Introduction: Why modern bookkeeping services matter

Bookkeeping refers to the recording of financial transactions and the organization of financial data that keeps a business healthy and compliant. For small business owners, startups, and entrepreneurs, modern bookkeeping services transform traditional bookkeeping from manual data entry and shoebox receipts into a streamlined, scalable set of bookkeeping solutions. Whether you’re evaluating the best online bookkeeping service or considering outsourcing your bookkeeping, modern bookkeeping services combine cloud bookkeeping, automated bookkeeping, and virtual bookkeeping services to ensure financial information is up-to-date and accessible when you need it.

What are modern bookkeeping services?

Modern bookkeeping services are comprehensive bookkeeping offerings that rely on cloud computing, bookkeeping software, and increasingly AI-driven tools to automate categorization, bank feeds, invoicing, and payroll integration. Unlike traditional bookkeeping, which often depends on in-house staff or local bookkeeping service firms performing manual data entry and periodic reconciliation, modern bookkeeping emphasizes continuous financial data flows, real-time bookkeeping dashboards, and seamless integrations with accounting systems and tax service providers.

Core components

- Cloud bookkeeping and bookkeeping software (QuickBooks, Xero, and other accounting systems)

- Automated bookkeeping features: AI categorization, recurring invoices, and automated receipts capture

- Bank feeds and real-time financial reporting

- Virtual bookkeeping services and access to a dedicated bookkeeper or full-service bookkeeping packages

- Integration with payroll and tax filing services

Key benefits of modern bookkeeping services

Small business owners and entrepreneurs choose modern bookkeeping services because they directly impact a business’s financial health and decision-making. The main benefits include:

Automation and efficiency

Modern bookkeeping services reduce manual data entry through AI-driven categorization and receipt capture, which improves accuracy and efficiency. This lowers bookkeeping prices in many cases because routine work is automated and human effort is focused on review and exception handling.

Real-time insights and better financial reporting

Real-time bookkeeping gives business owners up-to-date financial information and dashboards so you can monitor cash flow, track invoices, and make informed decisions for your business. Instead of waiting for quarterly reviews or monthly reconciliations, your financial data is ready when you are.

Scalability

Whether you’re a sole proprietor or running businesses of all sizes, modern bookkeeping services scale with your business. Cloud computing and subscription-based bookkeeping solutions let you grow with your business without the delays of hiring in-house staff or upgrading on-premise systems.

Compliance and accuracy

Modern bookkeeping services streamline tax season and tax filing with organized financial records, integrated tax service options, and certified bookkeepers who follow best practices. Up-to-date financial statements and accurate bookkeeping reduce the risk of penalties and make working with accountants and accounting firms easier.

Traditional bookkeeping vs. modern bookkeeping

Understanding the difference between traditional bookkeeping and modern bookkeeping helps you evaluate the best bookkeeping service for your needs.

Traditional bookkeeping

- Manual data entry and paper receipts

- Periodic reconciliation and delayed reporting

- In-house bookkeeper or local bookkeeping service with physical files

- Limited integration with payroll and accounting systems

Modern bookkeeping

- Cloud-based bookkeeping software and automated data capture

- Real-time bookkeeping and continuous financial reporting

- Virtual bookkeeping, outsourced full-service bookkeeping, or hybrid models with a dedicated bookkeeper

- Seamless integrations: payroll, invoicing, bank feeds, and tax filing systems

For many small business owners, modern bookkeeping services deliver better accuracy and efficiency, improve cash flow visibility, and reduce the administrative burden of bookkeeping and financial management.

Essential features to look for in modern bookkeeping services

When evaluating providers and bookkeeping solutions, prioritize features that align with your business needs and growth plans.

AI categorization and smart automation

Look for bookkeeping software that uses machine learning to categorize transactions and learn your preferences over time. This feature reduces manual corrections and speeds up reconciliation.

Bank feeds and real-time transaction syncing

Automatic bank feeds keep your financial data flowing smoothly into your books. Real-time syncing ensures invoices, receipts, and bank transactions are reflected promptly in your financial statements and cash flow reports.

Mobile apps and receipt capture

Mobile bookkeeping apps let you capture receipts, create invoices, and review financial data on the go. This is essential for business owners who travel, meet clients, or manage both personal and business expenses.

Integrations with payroll, invoicing, and tax filing

Modern bookkeeping services should integrate with payroll, invoicing, and tax service providers to minimize double entry and avoid reconciliation gaps during tax season. Integration with QuickBooks or other popular accounting systems ensures compatibility with accountants and accounting firms.

Dedicated bookkeeper or full-service support

Depending on your business needs, choose between a DIY model with bookkeeping software, a hybrid model with a dedicated bookkeeper, or full-service bookkeeping that includes monthly reconciliations, payroll, and tax service add-ons.

Common challenges and mistakes to avoid

Even with advanced bookkeeping solutions, small business owners can run into pitfalls. Recognizing these helps you avoid costly errors.

- Poor setup: Incorrect chart of accounts or inconsistent categorization can lead to inaccurate financial statements and bad decisions for your business.

- Neglecting bank reconciliation: Failing to reconcile bank accounts regularly creates discrepancies and hides cash flow problems.

- Relying solely on automation: Automation is powerful but not perfect. Regular review by a certified bookkeeper or accountant prevents misclassifications and ensures accuracy.

- Ignoring integrations: Not connecting payroll or sales platforms means missing important financial information and increases manual work.

- Waiting too long to outsource: Delaying outsourcing your bookkeeping can make it harder to get your books in order during tax season or when seeking funding.

Step-by-step guide to choosing and implementing modern bookkeeping services

Follow these steps to choose and implement the right modern bookkeeping service for your business’s needs.

1. Assess your business needs

Identify whether you need basic bookkeeping, full-service bookkeeping, payroll integration, or additional services like tax filing and quarterly reviews. Consider current pain points: Are you struggling with data entry, cash flow visibility, or tax preparedness?

2. Define your budget and expected bookkeeping prices

Determine what you’re willing to pay monthly or annually. Compare bookkeeping prices among the best online bookkeeping services and consider the value of time saved and improved financial management.

3. Choose between DIY software and virtual bookkeeping services

If you have the time and skills, bookkeeping software can be the best bookkeeping option for low-cost bookkeeping. If you’d rather focus on growing your business, outsourcing to virtual bookkeeping or full-service bookkeeping may be better.

4. Evaluate providers and integrations

Look for services that integrate with your accounting systems, payroll provider, point-of-sale, and banks. Check compatibility with QuickBooks or other popular bookkeeping software and ask about access to a dedicated bookkeeper or certified bookkeepers.

5. Plan the implementation

Implementation should include data migration, chart of accounts setup, bank feed connections, and staff training. Expect initial cleanup work to get your financial records current. This is a common additional service offered by many providers.

6. Establish a review cadence

Decide on monthly reconciliations, cash flow reviews, and quarterly reviews with your bookkeeper or accountant. Regular reviews help maintain accuracy and allow you to make informed decisions for your business.

7. Monitor and iterate

As your business grows, evaluate whether current bookkeeping solutions still meet your needs. Modern bookkeeping services are designed to be scalable so they can grow with your business.

Top providers and trends in 2026

As of 2026, several trends and providers stand out in modern bookkeeping services.

Key trends

- AI-driven bookkeeping: Increased reliance on machine learning for transaction categorization and anomaly detection.

- Embedded financial tools: Bookkeeping software offering integrated payroll, invoicing, and tax filing workflows.

- Verticalized solutions: Industry-specific bookkeeping solutions for e-commerce, professional services, and restaurants that handle unique transaction flows.

- Hybrid human+AI models: Combining automation with certified bookkeepers and accountants for higher accuracy.

Notable providers

Look for providers that offer a range of bookkeeping solutions, DIY software, best online bookkeeping service packages, and full-service bookkeeping options. Examples include established accounting systems with bookkeeping add-ons and specialized virtual bookkeeping services that provide a dedicated bookkeeper.

Popular bookkeeping software choices often used by small business owners include QuickBooks, Xero, and other leading platforms that connect easily to payroll, POS, and banking partners. Several virtual bookkeeping firms now advertise “best online bookkeeping services” and offer scalable plans to support growing your business.

How modern bookkeeping services support tax season and financial reporting

Modern bookkeeping services simplify tax filing by keeping receipts digitized, financial statements accurate, and financial data organized throughout the year. Certified bookkeepers and accounting firms can prepare the business’s financial information for tax professionals, reducing stress and surprises during tax season. Regular financial reporting and quarterly reviews also make it easier to plan taxes and identify deductions.

When to outsource your bookkeeping

Outsourcing your bookkeeping is often the right move when bookkeeping tasks take time away from revenue-generating activities, when accuracy issues persist, or when preparing for growth or fundraising. Outsourcing can provide access to a dedicated bookkeeper and additional services without the overhead of hiring in-house staff. This is a practical step for small business owners who want to get their books in order quickly and efficiently.

Pricing considerations and value

Bookkeeping prices vary by the level of service. Basic bookkeeping software may be inexpensive, but it requires time investment. Full-service bookkeeping, virtual bookkeeping, or specialized packages include higher fees but deliver more comprehensive support like payroll, tax service, and financial reporting. When evaluating prices, weigh the value of timely financial statements, accuracy, efficiency, and the ability to make informed decisions for your business.

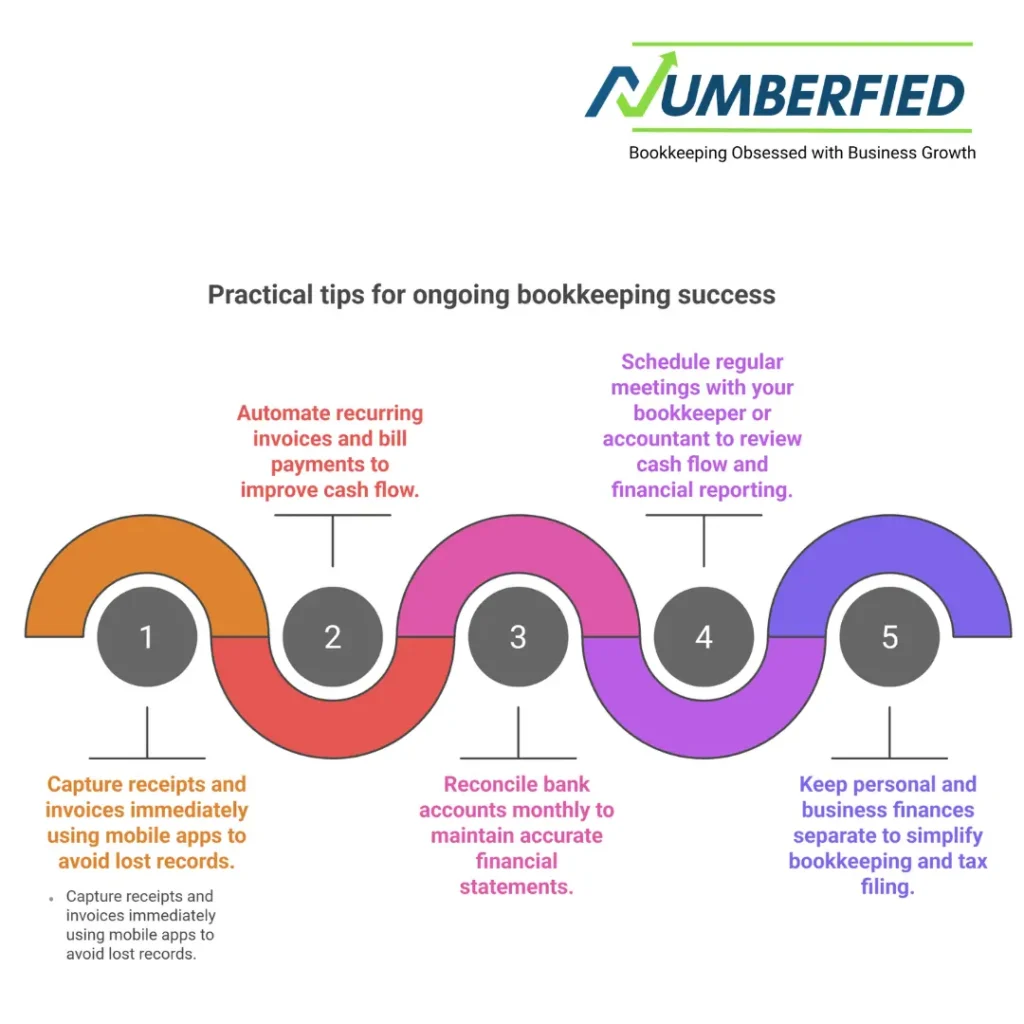

Practical tips for ongoing bookkeeping success

- Capture receipts and invoices immediately using mobile apps to avoid lost records.

- Automate recurring invoices and bill payments to improve cash flow.

- Reconcile bank accounts monthly to maintain accurate financial statements.

- Schedule regular meetings with your bookkeeper or accountant to review cash flow and financial reporting.

- Keep personal and business finances separate to simplify bookkeeping and tax filing.

Conclusion

Modern bookkeeping services are more than a replacement for traditional bookkeeping; they are a strategic tool for small business owners, startups, and entrepreneurs who need accurate, up-to-date financial information to grow. By combining automation, real-time bookkeeping, scalable solutions, and expert support, modern bookkeeping lets you focus on running your business while trusted professionals and software ensure your financial data is reliable. Whether you choose a dedicated bookkeeper, a full-service bookkeeping offering, or the best online bookkeeping service that fits your budget, the right modern bookkeeping service will help you make better decisions for your business and maintain long-term financial health.

Get started: Choose the right modern bookkeeping services today

Ready to transform your bookkeeping? Start by identifying your business needs, set a realistic budget for bookkeeping prices, and evaluate providers that offer cloud bookkeeping, virtual bookkeeping services, and integration with your accounting systems and payroll. If you need help, our team can assess your financial workflows, recommend the best bookkeeping solution, migrate your financial records, and connect you with a dedicated bookkeeper to keep your cash flow and financial statements up-to-date.

Schedule your free consultation to evaluate modern bookkeeping services and get a customized plan for your business today.

FAQ

What is modern bookkeeping?

Modern bookkeeping uses cloud-based software, automation, bank feeds, and AI to record transactions in real time instead of manual entry.It emphasizes accuracy, scalability, and real-time financial insights for business owners.Tools like QuickBooks Online, Xero, and FreshBooks are central to modern practices.

What are modern bookkeeping practices?

Modern bookkeeping practices include automatic bank feeds, AI categorization, mobile apps for approvals, multi-currency support, and real-time dashboards.

They focus on integration with e-commerce, payroll, and CRM platforms for seamless workflows.

What are the three types of bookkeeping?

The three main types are single-entry (simple cash-based tracking), double-entry (debits and credits for accuracy), and cloud/virtual bookkeeping (real-time, online-based system with automation).Cloud/virtual is the most common in modern bookkeeping due to accessibility and integration features.

What is the new term for bookkeeper?

The term “bookkeeper” is still widely used, but many professionals now call themselves “virtual bookkeeper,” “cloud accountant,” “financial operations specialist,” or “fractional CFO/bookkeeper.”

What is an example of modern accounting?

An example is a small business using Xero with automated bank feeds, AI transaction categorization, real-time profit/loss dashboards, and integrated sales tax calculation for e-commerce sales.

What are the three golden rules of bookkeeping?

The three golden rules are: debit the receiver and credit the giver (personal accounts), debit what comes in and credit what goes out (real accounts), and debit all expenses/losses while crediting all incomes/gains (nominal accounts).

What is a bookkeeper’s hourly rate?

In the US in 2026, bookkeepers typically charge $40–$90 per hour.

Freelance or junior bookkeepers often charge $40–$65, while experienced or full-charge bookkeepers charge $70–$90+ per hour.

How much do independent bookkeepers charge per hour?

Independent bookkeepers usually charge $50–$100 per hour in the US.Rates average $60–$80 for most independent professionals, with higher rates ($85–$100+) for those with niche expertise like e-commerce or QuickBooks certification.

What is the average hourly rate for a bookkeeper?

The average hourly rate for a bookkeeper in the US is $45–$75 in 2026.Most fall around $55–$65 per hour, depending on experience, location, and whether they specialize in cloud software or specific industries.

What is the hourly rate for a bookkeeper in the US?

Bookkeepers in the US charge $40–$90 per hour on average in 2026.Entry-level or basic bookkeepers charge $40–$60, while experienced, certified, or full-charge bookkeepers typically charge $70–$90 per hour.

Read Also: 9 Surprising Ways a Bookkeeping Service for Small Business Can Boost Your Success