Introduction

Starting a bookkeeping services business is an attractive path for aspiring entrepreneurs, experienced bookkeepers, and small business owners who want to convert accounting expertise into a sustainable company. This guide walks you through practical steps to launch, legal and licensing requirements, pricing models, marketing strategies, essential tools like QuickBooks and bookkeeping software, common mistakes to avoid, and proven tips to scale from freelance bookkeeping to a full-service bookkeeping firm.

Why Start a Bookkeeping Services Business?

Bookkeeping remains one of the most in-demand services for startups and small businesses. Small business owners frequently need help managing financial records, cash flow, payroll, and tax preparation. By offering bookkeeping services, business owners can free clients to focus on growing their businesses while providing peace of mind through accurate financials, timely financial reports, and compliance support during tax season and audits.

Benefits include recurring revenue, the ability to serve remote clients via virtual bookkeeping, and the opportunity to expand into advisory services and CFO services as you grow. Whether you offer basic bookkeeping or full-service bookkeeping packages, a bookkeeping services business can be tailored to your business needs and scaled over time.

Who Should Start One?

This path fits professional bookkeepers and accountants seeking to offer accounting and bookkeeping packages, and entrepreneurs looking to start a bookkeeping business with low initial overhead. Many small business bookkeeping services evolve from freelance bookkeeping into online bookkeeping firms, serving startups, established companies, and growing businesses that outsource to focus on core operations.

Practical Steps to Launch Your Bookkeeping Services Business

1. Define your niche and services

Start by selecting target clients: freelancers, retail, professional services, restaurants, or startups. Decide whether you will offer bookkeeping services for small businesses exclusively, virtual bookkeeping services, payroll services, tax filing preparation, or full-service bookkeeping that includes advisory and CFO-level reporting. A defined niche helps tailor marketing, pricing, and software choices.

2. Register the business and meet legal requirements

Choose a business structure: sole proprietorship, LLC, or S-corp. Register with state and local authorities, obtain an EIN, and check licensing requirements. While bookkeeping typically doesn’t require a license in many states, some jurisdictions or clients (e.g., handling payroll tax filings) may require registration, bonding, or background checks. If you provide tax preparation or represent clients before the IRS, consider obtaining an Enrolled Agent credential or partnering with a licensed accountant.

3. Set up business banking and insurance

Open a business bank account and separate your financials from personal finances. Obtain professional liability insurance, data breach insurance, and consider bonding if you’ll handle client funds. Insurance provides clients with confidence and protects your firm in case of errors, audits, or disputes.

4. Choose bookkeeping and accounting software

Select bookkeeping software that matches your services and clients’ needs. QuickBooks Online is the industry standard for many small business bookkeeping services, but you should also evaluate Xero, FreshBooks, Wave, and specialty bookkeeping software for e-commerce or multi-entity clients. Integrations for payroll, POS systems, and banking are essential for accurate and real-time financial data.

5. Create your service packages and pricing

Decide on pricing models: hourly rates, fixed monthly packages, value-based pricing, or per-transaction fees. Common approaches include:

- Basic bookkeeping: monthly bank reconciliations, categorization of transactions, and financial statements.

- Full-service bookkeeping: includes payroll services, tax preparation coordination, accounts payable/receivable, and monthly financial reports.

- Virtual bookkeeping subscription: remote services with cloud-based tools and real-time access to financial data.

Consider a tiered pricing structure to serve startups and small businesses while offering premium packages for growing businesses that need advisory services or CFO services. Be transparent about billing, turnaround times for financial statements, and additional fees for tax season or audits.

Marketing Strategies to Find Clients

Build an online presence

Develop a professional website that highlights bookkeeping services, business benefits, pricing models, and client testimonials. Optimize pages for search terms like bookkeeping services business, small business bookkeeping services, online bookkeeping services for small, and virtual bookkeeping. Create landing pages for industries you serve and publish helpful content, blog posts, financial checklists, and FAQs about managing business finances.

Leverage local networking and partnerships

Attend local business events, join chambers of commerce, and partner with accountants, tax preparers, and payroll firms that may refer clients needing day-to-day bookkeeping help. Offering referral fees or reciprocal partnerships with accountants can grow your client base quickly.

Use targeted advertising and social proof

Run targeted ads on Google and social platforms aimed at small business owners and startups. Share case studies and before-and-after financial reports anonymized for privacy to demonstrate how your bookkeeping service improved cash flow and financial clarity. Encourage satisfied clients to leave reviews on Google and industry directories to build trust.

Tools and Software Recommendations

Equip your bookkeeping services business with modern tools that streamline work and scale operations. Recommendations:

- QuickBooks Online: robust for small business bookkeeping, payroll, and tax prep integrations.

- Xero: strong for multi-currency and collaborative bookkeeping.

- Gusto or ADP: payroll services that integrate with bookkeeping software.

- Hubdoc or Receipt Bank: automate receipt capture and document management.

- Bill.com: accounts payable automation.

- Fathom or Spotlight: advanced financial reporting and KPI dashboards for advisory services.

- Stripe/PayPal: client billing and payment processing.

Adopt cloud storage, secure client portals, and two-factor authentication to protect financial data. Streamline processes with templates for onboarding, bookkeeping checklists, and client questionnaires to gather business needs efficiently.

Pricing Models and Cost Considerations

When setting prices, account for labor, software subscriptions, insurance, marketing costs, and time for client onboarding. Typical pricing approaches:

- Hourly rates: reasonable for irregular work, but can discourage predictable planning for clients.

- Monthly retainer or package: most typical clients pay a predictable fee based on transaction volume and scope.

- Value-based pricing: charge based on the perceived value, especially for advisory or CFO services.

Offer a free introductory consultation or a discounted first month to win new clients. Provide clear scope documents that outline bookkeeping needs covered, tax filing support, payroll services, and what will incur additional fees (e.g., catch-up bookkeeping, audits, or tax returns preparation). For bookkeeping services for small businesses, transparent pricing builds trust and helps clients budget during tax season and busy periods.

Legal, Compliance, and Best Practices

Data security and client confidentiality

Implement encryption, secure backups, and strict access controls. Comply with privacy laws and industry best practices for handling financial data. Offer secure invoice delivery and client portals, and ensure you have data breach policies in place.

Regulatory compliance and taxes

Stay current on payroll tax filings, sales tax requirements, and tax preparation rules. If you offer tax filing or tax preparation services, ensure you maintain the necessary credentials or partner with licensed tax professionals. Keep detailed financial records and be prepared to assist clients during audits by providing timely financial statements and supporting documents.

Quality assurance

Establish review processes and reconciliation schedules to ensure financial data is accurate. Implement checklists for month-end close, reconciliations, and financial report preparation to reduce errors and increase trust with clients.

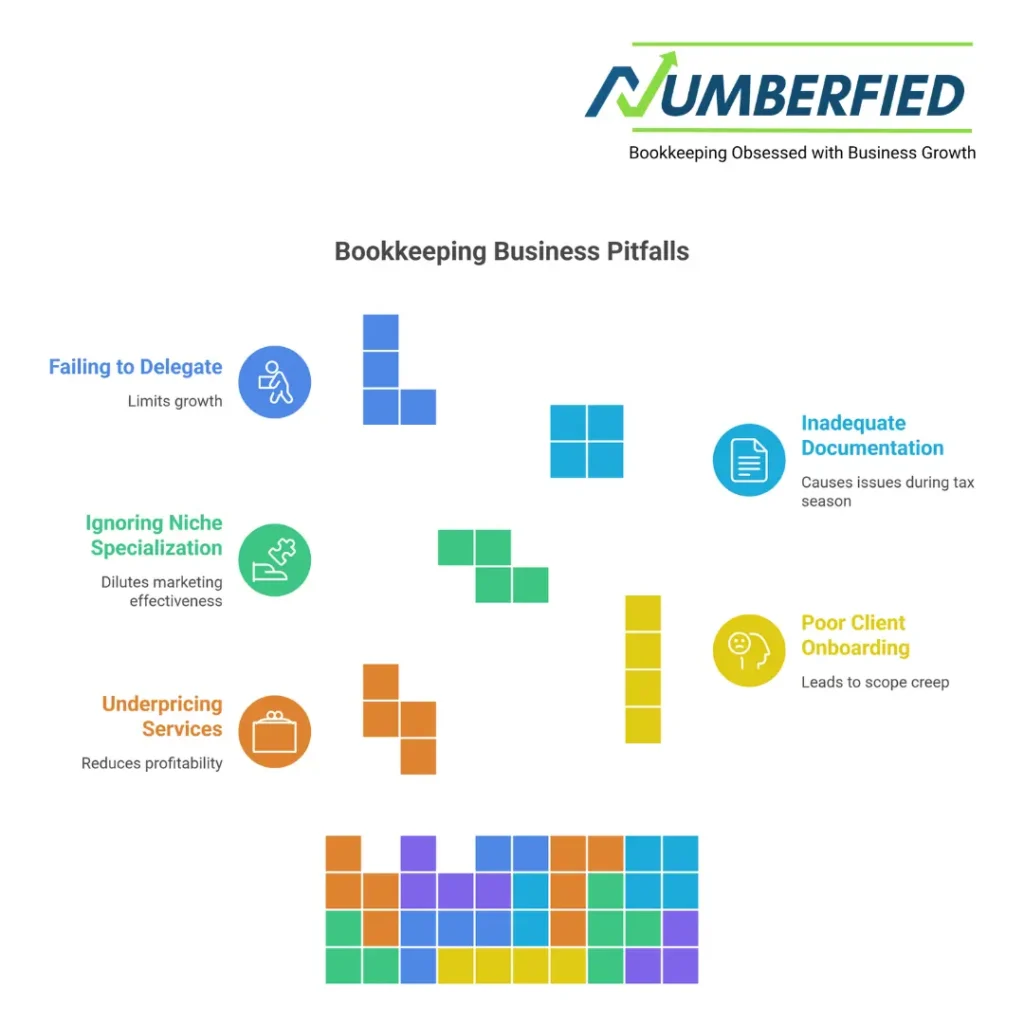

Common Challenges and Mistakes to Avoid

Typical pitfalls when running a bookkeeping business include:

- Underpricing services: Failing to account for software, benefits, and overhead reduces profitability.

- Poor client onboarding: Lack of clear expectations leads to scope creep and billing disputes.

- Ignoring niche specialization: Broad targeting dilutes marketing effectiveness.

- Inadequate documentation: Missing financial records can cause issues during tax season and audits.

- Failing to delegate: Trying to handle all bookkeeping tasks limits growth; build a bookkeeping team early if demand increases.

Avoid these by setting clear contracts, regular communication, and documented processes. Offer training for staff, keep up with accounting software updates, and continually streamline workflows to deliver consistent financial reports and advisory services.

Scaling from Freelance to Firm

Scaling your bookkeeping services business requires systems, people, and processes:

Hire and train a bookkeeping team

Start with contractors or junior bookkeepers. Create onboarding materials and standard operating procedures. Invest in training, so your team can handle bookkeeping and bookkeeping services for small clients consistently.

Standardize processes and use automation

Automate recurring tasks like bank feeds, categorization rules, invoice reminders, and payroll runs. Use templates for financial reports and dashboards to deliver real-time financial data to clients. Automation reduces errors and frees time for client advisory and business growth activities.

Expand service offerings

Introduce advisory services, financial forecasting, cash flow management, and virtual CFO services for growing businesses. Many clients will pay premium fees for strategic financial guidance, tax planning, and curated financial reports that support business growth.

Consider niches and partnerships

Target industries with higher margins or predictable recurring needs: e-commerce, professional services, franchises, and startups. Partner with accounting firms to refer tax work during tax season or to provide audit support when needed.

Measuring Success and Client Retention

Track key performance indicators: client churn rate, average revenue per client, utilization rate of your bookkeeping team, receivables aging, and on-time delivery of financial statements. Regularly solicit client feedback and provide value through monthly or quarterly business reviews that showcase financial reports, cash flow trends, and actionable recommendations.

Retention is boosted by clear communication, reliable financial data, and helping clients achieve measurable business outcomes like improved cash flow, fewer bookkeeping errors, or faster tax filing.

Checklist: Launch Timeline

- Week 1–2: Define niche, choose business structure, register business, open bank account.

- Week 3–4: Select software (QuickBooks, Xero), set up payroll integration, and create service packages.

- Month 2: Build website, begin marketing, network locally, and offer free consultations.

- Month 3–6: Acquire first clients, refine pricing, document processes, and automate workflows.

- Month 6+: Hire contractors or employees, add advisory services, and focus on scaling.

Conclusion

A successful bookkeeping services business centers on trust, accuracy, and reliable financial reporting. Help small businesses manage their financials with clear reports, streamlined processes, and timely payroll and tax support. Whether you offer online bookkeeping, virtual bookkeeping, or full-service bookkeeping, focus on solving core business needs, improving cash flow, preparing tax returns, and creating financial statements that guide smart decisions.

Delivering consistent, high-quality bookkeeping services for small businesses builds long-term relationships that lead to referrals, steady revenue, and the ability to scale into high-value advisory and CFO services.

Ready to Start or Scale Your Bookkeeping Services Business?

Explore resources, templates, and software integrations to streamline your launch. Book a free consultation to assess your business model, pricing, and tools so you can focus on growing your business with confidence. Reach out today to get tailored guidance on starting a bookkeeping services business that fits your goals.

FAQs

Is bookkeeping business profitable?

Yes, a bookkeeping business is highly profitable with low overhead costs and recurring monthly revenue from clients. Many independent bookkeepers earn $50,000–$150,000+ annually once established with 10–30 clients. Profitability depends on pricing, niche focus, and scaling through virtual services.

How to start a bookkeeping services business?

Start by getting certified (e.g., QuickBooks ProAdvisor), setting up a legal entity (LLC), and choosing software (QuickBooks, Xero). Build a website, market on LinkedIn and local networks, and offer free consultations to land your first clients. Set pricing ($300–$2,000/month per client) and use contracts for protection.

Is owning a bookkeeping business profitable?

Yes, owning a bookkeeping business is very profitable due to high demand, low startup costs, and scalable income. Established owners often net $70,000–$200,000+ yearly with 15–40 clients and low expenses. Success comes from specialization, automation, and strong client retention.

Can I be a bookkeeper without a CPA?

Yes, you can be a bookkeeper without a CPA; most bookkeeping roles require no certification beyond software proficiency. A CPA is needed only for tax preparation, audits, or advanced advisory services. Many successful bookkeepers operate with certifications like QuickBooks ProAdvisor.

What are the three golden rules of bookkeeping?

The three golden rules are: debit the receiver and credit the giver (personal accounts); debit what comes in and credit what goes out (real accounts); debit all expenses and losses and credit all incomes and gains (nominal accounts). They ensure every transaction balances in double-entry bookkeeping. These rules maintain accuracy and prevent errors in financial records.

How do I price myself as a bookkeeper?

Price based on value, not hours: charge $300–$2,500 monthly per client, depending on transaction volume and services. Start lower for simple clients ($400–$800/month) and higher for complex ones with payroll or advisory ($1,500+). Offer tiered packages and adjust rates as you gain experience and clients.

How much should I pay for bookkeeping services?

Small businesses should expect to pay $300–$2,000 per month for outsourced bookkeeping.

Basic services start at $400–$800, while comprehensive packages with payroll and reporting cost $1,000–$2,000. The price depends on transaction volume, complexity, and provider expertise.

How to start bookkeeping services business?

Get trained/certified (QuickBooks, Xero), register your business, and set up cloud tools and a website. Market locally and online (LinkedIn, Facebook groups), offer free trials, and secure your first clients with contracts. Focus on niches like e-commerce or real estate for faster growth.

Can I make 100k as a bookkeeper?

Yes, many bookkeepers earn $100,000+ annually, especially with 20–40 clients at $500–$2,000/month each. Virtual or specialized bookkeepers often reach this through scaling, premium pricing, and low overhead. It typically takes 2–5 years to build to six figures with consistent marketing.

Read Also: Why Numberfied’s Accounting Bookkeeping Service Saves Small Businesses Time and Money