Introduction

You lock the door after a smooth closing, keys in hand, ready to celebrate. Then the email hits: the tenant in Unit 3 needs a new water heater, and you have no idea if the repair fund covers it. Moments like these highlight why bookkeeping for real estate business matters every single day. At Numberfied, we step into exactly those scenarios for landlords, flippers, and brokers nationwide. We sort the chaos, deliver clear reports, and free you to chase the next opportunity. This guide walks you through proven fixes you can start today, plus the clear reasons to bring us on board when the workload climbs.

Key Takeaways:

- Enter transactions daily to avoid weekend catch-ups.

- Tag every dollar to a specific property from day one.

- Monthly reports reveal hidden profits and risks.

- Numberfied handles the details so you handle the deals.

Why Bookkeeping for Real Estate Business Keeps You Ahead of the Game

Good records do more than check boxes. They guide every move you make with properties.

Know Which Units Pay Their Way

Take two duplexes side by side. One clears the mortgage plus extra each month; the other fights to cover taxes. Bookkeeping for real estate business breaks down income and costs per door. You see the numbers clearly. That knowledge lets you raise rent on the strong performer, plan upgrades for the weak one, or list it for sale at the right time. Owners who track this way sell faster and negotiate from strength because buyers trust the data.

Stay Ready for Loans or Partners

A local bank offers a great rate on a fourplex refinance, but they need two years of schedules showing net income per unit. You pull the files, email them in minutes, and lock the rate before it rises. That speed comes from consistent entries and reconciled accounts. Partners feel the same confidence when you share clean profit-and-loss statements before signing a joint venture agreement. Trust in the numbers opens more doors than any sales pitch.

Catch Small Problems Before They Grow

Last month, the utility bill for the eight-unit building jumped. A quick look at the ledger shows the increase started three months ago. You call the city, discover a meter error, and save on future bills. Bookkeeping for real estate business flags these shifts early. Left unchecked, the overcharge could have eaten thousands before anyone noticed. Early detection keeps cash in your pocket and prevents surprises during tax reviews.

Typical Headaches in Bookkeeping for Real Estate Business

Every property pro hits these walls. Spot them, name them, and knock them down.

Mixed-Up Income Sources

Rent rolls in on the first, a closing commission hits on the fifteenth, and a vendor refund appears randomly. Dump them all in one checking account, and the picture blurs. Bookkeeping for real estate business fixes this by creating separate income lines for each stream. Rent goes to “Rental Income – 123 Main St,” commissions to “Sales Fees,” and refunds to “Miscellaneous.” At month-end, you see exactly what each source contributes. No more guessing where the money came from or why cash feels tight despite full occupancy.

Forgotten Receipts on the Go

You stop at the supply store for paint after a showing, pay cash, and toss the receipt in the truck console. Three weeks later, you need it for the renovation budget, and it is gone. The fix starts with your phone. Snap a photo the moment you pay, upload it to the cloud folder labeled for that property, and tag the expense. Five seconds at the register saves hours of hunting later. Agents who adopt this habit never miss a deduction and always know the true cost of each project.

Vacancy Swings That Blindside You

June fills every unit at premium summer rates; December leaves four empty in the student housing complex. Without tracking, you spend the fat months and scramble in the lean ones. Bookkeeping for real estate business tracks occupancy percentages month by month. You spot the pattern, set aside three months of expenses during peak season, and weather the dip without tapping personal savings or credit lines. Landlords who plan this way expand portfolios faster because lenders see the reserves and approve larger loans.

Tools That Make Bookkeeping for Real Estate Business Simple

The right setup cuts the work in half and the errors to zero.

Apps Built for Landlords

Programs like AppFolio or Buildium allow tenants to pay online, mark the payment as received, and post it to the correct ledger line automatically. Late on the fifth? The system sends a text, adds the fee on the tenth, and updates your books. You open the dashboard and see every unit’s status on one screen. No more chasing checks or manual late notices. Investors who switch to these apps report collecting rent two days faster on average and slashing admin time by hours each week.

Cloud Files You Open Anywhere

Store every invoice, lease, and statement in a shared drive like Google Drive or Dropbox, organized by property address. From a coffee shop between appointments, pull up last quarter’s expenses for the triplex and email the summary to a potential buyer. Changes sync across phones, tablets, and office computers instantly. Automatic nightly backups mean a crashed laptop does not erase years of records. Teams that go cloud stay aligned even when the property manager works remotely and the owner travels.

Direct Bank Links

Connect your business checking and credit cards to the accounting software. Transactions download at 2 a.m., ready for review with morning coffee. Click each line, assign it to “Unit 5 – Electrical” or “Office Supplies,” and done. The software matches deposits to open invoices and flags anything unusual. Bookkeepers who use bank feeds cut reconciliation time from days to minutes and catch fraud attempts the same day they post.

Daily Habits That Protect Bookkeeping for Real Estate Business

Consistency beats intensity every time.

Log It the Same Day

Pay the landscaper $180 for the lawn at the duplex. Open the app, snap the invoice, select “Landscaping – 456 Oak St,” and save. The entry takes forty-five seconds. Do this for every transaction- rent deposit, HOA fee, closing check. By Friday, the week is closed out, and the month-end requires only a quick scan. Agents who log daily never face a shoebox of receipts or missed deductions that cost real money on tax returns.

Match the Bank Every Month

First of the month, download the statement PDF. Open it side by side with your ledger. Starting balance matches? Check. Every withdrawal and deposit line up? Check. Circle the two that do not- a duplicate ATM fee and a tenant’s bounced check. Call the bank, reverse the fee, charge the tenant. The entire process runs under thirty minutes and locks in accuracy. Skip it, and errors compound until year-end cleanup costs thousands in accountant fees.

Stick to the Same Labels

Decide once: cleaning bills are “Janitorial,” online ads are “Marketing – Online,” paint is “Maintenance – Interior.” Train everyone to use the exact phrase. Reports then group spending perfectly. You see, janitorial crept up 20% and negotiated a new contract. Marketing shows ROI because you track leads per dollar spent. Consistent labels turn raw data into decisions that directly increase net income.

Bookkeeping for Real Estate Business and Tax Time

Make the IRS your ally, not your enemy.

Grab Every Write-Off

Drive to three showings? Log the miles at signup. Buy printer ink for lease packets? Scan the receipt. Host an investor lunch? Note the purpose. Bookkeeping for real estate business captures these routine costs as they happen. Come March, export the expense report filtered by “Deductible” and hand it to your CPA for a complete list. Clients who track this way routinely cut their tax bills by thousands compared to memory-based guesses.

Hand Your CPA a Neat Package

January rolls around. Run the annual profit-and-loss for each property, then the portfolio summary. Email the spreadsheets plus a folder of supporting invoices. The accountant schedules a thirty-minute review instead of three days of digging. Filings go out February 15th; extensions are never needed. Early submission means refunds arrive sooner, allowing you to fund the next down payment.

Dodge Late Fees

Quarterly estimated payments sneak up if you wait for the accountant to calculate. Monthly closes show profit trends, so you set aside the right percentage each time rent hits. The check mails on the deadline with zero panic. Bookkeeping for real estate business keeps penalties off the table and cash flow predictable.

Handing Off Bookkeeping for Real Estate Business to Pros

Know when to pass the baton and watch the business soar.

Win Back Your Weekends

Saturday morning used to mean four hours of spreadsheets. Outsource to Numberfied, and that time becomes open houses or family outings. Our team closes the prior month by the fifth, sends you the reports, and answers questions by Monday. You review highlights in ten minutes and get back to revenue-generating work.

Lean on People Who Know the Rules

Security deposits live in separate accounts- state law demands it. Depreciation schedules follow IRS tables for residential versus commercial. 1031 exchange timing must be exact. General bookkeepers miss these details and create compliance risks. Our real estate specialists handle escrow reconciliations, cost segregation studies, and like-kind paperwork so you stay audit-proof without studying the tax code.

Grow Without Hiring

Your portfolio jumps from eight units to twenty-five after inheriting a complex. In-house bookkeeping would require a new employee, benefits, and office space. Outsourced teams add capacity overnight. The same monthly fee covers the extra properties, reports scale automatically, and you avoid payroll taxes. Investors who outsource this way expand faster and keep overhead lean.

Tech Tricks for Bookkeeping for Real Estate Business

Smart upgrades that feel like extra staff.

Auto-Chase Late Rent

Tenant misses the third? The system texts a friendly reminder. Still late on the eighth? Email with fee notice. Payment posts and the ledger updates without your input. You see the dashboard turn green when everyone is current. Property managers who automate collections raise on-time payments and cut eviction filings.

Graphs That Talk

One pie chart shows expense breakdown: 40% mortgage, 25% maintenance, 15% utilities. A line graph tracks cash balance over twelve months. Red dips prompt reserve transfers before they hurt. Owners who watch visuals spot trends weeks earlier than spreadsheet divers and adjust spending proactively.

Phone Scans on Site

Plumber finishes the repair, hands you the bill. Open the app, photograph it, select the property, choose “Plumbing Repair,” and upload. The paper copy goes in the recycle bin. By the time you reach the next appointment, the expense is logged, coded, and ready for reimbursement if tenant-caused. Field teams that scan on-site maintain 100% capture rates.

Teaching Your Crew Bookkeeping for Real Estate Business Basics

Align the whole team in one afternoon.

Show the Receipt Routine

Gather leasing agents and maintenance leads. Demonstrate: pay vendor, photograph receipt, open shared drive, drop in folder named “2025 – 789 Pine – Expenses.” Walk through three examples. Hand out laminated cards with the steps. New receipts flow correctly from day one, and cleanup drops to zero.

Monthly Walk-Through

First Friday each month, project last month’s rent roll on the screen. Highlight two entries done right, one that needs tweaking. Answer questions live. The fifteen-minute session reinforces habits and catches sloppy labels before they spread. Teams that review together enter data the same way every time.

Post a Quick-Reference List

Print the category list- Janitorial, Marketing, Repairs – Exterior, etc.- and tape it above the office printer. Add the cloud folder structure diagram. Anyone processing mail or paying bills glances up and picks the right bucket. Consistency across staff turns good intentions into flawless execution.

Scaling Bookkeeping for Real Estate Business as You Add Doors

Build the plane while you fly it- without crashing.

Check the System Yearly

December, pull reports for the prior twelve months. Where did entry bottlenecks occur? Did multi-property owners need custom views? List three pain points and schedule fixes for January. Annual audits keep the process tight as transaction volume doubles or triples.

Run Portfolio-Wide Views

Set up a master dashboard showing net operating income for every asset. Sort by ROI descending. The top performer funds upgrades for the bottom one. The acquisitions team uses the same view to model new purchases against current benchmarks. Portfolio-wide bookkeeping for real estate business turns scattered holdings into a cohesive strategy.

Map the Next Jump

Eyeing a ten-unit complex? Export cash flow projections, layer in the new mortgage and projected rent, and watch the reserve impact. Numbers green? Move forward. Red flags? Renegotiate the price or walk. Forward modeling with real data removes emotion and stacks the odds in your favor.

Conclusion

Bookkeeping for real estate business changes scattered transactions into a clear playbook you trust every day. Start with the phone scan habit or the monthly bank match- pick one and run with it. As properties multiply and details mount, Numberfied stands ready to take the load. Visit https://numberfied.com/ right now and let us turn your books into your biggest competitive edge.

FAQs

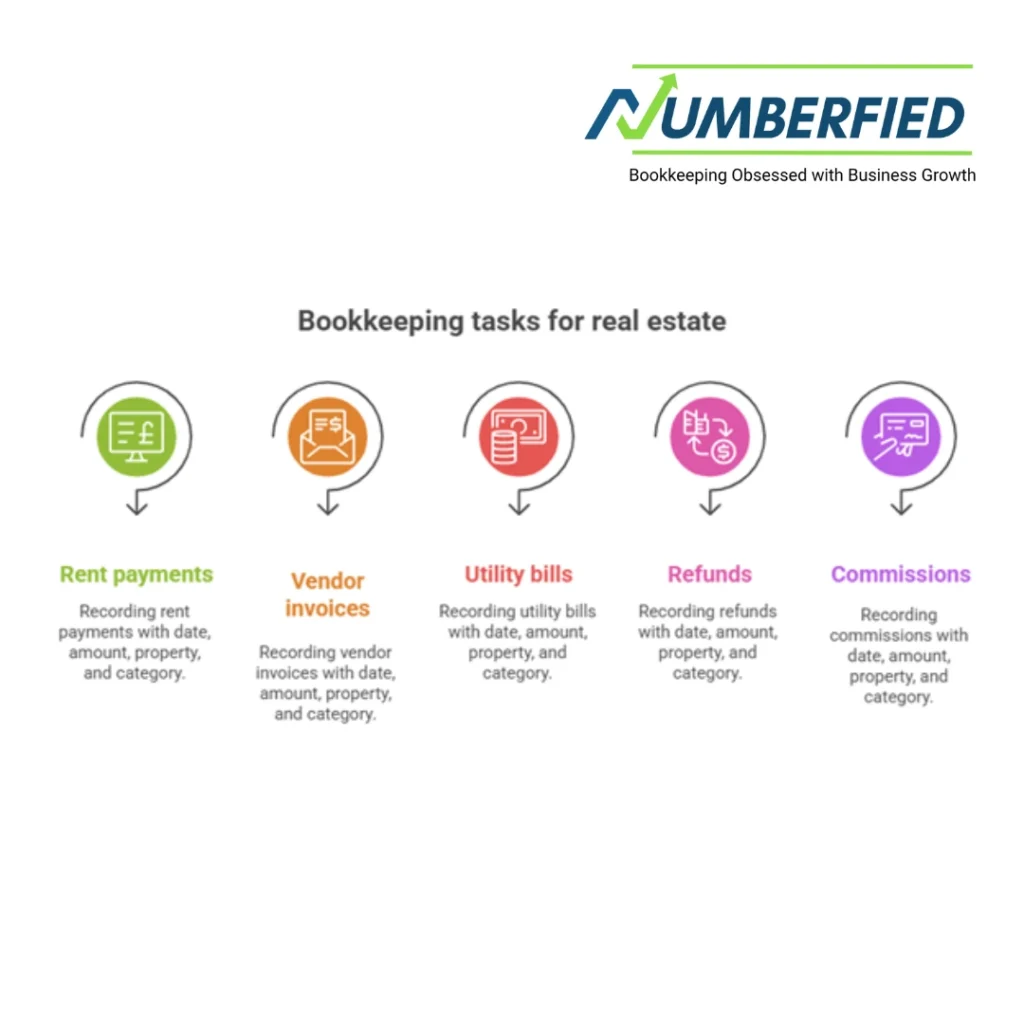

What falls under bookkeeping for real estate business each week?

Every rent payment, vendor invoice, utility bill, refund, and commission gets recorded with date, amount, property, and category. A typical week for a ten-unit owner includes twenty rent deposits, five maintenance payments, and two marketing charges. Logging them as they happen keeps the ledger live and accurate for instant decisions.

How does bookkeeping for real estate business differ from a restaurant’s books?

Restaurants record hundreds of small sales daily, plus perishable inventory. Real estate tracks fewer but larger transactions- monthly rents, quarterly tax payments, infrequent closings- plus trust accounts for deposits and depreciation over decades. The timing, account structure, and compliance rules are tailored to long-term asset management.

Can effective bookkeeping for a real estate business increase my selling price?

Buyers offer premiums for verifiable net income and expense control. Three years of property-level profit-and-loss statements prove the 8% cap rate you claim. Sellers with clean books close 5-10% above asking compared to those handing over bank statements and hoping for trust.

What if I skip bookkeeping for real estate business during a boom?

Rising rents and quick sales mask cash leaks. When the market cools, you cannot pinpoint overspending or secure bridge financing without historical data. The scramble to reconstruct records delays deals and erodes negotiating power at the worst possible moment.

Is professional bookkeeping for real estate business worth it for one rental house?

Even a single property requires correct security deposit tracking, expense allocation for Schedule E, and mileage logs. Professional setup prevents commingling funds- a common audit trigger- and captures every deduction. The habit scales seamlessly when you buy the next house.

How does bookkeeping for real estate business speed up a refi?

Lenders request rent rolls, operating statements, and trailing twelve-month NOI. Pull the reports in PDF format with one click and email them the same day. Underwriters verify numbers against bank deposits and expedite the appraisal process. Owners with ready books close refis in half the usual time.

Which monthly reports matter most in bookkeeping for real estate business?

Rent collected versus billed shows collection efficiency. An expense breakdown by category highlights the budget creep. A cash flow forecast predicts shortfalls thirty days in advance. Review these three pages, and you know exactly where to celebrate or intervene.

How fast can I transition to outsourced bookkeeping for my real estate business?

Share access to bank feeds and the last twelve months of statements on Monday. We import data, map accounts, and deliver the first reconciled month by the tenth of the following month. You review highlights, ask questions, and the handoff is complete with no disruption to operations.

Does bookkeeping for real estate business cover payroll for a property manager?

Yes. Enter hours worked, calculate gross pay, withhold federal and state taxes, issue direct deposit, and file quarterly 941s. You approve the timesheet; we handle the rest, keeping you compliant with wage laws and IRS deadlines.

Where do I begin fixing my bookkeeping for real estate business today?

Download this month’s bank statement. Open a spreadsheet, list every transaction, and match it to a receipt or invoice you can find. Highlight the five you cannot explain and track them down one by one. Clear those mismatches, and you have a clean starting point for tighter habits tomorrow.

Read Also: Virtual Bookkeeping Services for Small Businesses That’ll Change Your Life!