Why proper bookkeeping for real estate matters

Whether you are a real estate agent, property manager, or real estate investor, effective bookkeeping is the backbone of a successful real estate business. Good bookkeeping for real estate ensures accurate accounting, clean financial reporting, reliable cash flow forecasting, and maximized tax deductions. Solid bookkeeping practices protect you in an IRS audit, help a real estate professional make smarter investment decisions, and free you to focus on growing your real estate portfolio.

Who this guide is for

This guide is tailored for real estate agents, rental property owners, property managers, and real estate investing professionals who need practical, trustworthy advice on bookkeeping and accounting for real estate. It covers bookkeeping basics, bookkeeping services, bookkeeping software, common bookkeeping mistakes, and a step-by-step setup so you can implement proper bookkeeping now.

Core concepts: bookkeeping vs. accounting

Bookkeeping and accounting are often used interchangeably, but they serve different roles. Bookkeeping records day-to-day transactions, rental income, repairs, commissions, receipts, and expenses, while accounting interprets and reports that information in financial statements such as the balance sheet, income and expense reports, and cash flow statements. For property owners and managers, consistent bookkeeping makes the accountant or CPA’s work more efficient and reduces the risk of missed tax deductions.

Key bookkeeping terms you should know

- Transaction: Any financial event, such as rent paid, contractor invoice, security deposit, or commission.

- Income and expense: Core categories you’ll track for rental properties, agent commissions, and management fees.

- Balance sheet: A snapshot of assets, liabilities, and equity for your real estate company or investment.

- Cash flow: Money coming in and going out; critical for maintaining property and funding investments.

- Accrual accounting vs. cash basis accounting: Two accounting methods; accrual records when earned/incurred, cash basis when money changes hands.

Practical benefits of proper real estate bookkeeping

Investing time or budget into bookkeeping yields measurable returns:

- Maximized tax deductions: Tracking receipts and categorizing expenses (repairs, maintenance, property taxes, mortgage interest) ensures you capture eligible tax deductions.

- Improved cash flow management: Accurate transaction recording prevents surprises and keeps reserves for vacancies or major repairs.

- Faster audits and better compliance: Organized financial records make IRS audits less painful and reduce the risk of penalties.

- Better investment decisions: Reliable financial reporting makes comparing properties and evaluating returns straightforward.

- Simplified communication with your CPA or accountant: Clean books reduce accountant hours and lower tax preparation costs.

Related terms to track and use in reporting

When building financial reports and categorizing transactions, use industry-specific categories: real estate accounting, rental property bookkeeping, property management finances, investor bookkeeping, and commission tracking. These tailored categories help produce actionable insights for property owners and management companies.

Common bookkeeping mistakes and how to avoid them

Real estate bookkeeping errors are common but preventable:

- Mixing personal and business finances: Maintain separate bank accounts and credit cards for each property or business entity to preserve tax deductions and liability protections.

- Poor categorization: Classifying capital improvements as repairs (or vice versa) can inflate or deflate deductions incorrectly. Follow IRS guidance and consult your CPA for capitalization thresholds.

- Missing receipts: Keep digital copies of receipts and invoices to substantiate deductions and reduce audit risk.

- Failing to reconcile accounts: Regular reconciliations catch errors and fraudulent charges early.

- Inconsistent recording of transactions: Put bookkeeping routines in place to record rental income and expenses monthly to maintain accurate cash flow tracking.

DIY bookkeeping vs. outsourced bookkeeping: Which is right?

Choosing between bookkeeping in-house and hiring bookkeeping services depends on scale, complexity, and your time value.

DIY bookkeeping when it makes sense

DIY is practical if you manage a small portfolio (1–3 rental properties), have straightforward transactions, and are comfortable with accounting software. Benefits: lower monthly cost, direct control, and familiarity with every transaction. Drawbacks: time-consuming and risk of mistakes if you lack bookkeeping basics.

Outsourced bookkeeping: When to hire professionals

Outsourcing is ideal for larger portfolios, multiple entities, complex transactions (syndications, short-term rentals, multiple states), or when you prefer to delegate repetitive financial tasks. Outsourced bookkeeping services for real estate typically cost between $300 and $1,000/month, depending on transaction volume, complexity, and the level of reporting and integration with property management software.

Cost factors and value considerations

- Small portfolios and basic bookkeeping: $300–$500/month.

- Medium portfolios or multi-entity reporting: $500–$800/month.

- Large portfolios or full-service bookkeeping with integrations and monthly CFO-level reporting: $800–$1,000+/month.

Compare the cost against the time you’d spend on bookkeeping, potential tax savings from better categorization, and reduced risk in audits. Many real estate investors find that outsourcing pays for itself by maximizing tax deductions and freeing time to focus on deals.

Best software for bookkeeping for real estate

Choosing the right accounting software is a cornerstone of effective property accounting. The best options are designed for real estate or integrate well with property management software.

QuickBooks Online

Pros: Widely used by accountants and CPAs, strong reporting, bank integrations, and third-party apps that support property management workflows. Cons: Requires setup for rental properties and may need a chart of accounts tailored for real estate investment.

REI Hub

Pros: Designed for real estate investors and property managers, handles rent rolls, investor distributions, and property-level reporting. Cons: Niche product evaluation integrations and CPA familiarity.

Stessa

Pros: Built specifically for rental properties and real estate investors, automated transaction categorization, performance dashboards, and tax-ready reports. Cons: May be less flexible for complex entity structures.

Baselane

Pros: Tailored to real estate investors and rental property owners, integrates banking and bookkeeping, helps track rental income and expenses, and offers lending options for investors. Cons: Newer ecosystem; check integrations with your CPA.

Other options include Buildium, AppFolio, and property management software that includes accounting modules. When choosing, consider integration with your property management platform, ease of sharing financial records with your CPA, bank feed reliability, and support for accrual or cash basis accounting.

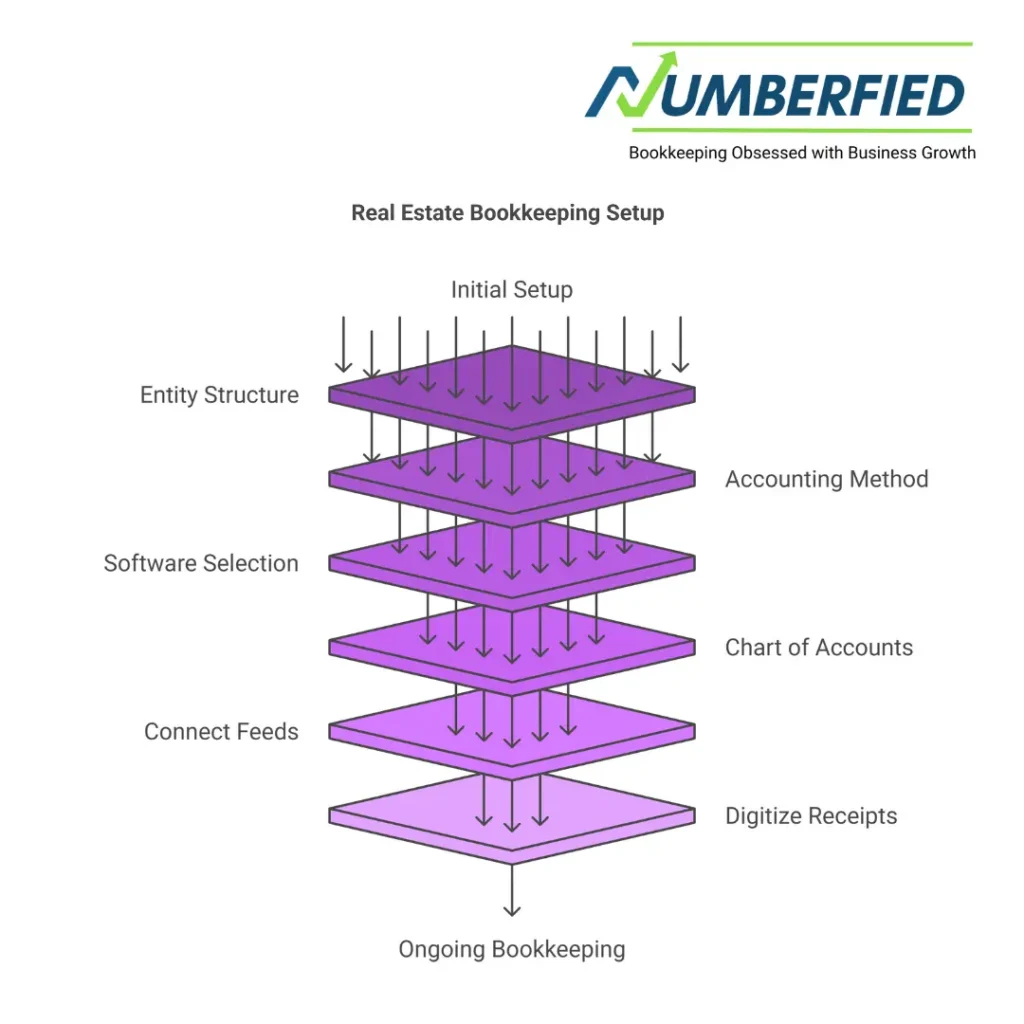

Step-by-step guide to setting up bookkeeping for real estate

Follow these steps to build reliable bookkeeping and accounting practices tailored for real estate:

- Define your business structure: Decide whether properties are held personally, in an LLC, or through multiple entities. Clear structure simplifies property accounting and helps with tax planning and liability protection.

- Open separate bank accounts and credit cards: Maintain separate accounts for each entity or management company to keep personal and business finances distinct.

- Choose an accounting method: Select cash basis accounting for simplicity or accrual accounting if you need period-matching and receivables/payables tracking. Confirm with your CPA which method is best for your real estate investment strategy.

- Select bookkeeping software: Pick software designed for real estate or one that integrates with your property management software. Customize your chart of accounts to include rental income, tenant security deposits, maintenance, property taxes, depreciation, mortgage interest, and management fees.

- Create a consistent chart of accounts: Use real estate-specific categories to improve reporting and tax preparation. Include categories for capital expenditures vs. repairs to ensure correct tax treatment.

- Set up bank and payment integrations: Connect bank accounts, merchant services, and property management platforms to automatically import transactions.

- Implement a receipt and documentation system: Digitize receipts and invoices using apps or software that attach receipts to each transaction for audit-proof financial records.

- Define accounting workflows and frequency: Decide who records transactions, reconciles accounts, and produces reports. Monthly reconciliation and quarterly financial reviews are standard bookkeeping best practices.

- Track owner equity and investor distributions: For partnerships or syndications, maintain detailed investor bookkeeping to track contributions, distributions, and K-1 preparation needs.

- Work with a CPA for taxes and year-end reporting: A real estate CPA can advise on depreciation schedules, cost segregation, and other tax strategies to maximize tax deductions for real estate professionals.

Reporting and metrics every real estate business should monitor

Use these financial reports and KPIs to evaluate performance and make strategic decisions:

- Profit & Loss (Income and Expense) by property: Shows rental income, vacancy loss, operating expenses, and net operating income.

- Balance sheet: Monitor assets, liabilities, and owner equity for each real estate company or entity.

- Cash flow statement: Track cash generated and used by operations, investing, and financing activities.

- Rent roll: List of units, tenants, lease terms, and rental income for property management finances.

- Expense detail and receipts: Enables claiming tax deductions and prepares you for an audit.

- CapEx vs. repairs report: Differentiates capital improvements from deductible repairs.

Bookkeeping best practices for different real estate roles

Real estate agents

Track commissions, referral fees, marketing expenses, and continuing education separately. Use a CPA experienced with agent tax deductions and ensure commission tracking matches brokerage statements.

Property managers

Maintain detailed tenant security deposit accounts, track management fees per contract, and reconcile trust or escrow accounts monthly to remain compliant and transparent to property owners.

Real estate investors

Record acquisition costs, capital improvements, depreciation, rental income, and financing costs. Use property-level reporting to analyze returns and optimize your real estate investing strategy.

Tax considerations and audit preparedness

Proper bookkeeping reduces tax exposure and streamlines audit responses. Keep these tax-focused practices:

- Keep receipts and invoices for all expenses and store them digitally, linked to transactions.

- Document business purpose for mixed-use expenses to separate personal and business portions.

- Follow IRS depreciation rules and maintain asset lists with purchase dates and costs for each property.

- Reconcile accounts monthly and produce year-end financials for your CPA to prepare accurate returns and K-1s.

- Consider cost segregation studies for eligible properties to accelerate depreciation deductions when appropriate.

How to choose a bookkeeper or bookkeeping service

When selecting bookkeeping services, look for these qualities:

- Specialization in real estate bookkeeping or property accounting experience with rental properties, management companies, and investor reporting.

- Familiarity with your chosen accounting software and property management software integrations.

- Transparent pricing and scope expect outsourced bookkeeping to cost roughly $300–$1,000/month, depending on complexity.

- Strong processes for receipt capture, bank reconciliation, and monthly reporting.

- Good communication and willingness to work with your CPA or in-house accountant.

Interview potential bookkeepers, ask for references from other real estate investors or property managers, and request sample reports to confirm they can deliver the financial visibility you need.

Action plan: quick start checklist

Use this condensed checklist to jumpstart bookkeeping for real estate:

- Decide on the entity structure and open dedicated bank accounts.

- Choose between cash basis or accrual accounting with CPA input.

- Select and set up accounting software (QuickBooks, Stessa, REI Hub, Baselane).

- Create a real estate-specific chart of accounts.

- Connect bank feeds and payment processors.

- Digitize receipts and link them to transactions.

- Reconcile monthly and review reports with your CPA quarterly.

- Decide whether to outsource based on transaction volume and budget ($300–$1,000/month).

Conclusion

Bookkeeping for real estate is not just a compliance task; it’s a strategic tool that empowers real estate professionals to make better decisions, preserve tax deductions, and maintain predictable cash flow. Whether you adopt bookkeeping basics yourself or invest in outsourced bookkeeping services, follow best practices: separate personal and business finances, choose accounting methods suited for real estate, use software designed for the industry, and work closely with a CPA. With accurate accounting and consistent financial records, your real estate business will be positioned for sustainable growth and successful real estate investing.

FAQ

Do real estate agents need a bookkeeper?

Real estate agents do not always need a full-time bookkeeper, but proper bookkeeping is essential due to their self-employed status, fluctuating commissions, high expenses (mileage, marketing, etc.), and quarterly tax obligations. Many agents handle basic tracking themselves with software like QuickBooks, but outsourcing to a specialized real estate bookkeeper is highly recommended for accuracy, tax deductions, and compliance as transaction volume grows.

Do realtors need a bookkeeper?

Realtors, like other real estate agents, benefit greatly from bookkeeping to manage irregular income, track deductible expenses, reconcile commissions, and prepare for taxes. While not mandatory, clean books prevent costly errors and free up time for client-focused work. Many successful realtors use virtual bookkeepers or specialized software for efficiency.

What is the biggest mistake a real estate agent can make?

The biggest financial mistake real estate agents make is mixing personal and business expenses, which complicates tax filings, reduces deductions, and risks IRS issues. Other common errors include poor tax planning, lifestyle creep during high-earning periods, and failing to separate finances, leading to cash flow problems in slow seasons.

How much should you pay a bookkeeper per month?

For real estate agents, monthly bookkeeping fees typically range from $300–$1,000, depending on transaction volume and complexity. Simpler operations start at $200–$500, while higher-volume agents pay more for commission tracking and expense categorization.

What is the 80/20 rule for realtors?

The 80/20 rule (Pareto Principle) for realtors states that 80% of results (sales, income) come from 20% of efforts (clients, activities, or leads). Successful agents focus on high-impact tasks like relationship-building and targeted prospecting, while delegating or minimizing low-value activities.

What is the 3 3 3 rule in real estate?

The 3-3-3 rule (often called the 30/30/3 rule) is a home-buying guideline: Housing costs should not exceed 30% of gross monthly income, the home price should be no more than 3 times annual household income, and you should have 3 months of expenses saved for reserves. It promotes financial stability amid market uncertainty.

How much do real estate agents make off a $300,000 house?

On a $300,000 home sale with an average 5.5–6% total commission, the full commission is $16,500–$18,000, typically split between buyer’s and seller’s agents (about $8,250–$9,000 each before broker splits). The agent’s take-home depends on their brokerage split (often 70/30), netting around $5,000–$7,000 per side.

What is a real estate bookkeeper?

A real estate bookkeeper specializes in tracking commissions, expenses (mileage, marketing), escrow, rental income (if applicable), and compliance for agents, investors, or managers. They handle transaction recording, reconciliations, reports, and tax prep support using tools like QuickBooks, ensuring accurate financials tailored to real estate’s unique needs.

What is the highest-paid position in real estate?

The highest-paid positions in real estate include real estate developers (often $150,000+ with profits), commercial brokers in luxury markets ($200,000+ via commissions), mortgage loan officers, and real estate attorneys (up to $180,000+). Top agents in high-value areas can exceed these through commissions.

How much is a bookkeeper’s salary?

Bookkeepers in real estate average $50,000 annually ($24–$27/hour), varying by location and experience. Specialized real estate bookkeepers may earn more due to industry complexity.

Also Read: Bookkeeping for Real Estate: Turn Numbers into Your Competitive Edge