Introduction

Bookkeeping for real estate is the backbone you rarely see until it breaks. A tenant mails a rent check, a plumber fixes a leak, you close on a fixer-upper, and each move leaves a financial fingerprint: Miss one, and your profit picture blurs. Numberfied records every print, cleans the data, and delivers reports that let you act before the market shifts.

Key Takeaways:

- One overlooked expense can erase a month’s gain.

- Fresh entries every day beat frantic fixes at year-end.

- We log the details; you chase the deals.

Why Bookkeeping for Real Estate Drives Every Decision

Bookkeeping for real estate is the daily habit of capturing income, expenses, and everything in between. Skip it, and you fly blind; nail it, and you steer with precision.

Stop Money Leaks in Their Tracks

Last week, a tenant paid $50 cash for a garage remote. You stuffed it in your pocket and forgot. Bank balance looks $50 short, profit report is off by the same. One line in the books, “Tenant Reimbursement – Garage Remote – Unit 5”, fixes the gap and proves the income if anyone asks.

Measure Profit Door by Door

Your six-unit on Maple clears $1,800 after utilities and repairs. The eight-unit on Cedar costs you $400 to maintain. Side-by-side columns in your ledger show Maple funds the next purchase, while Cedar needs a rent bump or a new manager. Without per-property tracking, you guess and hope.

Build Reserves That Actually Work

Winter storms hit hard. Last year’s roof repairs totaled $3,200 across three buildings. Your books flagged the pattern, so you set aside $250 monthly into “Roof Reserve.” When hail dents shingles this February, the money waits, no credit card scramble, no delayed fixes.

Build a Bookkeeping System That Sticks

A one-time setup for bookkeeping for real estate saves weeks of cleanup later. Numberfied configures it to match how you work.

Choose Software That Fits in Your Pocket

You inspect a rental at 10 a.m., spot a cracked window, and call the glazier on site. Snap the quote with your phone; the app reads the total, tags “Window Repair – 212 Oak – Unit 3,” and files the PDF. By lunch, the entry lives in the cloud, ready for the invoice when it arrives.

Create Accounts You Recognize Instantly

Forget generic “Expense 101.” Use “Electric – 456 Pine,” “Management Fee – All Properties,” “Capital Improvement – New HVAC 2025.” When you open the chart at 11 p.m. after a long day, the labels tell the story without a decoder ring.

Make Entry a Non-Negotiable Daily Ritual

Bank notification pings at 2:17 p.m., rent from Tenant Jones. Open the app, select “Rent Income – Unit 2A,” type the amount, and hit save. Ninety seconds. Do it for every deposit, every vendor payment, every reimbursement. The pile never grows.

Master Rent Collection and Expense Tracking

Cash flow is the heartbeat of real estate. Bookkeeping for real estate keeps the pulse steady and visible.

Capture Every Tenant Transaction in Full Context

Rent arrives via Venmo, ACH, paper check, or cash. Record the exact amount, payment date, unit, and any notes like “Applied to March + late fee.” A tenant disputes a charge six months later; your ledger shows the original entry and receipt scan. Dispute settled in minutes.

Manage Security Deposits Like a Fiduciary

Move-in day: $1,200 deposit hits the bank. Post it to “Security Deposits Payable – Tenant Smith – Unit 4B.” Move-out inspection finds $180 in carpet stains; deduct with photos attached, refund $1,020 by check. The liability drops to zero, the books balance, and you stay compliant with state law.

Tie Every Repair Dollar to the Right Property

The plumber bills $620 for a water heater in the basement of 789 Elm. Enter the cost under “Plumbing – 789 Elm – Common Area,” attach the invoice, and note the work order number. Next quarter, you see plumbing spiked 40% at that address, it’s time to inspect pipes before the next failure.

Navigate Property Purchases and Sales Seamlessly

Closing day generates a blizzard of numbers. Bookkeeping for real estate organizes the storm.

Record the Complete Acquisition Cost from Day One

Offer accepted at $320,000. Add $1,800 title policy, $550 appraisal, $400 home inspection, $2,100 in points. Total capitalized cost: $324,850. Start 27.5-year depreciation on the closing date. Your balance sheet reflects true value from hour one.

Close the Books on Sales the Same Week

Buyer wires $355,000. Pay 6% commission ($21,300), staging cleanup $1,200, concession for new carpet $3,500. Net proceeds $329,000 hit your operating account. Update the asset sale, remove the property from active tracking, and calculate gain for the CPA, all before the celebratory dinner.

Track Mortgage Details Down to the Payment

New loan: $240,000 at 7.25%, 30 years. First payment splits $1,450 interest, $382 principal, $300 escrow. Enter each piece separately. When the lender bumps escrow for rising insurance, adjust the template next month. You always know exactly where the dollars land.

Turn Tax Season into a Checklist

April 15 becomes another Tuesday when bookkeeping for real estate stays current.

Harvest Every Deduction the IRS Allows

Drive 42 miles to a new listing, log mileage at standard rate. Buy stamps for lease mailings, scan the receipt. Home office supplies, continuing education, even the coffee you grab on the way to a closing, all categorized, all exportable. Last client claimed $6,200 more than the year before.

Nail Quarterly Estimates Without Panic

March 10: run a profit-and-loss for January–March. Net $18,400; 25% safe harbor = $4,600 due March 15. Write the check, mark it paid in the books. Repeat June, September, and January. No underpayment penalty, no January surprise.

Deliver CPA-Ready Files in One Click

Export a CSV with columns for date, description, category, amount, and property tag. Include a PDF bundle of every receipt. Your accountant opens the file, nods, and starts optimizing instead of organizing.

Let Technology Handle the Grind

Modern tools shrink bookkeeping for real estate from hours to minutes.

Store Everything in the Cloud, Access Anywhere

Bank feed updates while you wait for the locksmith at a vacant unit. Change a category from your phone during your kid’s soccer practice. Automatic nightly backups mean a spilled coffee never wipes out a year of work.

Automate Recurring Entries Once

Rent posts the 1st for 12 units, mortgage drafts the 5th, and quarterly HOA fee hits the 15th. Set the template once; the software runs it monthly. You review exceptions, not every line.

Generate Reports That Answer Real Questions

One click: “Show profit per property last 12 months.” Another: “Graph maintenance costs by building.” A third: “Forecast cash balance if vacancy rises 10%.” Numbers become strategy.

Avoid the Pitfalls That Sink Portfolios

Common slip-ups kill accuracy. Bookkeeping for real estate stays healthy when you sidestep them.

Keep Personal and Business Money in Separate Universes

Business card for paint, personal card for dinner. Accidentally buy groceries on the wrong plastic? Transfer the exact amount back the same day with memo “Reimbursement – Personal.” IRS never sees overlap.

Reconcile Bank Statements the Day They Drop

First of the month: download PDF, open ledger, check off cleared items. Uncleared deposit from last month? Chase it. NSF fee? Reverse the entry. Twenty minutes prevents a month of drift.

Log Even the $9 Notary Fee.

Business expense, deductible, and it adds up across 20 closings a year. Scan the receipt, tag “Closing Costs – 101 Maple,” done. Small lines keep big pictures honest.

Scale Bookkeeping as Properties Multiply

Ten units today, fifty tomorrow, bookkeeping for real estate expands without exploding.

Onboard New Assets in Under an Hour

Buy a fourplex? Duplicate the chart from your last purchase, rename accounts “Rent – 555 Birch – Unit 1,” etc. Import the prior owner’s rent roll. Historical data merges seamlessly.

Add Hands Before the Workload Crushes You

Sixteen units push nightly entries past midnight. Numberfied takes over data entry and month-end close. You review summaries and sign off, strategy time reclaimed.

Audit the System Every Off-Season

January lull: delete inactive vendors, archive sold properties, tighten user permissions. Add new loan accounts for the refinance you closed in December. Clean books greet the spring rush.

Link Ledger to Long-Term Wins

Bookkeeping for real estate is not paperwork; it’s intelligence.

Project Cash Six Months Out

Last July, vacancy hit 18%; you lost $4,200. Books show the dip, so you bank extra in May and June. August refinance sails through because reserves prove stability.

Rank Every Holding by Net Return

Unit 3C clears $1,100 profit; Unit 3A costs $220 to maintain. Data says renovate 3A or convert to a short-term rental. You act, profits climb.

Walk into Financing Meetings Armed

The lender wants three years of schedules. Hand over clean profit-and-loss, balance sheets, and per-property summaries. Approval comes faster at a lower rate.

Outsource to Experts and Reclaim Your Life

Numberfied runs bookkeeping for real estate, so you run the empire.

Speak the Language of Closings and Cap Rates

We handle prorated rent at acquisition, escrow impounds, 1031 timelines, and cost-segregation studies. Questions get answers in minutes, not manuals.

Swap Data Entry for Deal-Making

We post transactions nightly, reconcile weekly, and report monthly. You spend the saved hours negotiating the next off-market duplex.

Make Offers With Zero Doubt

Earnest money check for $15,000? Ledger shows $28,000 in liquid. You write the offer at 7 p.m., sleep fine, and close 30 days later.

Conclusion

Bookkeeping for real estate transforms scattered receipts into a clear path forward. Enter daily, automate the repeats, review weekly, and partner with Numberfied when volume demands it. Your portfolio deserves records as solid as the foundations. Visit https://numberfied.com/ today and hand us the books, and watch your business run smoother tomorrow.

FAQs

What does a full day of bookkeeping for real estate actually involve?

Morning: scan three vendor invoices from yesterday, confirm four rent deposits via bank feed. Afternoon: enter mileage from two showings, approve automated mortgage draft. Evening: five-minute review of new entries. Total time: 12 minutes spread across the day, but the file stays perfect.

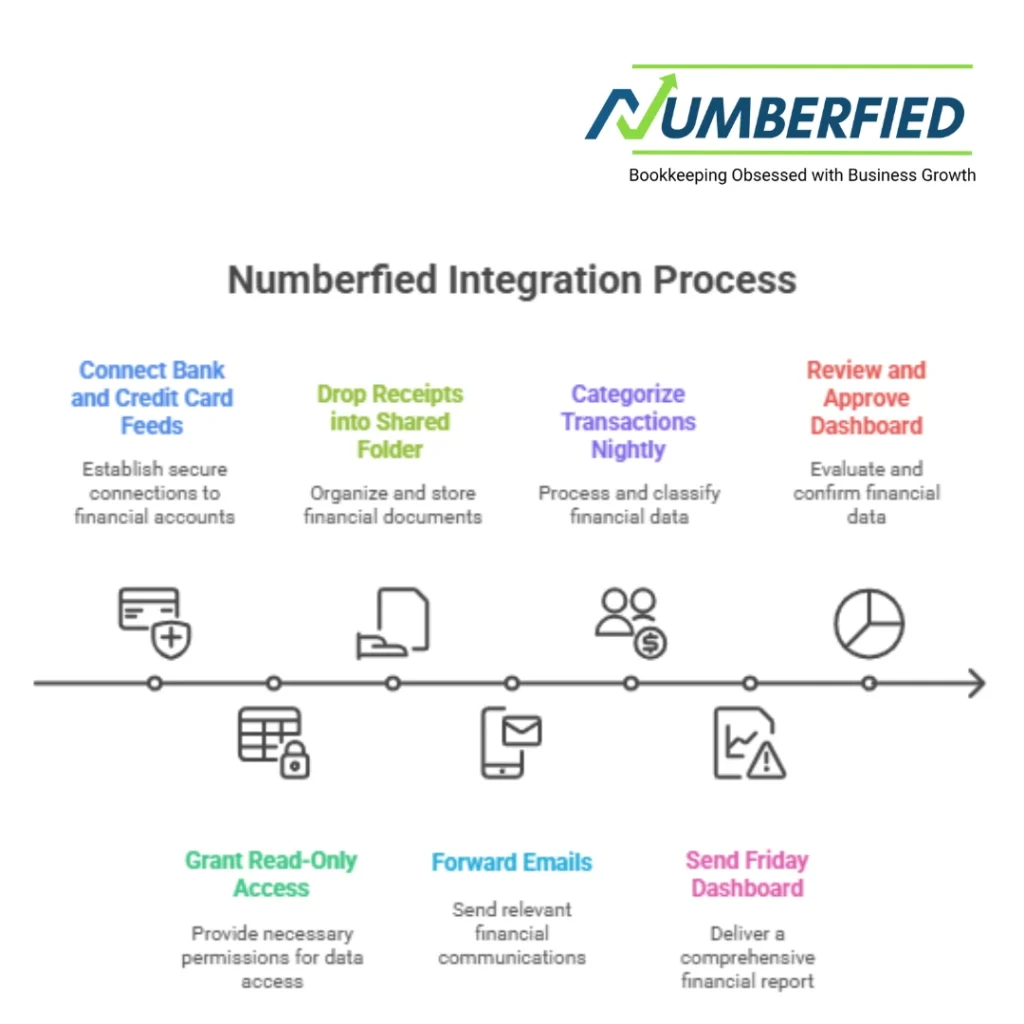

How exactly does Numberfied integrate with my current bookkeeping for a real estate setup?

Connect your bank and credit card feeds; grant read-only access. Drop receipts into a shared folder or forward emails. We categorize nightly, send a Friday dashboard with profit per property, and a cash forecast. You click “looks good” or flag questions. Zero disruption, full visibility.

What specific features separate great bookkeeping for real estate software from the rest?

Automatic bank import that tags by property, receipt OCR that reads handwritten totals, per-unit profit dashboards, and one-click Schedule E export. The mobile app must let you photograph a quote on site and file it before you leave. We test three platforms against your workflow and install the winner.

When during the day should I post updates to bookkeeping for real estate?

The moment money moves. Rent Zelle at 9:03 a.m., log at 9:05. Vendor emails invoice at 2:17 p.m., enter before 2:30. Fresh memory beats reconstructed guesswork, and the ledger never lags behind reality.

Can consistent bookkeeping for real estate actually reduce my tax bill?

Absolutely. Every logged expense, mileage, supplies, repairs, and even cell phone percentage, becomes a deduction. One client tracked $7,300 in previously forgotten items; CPA turned it into a $2,100 refund. The habit pays for itself.

Which bookkeeping mistakes for real estate create the biggest headaches down the road?

Commingling funds and skipping reconciliations lead the pack. Personal charges on business cards trigger IRS scrutiny; unreconciled statements hide errors until audit time. Both unravel months of work. We catch them early with daily feeds and monthly double-checks.

How do I maintain a clean wall between personal and business in bookkeeping for real estate?

Dedicated checking account and credit card for property only. Personal purchase slips through? Transfer the exact amount back the same day with memo “Reimbursement – Groceries 3/15.” Monthly statement review flags any overlap before it grows.

What three reports should I pull every month from bookkeeping for real estate?

- Profit-and-loss by property shows who earns, who drains.

- Cash balance forecast for the next 90 days, flags shortfalls.

- Expense breakdown by category reveals rising insurance or maintenance trends. Three pages tell the whole story.

Is outsourcing bookkeeping for real estate financially smart for a 12-unit owner?

Most owners spend 8–10 hours monthly on books. At $150/hour opportunity cost, that’s $1,200–$1,500 lost revenue. Our fee runs half that and includes error-proofing plus deduction hunting. Clients close one extra deal a year and call it even.

What concrete steps does Numberfied take to eliminate errors in bookkeeping for real estate?

Bank feed auto-matches 90% of transactions; we manually verify the rest. Two team members review the month-end close. We lock files after your approval. Quarterly audit compares random samples to source documents. Errors surface and die before they reach you.

Read Also: 7 Insider Tips to Simplify Your Finances with QuickBooks Bookkeeping Services for Small Businesses