Profit is a theory. Cash is a fact. You can look at a P&L statement that shows a healthy six-figure net income and still struggle to make payroll on Friday. This is the paradox of growth. As you scale, your operations expand. Your expenses rise. But if your collections process lags behind your sales velocity, you enter the liquidity trap. You are essentially offering zero-interest loans to your customers while paying interest on your own lines of credit.

It is unsustainable.

Most founders treat collections as an administrative afterthought. They assign it to an overburdened office manager or a junior bookkeeper. This is a strategic error. By utilizing professional accounts receivable outsourcing services, you aren’t just offloading data entry. You are deploying a strategic liquidity mechanism. You are prioritizing cash inflow. You are deciding that your business deserves to be paid for the value it provides. Fast.

Key Takeaways

- Strategic Liquidity: Move beyond cost-cutting. Learn how outsourcing AR acts as a funding mechanism for growth.

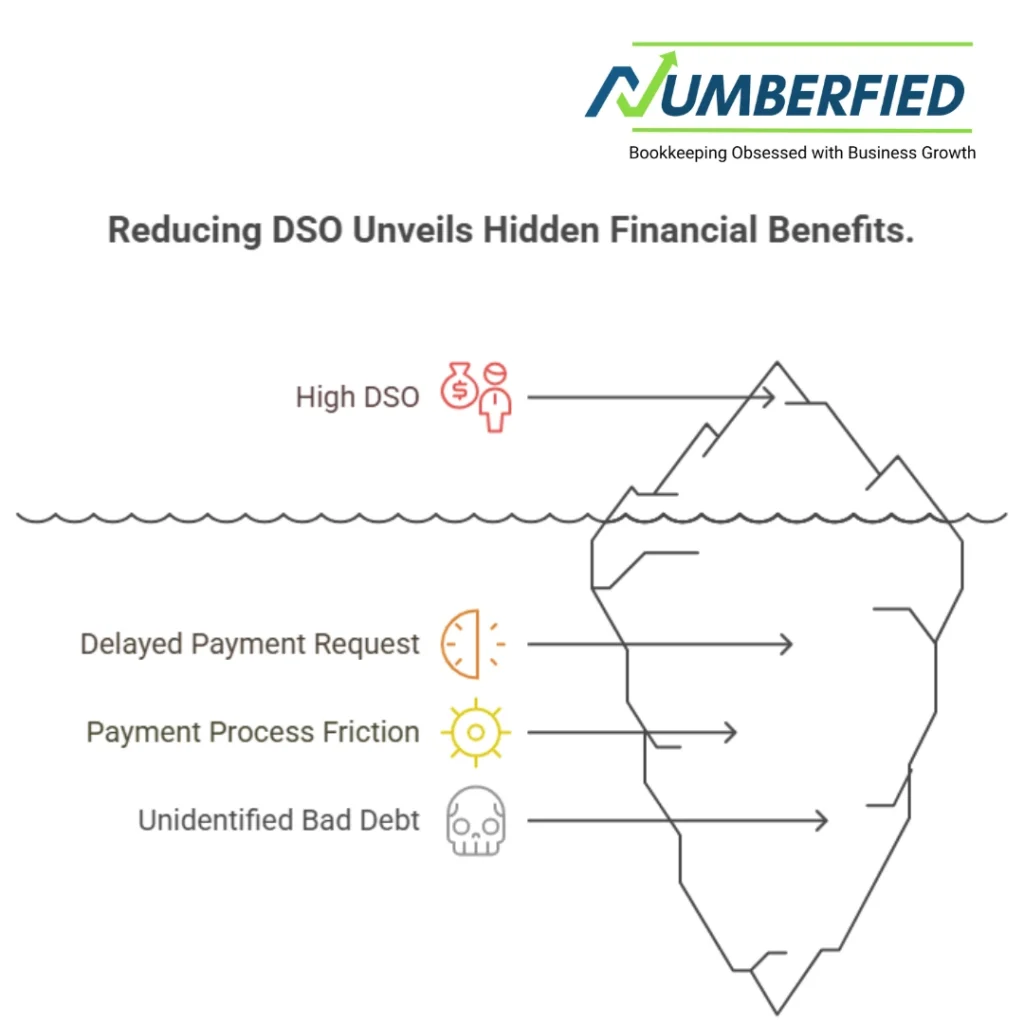

- DSO Compression: Understand the mathematical impact of reducing Days Sales Outstanding on your working capital.

- Relationship Preservation: Discover why a third-party buffer actually strengthens client relationships rather than hurting them.

- Capital Efficiency: See how accessing your own cash eliminates the need for expensive external debt.

The Liquidity Trap: Why In-House AR Often Fails

Founders often believe nobody cares about their money as much as they do. That is true. However, caring about money and having the bandwidth to chase it are two different things. In-house AR management usually suffers from a lack of consistency.

When business is good, you focus on delivery and sales. Invoicing gets delayed. Follow-ups are forgotten. Suddenly, you realize you have 90-day overdue invoices. Panic sets in. You stop selling to chase cash. This creates a “feast or famine” revenue cycle that cripples stability.

Internal teams rarely prioritize collections. It is an uncomfortable task. Asking for money feels confrontational. Consequently, your staff avoids it. They send passive emails. They hope the client pays voluntarily. Hope is not a strategy. The result is a bloated aging report and a stressed bank account. Professional management removes emotion from the equation. It replaces hesitation with protocol.

How Accounts Receivable Outsourcing Services Function as a Strategic Asset

We need to redefine what this service actually is. It is not just someone sending emails for you. Accounts receivable outsourcing services provide a systematic infrastructure for revenue realization. This involves a dedicated team that operates on a strict cadence.

The process begins before the invoice is even overdue. It starts with verification. Did the client receive the invoice? Is the purchase order number correct? These small administrative hurdles cause 80% of payment delays. An outsourced team clears these roadblocks immediately.

They implement a structured dunning process. This is a series of escalating communications designed to prompt payment without aggression. It ensures that your company stays top-of-mind for the accounts payable department of your client. You become the squeaky wheel that gets the grease. Yet, the squeaking is polite, professional, and persistent. This consistency is impossible to replicate with an internal team distracted by other duties.

The Protocol of Persistence

Consistency wins. The outsourced team does not get busy with other projects. Their only project is your cash flow. They log every interaction. They track promises to pay. If a client says “check is in the mail,” they follow up in three days to verify. This level of scrutiny signals to your clients that you are serious about your financial operations.

Compressing Days Sales Outstanding (DSO)

DSO is the most critical metric you are probably ignoring. It measures the average number of days it takes for you to collect payment after a sale.

Let’s look at the math. If you turnover $2 million a year, every single day of DSO is worth roughly $5,479. If your current DSO is 60 days, you have nearly $330,000 sitting in other people’s bank accounts. If you reduce that to 40 days, you put $110,000 back into your operating account.

That is $110,000 you don’t have to borrow. It is capital you can use to hire a new salesperson. You can buy inventory in bulk for a discount.

Outsourcing drives this number down aggressively. We have seen companies drop their DSO by 30% within the first quarter of engagement. This is not magic. It is simply the result of shortening the gap between service delivery and payment request. It minimizes the friction in the payment process. Speed is currency.

Identifying Bad Debt Early

A lower DSO also highlights problems faster. If a client isn’t paying at 45 days, you know immediately. You can stop work. You limit your exposure. In-house teams often let non-paying clients rack up huge bills before flagging the issue. Outsourcing mitigates this risk.

The Psychology of the “Neutral Third Party”

There is a massive misconception that outsourcing collections damages client relationships. The opposite is true.

When you or your sales team chase money, it sours the relationship. You are the “good guy” who solves their problems. You cannot also be the “bad guy” demanding a check. It creates cognitive dissonance. It makes future sales calls awkward.

An outsourced provider acts as a neutral buffer. We are the “bad cop.” But we are a professional bad cop. This allows you to maintain the role of the ally. When a client complains about a collections call, you can sympathize. You can say, “I’m so sorry, the finance team is very strict about protocol. Let me see if I can buy you a few more days.”

You become the hero. You save the relationship. Meanwhile, the invoice gets paid because the “finance team” (us) stays firm. It compartmentalizes the friction. It preserves the commercial trust while enforcing financial discipline.

Financing Growth Without Debt

Capital has a cost. Equity is the most expensive form of capital. You give up ownership. Debt is cheaper but carries risk and interest payments. Revenue is the cheapest form of capital. It is already yours. You just have to collect it.

Many businesses take out lines of credit to bridge cash flow gaps caused by slow-paying clients. You pay 8% or 10% interest to cover expenses because your client is taking 60 days to pay. You are effectively paying a penalty for their inefficiency.

By accelerating collections through outsourcing, you reduce your reliance on external funding. You become self-funding. This strengthens your balance sheet. It makes you more attractive to investors if you ever do decide to raise capital. They see a tight ship. They see efficient working capital management. They see a business that controls its own destiny.

Integration and Tech-Enabled Efficiency

Modern outsourcing is not a call center with rotary phones. It is a tech-enabled extension of your ERP.

Agencies like Numberfied integrate directly with Xero, QuickBooks, or NetSuite. We work inside your ledger. The data is real-time. When a payment lands in your bank, we reconcile it immediately. The dunning emails stop automatically. There is no crossover. There is no confusion.

Reporting and Transparency

You gain visibility you never had before. instead of a vague sense that “people owe us money,” you get granular reports.

- Who are the chronic late payers?

- Which sales rep brings in the clients with the worst credit?

- What is the exact aging forecast for next month?

Data drives decisions. You might realize that a certain client is not profitable because the administrative cost of collecting from them wipes out the margin. You might adjust your credit terms. You stop flying blind. You start managing your cash flow with the same precision you manage your product.

Conclusion

Cash flow is the oxygen of your business. You can survive without profit for a while. You cannot survive without cash for a day. Keeping your collections process in-house often restricts that oxygen supply. It traps your hard-earned revenue in a cycle of inefficiency and hesitation.

By moving to a professional model, you do more than save on administrative wages. You accelerate the velocity of money through your company. You separate the sales relationship from the financial obligation. You fund your own growth. It is time to stop acting as a bank for your customers. It is time to bring your capital home where it belongs.

Frequently Asked Questions

Will outsourcing collections make my clients angry?

No. Professional persistence is expected in business. We treat your clients with respect while enforcing the terms they agreed to.

Is this only for large corporations?

No. Small businesses actually suffer more from cash flow gaps. If you have over $500k in revenue, you likely need this.

Do I lose control over my accounting file?

Never. We work within your existing systems. You maintain full access and authority over your data at all times.

How quickly will I see a reduction in DSO?

Usually within 30 to 45 days. The immediate impact comes from clearing the backlog of ignored invoices.

Can’t I just use automation software?

Software sends emails. People ignore emails. You need a human element to handle disputes and verify receipt.

Ready to Fix Your Cash Flow?

Stop chasing. Start growing. Let Numberfied handle the awkward conversations so you can focus on closing the next big deal. Book Your Free Growth Strategy Meeting Today

Also Read: Why Numberfied’s Accounting & Bookkeeping Services Outsourcing Is Your Business’s Secret Weapon