Introduction

Small to mid-size business owners and financial managers increasingly choose outsourced accounts payable services to reduce processing costs, improve accuracy, and streamline the accounts payable process. Whether you are exploring accounts payable outsourcing, accounts payable automation, or a hybrid accounts payable solution, this guide explains the benefits of outsourcing your accounts payable, how it compares to a DIY approach, top providers and features, common mistakes to avoid, and a step-by-step plan to choose and implement an accounts payable outsourcing service.

What are outsourced accounts payable services?

Outsourced accounts payable services (also called AP outsourcing or payable outsourcing service) transfer all or part of your accounts payable function to an external outsourcing provider or accounts payable services company. Services can range from basic data entry and invoice receipt processing to full-service accounts payable outsourcing solutions that include invoice capture, approval workflow, automated invoice processing, vendor payment services, and integration with accounts payable automation software or an AP system.

Primary benefits of outsourced accounts payable services

1. Reduce accounts payable processing costs

One of the strongest reasons to outsource accounts payable is to reduce costs. Outsourcing providers use automation solutions, optimized AP workflows, and centralized processing to lower labor and processing costs compared with maintaining an in-house AP department. By outsourcing accounts payable processes, many businesses reduce invoice processing costs per invoice, lower error rates, and reduce late payment penalties.

2. Faster invoice and payment process

Outsourced AP providers standardize the invoice process and use accounts payable automation software or automated invoice processing to accelerate invoice receipt, invoice data capture, approval routing, and payment execution. Faster processing improves relationships with suppliers, increases the opportunity for early-payment discounts, and smooths cash flow.

3. Improved accuracy and compliance

Accounts payable outsourcing companies deploy data capture, optical character recognition (OCR), and workflow controls that reduce duplicate invoices, missed approvals, and compliance risks. Outsourcing reduces human errors in data entry and improves audit trails for invoice and payment records.

4. Access to technology and expertise

Many small businesses cannot justify the expense of accounts payable automation solutions or hiring AP specialists. Outsourcing provides immediate access to AP automation, accounts payable software, and experienced AP staff without a large capital outlay. An outsourcing provider can offer bespoke accounts payable solutions that scale as your business grows.

5. Scalability and flexibility

Outsourced AP services can scale up during seasonal peaks, mergers, or rapid growth. Whether you need accounts payable processing services, vendor payment services, or a virtual accounts payable team, outsourcing allows you to adjust capacity without expanding the AP department headcount.

Related terms you’ll see often.

- AP outsourcing

- Accounts payable automation

- Outsourced invoice processing

- Vendor payment services

- Virtual accounts payable

DIY vs. Outsourced: How to decide

Deciding whether to outsource accounts payable or keep the function in-house depends on current costs, internal capabilities, volume of invoices, and strategic goals. Below is a comparison to help you evaluate which path is best for your business.

DIY (In-house accounts payable)

- Control: Full control over the AP process, policies, and internal approvals.

- Cost structure: Fixed costs include salaries, benefits, office space, software licenses, and training.

- Technology: May require capital investment to implement accounts payable automation software or AP automation solutions.

- Scalability: Limited; additional staff or overtime needed during peaks.

- Customization: Highly customized to your internal processes, but may lack best-practice workflow efficiency.

Outsourced accounts payable services

- Control: Shared control; the outsourcing provider manages day-to-day processing while you retain approval authority for payments.

- Cost structure: Variable cost paid per invoice, per transaction, or monthly service fees that often reduce processing costs.

- Technology: Provider supplies accounts payable outsourcing solutions, automated invoice processing, and AP automation software.

- Scalability: Highly scalable to seasonal demand or business growth.

- Expertise: Access to specialized knowledge, best-practice accounts payable workflow, and data capture technologies.

When outsourcing makes sense

Consider outsourcing if you want to reduce processing costs, if your team is overloaded, if you lack AP automation solutions, or if you need to scale quickly without adding headcount. Outsourcing is also attractive for companies seeking to improve the invoice and payment process or eliminate backlogs and late payments.

Top outsourced accounts payable services and provider features

Not all accounts payable outsourcing providers are the same. When evaluating accounts payable services providers, look for these features and capabilities:

Core capabilities

- Invoice receipt and data capture (paper, email, EDI)

- Invoice data extraction using OCR and validation

- Automated invoice processing and workflow routing

- Duplicate invoice detection and exception handling

- Vendor master management and vendor payment services

- Payment execution (ACH, virtual card, check printing, international wires)

- Integration with your ERP, accounting software, or AP system

- Secure document storage and audit trails

Advanced features

- Accounts payable automation software with machine learning for improved data capture

- Early payment and dynamic discount management

- Real-time dashboarding and accounts payable reporting

- AP workflow customization and approval mobile apps

- Fraud detection and payment controls

- Global payment capabilities for multi-country operations

Service model options

- Full outsourcing: The provider manages the entire accounts payable function.

- Partial outsourcing: The provider manages specific parts of the AP process, such as data entry or payment execution.

- Managed services: Providers supply the platform and support while your team remains involved in approvals or exceptions.

- Hybrid: Combination of onshore staff for sensitive tasks and offshore teams for routine processing.

Top providers to consider

Many companies offer accounts payable outsourcing solutions and accounts payable outsourcing services. When shortlisting accounts payable outsourcing companies, consider proven vendors with expertise in your industry, integration capabilities, and transparent pricing. Examples of well-known providers and their strengths include:

Provider examples and notable features

- Provider A: Strong accounts payable automation software, advanced OCR, and machine learning for automated invoice processing; ideal for companies wanting to automate accounts payable workflow end-to-end.

- Provider B: Comprehensive outsourced AP services with vendor payment services and global payables; strong for multinational businesses needing cross-border payment process support.

- Provider C: Cost-effective payable outsourcing service with competitive per-invoice pricing and excellent data capture for mid-sized firms seeking to reduce processing costs.

- Provider D: Accounting service and accounts payable outsourcing provider that integrates tightly with popular ERP systems and offers managed services for hybrid models.

Common mistakes to avoid with accounts payable outsourcing

Outsourcing your accounts payable can correct many problems, but mistakes in selection and implementation can cause issues. Common mistakes include:

1. Late payments and poor vendor communication

Switching providers without clear timelines or incomplete vendor data can generate late payments and strained vendor relationships. Ensure the outsourcing provider understands your payment terms and has a plan to migrate vendor payment information accurately.

2. Duplicate invoices and data errors

Poorly implemented data capture or a lack of deduplication rules can allow duplicate invoices to be paid. Verify that the AP automation solution includes duplicate detection and a robust exception-handling process.

3. Lack of integration with your financial systems

Failing to integrate the outsourced AP system with your ERP or accounting software results in manual reconciliations and increased processing costs. Prioritize providers with strong integration capabilities.

4. Inadequate security and compliance controls

Not verifying a service provider’s security, audit controls, or payment protocols exposes your business to fraud or compliance breaches. Ask for SOC reports, encryption standards, and payment authorization processes.

5. Poor change management and training

Underestimating the internal change management effort can cause resistance from staff and delayed benefits. Plan for training, clear communication, and transition support from the outsourcing company.

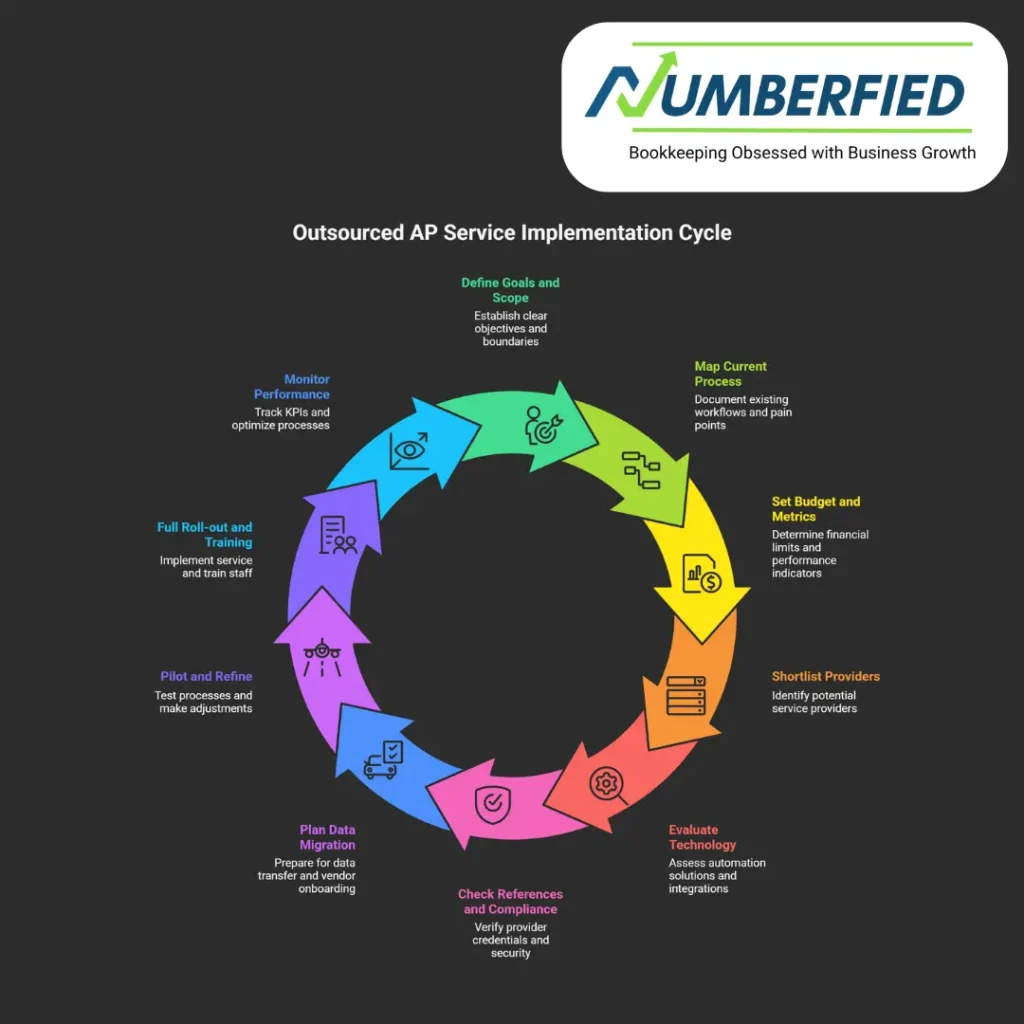

Step-by-step guide to choosing and implementing an outsourced AP service

Step 1: Define goals and scope

Start by documenting what you want to achieve: reduce accounts payable processing costs, shorten the invoice-to-pay cycle, eliminate manual data entry, increase early-payment discounts, or improve vendor relations. Decide whether you will outsource the full accounts payable function or specific tasks such as data capture or payment execution.

Step 2: Map your current accounts payable process

Document your existing accounts payable workflow: invoice receipt channels, AP process steps, approvals, exception handling, payment methods, and reporting needs. Identify pain points like high processing costs, late payments, or backlogs.

Step 3: Set budget and performance metrics

Establish a budget for the outsourcing service and key performance indicators (KPIs) such as cost per invoice, days payable outstanding (DPO), invoice cycle time, error rate, and percentage of automated invoice processing.

Step 4: Shortlist providers and request proposals

Identify outsourcing providers with experience in your industry and ERP. Request proposals that detail services, automation capabilities, integration approach, security certifications, pricing models, migration plan, and expected SLA metrics.

Step 5: Evaluate technology and integrations

Assess accounts payable automation solutions, OCR accuracy, AP workflow capabilities, and API or connector support for your accounting system. Test invoice capture and validation with sample invoices to confirm the accuracy of invoice data extraction and automated invoice processing.

Step 6: Check references and compliance

Ask for references from similar clients and verify security controls, compliance certifications (SOC 1/2), and evidence of payment controls. Confirm how the provider handles dispute resolution and exception management.

Step 7: Plan data migration and vendor onboarding

Create a detailed migration plan for invoice history, vendor master data, and open invoices. Communicate with vendors about any changes in invoice submission or payment remittance advice to avoid payment interruptions.

Step 8: Pilot and refine

Run a pilot with a subset of invoices or departments to validate processes, integrations, and KPIs. Use the pilot to refine rules for invoice approval routing, data capture exceptions, and duplicate invoice detection.

Step 9: Full roll-out and training

Roll out the outsourced accounts payable services across the organization with training for AP staff, approvers, and procurement. Provide clear documentation for new AP workflow steps and the escalation process for exceptions.

Step 10: Monitor performance and continuous improvement

Track KPIs and meet regularly with the service provider to review performance. Use insights from accounts payable reporting to continually optimize the invoice and payment process, reduce processing costs, and drive further automation opportunities.

Measuring ROI and benefits of outsourcing accounts payable

To measure the return on investment for accounts payable outsourcing, track before-and-after metrics: reduction in processing costs per invoice, improvement in invoice cycle time, reduced late payments, increase in early-payment discounts captured, and fewer exceptions requiring manual intervention. Include intangibles like improved vendor relationships, reduced management burden, and access to analytics and reporting as part of the benefits of outsourcing accounts payable.

Practical tips to maximize success

- Standardize invoicing requirements with suppliers, clear remit-to instructions, and preferred formats to reduce exceptions.

- Implement three-way matching rules and automated exception workflows to minimize manual approvals.

- Use AP automation solutions that learn and adapt, improving invoice data accuracy over time.

- Retain approval authority internally while outsourcing routine invoice processing and payment execution to the provider.

- Review and renegotiate payment terms with vendors to take advantage of early-payment discounts enabled by faster processing.

Conclusion

Outsourced accounts payable services can transform your accounts payable operations, reduce processing costs, and free finance teams to focus on higher-value activities like cash management and strategic financial planning. By carefully selecting an accounts payable outsourcing provider, planning a structured migration, and leveraging accounts payable automation and best-practice AP workflows, small and mid-size businesses can achieve faster invoice processing, stronger vendor relationships, and measurable financial benefits.

If your business struggles with invoice backlogs, high processing costs, or limited AP automation, consider evaluating accounts payable outsourcing solutions to find the right balance of service, technology, and cost savings for your organization.

FAQ

How much does it cost to outsource accounts payable?

Outsourcing accounts payable typically costs $1.40–$15 per invoice processed or falls into monthly fees based on volume and complexity. Many providers charge flat monthly rates or per-transaction fees, often resulting in significant savings compared to in-house processing, with some achieving reductions of up to 70%.

What are the four types of outsourcing?

The four main types of outsourcing are professional outsourcing (specialized services like accounting or legal), IT outsourcing (technology and software support), manufacturing outsourcing (production of goods), and process-specific outsourcing (ongoing tasks like payroll or customer service). These are often further categorized by location: onshore, nearshore, and offshore.

Can accounts payable be outsourced?

Yes, accounts payable is commonly outsourced to third-party providers who handle tasks like invoice processing, approvals, payments, and vendor management. This approach improves efficiency, reduces errors, and allows internal teams to focus on strategic work, making it a popular choice for businesses of all sizes.

Can you outsource accounts payable?

Yes, businesses frequently outsource accounts payable to specialized providers for invoice capture, data entry, approvals, payment execution, and reporting. Outsourcing delivers cost savings, better compliance, and access to advanced automation tools.

What is the accounts payable outsourcing process?

The accounts payable outsourcing process typically involves vendors sending invoices directly to the provider (via email or portal), where they capture data, route for approvals, match to purchase orders, process payments, and generate reports. Secure data sharing and regular performance reviews ensure smooth collaboration.

Can accounts payable be remote?

Yes, accounts payable can easily be managed remotely using cloud-based software, digital workflows, electronic approvals, and online payment tools. This setup supports flexible, location-independent operations while maintaining efficiency and security.

What should you not outsource?

In accounts payable, avoid outsourcing core strategic functions like high-level financial decision-making, sensitive compliance oversight, or tasks requiring deep internal business knowledge. Repetitive processes like invoice processing and payments are ideal for outsourcing, but retain control over fraud prevention and vendor strategy.

Can accounts payable be automated?

Yes, accounts payable can be fully automated using software that handles invoice capture (via OCR), data entry, three-way matching, approvals, payments, and reporting. Automation significantly reduces manual effort, errors, and processing time while improving accuracy and compliance.

How much does it cost to outsource an accountant?

Outsourcing an accountant typically costs $500–$5,000+ per month or $150–$500 per hour, depending on the scope (basic bookkeeping vs. full advisory). Full-service packages, including CFO-level support, can exceed this for complex needs.

How much does it cost to outsource accounting?

Outsourcing accounting services generally ranges from $500–$5,000+ per month, varying by business size, transaction volume, and services (bookkeeping, tax prep, advisory). Simpler needs start lower, while comprehensive packages with controller oversight cost more.

Also Read: Outsourced Accounts Payable Services: Save Money, Improve Accuracy, and Scale Faster