Why accounts payable services matter for SMBs

For small to medium business owners, CFOs, and finance managers, managing the company’s accounts payable function is more than paying bills. Efficient accounts payable services reduce manual data entry, prevent duplicate or late payments, and help you optimize cash flow. Whether you choose an accounts payable service provider, accounts payable outsourcing services, or accounts payable automation software, the right approach can transform the AP department from a transactional cost center into a strategic lever for working capital and vendor relationships.

What are accounts payable services?

Accounts payable services encompass the processes, people, and technology that handle invoices, approvals, and payments to suppliers for goods and services. That includes invoice receipt and capture, validation, approvals routing, payment execution, reconciliation, and reporting. The phrase covers on-premise accounts payable process automation, online accounts payable services, and fully outsourced accounts payable processes delivered by accounts payable outsourcing companies or business process outsourcing (BPO) services.

Common deliverables from an accounts payable services company include an accounts payable solution or accounts payable software, invoice processing services, accounts payable workflow design, AP automation, and managed accounts payable operations.

Top benefits of accounts payable services

1. Reduce errors and fraud

Manual invoice processing and data entry increase the risk of duplicate invoices, incorrect payments, and fraud. AP automation and structured accounts payable outsourcing solutions use validation, three-way matching, and audit trails to significantly reduce mistakes and provide compliance-ready records.

2. Save time and focus on strategy

An outsourced accounts payable service or automated accounts payable process frees your accounts payable team from repetitive tasks, letting your finance staff focus on analysis, forecasting, vendor negotiations, and strategic projects.

3. Improve cash flow and working capital

Professional accounts payable services optimize payment timing and often enable dynamic discounting or early payment discounts. Better visibility into payables and predictable payment cycles helps CFOs improve cash flow forecasting and working capital management.

4. Standardize and streamline operations

Accounts payable outsourcing providers implement consistent processes across departments and locations. Streamlined payable workflows reduce cycle times and improve supplier satisfaction.

5. Scale without adding headcount

Growing companies can outsource accounts payable or adopt accounts payable automation software to handle increasing invoice volumes without proportional increases in staffing and office space.

In-house vs outsourced accounts payable: a clear comparison

Choosing between maintaining an internal AP department and leveraging accounts payable outsourcing depends on cost, control, complexity, and strategic priorities. Below is a practical comparison to help decision-makers weigh options.

Cost and staffing

In-house: Salaries, benefits, training, and infrastructure (scanners, automation software, accounting system integrations) add ongoing costs. Outsource: Predictable service fees often lower total cost, particularly when the outsourcing company achieves economies of scale.

Control and visibility

In-house: Full control over the accounts payable process, direct oversight of the AP process, and culture. Outsource: Service providers supply dashboards and reports; however, organizations must trust the provider and define SLAs for visibility.

Technology and automation

In-house: You may need to invest in accounts payable automation software and manage upgrades. Outsource: Many accounts payable outsourcing companies deliver an accounts payable solution with embedded automation and integrations to your accounting system.

Security and compliance

In-house: Direct control over internal controls and segregation of duties. Outsource: Reputable accounts payable service providers deploy robust security, compliance, and audit processes, but require contractual protections and due diligence.

Flexibility and scalability

In-house: Scaling may mean hiring more staff. Outsource: Payable outsourcing services can scale quickly to meet seasonal or rapid business growth.

Key features to look for in accounts payable service providers

When evaluating accounts payable services, prioritize providers that offer a blend of process expertise, automation, and reliable service delivery. Consider these must-have features:

- Invoice capture and OCR: Accurate invoice process capture and minimal manual data entry.

- Approval workflows: Configurable accounts payable workflow for multi-level approvals and auditability.

- Integration capabilities: Seamless integration with your accounting system, ERP, and banking/payment systems.

- Payment options: Support for ACH, virtual card, check, and international payment rails, plus payment automation to streamline the payment process.

- Security and compliance: SOC reports, data encryption, and controls for segregation of duties and supplier validation.

- Reporting and analytics: KPIs for invoice cycle time, exceptions, discounts captured, and cash flow impact.

- Supplier portal: Self-service for suppliers to submit invoices and check payment status, reducing inquiries to your AP department.

- Dedicated service team: A named accounts payable service contact or managed services offering for rapid issue resolution.

- Scalability and SLAs: Clear service-level agreements and proven capacity to handle growing invoice volumes.

Common challenges and mistakes to avoid

Even with the best intentions, companies encounter pitfalls when modernizing the accounts payable process. Avoid these common mistakes:

Poor process mapping

Not documenting your existing accounts payable operations leads to misaligned automation and increased exceptions. Map the AP process before implementing a new accounts payable solution.

Ignoring supplier onboarding

Failing to onboard suppliers to the new invoice process or portal increases exceptions and phone calls. A structured supplier enrollment plan reduces friction.

Underestimating change management

Finance and procurement teams must be trained on new payable systems and workflows. Neglecting change management stalls adoption and undermines expected benefits.

Choosing a one-size-fits-all vendor

Not all accounts payable outsourcing providers specialize in your industry or the complexity of your payables (e.g., high-volume supplier credits or diverse payment methods). Look for providers with relevant experience.

Failing to measure results

Without baseline KPIs, you cannot quantify improvements in invoice processing time, discount capture, or cost-per-invoice. Set targets before deployment.

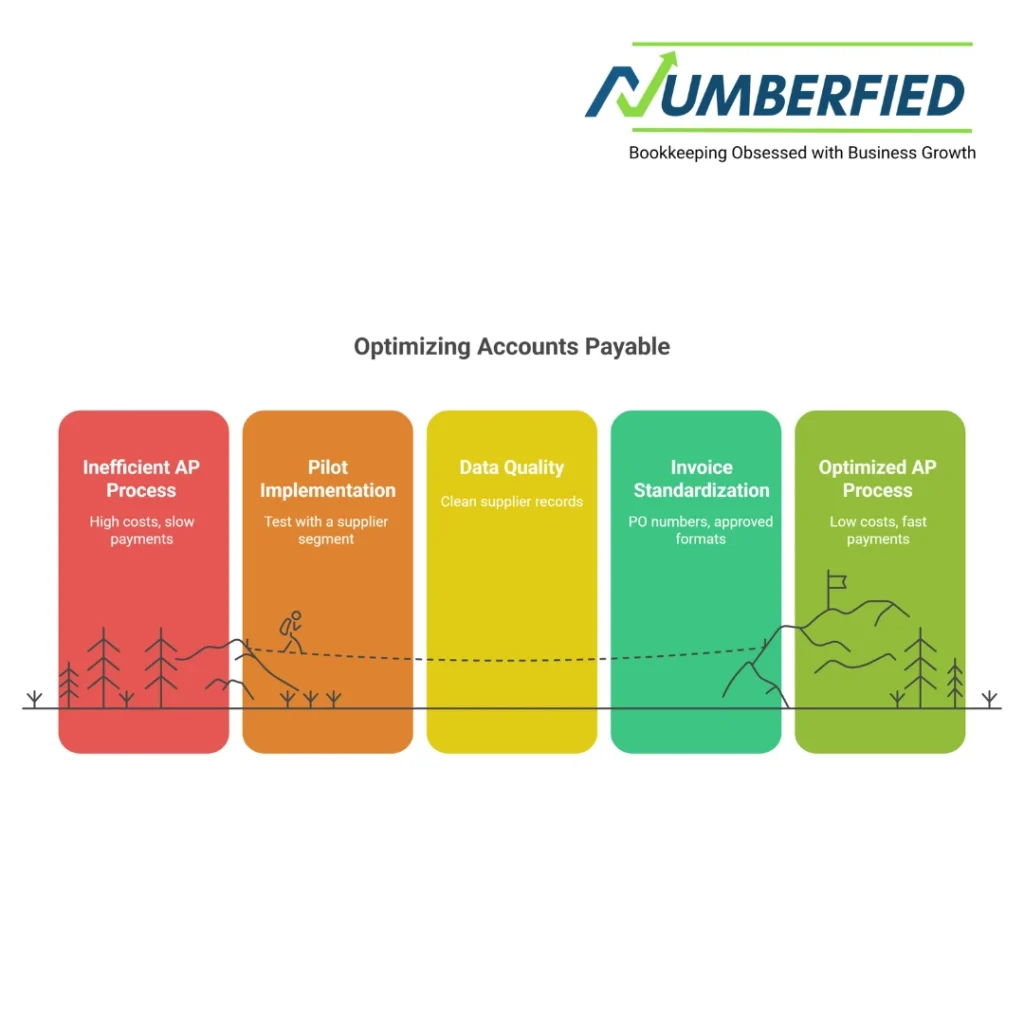

Step-by-step guide to select and implement accounts payable services

Step 1: Define objectives and scope

Clarify what you want from accounts payable services: reduce invoice cycle time, automate invoice process, improve cash flow, lower costs, or all of the above. Decide whether to outsource the entire accounts payable function, adopt software, or use a hybrid model.

Step 2: Map your current AP process

Document the accounts payable workflow from invoice receipt to payment. Identify high-volume suppliers, common exceptions, approval bottlenecks, and current cost-per-invoice metrics.

Step 3: Establish requirements and budget

Create a list of must-have features such as AP automation, supplier portal, accounting system integrations, payment rails, and reporting. Set a realistic budget for implementation and ongoing service fees.

Step 4: Shortlist providers and request proposals

Evaluate accounts payable outsourcing providers, accounts payable software vendors, and accounting service firms. Look for experience with similar companies, referenceable customers, and clear SLAs. Ask for demos showing your typical invoice scenarios.

Step 5: Pilot and measure

Run a pilot with a subset of suppliers or a single business unit. Track KPIs: invoice capture accuracy, cycle time, exceptions rate, and cost-per-invoice. Use the pilot to refine workflows and supplier onboarding approaches.

Step 6: Full implementation and change management

Roll out the accounts payable service across the organization. Provide training to the accounts payable team, approvers, procurement, and suppliers. Communicate benefits, timelines, and escalation procedures.

Step 7: Continuous improvement

Review performance against KPIs monthly and quarterly. Use analytics from your accounts payable solution to find further automation opportunities, renegotiate payment terms, or capture additional discounts.

Top providers and trends in accounts payable services

The accounts payable market includes pure software vendors, BPO providers, and hybrid service companies. Leading accounts payable automation software vendors focus on AI-driven invoice data capture, automated approval routing, and integration with popular ERPs and accounting systems. Accounts payable outsourcing companies combine human-led exception processing with automation to handle complexity and maintain a low cost-per-invoice.

Key trends to watch:

- AP automation and AI: Machine learning improves invoice recognition, categorization, and exception prediction to further reduce manual work.

- Payment innovation: Virtual cards and automated payments increase security and often generate rebates or cashback opportunities.

- End-to-end accounts payable outsourcing: Providers are offering integrated invoice-to-pay services, including supplier onboarding and payment reconciliation.

- Cloud integration: Seamless connections between accounts payable software and ERP systems speed up month-end closes and improve data accuracy.

- Focus on supplier experience: Self-service portals and clear payment timelines reduce inquiries and disputes.

How accounts payable services improve cash flow and financial control

The accounts payable process directly impacts working capital. Effective accounts payable services enable you to:

- Optimize payment timing to retain cash longer without harming supplier relationships.

- Capture early payment discounts through automated discounting workflows.

- Improve visibility into upcoming obligations for better cash forecasting.

- Reduce leakage from duplicate or erroneous payments.

- Centralize payables for improved negotiation leverage with suppliers.

These outcomes support a company’s finance and accounting goals and improve partnerships with suppliers of goods and services.

Practical tips to get the most from your accounts payable service

- Start small: Pilot with a segment of suppliers before a full rollout to minimize disruption.

- Enforce master data quality: Clean supplier records reduce exceptions and payment errors.

- Standardize invoice requirements: Require PO numbers, approved formats, and preferred delivery methods.

- Benchmark costs and cycle times: Know your baseline so you can quantify savings and improvements.

- Prioritize automation for high-volume, low-value invoices to maximize ROI.

- Create an internal SLA with approvers to keep the approval process timely and predictable.

Measuring success: KPIs for accounts payable services

Track these KPIs to evaluate the performance of your accounts payable service:

- Cost per invoice processed

- Average invoice cycle time (receipt to payment)

- Percentage of invoices processed electronically

- Discounts captured versus available

- Number of exceptions per 1,000 invoices

- Supplier inquiry volume

Decision checklist: Is it time to outsource or automate?

Consider these indicators that signal a need for accounts payable services:

- Rising invoice volumes without proportional staff increases

- Chronic late payments or missed discounts

- High error rates and duplicate payments

- Excessive time spent on manual data entry and reconciliations

- Poor visibility into upcoming payables is impacting cash flow decisions

Conclusion

Modern accounts payable services, whether delivered by accounts payable software, accounts payable outsourcing solutions, or a blended model, offer tangible benefits for small and medium businesses. By automating invoice process steps, streamlining the AP process, and leveraging experienced accounts payable service providers, organizations can reduce costs, improve cash flow, and redeploy finance resources to higher-value activities. Thoughtful selection, a pilot-driven implementation, and continuous measurement are the keys to realizing these gains.

Next step: Request a free consultation

If your company’s accounts payable operation is consuming too much time, creating cash flow uncertainty, or generating costly errors, take the next step. Request a free consultation with an experienced accounts payable services provider to evaluate your current AP process, quantify potential savings, and design an accounts payable outsourcing or automation roadmap tailored to your needs. Streamline your payable systems, reduce manual work, and improve financial control. Start today.

FAQ

What is accounts payable service?

Accounts payable service refers to the process or outsourced function of managing a company’s bills, invoices, and payments to vendors and suppliers. It includes receiving invoices, verifying them, processing payments, and recording transactions accurately in the financial system.

What is an example of accounts payable?

An example of accounts payable is the amount a company owes to a supplier for office supplies delivered on credit, such as a $2,000 invoice due in 30 days that is recorded as a liability until paid.

What are the four functions of accounts payable?

The four main functions of accounts payable are invoice receipt and verification, approval workflow management, payment processing (checks, ACH, wire), and accurate recording of liabilities and expenses in the accounting system.

What are the duties of accounts payable?

Duties of accounts payable include receiving and matching invoices to purchase orders, obtaining approvals, preparing and issuing payments, reconciling vendor statements, maintaining vendor records, and ensuring timely payments to avoid penalties.

What skills are needed for accounts payable?

Key skills for accounts payable include strong attention to detail, proficiency in accounting software, good organizational abilities, basic understanding of financial principles, communication skills for vendor interactions, and accuracy in data entry.

How much do AP accountants make?

AP accountants (accounts payable specialists) typically earn between $45,000 and $65,000 annually in the US, depending on location, experience, and company size, with an average of around $55,000.

Is an AP specialist a stressful job?

Yes, AP specialist roles can be stressful due to tight payment deadlines, high volume of invoices, vendor pressure, and the need for absolute accuracy to avoid financial errors and penalties.

Is accounts payable a stressful job?

Accounts payable can be stressful, especially during month-end closings, high transaction volumes, or when dealing with payment disputes and tight cash flow situations, but stress levels vary by company and role.

What skills do you need to be an accounts payable specialist?

To be an accounts payable specialist, you need strong attention to detail, proficiency with accounting software (e.g., QuickBooks, SAP), good time management, basic accounting knowledge, communication skills, and accuracy in processing invoices and payments.

Is accounts payable a dying field?

No, accounts payable is not a dying field; while automation is increasing, the need for human oversight, vendor relations, exception handling, and compliance ensures AP roles remain essential in businesses.

Read Also: 7 Insider Tips to Simplify Your Finances with QuickBooks Bookkeeping Services for Small Businesses