Introduction: Why CPA bookkeeping services matter

As a small business owner or entrepreneur, your time is best spent growing your company, not sorting receipts. CPA bookkeeping services offer a trusted, professional approach to bookkeeping and accounting that goes beyond basic data entry. By combining certified accounting expertise with bookkeeping best practices, a CPA bookkeeping services provider can help you maintain accurate financial records, stay compliant with tax rules, and make informed decisions that move your business forward.

What are CPA bookkeeping services?

CPA bookkeeping services are bookkeeping and accounting services provided or supervised by certified public accountants (CPAs) or CPA firms. These services often include monthly bookkeeping, payroll integration, financial statements preparation, tax-ready bookkeeping, and advisory services. Unlike standard bookkeeping services, CPA bookkeeping blends accounting expertise with strategic tax planning and audit-ready documentation so your accounting and tax needs are met with professional oversight.

Related roles and terms

Typical related roles include a CPA bookkeeper (a bookkeeper working with a CPA), certified public accountant bookkeeping specialists, and traditional bookkeepers. Related service models you may see include outsourced bookkeeping, online bookkeeping services, and outsourced accounting services from accounting firms or accounting teams that act as your extended finance department.

Top benefits of hiring CPA bookkeeping services

1. Compliance and audit readiness

CPA bookkeeping services prioritize compliance with accounting standards and tax laws. Whether you face a tax return review, a lender request, or an audit, having financial records prepared under CPA oversight minimizes risk and speeds resolution. Accurate, CPA-reviewed financial statements reduce the chance of penalties and demonstrate reliable financial management to stakeholders.

2. Tax savings and planning

CPAs bring tax expertise to bookkeeping. With CPA bookkeeping services, bookkeeping data is organized to support tax planning and deductions, reducing surprise liabilities. Certified public accountant bookkeeping integrates tax planning into accounting processes so your business benefits from strategies that align with current tax law.

3. Higher accuracy and fewer errors

CPAs and expert bookkeeping teams ensure that accrual accounting or cash-basis records are accurate, reconciled, and timely. This reduces errors that can distort cash flow projections, payroll processing, and financial reporting. Accurate financial data supports better invoice tracking, expense categorization, and financial statements.

4. Time and cost efficiency

Outsourcing CPA bookkeeping services or hiring a CPA firm bookkeeping solution frees business owners from bookkeeping tasks. Instead of spending hours on bookkeeping and accounting tasks, you can focus on sales, product development, or scaling operations. In many cases, outsourcing bookkeeping and accounting services is less expensive than maintaining an in-house accounting team.

5. Strategic advisory

Beyond bookkeeping and taxes, CPA bookkeeping services often include advisory services that help you interpret financial statements, improve financial processes, and plan for growth. Whether you need CFO-level input, help choosing the right accounting software, or guidance on financial management, CPAs can provide strategic advice tailored to growing businesses.

CPA vs. regular bookkeeper: What’s the difference?

Understanding the difference is critical when selecting bookkeeping and accounting services. A bookkeeper handles daily bookkeeping tasks: recording transactions, reconciling bank accounts, tracking invoices, and maintaining financial records. A CPA brings advanced training, licensing, and the ability to provide tax services, audits, and strategic financial advice.

Key comparisons

- Qualifications: CPAs are licensed and held to professional standards; regular bookkeepers may be certified but not licensed as accountants.

- Services: CPAs offer tax planning, audit representation, and complex accounting support; bookkeepers specialize in bookkeeping tasks and routine accounting.

- Compliance: CPA bookkeeping services often include audit-ready documentation and tax-ready bookkeeping; regular bookkeepers may not cover complex compliance needs.

- Strategic capacity: CPAs can act as outsourced CFOs or advisors to help with financial management and growth planning.

Key features to expect from expert CPA bookkeeping services

When evaluating providers, look for these essential features:

- Monthly bookkeeping and reconciliation: timely, accurate records and bank reconciliations.

- Integration with existing accounting software: seamless use of your current accounting system, like QuickBooks, Xero, or other platforms.

- Payroll coordination: payroll processing or integration with payroll providers to ensure timely pay and tax filings.

- Tax-ready financial statements: reports prepared for tax return filing and planning.

- Advisory and strategic reports: cash flow forecasts, budgeting, and KPI dashboards.

- Secure handling of financial data: HIPAA and data protection practices where relevant, secure cloud access, and controlled permissions.

- Scalable services: support for startups and growing businesses of all sizes with options to outsource more complex accounting as needs increase.

Common bookkeeping mistakes CPA services help you avoid

Many small business owners make bookkeeping mistakes that cost time and money. CPA bookkeeping services help mitigate common issues, including:

- Mismatched accounts and unreconciled bank statements that hide errors or fraud.

- Misclassified expenses that lead to incorrect tax deductions or misleading financial statements.

- Late payroll filings and payroll tax miscalculations result in penalties.

- Inadequate documentation for deductions and audit support.

- Poor cash flow management due to inaccurate revenue recognition or billing delays.

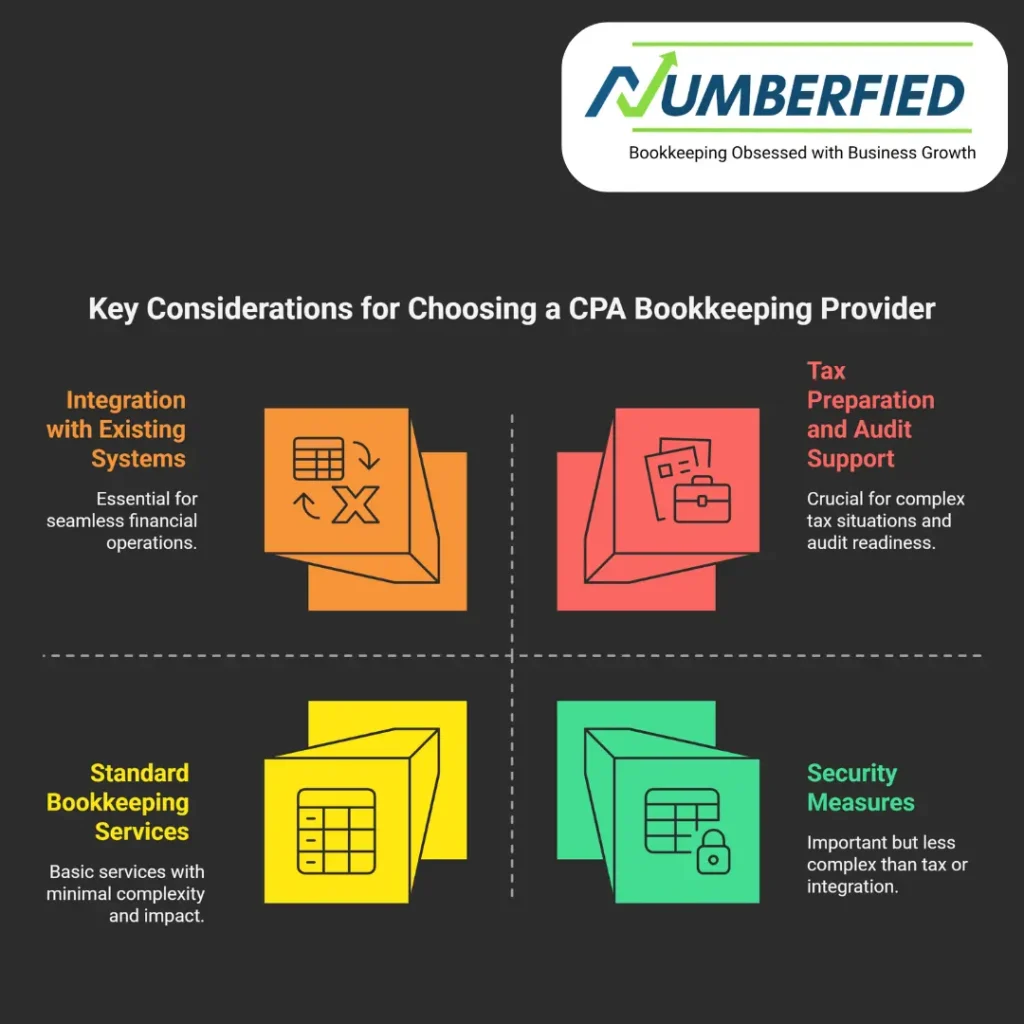

Step-by-step guide to choosing CPA bookkeeping services

Follow these steps to select the right provider for your bookkeeping needs:

1. Define your bookkeeping and accounting needs

Start by listing bookkeeping tasks, accounting needs, payroll requirements, and advisory expectations. Decide if you need monthly bookkeeping, payroll support, tax planning, or CFO-level guidance as your business grows.

2. Decide between in-house, outsourced bookkeeping, or hybrid

Evaluate whether to hire a bookkeeper, outsource to a CPA firm, or use a hybrid model where an in-house staff works with outsourced CPAs. Outsourcing CPA bookkeeping services is often efficient for startups and small businesses that need expert bookkeeping without hiring a whole accounting team.

3. Check qualifications and experience

Look for CPA credentials, industry experience, and references. An accounting firm experienced in small business, startup accounting, or your industry will better understand your business needs and complex accounting situations.

4. Review technology and integration capabilities

Ensure the provider supports your accounting software and can streamline financial processes through automation. Accounting technology that integrates invoices, payroll, and financial statements simplifies bookkeeping tasks and improves accuracy.

5. Understand pricing and scope

Ask for transparent pricing models: flat monthly fees, tiered services, or hourly rates for advisory work. Clarify what’s included: bookkeeping tasks, tax preparation, payroll, and advisory services, and how additional work is billed.

6. Seek references and testimonials

Ask for case studies or client references from businesses similar to yours. Confirm the provider’s track record in delivering accurate financial records and helping companies to grow.

7. Start with a trial or phased engagement

Begin with a one-time cleanup or a 3–6 month pilot to evaluate the provider’s compatibility, responsiveness, and ability to streamline your accounting and bookkeeping needs.

Top providers and trends in CPA bookkeeping services for 2026

The bookkeeping industry continues to evolve. In 2026, expect these trends and provider capabilities:

Trends shaping CPA bookkeeping services

- Cloud-first accounting systems and automation: Accounting software integration and AI-assisted reconciliation increase speed and accuracy.

- Outsourced accounting and CPA outsourcing: More small businesses outsource to CPA firms for cost-effective accounting and tax services.

- Virtual CFO and advisory services: CPAs increasingly offer strategic advisory and CFO services to help businesses scale.

- Subscription pricing models: Transparent monthly pricing for bookkeeping,d accounting, and tax services tailored to business needs.

- Industry-specific expertise: Firms offering niche services for startups, online retailers, or service providers to handle complex accounting scenarios.

Types of top providers

- National CPA firms with dedicated outsourced bookkeeping divisions for small businesses.

- Regional CPA firms offering personalized accounting and bookkeeping services and tax planning.

- Online bookkeeping services partnered with licensed CPAs for tax and audit support.

- Specialized bookkeeping and accounting services for startups and growing businesses that include advisory, payroll, and tax services.

How CPA bookkeeping services integrate with your business systems

Expert CPA bookkeeping services will work with your existing accounting software, migrate data when needed, and streamline financial workflows. Whether you use QuickBooks, Xero, or another accounting system, a CPA firm’s bookkeeping team will connect invoicing, payroll, and bank feeds to deliver consolidated financial statements. This seamless integration makes monthly bookkeeping efficient and supports timely tax return preparation and audit readiness.

Real-world examples of value

Example 1: A startup using outsourced CPA bookkeeping services moved from reactive bookkeeping to proactive tax planning. The CPA helped classify expenses correctly, implemented accrual accounting where appropriate, and reduced quarterly tax liabilities through strategic tax planning.

Example 2: A small retail business worked with a CPA firm’s bookkeeping team to integrate online sales data into their accounting system, automate invoice processing, and create weekly cash flow reports. This allowed the owner to focus on inventory and marketing while getting clear financial management insights.

Costs and ROI of CPA bookkeeping services

Costs vary by scope and complexity: basic monthly bookkeeping may be affordable for small businesses, while full-service outsourced accounting and advisory services command higher fees. Consider cost versus ROI: improved tax savings, fewer compliance penalties, better cash flow management, and the ability to make informed decisions that drive revenue often more than offset the expense.

Questions to ask prospective CPA bookkeeping providers

- Are you a licensed CPA or part of a CPA firm?

- What bookkeeping and accounting services are included in your standard package?

- How do you integrate with existing accounting software and payroll systems?

- Can you provide references from businesses similar to mine?

- How do you handle tax preparation, planning, and audit support?

- What security measures protect my financial data?

- What are your pricing and engagement terms, and how do you measure success?

Making the transition: onboarding tips

Plan your transition to CPA bookkeeping services with these steps:

- Assemble historical financial records, invoices, bills, and bank statements for the onboarding team.

- Map out existing accounting workflows and identify pain points for improvement.

- Confirm access levels to accounting software and bank feeds with secure credentials.

- Set expectations for reporting cadence, KPI dashboards, and advisory touchpoints.

- Schedule a cleanup and reconciliation phase to ensure financial statements are tax-ready.

Conclusion

Choosing expert CPA bookkeeping services is an investment in your business’s financial health. Whether you’re a startup, growth-stage company, or established small business, CPA bookkeeping merges bookkeeping and accounting expertise to streamline financial processes, support tax planning, and help you focus on what matters most: growing your business. From outsourcing bookkeeping tasks to building an accounting team that scales as your business grows, CPA bookkeeping services deliver accuracy, compliance, and strategic advice.

Call to action

Ready to streamline your bookkeeping and accounting needs with expert CPA bookkeeping services? Request a free consultation today to discuss your bookkeeping needs, get a customized proposal, and learn how a CPA firm’s bookkeeping solution can help your business stay compliant, save on taxes, and make informed decisions that drive growth. Contact our accounting experts now to start your hassle-free transition to tax-ready bookkeeping and outsourced accounting services.

Trusted CPA bookkeeping services help businesses of all sizes manage financial records, payroll, tax return preparation, and advisory services so you can focus on growing your business. Partner with a certified CPA and take control of your financial management today.

FAQs

How much should I pay for bookkeeping services?

For CPA-level bookkeeping services, expect to pay $800–$3,000 per month for small to medium businesses. Basic monthly bookkeeping by a CPA usually starts at $1,000–$1,800, while full-service packages with tax planning reach $2,000–$3,000+. Pricing depends on transaction volume, complexity, and whether tax or advisory work is included.

How much does a CPA charge per hour for bookkeeping?

CPAs typically charge $100–$300 per hour for bookkeeping services in 2026.

Rates average $150–$220/hour for most small business clients, higher in major cities or for specialized work. Hourly billing is shared for one-off projects or when monthly retainers aren’t used.

Do CPA firms do bookkeeping?

Yes, most CPA firms offer bookkeeping services, especially for small business clients.

Many provide full-service packages that combine bookkeeping, payroll, financial reporting, and tax preparation. It’s common for CPAs to handle or oversee bookkeeping to ensure tax-ready, compliant books.

Does a CPA do bookkeeping?

Yes, many CPAs perform or supervise bookkeeping, particularly for small businesses and startups. They often use it as an entry point to offer higher-value services like tax planning and financial advisory. Some CPAs focus only on tax and review work, delegating routine bookkeeping to staff or outsourced teams.

How much should a CPA charge for bookkeeping?

A CPA should charge $800–$3,000 per month or $100–$300 per hour for bookkeeping services.

Fair pricing reflects expertise, accuracy, and tax compliance benefits often higher than those of non-CPA bookkeepers. Monthly retainers of $1,200–$2,500 are standard for comprehensive small business bookkeeping.

What does a bookkeeper do at a CPA firm?

At a CPA firm, a bookkeeper handles daily transaction entry, bank reconciliations, accounts payable/receivable, payroll processing, and financial statement preparation.

They maintain clean, tax-ready books and work under CPA supervision to ensure compliance and accuracy. Their work supports the firm’s tax preparation, audit, and advisory services.

Do CPAs like QuickBooks?

Yes, most CPAs like and actively use QuickBooks (especially QuickBooks Online) for small business clients. It’s the leading platform for bookkeeping, tax prep integration, and client collaboration. Many CPAs are QuickBooks ProAdvisors and recommend it for its reliability and reporting features.

What can a CPA do that a bookkeeper can’t?

A CPA can prepare and sign tax returns, represent clients in IRS audits, provide tax planning and strategy, offer financial forecasting, and issue audited/reviewed financial statements.

Bookkeepers focus on transaction recording and basic reporting, but cannot legally perform tax preparation or attestation services. CPAs also give formal financial advice and help with complex entity structuring.

Can a CPA make 300k a year?

Yes, many CPAs earn $300,000+ per year, substantial owners, partners, or those in high-demand niches (tax planning, forensic accounting, business valuation).

Solo CPAs with 30–50 small business clients charging premium rates often reach $250k–$400k+ net. Income depends on location, specialization, client base, and whether they own the practice.

How much does a CPA charge per month for bookkeeping?

CPAs typically charge $1,000–$3,000 per month for ongoing bookkeeping services for small businesses. Basic monthly packages often start around $1,200–$1,800, while full-service (bookkeeping + tax prep) ranges from $2,000–$3,000+. Pricing reflects CPA expertise, compliance focus, and added value over non-certified bookkeepers.

Read Also: Virtual Bookkeeping Services for Small Businesses That’ll Change Your Life!