Introduction

Real estate underwriting is the process lenders, investors, and underwriters use to determine whether a borrower and a property are viable for financing. For real estate investors, developers, lenders, and mortgage professionals, a disciplined underwriting process protects capital, optimizes loan terms, and identifies potential risk for the lender and investor before closing.

Why Real Estate Underwriting Matters

Underwriting is central to real estate investing and lending because it evaluates the ability to repay the loan and the property’s ability to generate income. Whether you’re assessing a multifamily property, a commercial real estate investment, or a single-family residential loan, underwriting involves analyzing borrower creditworthiness, property value, and market conditions. Accurate underwriting reduces unexpected losses from vacancies, natural disasters, or mispriced assets and helps determine appropriate loan amount, interest rate, and covenants.

Key Benefits for Investors, Lenders, and Developers

- Risk mitigation: Underwriting assesses the risk associated with a borrower and property, helping underwriters evaluate potential risk for the lender and investor.

- Better pricing: Thorough analysis supports appropriate interest rate setting, loan terms, and LTV limits.

- Improved investment decisions: Investors can compare cap rate expectations, DSCR, and net operating income to assess the value of the property.

- Regulatory and portfolio protection: Underwriting helps compliance with lending standards and protects real estate funds and REITs from systemic issues.

What Is the Real Estate Underwriting Process?

The real estate underwriting process is the systematic method used to assess whether to approve a loan or investment. The process involves analyzing borrower financials, property appraisal, lease and operating expense review, and market analysis. In short, underwriting is the process used to determine if the loan amount relative to the property’s value and the borrower’s creditworthiness creates acceptable risk.

High-level Steps in the Underwriting Process

- Initial application and prequalification: Gather borrower information, credit report, credit score, and basic property details.

- Document collection: Request tax returns, rent rolls, leases, insurance, property appraisal, and operating expense histories.

- Property and market analysis: Evaluate net operating income, vacancy assumptions, market value, cap rate, and comparable sales.

- Financial modeling: Calculate DSCR (debt service coverage ratio), LTV (loan-to-value), loan underwriting scenarios, and stress tests for interest rate changes or income dips.

- Risk assessment and red flags: Identify issues such as environmental concerns, inadequate insurance, high vacancy, or unstable lease structures.

- Credit decision and recommended loan terms: Determine approval, conditions, interest rate, loan amount, amortization, and covenants.

- Closing and monitoring: Fund the loan, then monitor performance, covenants, insurance, and market conditions post-closing.

Key Components Underwriters Evaluate

Underwriting in real estate integrates quantitative metrics and qualitative judgment. The most common components underwriters focus on include:

The 3 C’s: Credit, Capacity, Collateral

- Credit: The borrower’s credit report and credit score reflect past performance and help predict the ability to repay.

- Capacity: Cash flow analysis, debt service coverage ratio (DSCR), and the borrower’s income streams determine the ability to meet loan payments.

- Collateral: The property’s value, supported by a property appraisal and market comparables, secures the loan.

Property Financials and Operating Metrics

Underwriters evaluate net operating income (NOI), operating expenses, vacancy rates, cap rate, rent roll, and lease terms. For commercial real estate underwriting, lease structure and tenant credit are critical to assessing a property’s ability to generate stable cash flow.

Loan Structure and Ratios

Loan underwriting requires calculating LTV, DSCR, loan term, and amortization schedule. These metrics determine if the loan amount is appropriate for the property’s value, and whether the property will produce enough income to cover debt service.

Market and Environmental Review

Underwriters assess market conditions, comparable sales, neighborhood trends, and risks like natural disasters or zoning changes. Environmental and title reports can reveal latent liabilities that affect viability.

Residential vs. Commercial Underwriting: What’s Different?

While the core principles are similar, the underwriting process differs significantly between residential and commercial real estate underwriting.

Residential Underwriting

Residential mortgage underwriting focuses on borrower creditworthiness, income documentation, appraisal value, and mortgage underwriting guidelines. It often uses automated underwriting systems for speed. Key metrics include credit score, debt-to-income ratio, loan amount, and property appraisal. Insurance underwriting and mortgage underwriting are closely tied to ensure proper hazard and title coverage.

Commercial Real Estate Underwriting

Commercial underwriting centers on property performance and income potential. For commercial real estate investment and multifamily properties, underwriters analyze NOI, cap rate, lease terms, tenant mix, and DSCR. The process involves deeper market analysis and stress testing to evaluate the viability of a commercial real estate investment. Lenders may consider the sponsor’s track record, commercial management experience, and the ability to handle operating expense fluctuations.

Red Flags Underwriters Watch For

Underwriters look for potential risk and deal breakers throughout the underwriting process. Common red flags include:

- Overly optimistic rent or low vacancy assumptions that inflate NOI.

- High LTV or low DSCR that leaves little margin for error.

- Poor borrower credit or inconsistent income documentation.

- Unsecured or short-term leases in commercial properties that threaten future cash flow.

- Insufficient insurance or environmental liabilities from past uses of the property.

- Rapidly declining market conditions or evidence of oversupply.

In-House Underwriting vs. Outsourced Underwriting

Organizations can perform underwriting in-house or outsource to third-party underwriters. Each approach has trade-offs.

In-House Underwriting

Benefits: Faster decisions, deeper alignment with internal lending policies, and direct control over underwriting criteria. In-house teams better support portfolio monitoring and tailored credit strategies for private real estate, real estate funds, and REITs.

Challenges: Requires skilled underwriters, investment in training and tools, and overhead for staffing and compliance.

Outsourced Underwriting

Benefits: Access to specialized expertise, scalability, and lower fixed costs. Outsourcing can be especially useful for lenders and investors who need peak capacity during pipeline surges or require commercial real estate underwriting expertise for unfamiliar asset classes.

Challenges: Less control over timelines and potential misalignment with firm-specific underwriting culture and risk tolerances. Clear SLAs and documentation standards are critical.

Top Tools and Software for Real Estate Underwriting

Modern underwriting relies on technology to increase accuracy and speed. Common tools include:

- Automated underwriting systems for the mortgage underwriting process and initial borrower screening.

- Financial modeling platforms and Excel templates for DSCR, LTV, and sensitivity analysis.

- Property databases and comps platforms for market value and cap rate benchmarking.

- Loan servicing and portfolio monitoring systems for post-close tracking.

- Underwriting risk assessment software and AI-driven tools that analyze trends, automate document processing, and predict borrower default probabilities.

Selecting tools depends on the asset type. Residential lenders often prioritize automated underwriting systems, while commercial lenders adopt platforms that integrate lease data, cash flow modeling, and scenario analysis.

Common Underwriting Mistakes and How to Avoid Them

Even experienced underwriters can face pitfalls. Recognizing typical mistakes helps protect investments:

Mistake 1: Overly Optimistic Revenue Assumptions

Assuming full occupancy or aggressive rent growth inflates NOI. Use conservative vacancy rates and stress-test for rent downturns to ensure the property can still repay the loan under stress scenarios.

Mistake 2: Ignoring Market Trends

Failure to assess market conditions, new supply, or changing demand can erode property value and cash flow. Analyze local market indicators and comparable property performance.

Mistake 3: Inadequate Borrower Due Diligence

Not verifying the borrower’s track record, liquidity, or credit can expose lenders to repayment risk. Review credit reports, historical performance, and the borrower’s ability to absorb shocks.

Mistake 4: Neglecting Expense Details

Underestimating operating expenses or capital expenditure needs understates required income. Review historical operating expenses, reserve requirements, and potential capital improvements.

Mistake 5: Weak Post-Close Monitoring

Underwriting should not end at closing. Ongoing monitoring of DSCR, vacancy, and compliance clauses ensures early detection of deterioration.

Tips for Successful Real Estate Underwriting

Adopt these best practices to strengthen underwriting outcomes:

- Standardize underwriting templates and checklists to improve consistency across underwriters.

- Use conservative assumptions for occupancy, cap rate, and operating expenses to build resilience into loan terms.

- Incorporate scenario and sensitivity analysis for interest rate changes, natural disasters, or tenant loss.

- Prioritize transparent documentation: clear lease abstracts, appraisal reports, and insurance certificates.

- Invest in training for underwriters on market analysis, environmental risk, and specialty asset classes like multifamily properties or mixed-use developments.

- Align underwriting with investment policy: ensure loan terms and covenant structures reflect investor or lender risk tolerance.

How Underwriting Determines Loan Terms

Underwriting determines the structure of the loan, including the interest rate, amortization schedule, loan amount, and required reserves. For example, a property with strong NOI and low vacancy will typically support a higher loan amount and a competitive interest rate. Conversely, a marginal DSCR or unstable tenant base may result in a higher interest rate, lower LTV, or additional covenants such as cash reserves or personal guaranties.

Underwriters use metrics like LTV, DSCR, cap rate, and market value to quantify risk. The decision to approve a loan ultimately balances the borrower’s creditworthiness, the property’s value, and the expected risk for the lender.

Special Considerations for Commercial Real Estate Underwriting

Commercial underwriting demands deeper scrutiny in certain areas:

- Lease structure: Underwriting assesses the length of leases, renewal terms, tenant creditworthiness, and rent escalations.

- Tenant diversification: Reliance on a single tenant increases risk; underwriters evaluate tenant mix and industry exposure.

- Capital expenditure needs: Older buildings may require significant capex and reserves, affecting cash flow.

- Market value volatility: Commercial markets can shift quickly; underwriters stress-test cap rates and market value assumptions.

Integrating Underwriting into a Broader Investment Strategy

For real estate investors and funds, underwriting should be integrated into acquisition, asset management, and disposition strategies. Use underwriting to identify which properties align with your investment thesis, focusing on value-add opportunities versus stabilized assets, and to establish expected returns and exit strategies. Underwriting in real estate also informs portfolio diversification, helping investors evaluate how a new acquisition will affect overall cash flow, leverage, and risk exposure.

Real-World Example: Underwriting a Multifamily Property

Imagine underwriting a 100-unit multifamily property. The underwriter collects rent rolls, operating expenses, tenant credit data, and a property appraisal. They calculate current NOI, apply a conservative vacancy assumption, and forecast rent growth aligned with market conditions. With an appraisal-based market value and chosen cap rate, they determine LTV and project a DSCR based on proposed loan terms. They then run sensitivity analyses for higher vacancy or expense increases. If the stress-tested DSCR remains acceptable and borrower creditworthiness is strong, the lender proceeds with a loan offer including interest rate, amortization, reserves, and loan covenants. This process illustrates how underwriting evaluates both borrower and property to assess the ability to repay the loan and the value of the property as collateral.

When to Use Third-Party Appraisals and Specialists

Third-party appraisals and specialists are essential when underwriters need independent verification of market value, environmental condition, or structural issues. Appraisals provide an objective opinion of market value and comparables, while environmental site assessments (ESAs) and engineering reports can uncover risks that affect safety, insurance underwriting, and long-term operating expenses.

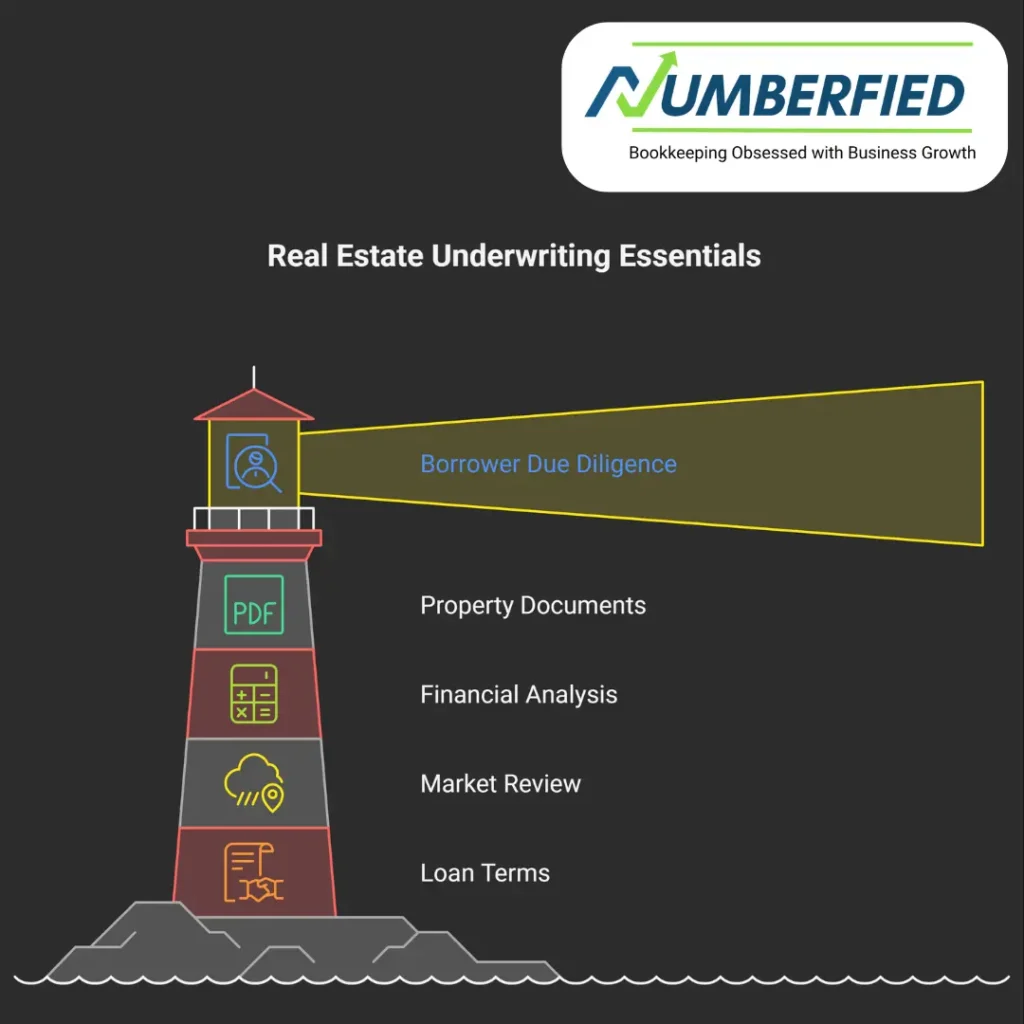

Final Checklist: Real Estate Underwriting Essentials

- Borrower due diligence: credit report, credit score, financial statements, and track record.

- Property documents: appraisal, rent roll, leases, operating expenses, and insurance policies.

- Financial analysis: NOI, DSCR, LTV, cap rate, and sensitivity testing.

- Market and environmental review: comps, vacancy rates, zoning, and natural disaster exposure.

- Loan terms and covenants: interest rate, amortization, reserves, and monitoring requirements.

Conclusion

Real estate underwriting is more than a compliance step; it’s a strategic function that protects capital, informs pricing, and enhances investment performance. Whether you’re a real estate investor evaluating acquisition opportunities, a lender structuring loan terms, or a mortgage professional refining underwriting policies, a rigorous underwriting process helps determine whether a deal is viable and how to structure it to mitigate risk. Use conservative assumptions, adopt strong tools, and maintain ongoing monitoring to turn underwriting into a competitive advantage.

If you want to strengthen your underwriting capabilities, avoid common pitfalls, and tailor the process to your portfolio, request a free consultation with our underwriting experts. We’ll review your underwriting templates, analyze your current process, and recommend software and staffing options to improve accuracy and speed.

Ready to improve your underwriting process? Request a free consultation today to assess risk, optimize loan terms, and protect your investments.

FAQ

What are the four types of underwriting?

The four main types of underwriting in real estate and mortgage lending include residential underwriting (focused on personal borrower credit and income for homes or small multifamily properties), commercial underwriting (emphasizing property cash flow and performance for larger income-producing assets), construction/development underwriting (evaluating project budgets, timelines, and sponsor experience), and bridge/short-term underwriting (handling transitional properties with higher risk and streamlined requirements).

What are the different types of underwriting?

Underwriting varies by context, but common types include loan/mortgage underwriting (assessing borrower and property risk for financing), insurance underwriting (evaluating policy risks), securities underwriting (pricing and distributing investments like IPOs), and real estate-specific variants such as residential, commercial, construction, and bridge financing.

What are the 4 C’s of underwriting?

The four C’s of underwriting are Credit (borrower’s credit history and score), Capacity (ability to repay based on income and debts), Collateral (property value and quality as security), and Capital (borrower’s reserves and down payment). These factors help assess overall loan risk.

What is the most common type of underwriting?

The most common type of underwriting is mortgage or residential loan underwriting, which involves human or automated review of borrower finances, credit, and property value for home purchases the majority of individual lending encounters this process.

What are the four stages of underwriting?

The four typical stages of mortgage underwriting include application review and document verification, credit and income analysis, property appraisal and valuation, and final risk assessment leading to approval, conditional approval, or denial.

What are common red flags for underwriters?

Common red flags include inconsistent income or employment gaps, large unexplained deposits, high debt-to-income ratios, low credit scores or recent delinquencies, appraisal issues (low value or property defects), undisclosed debts, frequent job changes, and title problems like liens.

What are red flags for underwriters?

Underwriters watch for inconsistencies in documentation, sudden credit inquiries or new debts, declining occupancy or cash flow in investment properties, environmental hazards, deferred maintenance, overleveraged borrowers, and discrepancies between reported and verified information.

What are the five red flag symptoms?

In mortgage underwriting, five key red flags are a high debt-to-income ratio, poor credit history (late payments or low score), insufficient reserves or large unexplained deposits, unstable employment, and property issues like low appraisal or unrepaired defects.

What are the 5 C’s of underwriting?

The five C’s of underwriting are Character (borrower’s reputation and credit history), Capacity (repayment ability via income), Capital (personal investment and reserves), Collateral (property value), and Conditions (economic and market factors).

What gets you denied in underwriting?

Common denial triggers include insufficient income or high DTI, poor credit, low appraisal, unverifiable documentation, undisclosed debts, job loss or changes, excessive reserve requirements not met, or property not meeting lender standards.

What are the five red flags?

Five major red flags in underwriting are overdrafts or NSFs on bank statements, unexplained large deposits, recent credit inquiries/new debt, employment gaps or frequent changes, and appraisal discrepancies or property defects.

What things can stop you from getting a mortgage?

Factors like low credit score, high debt levels, unstable income or job history, insufficient down payment/reserves, poor property condition or low appraisal, undisclosed liabilities, and recent major financial changes (e.g., new loans) can prevent mortgage approval.

Also Read: Real Estate Underwriting: How Lenders and Investors Assess Risk