Introduction

Running a small business is like tending a garden, you plant ideas, nurture customers, and dream of a big harvest. But one task can feel like pulling weeds: bookkeeping. Small business bookkeeping isn’t just about jotting down numbers or surviving tax season. It’s about knowing your business’s roots, making bold choices, and growing strong. At Numberfied, we believe bookkeeping should be your ally, not a chore. No matter what you do or where you do it, smart bookkeeping is key to steady growth. Let Numberfied show you how we help small businesses succeed.

Key Takeaways

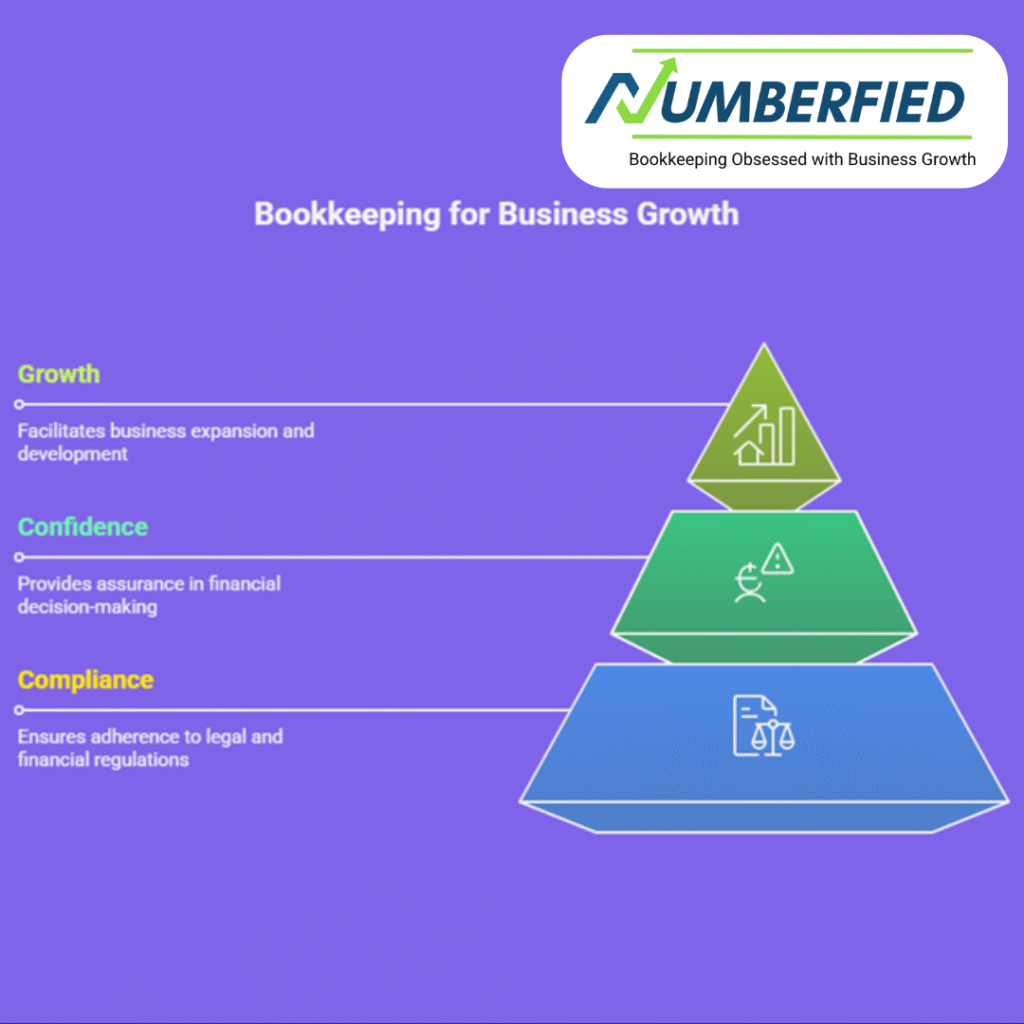

- Small business bookkeeping ensures transparent and compliant finances.

- Accurate records fuel smarter decisions and attract investors.

- Outsourcing saves time, reduces errors, and offers expert advice.

- Numberfied transforms bookkeeping into a growth tool.

Why Small Business Bookkeeping Is Essential

It’s Your Business’s Map

Bookkeeping tracks every dollar sales, expenses, profits. It’s like a map guiding your journey. Without it, you’re lost. A cafe owner in Tucson once shared how her messy books hid a profit dip. Proper small business bookkeeping helped her bloom again.

Eases Tax Season

Taxes can feel like a storm cloud. Good bookkeeping ensures you follow IRS rules, dodging fines. A Numberfied client, a Raleigh photographer, avoided a $3,100 penalty after we organized his receipts.

Sparks Growth

Precise numbers let you plan big. A Denver dog groomer used her books to spot a demand surge, opening a second shop. With Numberfied, your books are a guide to brighter days.

Builds Trust

Investors and lenders love tidy financials. A San Francisco startup we helped landed $160,000 after we cleaned their books. Small business bookkeeping shows you’re serious.

Plans Your Future

Your books tell your business’s story. A Chicago cafe owner utilized our insights to eliminate slow-selling menu items, resulting in a 10% increase in profits.

Keeps You Grounded

Understanding your finances gives you peace of mind. A Numberfied client in Miami, a florist, said clear books let her focus on creative arrangements.

Common Bookkeeping Challenges

Time Is Precious

Running a business is a full-time job. Bookkeeping often gets ignored. Owners spend 80-100 hours a year on books time better spent on customers or new ideas.

Numbers Can Trick You

Math isn’t everyone’s strength mistakes like logging a sale as an expense hurt. An Omaha plumber overpaid taxes by $1,600 due to a simple mix-up.

Messy Records Cause Stress

Piles of receipts or random files create chaos. An Orlando yoga teacher groaned about her paper-stuffed box at tax time. Numberfied’s system brought order.

Rules Keep Changing

Tax laws shift like seasons. Staying compliant feels tough. A Miami designer leaned on Numberfied to avoid penalties and remain current.

Missing Opportunities

Bookkeeping isn’t just recording, it’s spotting trends. Without it, you might miss growth chances. We helped a Seattle retailer pivot after spotting a sales drop.

Overwhelm Sets In

Juggling tasks can bury bookkeeping. A Numberfied client in Boston said she felt swamped until we took over her books.

Why Professional Bookkeeping Helps

Frees Your Time

Handoff bookkeeping, and you’re free to shine. A Seattle jeweler used her extra hours to craft a collection that grew sales by 20%. Small business bookkeeping shouldn’t dim your spark.

Stops Mistakes

Pros catch errors fast. We identified a payroll glitch for a Chicago cafe, resulting in a $4,000 annual savings. Numberfied keeps your books clean.

Offers Smart Guidance

Bookkeepers are more than number crunchers they’re advisors. We helped a Phoenix landscaper spot late payers, boosting cash flow by 14%.

Supports Growth

Scaling means more numbers. Pros keep up. We helped a Houston startup manage a 45% sales surge without a hitch.

Boosts Confidence

Knowing your finances are solid lets you focus on your vision. A Boston caterer said our help gave her the courage to take on significant events.

Saves Money Long-Term

Investing in pros prevents costly errors. A Numberfied client in Denver saved $5,000 by avoiding tax mistakes.

How Numberfied Makes Bookkeeping Great

Custom Plans for You

Your business is special, so your bookkeeping should be too. We tailor services whether you’re solo or growing. A Miami boutique owner praised our help with her tricky inventory.

Growth Is Our Goal

We don’t just track numbers we help you soar. A San Antonio tutor doubled clients after we showed her new markets. Small business bookkeeping with Numberfied is about winning.

Simple, Smart Tech

Our cloud platform lets you check your finances anytime. A Boston caterer tracks event costs on the go, lifting profits by 8%. Numberfied makes bookkeeping easy.

Your Biggest Fan

We’re not just a service, we’re your partner. A Portland bookstore owner called us her financial lifeline for simplifying books and sharing growth tips.

Always Ready to Help

Our team answers questions quickly. A Denver contractor said our quick support saved him hours of stress.

Secure and Trustworthy

Your data is safe with us. We use top encryption. A Dallas consultant trusts Numberfied because we’ve never let her down.

Best Practices for Small Business Bookkeeping

Stay Regular

Log transactions daily or weekly. It’s like watering plants-small efforts prevent wilt. An Austin pet groomer cut bookkeeping time by 50% with this.

Separate Accounts

Mixing business and personal funds is like mixing paints-messy. Get a business account. We helped a Nashville artist organize her books for easy tax preparation.

Use Cloud Tools

The software syncs with your bank and automates entries. A Portland bookstore switched to Numberfied’s platform, cutting errors by 75%. Small business bookkeeping loves tech.

Check Monthly

Review books monthly to catch issues. A Denver contractor spotted a $2,100 error during a routine check with us.

Back Up Everything

Lost records are trouble. Numberfied’s cloud backups saved a Miami retailer when their laptop failed.

Keep It Simple

Complex systems waste time. A Chicago tutor streamlined with our tools, saving 40% of her bookkeeping hours.

When to Outsource Bookkeeping

You’re Overwhelmed

If bookkeeping feels like a second job, delegate. A Charlotte food truck owner outsourced to us and tested recipes that packed her lines.

Your Business Is Growing

Scaling means more numbers. Pros keep up. We helped a Houston e-commerce brand handle a 50% sales spike flawlessly.

You Need Advice

Bookkeepers are strategists. We advised a New Orleans gym to eliminate slow classes, saving $8,000 per year.

Audits Worry You

Clean books reduce audit risks. An Atlanta client sailed through an IRS check with our organized records.

You Want to Focus

Outsourcing lets you chase your passion. A San Francisco startup utilized Numberfied to refine its investor pitches.

Growth Feels Messy

Scaling can tangle finances. We helped a Denver gym open a second location with clear books.

Tools and Tech for Bookkeeping

Cloud Software Rocks

Forget paper ledgers. Cloud tools give real-time data. A Minneapolis coffee roaster checks sales daily with Numberfied to plan stock.

Automation Saves Hours

Software sorts expenses or sends invoice reminders. We set up automation for a San Diego freelancer, cutting bookkeeping time by 50%.

Security Matters

Your data needs protection. Numberfied uses bank-level encryption. A Dallas consultant trusts us for our flawless security record.

Tool Integration

Our platform seamlessly integrates with payroll and invoicing systems. A Seattle retailer linked their POS to Numberfied for seamless operations.

User-Friendly Dashboards

Our tools show finances clearly. A Chicago tutor loves our dashboards for quick insights without hassle.

Mobile Access

Check books on the go. A Boston caterer uses our app to track costs during events, saving time.

Bookkeeping for Different Businesses

Retail and E-Commerce

Shops handle inventory and sales surges. We helped a Seattle boutique avoid $9,000 in over-ordering. Small business bookkeeping keeps retail smooth.

Freelancers and Solopreneurs

Solo acts need simple systems. A Boston writer uses Numberfied to log gigs and prepare taxes quickly, freeing her up for clients.

Service Businesses

Plumbers, tutors, and salons track hours and payments. We streamlined books for a Miami electrician, saving 9 hours monthly.

Restaurants and Cafes

Food businesses juggle tips and vendors. A Chicago cafe owner utilized our insights to optimize staffing, resulting in a 10% reduction in costs.

Nonprofits

Nonprofits track grants and donations. We helped a Chicago charity organize funds for compliance and transparency.

Creative Professionals

Artists need easy systems. A Portland designer tracks gigs with Numberfied’s tools, saving time for creativity.

Tax Prep Made Simple

Catch Every Deduction

Bookkeeping identifies write-offs, such as mileage or supplies. We uncovered $5,200 in deductions for a Phoenix stylist.

Avoid Tax Stress

Organized books mean no last-minute panic. An Atlanta client filed early with our year-round prep.

Be Audit-Ready

Clean records keep the IRS happy. We helped a Denver contractor ace an audit with solid books.

Stay Current

Tax rules change often. Numberfied keeps you compliant, like updating a Miami consultant’s books for new deductions.

Plan Quarterly Taxes

Freelancers pay quarterly. We helped a Boston freelancer set up a system to avoid surprises.

Maximize Refunds

Good books ensure you claim all credits. We helped a Seattle retailer boost their refund by $3,000.

Scaling with Bookkeeping Insights

Spot Trends

Books show what’s working. A Chicago pet store stocked up on hot-selling treats, lifting profits by 15%. Small business bookkeeping finds opportunities.

Master Cash Flow

Know when money flows. We helped an Orlando photographer’s time payments to stay steady.

Impress Investors

Clean books attract funding. A San Francisco startup landed $180,000 after we polished their financials.

Plan Expansion

Bookkeeping shows when you’re ready to grow. A Denver gym opened a second location with our help.

Optimize Spending

Books reveal where to cut. We helped a Seattle retailer reduce slow-moving stock, saving $6,500 per year.

Forecast with Confidence

Clear books help predict trends. A Miami boutique planned a holiday surge with our insights.

Common Bookkeeping Mistakes

Skipping Small Transactions

Every expense counts. A Boston client missed $800 in write-offs by ignoring small entries.

Delaying Reconciliation

Waiting to balance books creates errors. We helped a Seattle freelancer reconcile their monthly accounts, catching a $500 mistake.

No Backups

Lost records hurt. Numberfied’s cloud backups saved a Miami retailer after a laptop crash.

Overcomplicating Systems

Simple is best. A Chicago tutor switched to our platform, saving 35% of bookkeeping time.

Missing Deadlines

Late filings cost money. We helped a Denver contractor set reminders to stay on track.

Ignoring Reports

Books offer insights. A Numberfied client in Portland missed a profit dip until we reviewed her reports.

How Numberfied Supports Your Industry

Construction and Trades

Contractors track materials and labor. We helped a Dallas carpenter save $6,000 by organizing job costs.

Tech Startups

Startups need scalable bookkeeping. We supported a San Francisco firm during a 50% revenue jump.

Healthcare and Wellness

Gyms track memberships. We streamlined the books for a Miami yoga studio, saving 7 hours per month.

Retail and Hospitality

Shops and cafes handle busy seasons. We helped a Chicago cafe cut staffing costs by 12%.

Creative Fields

Writers and artists need simplicity. A Portland designer saves time with Numberfied’s tools.

Nonprofits

Nonprofits need transparency. We helped a Chicago charity track grants cleanly.

Choosing Your Bookkeeping Partner

Experience Counts

Pick a team that knows your industry. Numberfied has helped bakeries to tech firms thrive.

Clear Communication

Your bookkeeper should be reachable. Clients love our quick, friendly support.

Tech-Savvy Team

Modern tools make life easier. Numberfied’s platform keeps you connected.

Growth Mindset

Choose a partner who cares about your goals. We helped a Boston retailer expand with new insights.

Top Security

Data safety is key. Numberfied’s encryption keeps your info secure.

Flexible Plans

Your needs change. We adjust services to fit, like we did for a growing Denver gym.

Conclusion

Small business bookkeeping is your foundation for success. It keeps you compliant, confident, and ready to grow. With Numberfied, you get a partner who’s as excited about your business as you are. From saving time to spotting opportunities, we’re here to help. Ready to make your numbers bloom? Visit https://numberfied.com/, and let’s grow together.

Read Also: QuickBooks Outsourced Bookkeeping Your US Business’s Winning Move

FAQs

What is small business bookkeeping?

It tracks income, expenses, and taxes to keep your business healthy and thriving. It ensures compliance and growth. Numberfied simplifies it with tools and expertise.

Can I do bookkeeping myself?

You can, but it’s time-heavy and risky. Pros save hours and prevent errors. Numberfied makes it affordable and easy.

How often should I update books?

Daily or weekly keeps things tidy. Regular checks catch issues. Our platform makes logging simple.

What makes Numberfied different?

We’re growth partners. Our custom plans and insights help you scale. Clients call us their financial allies.

How does bookkeeping help taxes?

It organizes deductions and ensures compliance no stress at filing time. Numberfied keeps books tax-ready.

Can bookkeeping increase profits?

Yes! It spots savings and opportunities. We helped a client boost revenue by 18% with insights.

What tech does Numberfied use?

Secure cloud tools for real-time access. They sync with banks and automate tasks. Clients love the ease.

How much is bookkeeping?

Costs vary by business numberfied offers tailored plans. Contact us at https://numberfied.com/ for details.

When should I outsource?

When you’re swamped or scaling, early outsourcing saves stress. Numberfied is ready to help.

Is my data safe with Numberfied?

Yes. We use top encryption. Your trust matters, and we’ve never had a breach.