Why quality bookkeeping services in USA matter for small business owners

Accurate bookkeeping services in USA are the backbone of smart business decisions. For small business owners, entrepreneurs, and startups, maintaining clean financials and real-time financial reporting means better cash flow management, easier tax filing, and more time to focus on growing your business. Whether you need monthly bookkeeping, payroll services, or complete accounting and bookkeeping services, investing in expert bookkeeping makes running a business less risky and more profitable.

What “bookkeeping services in USA” covers

The phrase bookkeeping services in USA includes a range of accounting services and accounting support that small business owners rely on: transaction categorization, bank reconciliations, payroll management, preparation of financial statements, tax prep support, year-round tax guidance, and advisory services. Providers may offer bookkeeping and controller services, outsourced accounting services, or online bookkeeping services for small businesses that cannot maintain a full accounting department.

Common related services and terms

- Small business bookkeeping / bookkeeping services for small businesses

- Outsourced bookkeeping / outsourced accounting / outsourced accounting services

- Payroll services and tax filing support

- Financial reporting and financial statements

- Advisory services, CFO support, and bookkeeping and tax integration

Practical benefits of using professional bookkeeping services

Professional bookkeeping services deliver tangible benefits that help businesses of all sizes, especially small business owners and startups:

- Accurate financials: Clean books improve financial reporting and make year-round tax prep more efficient.

- Better cash flow: Timely reconciliations and real-time financial insights reveal opportunities to optimize cash flow.

- Time savings: Outsourced bookkeeping frees business owners to focus on operations and growth instead of daily accounting tasks.

- Cost predictability: Monthly bookkeeping packages let you budget average monthly expenses and avoid surprises from staffing a full accounting team.

- Access to expertise: Certified bookkeepers USA and CPAs provide advisory services, tax support, and help you understand your business’s financials.

- Scalability: As your business grows, bookkeeping services can expand to include bookkeeping and controller services, CFO-level insights, and advanced accounting solutions.

DIY bookkeeping vs outsourced bookkeeping: which is right?

DIY bookkeeping: pros and cons

Many small business owners start with DIY bookkeeping using accounting software like QuickBooks, Xero, or built-in bookkeeping software. Pros include lower upfront costs, hands-on control of your financial data, and learning your business’s finances intimately. Cons are time consumption, risk of mistakes, and limited access to advisory services. DIY often works for sole proprietors or early-stage startups with simple cash flow and few transactions.

Outsourced bookkeeping: pros and cons

Outsourced accounting or online bookkeeping services for small businesses provide expert bookkeeping and accounting support without hiring an in-house accounting department. Pros include real-time financial updates when offered, professional financial reporting, payroll integration, and tax prep coordination. Outsourcing reduces workload, improves accuracy, and gives access to bookkeeping experts and CPAs. Cons include cost (though often predictable monthly fees), potential loss of direct control, and the need to find a provider that understands your unique needs.

When to choose outsourced bookkeeping

Consider outsourced bookkeeping if your business has increasing transaction volume, you want accurate financial statements for investors or lenders, you need payroll services and tax filing support, or you want to focus on growing your business instead of bookkeeping tasks. Outsourced accounting solutions are particularly useful for growing businesses that cannot justify a full accounting team yet.

Common bookkeeping mistakes small businesses make

Avoiding these mistakes will improve financial accuracy and reduce stress during tax season:

- Poor categorization of transactions leads to incorrect financial statements and tax issues.

- Neglecting bank reconciliations, unreconciled accounts hide errors and fraud.

- Mixing personal and business finances complicates bookkeeping and tax filing.

- Ignoring payroll compliance mistakes can trigger penalties and problems with employees.

- Failing to use accounting software effectively and underutilizing bookkeeping software wastes efficiency and real-time capabilities.

- Waiting until year-end to organize books makes tax prep expensive and stressful.

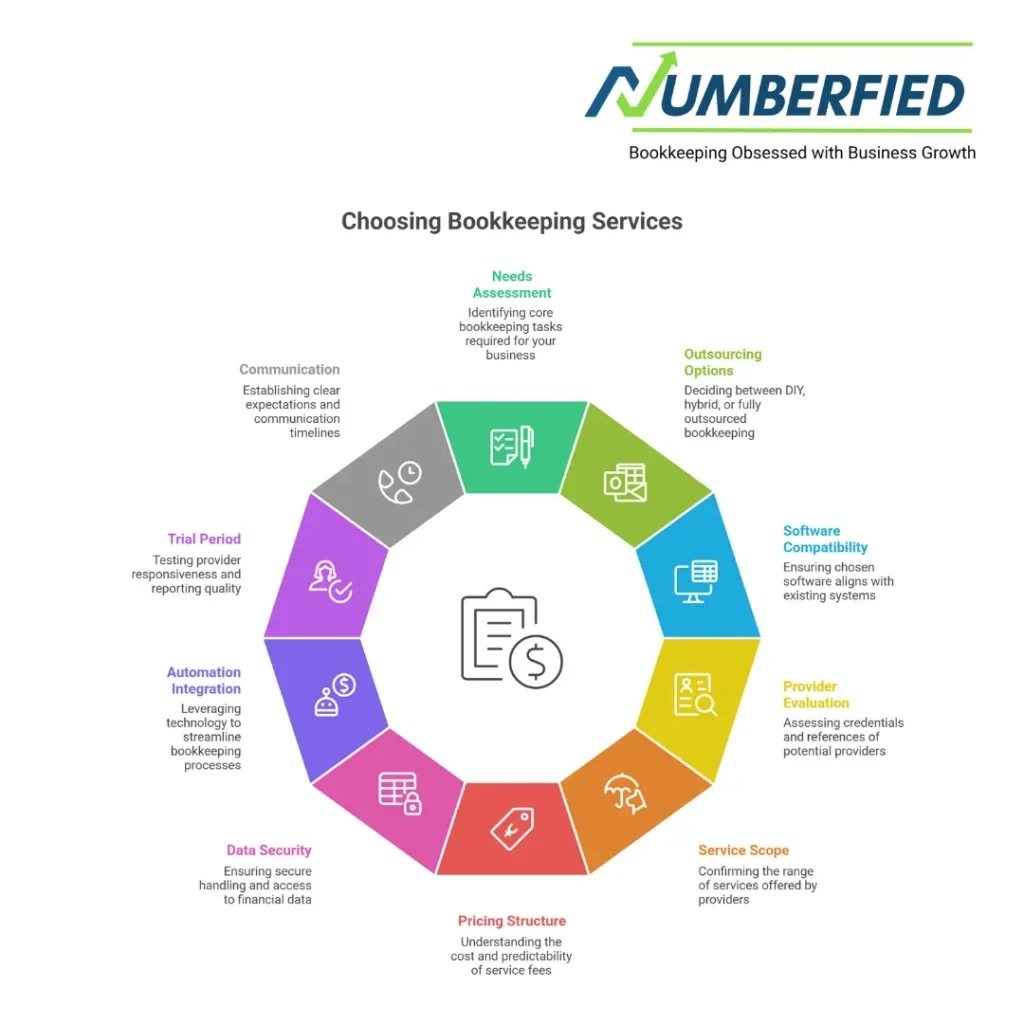

Step-by-step guide to choosing bookkeeping services in USA

- Assess your bookkeeping needs: List core tasks you need, such as daily transaction entry, monthly bookkeeping, payroll services, monthly financial statements, tax prep support, advisory services, or bookkeeping and controller services.

- Decide between DIY, hybrid, or fully outsourced: Consider your time, budget, and complexity. Hybrids combine in-house handling with outsourced experts for tax filing or periodic CFO-level guidance.

- Choose compatible accounting software: If you already use QuickBooks, Bench, or QuickBooks Live, it might be a natural fit. If you prefer Xero or FreshBooks, ensure providers support your platform.

- Evaluate providers and credentials: Look for providers offering small business bookkeeping services, certified bookkeepers USA, CPAs, and references from businesses similar to yours.

- Check service scope and SLAs: Confirm whether services include bank reconciliations, payroll services, tax filing coordination, month-end financials, and advisory time. Understand response times and real-time access options.

- Compare pricing and predictability: Review average monthly expenses for bookkeeping packages, and confirm if pricing scales with transaction volume or remains flat.

- Understand data security and access: Ensure providers use secure accounting software and provide role-based access to protect sensitive financial data.

- Ask about integration and automation: Good bookkeeping services leverage automation to reduce manual entry, connect payroll, invoicing, and banking data, and deliver real-time financials.

- Request a trial or initial assessment: Many top providers offer assessments or trial periods to evaluate fit. Use this to test responsiveness and reporting quality.

- Set expectations and communication cadence: Define monthly close timelines, when you will receive financial statements, and how advisory consultations will occur.

How bookkeeping services support tax and advisory needs

Bookkeeping services play a central role in tax prep and ongoing advisory. Clean books enable CPAs to file taxes accurately and provide tax strategies that minimize liabilities. Many outsourced accounting firms offer bookkeeping and tax bundles or referrals to CPAs. Advisory services built on accurate financial reporting help you make decisions about hiring, pricing, financing, and cash flow planning.

Cost considerations and ROI

Pricing for bookkeeping services varies based on transaction volume, complexity, payroll needs, and the level of advisory support. Typical pricing models include flat monthly fees for small business bookkeeping services or tiered packages that scale as your business grows. When evaluating costs, consider the ROI: timely financials can reduce tax expenses, prevent costly errors, improve cash flow, and free up your time to grow revenue. For many businesses, the cost of outsourced bookkeeping is lower than hiring a full accounting team and delivers higher-quality financial reporting.

Tips to work effectively with your bookkeeper

- Provide clear documentation and consistent access to bank and credit accounts.

- Use an agreed-upon chart of accounts and transaction categorization rules.

- Schedule regular check-ins to review financial statements and cash flow forecasts.

- Keep personal and business accounts separate and use business credit cards for expenses.

- Ask for training or documentation for accounting software so you can retrieve key data when needed.

Scalable bookkeeping solutions as your business grows

As your business grows, your bookkeeping needs evolve. Early on, simple bookkeeping and payroll services may suffice. As you expand, look for providers that offer bookkeeping and controller services, outsourced accounting services with CFO-level advisory, or complete accounting solutions that include financial reporting, tax filing, and accounting team support. The right partner can scale with you, providing accounting solutions that match your unique needs and help you understand your business with better financial data.

Final checklist before hiring bookkeeping services in USA

- Does the provider offer expertise in small business bookkeeping and tax prep?

- Are they familiar with your industry and business model?

- Can they integrate with your accounting software (QuickBooks, Xero, etc.)?

- What payroll services and year-round tax support do they provide?

- Do they provide monthly financial statements and real-time financial access?

- Are pricing, average monthly expenses, and scaling terms transparent?

- Do they offer advisory services or connections to CPAs and CFO support?

Conclusion

Bookkeeping services in USA are more than just transaction entry; they are a strategic part of your accounting and financial management. Expert bookkeeping services bring clarity to your financials, reduce tax risk, improve cash flow, and create room for business owners to focus on their core priorities. Whether you opt for DIY bookkeeping software like QuickBooks or outsource to providers such as QuickBooks Live, Bench, or Bookkeeper.com, the right bookkeeping and accounting solution will align with your business needs and support long-term growth. Start by assessing your bookkeeping needs, comparing providers and accounting software, and choosing a partner that offers transparent pricing, reliable reporting, and advisory services that help you understand your business and reach your goals.

FAQ

What are bookkeeping services in USA, and who needs them?

Bookkeeping services in USA involve recording financial transactions, reconciling accounts, managing payroll, and preparing financial reports. Small businesses, startups, freelancers, and nonprofits commonly use these services to maintain accurate records and ensure compliance with U.S. tax laws.

How much do bookkeeping services in USA typically cost?

Costs vary by region, business size, and complexity. Many firms charge hourly rates ($30–$100+), monthly packages ($200–$2,000+), or flat fees for specific tasks. Virtual bookkeeping services often offer more affordable, scalable pricing for small businesses.

What is the difference between bookkeeping and accounting?

Bookkeeping services in USA focus on day-to-day transaction recording, bank reconciliations, and maintaining ledgers. Accounting builds on bookkeeping to analyze financial data, prepare tax returns, and provide strategic financial advice.

Can I hire remote or virtual bookkeeping services in USA?

Yes. Many U.S.-based firms and remote professionals offer virtual bookkeeping using cloud accounting software like QuickBooks Online, Xero, or FreshBooks. Remote services provide flexibility, lower overhead, and often faster turnaround times.

How do I choose the right bookkeeping service in USA?

Look for providers with experience in your industry, strong references, certified staff (e.g., certified bookkeepers or QuickBooks ProAdvisors), transparent pricing, and secure data handling practices. Ask about the software they use and how they communicate with clients.

What software do bookkeeping services in USA typically use?

Common platforms include QuickBooks Online, Xero, Zoho Books, FreshBooks, and Wave. Choose a service that uses software compatible with your business needs and offers integrations with payroll, invoicing, and banking.

Are bookkeeping services in USA compliant with U.S. tax regulations?

Reputable bookkeeping services stay up to date with federal, state, and local tax rules and help prepare records needed for tax filing. However, for tax preparation and planning, many businesses also work with CPAs or tax professionals in addition to bookkeepers.

How often should a business use bookkeeping services in USA?

Frequency depends on transaction volume: businesses with regular transactions often require weekly or monthly bookkeeping, while very small operations may manage with quarterly reviews. Regular bookkeeping ensures accurate financial statements and timely tax compliance.

Can bookkeeping services in USA help with payroll and sales tax?

Yes. Many bookkeeping providers handle payroll processing, payroll tax filings, and sales tax tracking and remittance. Confirm whether payroll services are included or offered as an add-on, and verify they support your state-specific requirements.

How secure is my financial data with bookkeeping services in USA?

Security varies by provider. Trusted bookkeeping services use encrypted cloud platforms, secure access controls, regular backups, and privacy policies that comply with data protection standards. Ask prospective providers about their security measures before sharing sensitive financial information.

Also Read: Bookkeeping Services in USA Your Business’s Key to Winning with Numberfied