Introduction

You sign the purchase agreement for the perfect parcel, vision already taking shape. Then the invoices start rolling in, surveyors, engineers, permits, and the numbers blur. Bookkeeping for real estate developers cuts through that blur. We’re the Numberfied crew, and we’ve kept the books for developers building everything from townhome clusters to mixed-use towers across the country. This guide lays out the real-world steps we use every day. No theory, just what works.

Key Takeaways

- Tag every invoice to the right phase so nothing gets lost.

- Pull lender reports in minutes instead of days.

- Spot budget leaks before they drain the job.

- Let Numberfied run the books while you run the site.

Why Developers Can’t Skip Bookkeeping for Real Estate Developers

One missed lien waiver or untracked change order can stall a closing. Bookkeeping for real estate developers builds the guardrails that keep cash flowing and deadlines met.

Matching Dollars to Dirt and Concrete

Land closes in week one; footings pour in week six. Proper accounting ties the check to the milestone. You open the file and see exactly what’s spent on entitlements versus vertical construction. No more guessing where the money went.

Keeping Lenders Happy

Banks want to draw packages with backup. The bookkeeper staples the paid invoice to the AIA form and emails it before lunch. Covenants stay green, funds keep coming, subs keep working.

Closing the Loop on Every Lot

Unit sells, buyer upgrades the countertops. Bookkeeping for real estate developers logs the base price, the upgrade, and the credit at closing. Profit per door shows up clean on the final report.

Picking the System That Fits Bookkeeping for Real Estate Developers

Off-the-shelf software chokes on job costing. You need setups built for dirt-to-door accounting.

Software That Talks to the Trailer

QuickBooks with Buildertrend sync or Procore financials, pick one that pulls pay apps straight into the ledger. Bookkeeping for real estate developers sets the integration once; after that, superintendents approve draws on their phones, and the books update live.

In-House or Hand It Off

Small shop with two projects? Train the office manager. Ten lots and climbing? Outsource to a firm that already knows retention schedules. Most of our clients start hybrid and go full external once permits hit double digits.

Building the Chart That Makes Sense

Separate land holding costs from horizontal improvements from vertical shells. A good system creates job codes like 123-Phase2-Roads so the excavator invoice lands in the exact bucket. Review the list every January; add codes for new amenity packages as they come online.

Running the Money on Each Job

Treat every site like its own company. Bookkeeping for real estate developers gives you profit per project without losing the big picture.

Front-End Costs That Set the Tone

Appraisals, soil tests, traffic studies, log them the day the check clears. The system rolls these into the total acquisition cost, so your pro forma stays honest. When the lender asks for soft-cost backup, it’s one click away.

Draw Schedules That Actually Match Progress

The inspector signs off on rough plumbing; your bookkeeper releases the plumber’s pay app. This process holds 10% retention until drywall passes. Subs stay paid, liens stay off title, closing tables stay on schedule.

Sales, Upgrades, and Final Punch

The buyer selects the $3,000 appliance package. Bookkeeping for real estate developers adds it to the sales contract line, collects at closing, and pays the vendor. Warranty reserves are held in a separate liability account until the one-year walk-through is completed.

Heading Off Trouble with Bookkeeping for Real Estate Developers

Steel prices surge, permits decline, and unexpected events occur. The books spot it early.

Rainy-Day Buckets

Five percent of hard costs goes into contingency from day one. This setup requires a change order and a superintendent sign-off to tap it. Money stays put for the surprises that matter.

Paying Subs Without Drama

Invoice hits the portal, matches the bid, and and is coded to the job. Bookkeeping for real estate developers cuts the check on the 25th and files the conditional waiver. One late payment last year? Zero this year.

Insurance That Matches the Phase

Builder’s risk converts to homeowner policies, lot by lot. The service tracks expiration dates and prorates premiums across units. No gaps, no double payments.

Turning Numbers into Next Steps

Monthly close isn’t the finish line; it’s the starting gun.

Profit by Dirt Pile

Phase 1 roads cost 8% over estimate; Phase 2 came in under. Bookkeeping for real estate developers builds the side-by-side so the estimator sees where to tighten bids next time.

Benchmarking the Portfolio

Three subdivisions, two commercial pads. Good accounting ranks cost per buildable acre. The low performer gets a site visit; the winner becomes the template.

Cash Flow That Looks Ahead

Next quarter needs bridge financing for the clubhouse. Bookkeeping for real estate developer projects absorption, lines up the loan package, and schedules the draw before the framing crew runs out of payroll.

Growing Without Growing Pains

Add phases, add markets, add partners, the books scale.

Investor Packets That Close Rounds

Equity partner wants waterfall updates. The accounting team emails the preferred return calc every 15th. Capital calls go out on time, trust stays high.

Tax Rules That Shift

New bonus depreciation phase-out? Bookkeeping for real estate developers tags assets by the placed-in-service date and adjusts the return before April. No surprises, maximum deduction.

Systems for Ten Projects or Fifty

Parent company ledger with child job files. This system rolls up cash weekly, drills down to rebar invoices in seconds. The dashboard grows with the dirt under contract.

Conclusion

Bookkeeping for real estate developers is the difference between hoping the numbers work and knowing they do. Track the costs, protect the cash, read the trends, and build the next phase with confidence.

Numberfied lives in the trenches with you. Visit https://numberfied.com/ and grab a 15-minute call. We’ll walk your latest pro forma and show exactly where the books can tighten the screws.

FAQs

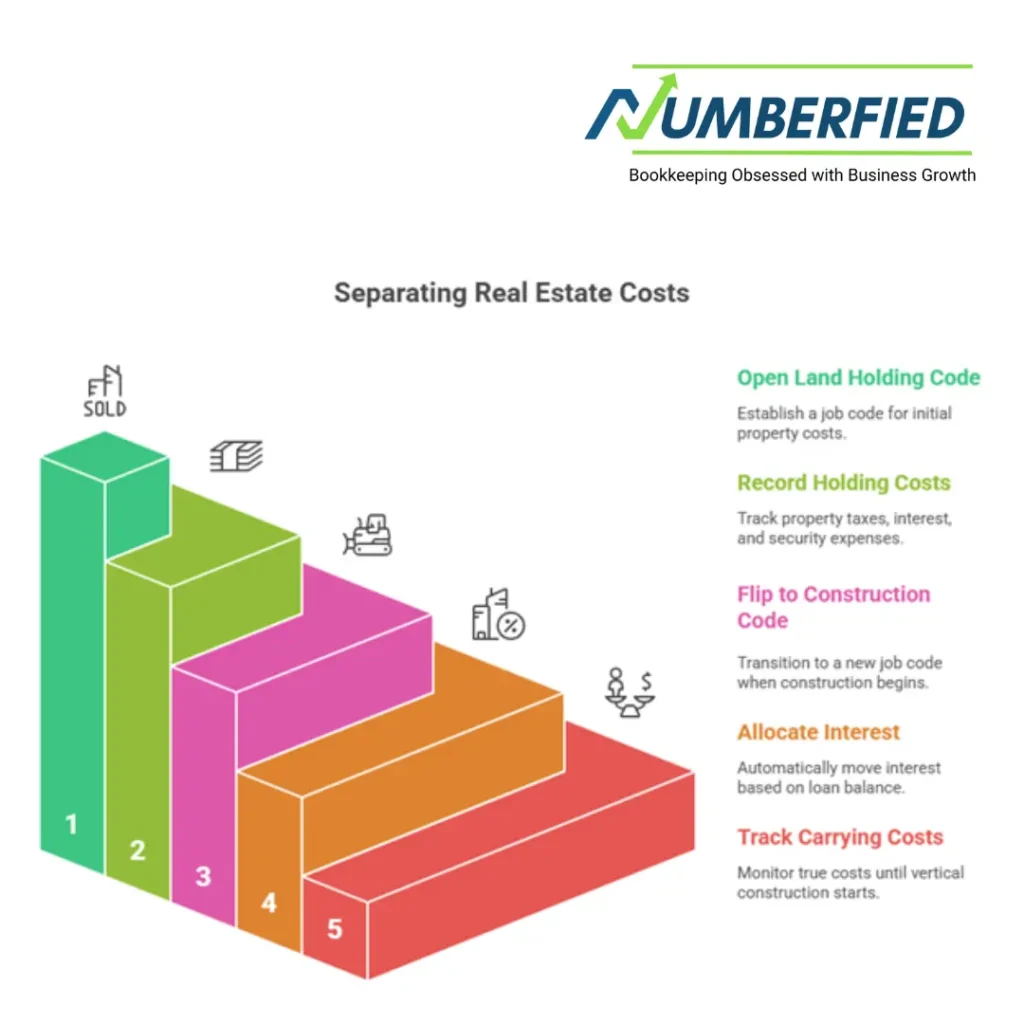

1. How do you separate holding costs from construction costs in bookkeeping for real estate developers?

We open a land holding job code the day escrow closes. Property taxes, interest carry, and security go there. The minute the grader breaks ground, we flip to a construction job code. Monthly interest allocation moves automatically based on the loan balance. You see the true carrying cost until vertical starts.

2. What happens when a lender changes the draw format mid-project?

Our team updates the template the same day. We map old line items to new ones, test one draw, and push it through. Historical draws stay intact for audit; future ones match the bank’s new spreadsheet. Zero rework on your end.

3. How do you track multiple funding sources on one job?

Each lender or investor gets an equity sub-account. The system posts their wire to their line, tracks their preferred return, and runs the distribution waterfall. The job profit statement shows total sources and uses in one column.

4. Can bookkeeping for real estate developers flag budget overruns before the monthly close?

Yes, daily commitment reports. Open purchase orders plus paid invoices versus the budget. Anything over 90% triggers a text to the PM. We catch a $40,000 overage on underground utilities two weeks before the invoice hits accounting.

5. How do you handle developer fee deferrals?

We park the fee in a due-to-developer liability account. We accrue it monthly based on the operating agreement and pay it down from available cash after debt service. Tax basis schedules update automatically for partner K-1s.

6. What about cost segregation studies? Where do those fit?

Once the certificate of occupancy is issued, bookkeeping for real estate developers freezes the hard cost ledger. We export the detail to the cost seg engineer, book the accelerated depreciation, and tie it back to the asset module. Year-one tax savings hit the cash flow forecast immediately.

7. How does bookkeeping for real estate developers manage amenity overages?

Clubhouse budget $1.2 million, actual $1.4 million. We code the extra to a separate amenity contingency line, get owner approval, and amend the lender draw. The overage shows clearly on the sources-and-uses, so no one’s surprised at stabilization.

8. What’s the process for releasing retention to subs?

Final punch list signed, affidavit of payment received. The bookkeeper flips the 10% holdback to accounts payable, cuts the check, and files the unconditional waiver. Retention ledger zeroes out; lien risk drops to zero.

9. How do you prepare for a 1031 exchange on sold lots?

Bookkeeping for real estate developers tags basis by parcel from day one, land, horizontal, vertical proration. At sale, we generate the exact gain calc, park proceeds in the QI account, and match to the replacement property ledger. Timeline stays tight, tax deferral stays intact.

10. Why trust Numberfied with bookkeeping for real estate developers?

We’ve closed the books on over 200 phases in 38 states. Our team knows AIA forms, lien waivers, and waterfall math cold. Drop us your latest budget; we’ll return a sample job cost report in 24 hours and prove the fit.

Also Read: Discover the Best Virtual Bookkeeping Services That Make Business Simpler – Powered by Numberfied