Why accounting and tax services for small business matter

As a small business owner or entrepreneur, your time is limited, and your tax situation can be complex. Accounting and tax services for small business provide bookkeeping, tax preparation, advisory, payroll coordination, and year-round tax planning so you can focus on growth. Proper business accounting and tax services reduce tax liability, improve cash flow, and help you file accurate federal tax returns and state tax filings. Whether you need a bookkeeping service, a tax pro for your federal tax return, or tax advisory services to plan quarterly tax payments, choosing the right services for small businesses delivers long-term tax savings and peace of mind.

What these services include (core products and services)

Accounting and tax services for small business commonly include:

- Small business bookkeeping and reconciliations

- Tax preparation and filing for business tax and personal tax returns, including the income tax return for new clients

- Year-round tax advisory and planning to reduce tax liability and maximize deductions

- Payroll services or premium payroll services (note: some firms offer payroll as an add-on; check if payroll services are not included)

- Sales tax and state tax compliance

- Business tax audit support and IRS tax audit defense

- Tax refund optimization and tax strategy for sole proprietors and corporations

- Virtual accountant or outsourced tax preparation options

Benefits: Why invest in accounting and tax services for small business

Hiring reliable accounting and tax services for small business pays for itself in many ways:

- Tax savings: Professional tax planning and accurate tax filing reduce overpayments and identify tax deductions and credits.

- Time savings: Outsourcing bookkeeping and tax prep frees you to run operations and grow revenue.

- Accuracy and compliance: A tax professional reduces errors on your tax return and ensures federal tax and state tax compliance.

- Cash flow management: Regular business accounting and advisory services improve forecasting and tax payment planning (quarterly tax payments, payroll taxes, estimated taxes).

- Audit protection: Business tax audit support and experienced tax preparers help you respond to IRS inquiries and audits.

- Strategic advice: Advisory services go beyond filing taxes and provide long-term tax strategy, retirement planning, and growth-oriented recommendations.

DIY vs Professional: Which path is right for your small business?

DIY (When DIY can work)

Small business owners can handle basic bookkeeping and tax filing using online tax products and services, such as online tax software, when their operations are simple. If you are a single-member sole proprietor with minimal transactions and predictable income tax, tools such as TurboTax Free Edition or low-cost tax prep can work. DIY might suit those who:

- Have simple books and a few expenses.

- Feel comfortable with filing taxes and using software for income tax returns and tax filing.

- Want to minimize additional fees like tax preparation or bookkeeping service costs.

Professional (When to hire a tax professional)

Hire accounting and tax services for small business when complexity increases. Work with a tax preparer or accounting firm if you have:

- Inventory, payroll, multiple employees, or sales tax obligations.

- Complex business tax issues, mixed personal and business expenses, or high tax liability.

- Plans for hiring, seeking funding, or selling the business.

- Need year-round tax planning, advisory services, or audit support.

A tax pro can handle business tax, personal income tax return strategies, federal tax return complexities, and provide a coordinated approach to bookkeeping, tax preparation, and payroll services.

Common mistakes small business owners make

Avoid these frequent errors when managing small business taxes and accounting:

- Poor bookkeeping: Missing receipts, unrecorded transactions, and inconsistent bookkeeping lead to inaccurate tax returns.

- Mishandled payroll taxes: Salary payments and payroll taxes require careful calculation; missteps can create tax liability and penalties.

- Missing deductions: Overlooking legitimate tax deductions reduces tax savings. A tax advisor can identify industry-specific deductions.

- Late tax filing and payments: Missing tax filing deadlines or quarterly tax payments results in penalties and interest.

- Mixing personal and business funds: Not separating accounts complicates tax prep and increases audit risk.

- Assuming tax software handles everything: Software helps, but complex state tax, federal tax return nuances, and tax advisory need professional judgment.

Key features to look for in providers

When evaluating accounting and tax services for small business, look for these provider features:

- Comprehensive services: bookkeeping, tax prep, advisory, and business accounting in one place.

- Year-round tax planning: proactive tax strategy for the full tax year, not just tax season or the 2025 tax return.

- Transparent pricing: clear fees for bookkeeping service, tax preparation, and payroll, and additional fees like tax preparation for special returns.

- Audit support: access to business tax audit support and expert response to IRS tax notices.

- Technology integration: cloud accounting, online tax filing, and secure client portals for documents.

- Experienced tax experts: CPAs, enrolled agents, and tax preparers with small business tax experience.

- Advisory services: financial forecasting, tax strategy, and business growth advice.

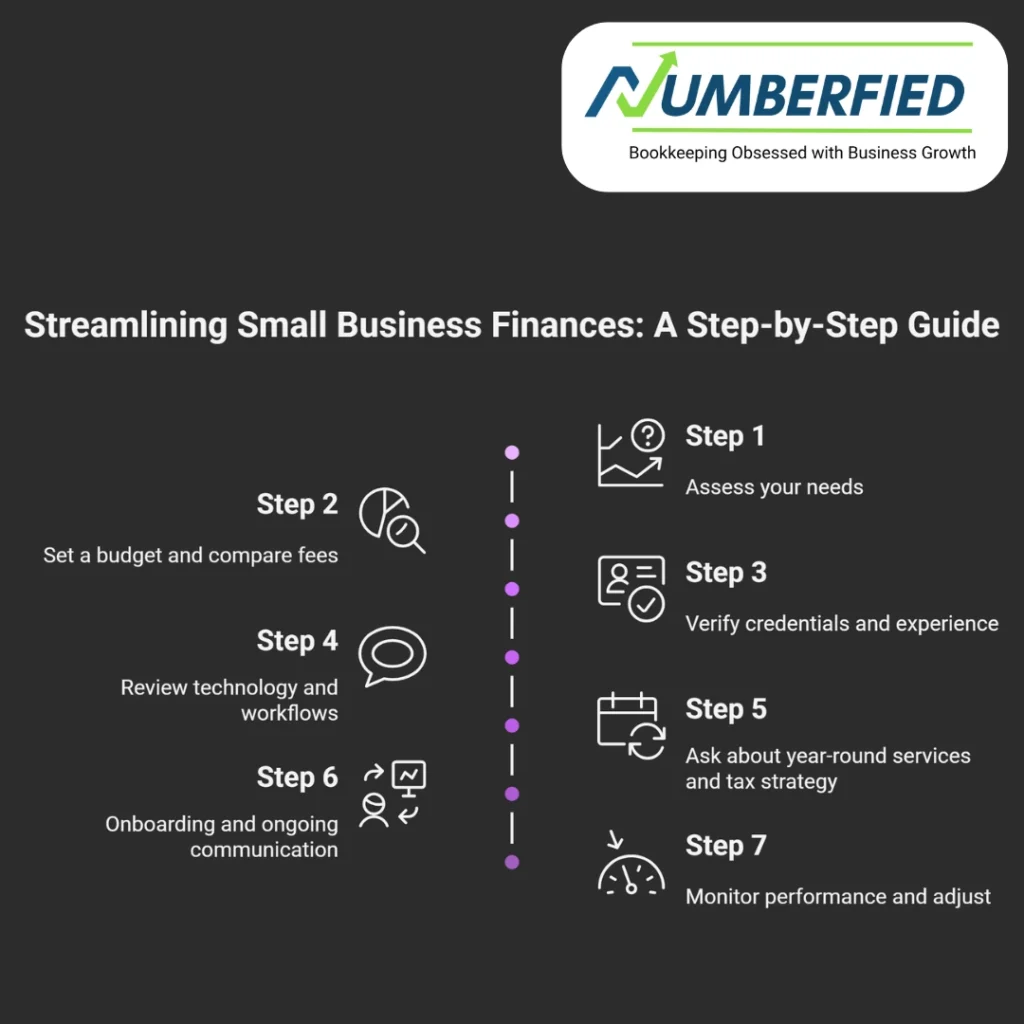

Step-by-step guide to choosing and working with accounting and tax services for small business

Step 1: Assess your needs

Start with a clear list of what you need: bookkeeping frequency, payroll or premium payroll services, sales tax filings, monthly financial statements, or tax advisory. Identify whether you need ongoing small business bookkeeping or seasonal tax prep for a particular tax year.

Step 2: Set a budget and compare fees

Understand average costs for bookkeeping services, tax preparation, and advisory services. Ask about additional fees like tax preparation for complex returns, filing taxes for new entities, or business tax audit support. Determine whether payroll services are not included or offered as part of a package.

Step 3: Verify credentials and experience

Look for tax professionals with CPA or enrolled agent status, experience with small business tax services, and references. Confirm industry experience, retail, services, or gig economy, as each has unique tax deductions and sales tax obligations.

Step 4: Review technology and workflows

Ensure the provider uses modern accounting software, secure online tax filing systems, and provides transparent access to financials. A virtual accountant or outsourced tax preparation solution can offer flexibility and remote access.

Step 5: Ask about year-round services and tax strategy

Good providers offer year-round tax planning, quarterly tax guidance, and tax advisory services to minimize tax liability and optimize tax savings. Ask about how they handle changes in your tax situation, such as hiring employees or changing entity type.

Step 6: Onboarding and ongoing communication

Plan a clear onboarding process: collect prior tax returns, set up bookkeeping, and schedule regular advisory check-ins. Confirm who handles tax filing, who will be your main contact, and the cadence of financial reviews.

Step 7: Monitor performance and adjust

Track the benefits: better cash flow, reduced tax payments, faster tax return preparation, and improved financial insights. Reassess annually to ensure the services meet evolving business needs.

How providers handle tax season, year-round planning, and audits

The best accounting and tax services for small business combine efficient tax preparation for tax season with proactive planning throughout the year. Year-round tax planning includes quarterly tax calculations, tax payment scheduling, and tax advice before major transactions. For businesses facing an IRS tax audit, choose a provider that offers business tax audit support or partners with tax attorneys to defend your returns.

Top providers and trends in 2026

In 2026, several trends shape accounting and tax services for small business:

- Increased adoption of virtual accountants and fully remote bookkeeping services for flexibility.

- Integrated platforms that combine bookkeeping, payroll, tax prep, and advisory into one subscription.

- AI-assisted accounting tools that speed up data entry and flag deduction opportunities, paired with human tax experts for quality control.

- Subscription-based pricing models that include year-round tax advisory and audit support.

Notable provider categories to consider in 2026:

- Full-service accounting firms and accounting firms focused on small business accounting offering advisory and audit support.

- Online tax and bookkeeping platforms that pair software with certified tax pros for filing taxes and preparing the federal tax return.

- Specialized tax boutiques and tax preparer services with deep expertise in niche industries and complex business tax situations.

Top providers will vary by need: a growing small business with employees might prefer a firm offering payroll services and tax planning; a solo entrepreneur may choose an outsourced tax preparation service or Turbotax Free Edition for a basic personal income tax return, then upgrade to a tax pro for complex filings.

How much will it cost, and what affects tax savings?

Costs for accounting and tax services for small business depend on the scope, including monthly bookkeeping, annual tax preparation, payroll management, and advisory services, all of which add up. While some small business bookkeeping and tax prep can be affordable, additional fees like tax preparation for complex returns, sales tax filings, and business tax audit support increase costs. Tax savings will vary based on your tax situation, eligible tax deductions, entity type, and how proactive your tax planning is. A tax advisor can quantify the potential tax savings of sole proprietor vs corporation structures and recommend strategies to lower tax liability.

Practical checklist before hiring

- Gather prior year tax returns, including federal tax returns and state tax filings.

- List payroll needs: salary payments and payroll taxes, frequency, and number of employees.

- Prepare questions about year-round tax planning, advisory services, and audit support.

- Request references and sample reports to validate small business bookkeeping quality.

- Confirm security measures for online tax filing and document storage.

Conclusion

Accounting and tax services for small business are an investment in accuracy, compliance, and future growth. Start by assessing your current tax situation and bookkeeping needs, then shortlist providers that offer comprehensive services, transparent pricing, and year-round tax planning. Prioritize firms that combine modern technology with experienced tax experts and clear audit support.

Ready to reduce tax stress and boost your business finances? Request a free consultation with an experienced accounting and tax services for small business provider today. Get tailored tax planning, accurate bookkeeping, and reliable filing for your business tax and personal tax needs. Start with a free consultation and see how year-round tax advisory can save you money.

FAQ

How much do accountants charge for small business taxes?

Most accountants charge small businesses $800–$3,500 for annual tax preparation, depending on business complexity, entity type, and services included. Simple sole proprietor returns often fall in the $800–$1,500 range, while S-corporations, partnerships, or multi-state businesses commonly cost $2,000–$3,500+.

How much do most accountants charge for taxes?

The average fee for tax preparation by accountants ranges from $500–$2,500 for individuals and small businesses. Basic 1040 returns average $500–$800, while small business returns (Schedule C, 1120S, 1065) typically range from $1,200–$2,500.

Is an accountant worth it for a small business for taxes?

Yes, an accountant is usually worth it for small businesses. They maximize deductions, ensure compliance, reduce audit risk, and often save more in taxes than their fee costs, especially for businesses with employees, inventory, or multiple income streams.

How much should a small business spend on an accountant?

A small business should budget $1,500–$5,000 annually for accounting and tax services. This covers tax prep, quarterly estimates, basic bookkeeping review, and occasional advice for higher payroll, multi-state filings, or complex entities.

How much should I expect to pay for an accountant?

Expect to pay $150–$400 per hour for accountant services, or $1,000–$4,000+ for full annual tax preparation and planning. Monthly retainers for ongoing support typically range from $300–$1,200, depending on business size and needs.

Is it worth getting an accountant to do my taxes?

Yes, it’s worth it for most people and small businesses. An accountant saves time, reduces errors, uncovers deductions, and provides peace of mind, often paying for themselves through tax savings and avoiding costly IRS penalties.

What’s the most a tax preparer can charge?

There is no legal maximum a tax preparer can charge; fees are set by the market and complexity. High-end CPAs or specialists handling complex businesses, multi-state returns, or audits can charge $5,000–$15,000+ per return in rare cases.

How much do accountants charge for small business taxes?

Accountants typically charge small businesses $800–$3,500 for annual tax preparation. Simple Schedule C returns often cost $800–$1,500, while S-corp, partnership, or multi-entity returns commonly range from $2,000–$4,000+.

How much should an accountant charge for a small business?

A fair range for accounting services for a small business is $1,200–$4,000 annually for tax preparation and basic advisory. Monthly ongoing support usually costs $300–$1,000, depending on transaction volume and complexity.

Is a CPA worth it for a small business?

Yes, a CPA is often worth it for small businesses with revenue over $100k, employees, inventory, or multi-state operations. CPAs provide higher expertise, better deduction strategies, audit representation, and long-term planning that frequently outweigh the higher fees compared to non-certified preparers.

Read Also: 9 Surprising Ways a Bookkeeping Service for Small Business Can Boost Your Success