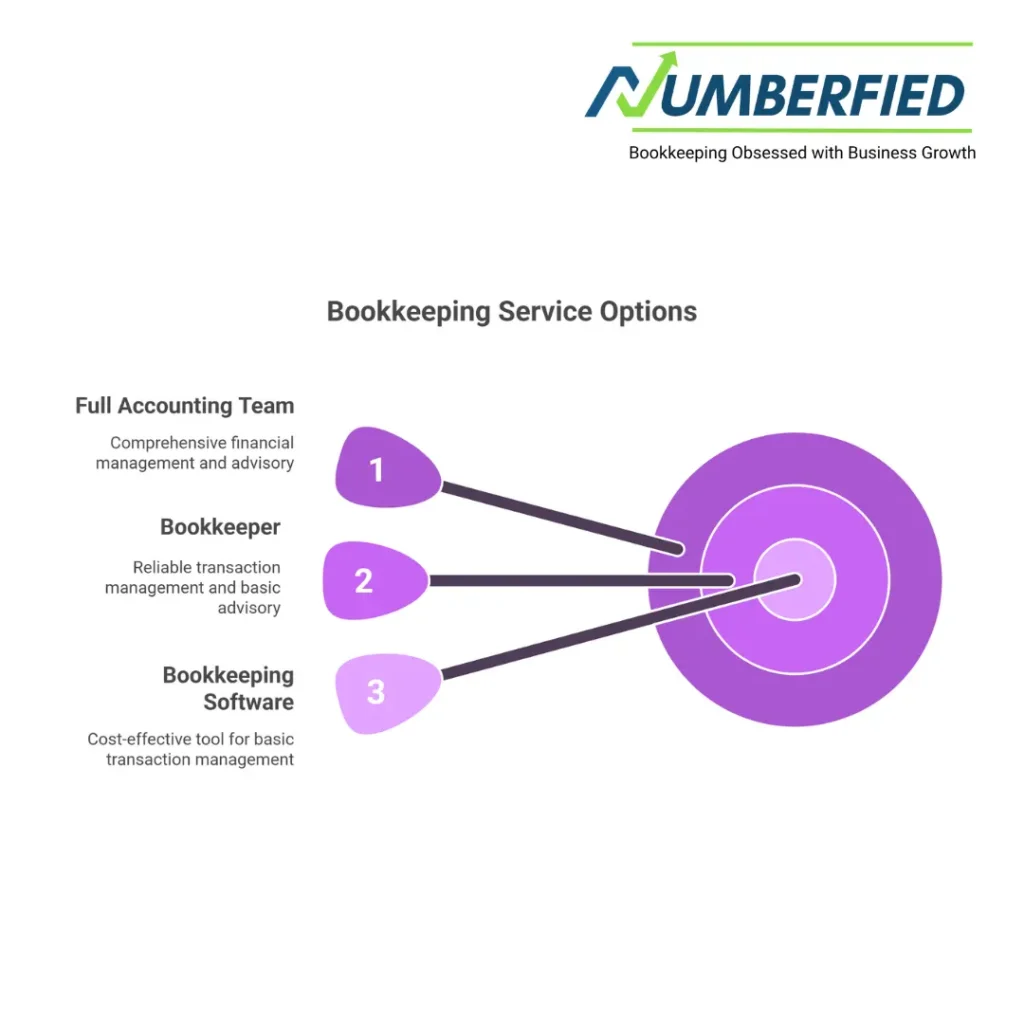

Choosing between bookkeeping software, a bookkeeper, or a full accounting team

Software: Ideal if you have time and basic accounting knowledge, bookkeeping software is a cost-effective tool for managing transactions.

Bookkeeper: Hire a bookkeeper or bookkeeping services for small businesses when you need reliable, day-to-day transaction management but limited advisory services.

Full accounting team: Choose expert accounting and bookkeeping services or outsourced accounting services when you want comprehensive financial management, payroll, tax prep, and strategic advisory to support growth.

How to measure success with accounting and bookkeeping services

Track these KPIs to evaluate performance:

- Timeliness and accuracy of monthly reconciliations and financial statements.

- Cash flow improvements and a reduction in days sales outstanding (DSO).

- Tax savings are achieved through better deductions and a tax strategy.

- Time saved by the business owner on financial tasks.

- Quality of advisory input, are you making more informed decisions based on financials?

Final recommendations

For most small businesses, outsourcing bookkeeping and accounting services pays off, especially when you want accurate financials, year-round tax prep, and professional advice that supports growth. Start by assessing your business needs, choose a provider that works with your accounting software, and trial a package that matches your transaction volume. Remember that prices typically range from $300 to $1,200/month; pick a plan that balances cost with the value of time and risk reduction.

Conclusion

If you’re a small business owner or entrepreneur seeking to streamline financial processes, minimize tax burdens, and reclaim time to focus on customers and growth, expert accounting and bookkeeping services can be a valuable asset. Schedule a free consultation today to review your bookkeeping needs, get a customized quote, and learn how a dedicated accounting team can deliver real-time financials and strategic insight to help your business thrive.

Schedule a free consultation and start optimizing your accounting and bookkeeping services now.

FAQ

What is an accounting and bookkeeping service?

Accounting and bookkeeping services manage a business’s financial records and transactions. Bookkeeping involves recording daily transactions, categorizing expenses, reconciling bank statements, and maintaining accurate ledgers. Accounting builds on this by analyzing data, preparing financial statements, providing tax advice, strategic planning, and ensuring compliance. Bookkeepers maintain financial organization, while accountants provide valuable insights and expert advice for business growth.

How much should I pay for bookkeeping services?

Small businesses typically pay between $300 and $1,200 per month for outsourced bookkeeping services, depending on the transaction volume, complexity, and any additional services such as payroll. Hourly rates range from $40 to $100. Virtual or online services (e.g., QuickBooks Live) typically start at $200–$700 per month, plus an initial setup fee.

How much does an accountant’s service cost?

Accountant services for small businesses typically cost $150–$400 per hour, with annual fees ranging from $1,000 to $5,000 for ongoing support, including tax preparation and financial advice. Costs vary by experience (CPAs charge more), location, and scope. Basic tax returns may be $500–$1,500, while full advisory services are higher.

How much should I pay someone to do my QuickBooks?

For QuickBooks-specific bookkeeping, expect to pay $200–$700 per month through services like QuickBooks Live (based on your monthly expenses), plus a potential one-time $500 cleanup fee. Freelance QuickBooks bookkeepers charge $20–$50 per hour or $300–$1,000 per month for ongoing management, depending on the business size and needs.

What falls under accounting services?

Accounting services encompass a wide range of tasks beyond basic record-keeping, including preparing and analyzing financial statements, tax preparation and planning, auditing, financial forecasting, cash flow management, budgeting, business valuations, payroll processing, and strategic advisory services like consulting on investments or compliance. While bookkeeping focuses on recording daily transactions, accounting provides deeper insights, ensures regulatory compliance, and supports informed business growth decisions.

What is included in full-service bookkeeping?

Full-service bookkeeping covers comprehensive financial management, including recording daily transactions, reconciling bank and credit card accounts, managing accounts payable and receivable, processing payroll, generating financial reports (such as profit and loss statements, balance sheets, and cash flow reports), handling invoicing and collections, and preparing records for tax filing. It often includes initial cleanup, ongoing categorization, and basic compliance support to keep your books accurate and up-to-date.

Who makes more money, a bookkeeper or an accountant?

Accountants generally earn more than bookkeepers due to their advanced qualifications, analytical role, and advisory responsibilities. Accountants (especially CPAs) focus on interpretation, tax strategy, and planning, while bookkeepers handle transactional record-keeping.

How much does an accountant service cost?

Accountant services for small businesses typically cost $150–$400 per hour, with annual fees often ranging from $1,000 to $5,000 for ongoing support, such as tax preparation and advisory services. Costs depend on complexity, location, and experience; basic services are lower, while full advisory or CPA expertise is higher.

What is a reasonable price for an accountant?

A reasonable price for a small business accountant is $150–$400 per hour or $1,000–$5,000 per year, depending on the needs. For basic tax prep and bookkeeping support, aim for the lower end; comprehensive services with advisory justify higher rates. Shop around and consider value like tax savings and insights provided.

How much does an accountant normally charge?

Accountants normally charge $150–$400 per hour for small businesses, with many offering monthly retainers of $500–$2,500 or project-based fees (e.g., $500–$1,500 for tax returns). Rates vary by credentials (CPAs are higher), location, and scope; entry-level or basic services start lower.

How much do accounting services charge?

Small business accounting services charge $150–$400 per hour on average, or $1,000–$5,000+ annually for bundled packages including bookkeeping, tax prep, and advisory. Monthly options range from $300–$2,500, depending on transaction volume and extras like payroll.

Also Read: Why Accounting and Bookkeeping Services Will Change Your Business for the Better!